Nuclear startup Deep Fission has jumped through a back door onto the public markets through a reverse merger that raised around $30 million, a small sum in a capital-intensive sector but an indication that investors remain cautious.

The company’s pitch is as audacious as its route to market is idiosyncratic: 15‑megawatt pressurized water reactors that can be dropped into 30‑inch boreholes drilled 1.8 miles deep into the Earth, deploying new, safer and harder to target power for energy hungry customers like data centers. The combined company intends to list on the OTCQB, not a major exchange.

A reverse merger puts SPAC decorum to the test

Deep Fission merged with Surfside Acquisition Inc. at $3 a share, well below the $10 at which SPAC prices were trading at historically, a sign of a market that has become skeptical of pre‑revenue hardware bets. The OTCQB, a venture‑focused market run by OTC Markets Group, points further to how the deal was constructed to reduce listing hurdles and hold down costs following steep redemptions or limited new capital.

That frugality comes with trade‑offs. Public company responsibilities introduce recurring costs running to the low single‑digit millions annually for audit, governance and reporting. The proceeds from Deep Fission are modest, especially relative to recent nuclear listings — NuScale’s SPAC in 2022 and X‑energy’s in 2024. Oklo’s 2024 entrant came into the project with a bigger war chest and a marquee sponsor, but other peers also have long licensing timelines and escalating costs. In that environment, Deep Fission’s $30 million is runway, not destination capital.

An underground reactor Wager: 15 MW, 30‑inch boreholes

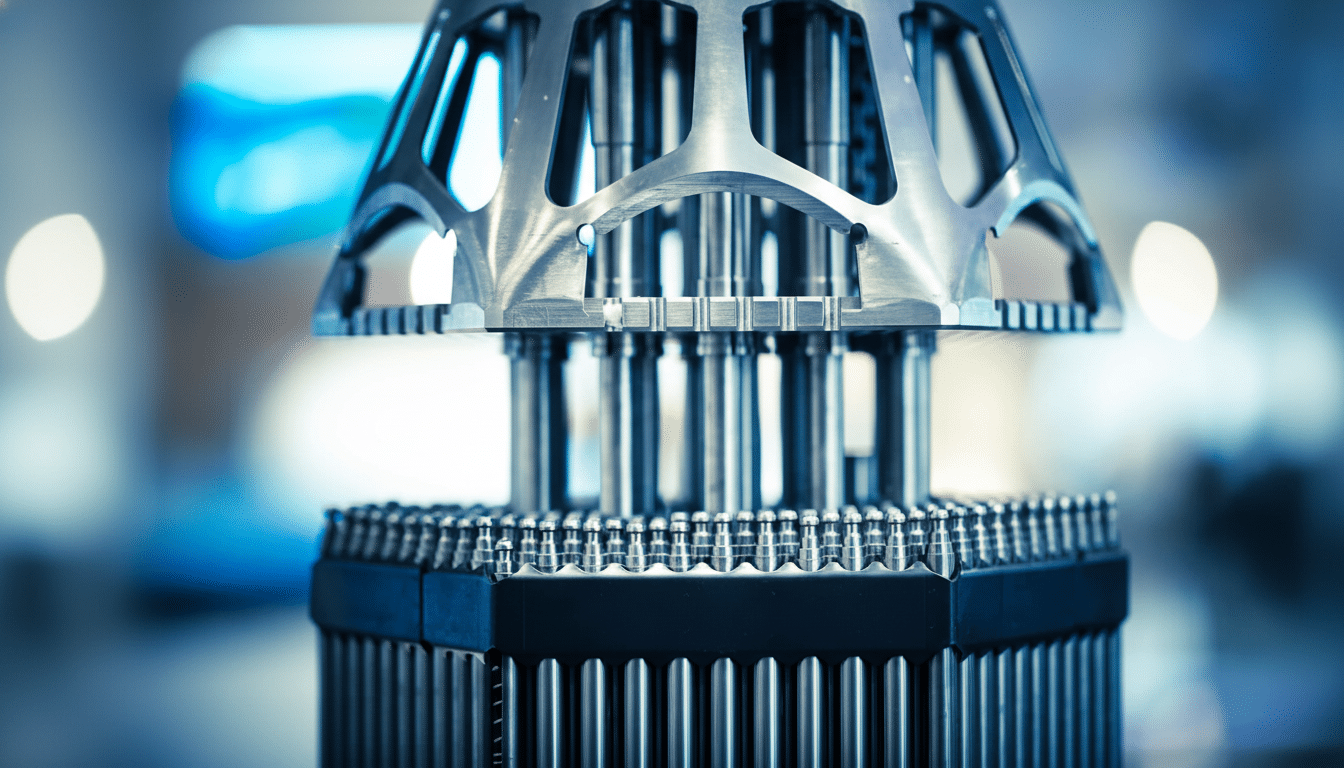

The company’s design is a small, cylindrical pressurized water reactor — technology that has decades of operating history in naval propulsion and commercial plants — and it would be sunk vertically in a deep, narrow bore hole. Burial seeks to address two perpetual fears about nuclear: risk of a severe accident and physical security. Shielding and standoff distance is on the order of a mile of rock.

The engineering, however, is nontrivial. Drilling and casing a 30‑inch shaft to that depth was a bit of a stretch from the standard oil‑and‑gas practice, which uses much larger diameters only in shallow sections. Open questions on a subterranean pressurised-water system include heat rejection, corrosion, groundwater integrity and long‑term inspection. Regulators will also investigate how the design allows retrieval, maintenance, and decommissioning – key components of the U.S. Nuclear Regulatory Commission’s safety philosophy.

Chasing data center demand with 2GW plan

Deep Fission recently announced it had reached a deal with Endeavor, a data center developer, that would cover up to 2 gigawatts of underground capacity. It’s an audacious figure that speaks to the moment: global data centers could consume 620 to 1,050 terawatt‑hours of electricity by 2026, potentially doubling from 2022 levels as AI workloads soar, according to the International Energy Agency. Operators are seeking to lock in affordable, carbon‑free baseload power that is locatable near load and capable of being scaled up in a modular manner.

One of the more-subtle benefits of Deep Fission’s approach is fuel. Pressurized water reactors rely on low‑enriched uranium below 5% U‑235, a supply chain that is much deeper and more mature than that required for the high‑assay fuel in many advanced microreactors. With commercial availability of high‑assay fuel still restricted, keeping things simple may be an advantage in early deployments — if the drilling and subsurface systems live up to their marketing.

Regulatory runway, schedule risk

The company was chosen as part of the Department of Energy’s Reactor Pilot Program, which is intended to accelerate early projects by connecting federal investment with de‑risking at the permitting level. That’s useful, but it’s no shortcut around N.R.C. licensing. For designs that have been standardized, the sum of design certification, environmental review and site‑specific approvals can take years. As for NuScale’s path through design certification, it was a process that occupied most of a decade and a reminder that first‑of‑a‑kind reactors hardly ever debut on startup schedules.

Deep Fission has set an ambitious goal for when it will start up its first reactor, in mid‑2026. Hitting that mark would involve simultaneous achievements across licensing, drilling validation, supply chain build-out and customer integration. Slippage in any one stream can cause cascading effects in the others, especially for a new underground architecture that lacks in-field precedents.

What $30 million gets you — and what it doesn’t

There should be an emphasis on design finalization, the development of the safety case, borehole demonstrations and early licensing work at Deep Fission, with funding of around $30 million. Nuclear first of kinds projects, even in micro, usually have hundreds of millions of through CO, though. That gap could potentially require subsequent fund‑raisings, strategic partnerships, or access to federal programs like the DOE Loan Programs Office, in addition to potential cost‑share agreements with customers who demand dedicated, resilient power.

The upside, if the company threads the technical and regulatory needles, is a product that is all too perfect to the moment: compact, standardized reactors that can be sited discreetly (even if that means deep underground), paired directly with mission-critical loads such as space habitats and military bases, and fueled by a traditional uranium supply chain. The flip side is that the capital stack and timeline are razor‑sharp for a sector that typically operates in delays. Deep Fission’s unusual SPAC doesn’t alter the equation but does buy time — along with a public currency — to demonstrate that the borehole reactor can clear the formidable hurdle from concept to grid.