Databricks is in discussions with investors to raise new capital at a valuation over $130 billion, according to The Information. No term sheet has been signed, but should the talks crystallize, it would take funding for the company to $15.3 billion if it does come together, representing a significant step-up from its last private round (which valued it at around $8.5 billion) and an endorsement of investor confidence in enterprise AI and data infrastructure today.

The potential pricing would imply an increase in the valuation of at least 30 percent from previous reports on its most recent raise around $100 billion. For a late-stage company that was already considered an IPO candidate, such a premium implies some steep growth expectations around Databricks’ core lakehouse platform as well as its efforts to push into generative AI tooling.

Why Databricks Is Valued So Highly by Investors Now

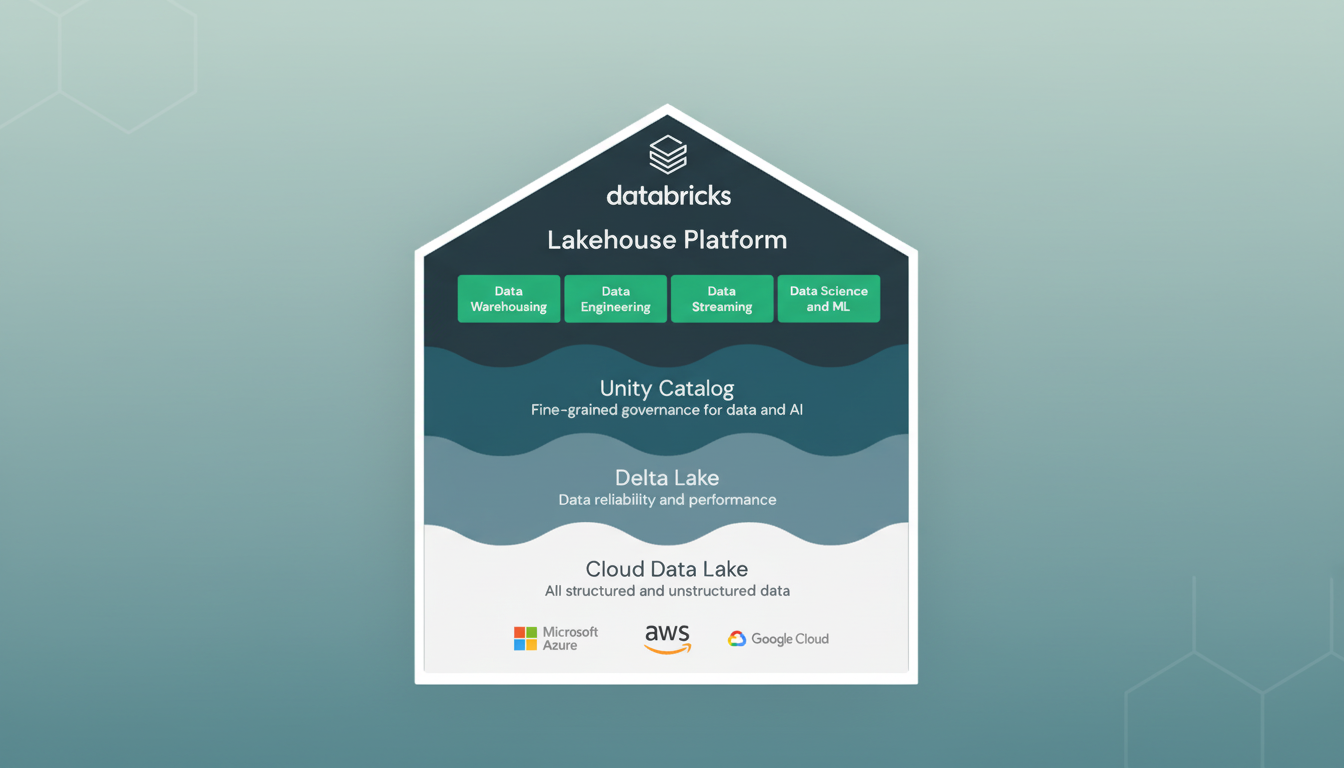

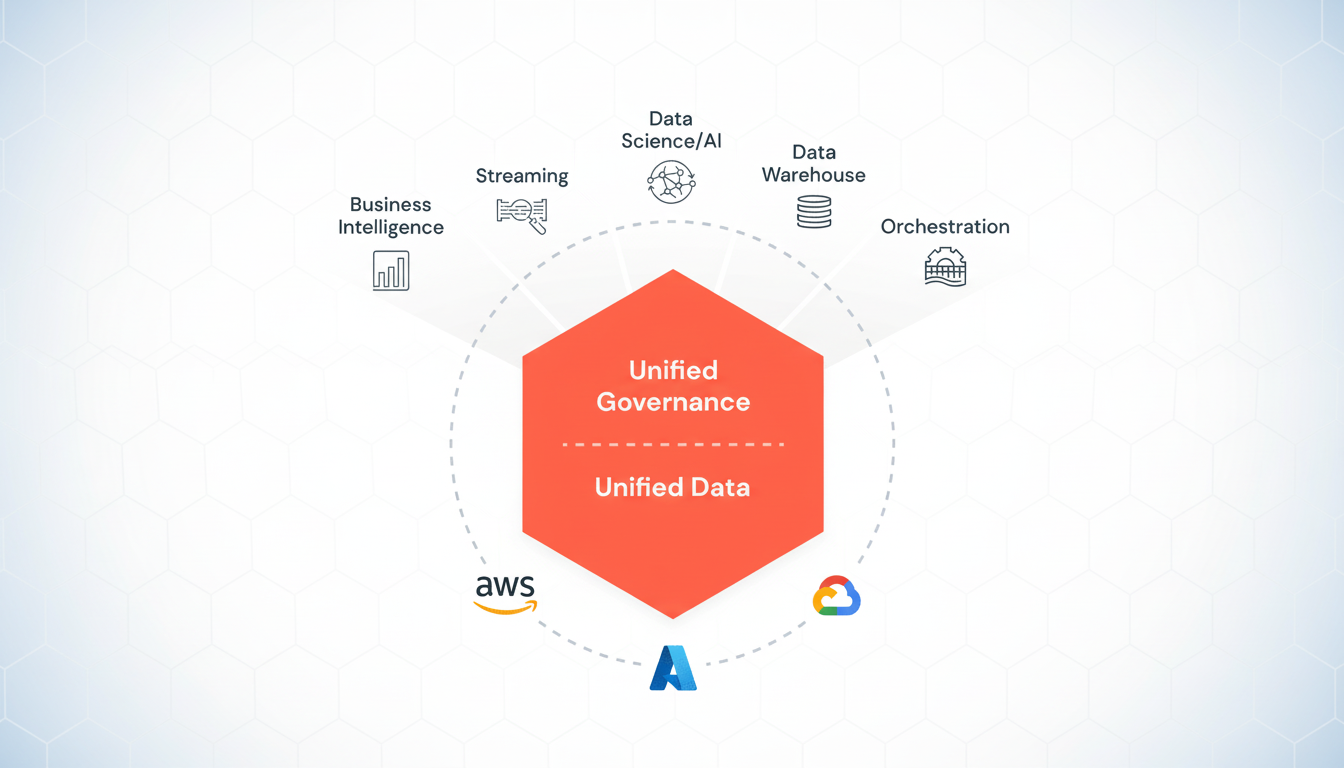

Databricks has been the beneficiary of a confluence of trends that are remaking enterprise data stacks. There’s a push from companies to consolidate their analytics, machine learning and governance on fewer platforms, with an expectation that those systems are natively able to support both structured data and unstructured AI workloads. The lakehouse thesis that Databricks early led the advocacy for has shifted from an architectural debate to a procurement reality with large enterprises.

That momentum has been boosted by rapid adoption of generative AI in production environments, where training and serving models necessitate tight integration with governed data. Databricks has also doubled down on features for model training and inference, vector search and governance through Unity Catalog, as well as a new open-weight model, DBRX, that it designed to cater more specifically toward enterprises that would like portability and knowing exactly what is going on within their systems rather than a black box.

Aggressive M&A and the Data Platform Land Grab

The company’s appetite for buys has also indicated a platform-aggregation strategy. The open-source database startup Neon has agreed to be acquired by data-processing giant Databricks for around $1 billion, acquiring a Postgres-compatible cloud database and extending its reach into the transactional workloads that power analytics and AI. Previous transactions such as MosaicML have also reinforced internal model training capabilities and depth of applied AI staffing.

Databricks has also made investments in the open data ecosystem, supporting technologies such as Delta Lake and contributing to formats through product efforts and partnerships (e.g., with Apache Iceberg). The plan is obvious: make it simpler for businesses to standardize on open formats while still enjoying high-value proprietary services when it comes to security, governance and performance.

Stakes Are Competitive With Cloud and Data Rivals

Databricks at a $130 billion-plus valuation would tower over most public data platform peers and naturally draw comparisons to Snowflake and massive cloud providers selling packaged AI. Snowflake’s bet: investing in data applications and AI services. The big clouds offer end-to-end stacks, which include compute, storage and AI tooling. Databricks differentiates on open standards, multi-cloud optionality, and a lifecycle that ranges from ETL through model serving.

For the company to continue charging a premium, more than feature breadth is at work. Businesses evaluate total cost of ownership, egress charges and operational overhead in constructing data pipelines across clouds. Databricks’ pitch is that a unified lakehouse cuts through that complexity and speeds time-to-value for production AI, with the story gaining credibility as customer references mount and third-party benchmarks roll in.

Where Else New Databricks Funding Might Flow

New funding would probably go toward three areas. First and foremost is infrastructure: including increasing GPU access, driving down the cost of inference, and building out managed services for model training (as well as retrieval-augmented generation). Second is product: more profound integrations around governance, lineage and real-time workloads that bind together transactional and analytical data with AI applications. Third is consolidation: targeted M&A to narrow capability gaps in databases, orchestration and security.

Expect further investment in vertical solutions where highly regulated data collides with AI, such as financial services and healthcare. These are segments where the platform that solves for compliance, reproducibility and high-performance compute comes with explicit controls on data residency and auditability.

IPO Signals and the Risk Ledger for Databricks

A fundraising round at that size would bolster the belief that Databricks is taxiing toward an eventual public offering. Late-stage rounds at high valuations are frequently about shoring up the balance sheet and signaling to customers purchasing three-year contracts. The flip side is risk of execution: executing on M&A, maintaining fast product cadence, and showing that AI-driven expansions do translate into durable gross margins and cash flow.

Macroeconomic factors are a wild card. Enterprise software budgets are strong but not eternal, and AI pilots need to become high-ROI deployments. Nonetheless, if the reporting from The Information holds up, the round would make Databricks one of the most valuable private software companies in the world, a reflection of a broader re-rating of AI infrastructure and its importance as a strategic layer rather than an optional add-on.

Databricks did not reply to a request for comment. (The Information, which reported on the talks and noted that no term sheet had been agreed upon, earlier wrote about them.)