America’s hottest new technologies are transforming software fortunes and richly rewarding workers on the jobsite. As tech giants race to build the electrical data centers that hum with generative AI, craft workers from electricians to drywall crews are demanding premium wages, richer benefits and faster promotions. According to The Wall Street Journal, increases in pay for those moving on to data center builds are being cited in the range of 25% to 30%, a spike exacerbated by the nationwide lack of skilled labor — estimated recently at about 439,000 jobs by Associated Builders and Contractors.

Worker Positions Pay High at Data Center Sites

On these hyperscale jobs, six-figure salaries are not unusual. The Journal features a former drywall business owner in Columbus who oversees more than 200 workers at a data center site and makes north of $100,000. An electrical safety specialist in Oregon earns about $225,000, and an electrician overseeing crews on several Northern Virginia campuses makes more than $200,000 — pay enhanced by overtime, per diems and retention bonuses.

The incentives reflect the intensity. Contractors talk about seven-day shifts, compressed schedules and tight deadlines for testing of mission-critical gear. Jobsite perks — heated break tents in winter, free lunches and $100 daily performance bonuses — also help maintain schedules and crew morale. Project management and quality-control jobs are also growing, with some companies allowing administrative support staff to work from home through cloud-based construction tools that have become the norm.

Trades In The Driver’s Seat Amid Shortages

Scarcity is shaping the market. The impact of that skills gap is clear in ABC’s analysis of the workforce, and data center construction only makes it worse with specialized needs in high-voltage electrical, HVAC, fiber, fire suppression and controls. Employers are bidding up hourly rates, piling travel stipends on top of base pay and fast-tracking apprentices into more demanding roles once restricted to the most experienced foremen.

Compared with normal regional wages, as reported by the Bureau of Labor Statistics, those 25% to 30% premiums stack up fast — particularly with double-time Sundays and long stretches of overtime.

Both union and open-shop contractors are jockeying for position, offering sign-on bonuses and multi-project guarantees to ensure that crews stay in place through commissioning and fit-out stages.

Regional Hot Spots And Training Pipelines

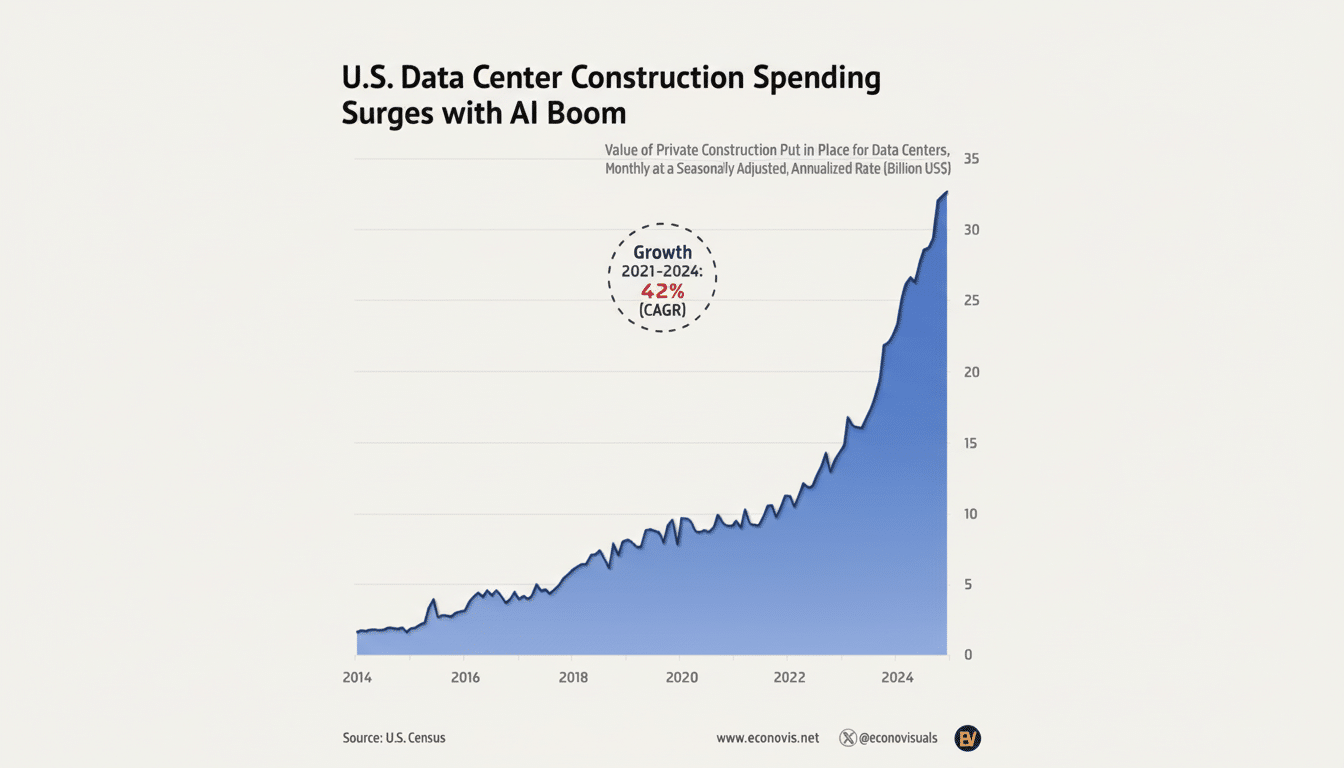

North American demand gravitates to a few hubs: Northern Virginia, the source of “Data Center Alley;” the area around Columbus, Ohio; Phoenix; Dallas–Fort Worth; and areas in the Pacific Northwest. Real estate researchers such as CBRE have seen record leasing and an under-construction pipeline growing across these markets, fueled by cloud providers and AI infrastructure buyers provisioning megawatts of available power.

Those clusters are catalyzing training. Apprenticeship programs for electricians funded by IBEW and NECA have grown cohorts, and community colleges are launching fast-track certificates in data center operations, low-voltage systems and commissioning. AI builds reward cross-trained crews — a journeyman who can do conduit, fiber terminations and basic controls troubleshooting will have the most offers pouring in, not to mention the largest raises.

From Field to Office, New Positions Are Emerging

In addition to traditional trades, new career paths are being paved in virtual design and construction, BIM coordination, QA/QC and environmental health and safety. Site teams are relying on laser scanning, drone surveys and reality-capture tools to keep up with quickly changing designs. Thorough knowledge of platforms such as Autodesk Construction Cloud, Procore and typical scheduling software is becoming a point of differentiation, and field leaders are shifting into hybrid roles that mix craft with data and logistics.

There is also a career stagger to commissioning. Now, with racks full of AI-ready gear humming and advanced cooling at work, owners are willing to pay a premium for technicians that can certainly validate electrical and mechanical systems but also troubleshoot anomalies and shepherd facilities through staged energization to turnover.

What Could Cool the Market for Data Center Projects

There are constraints. Utilities in a few hotspots are cautioning that power interconnection queues stretch years long, and interest-rate sensitivity may slow campus expansions. Lead times on equipment — from switchgear to chillers — continue to be a scheduling risk. Assuming AI workloads or funding conditions ease up, fluttering bid cadence could slow for contractors.

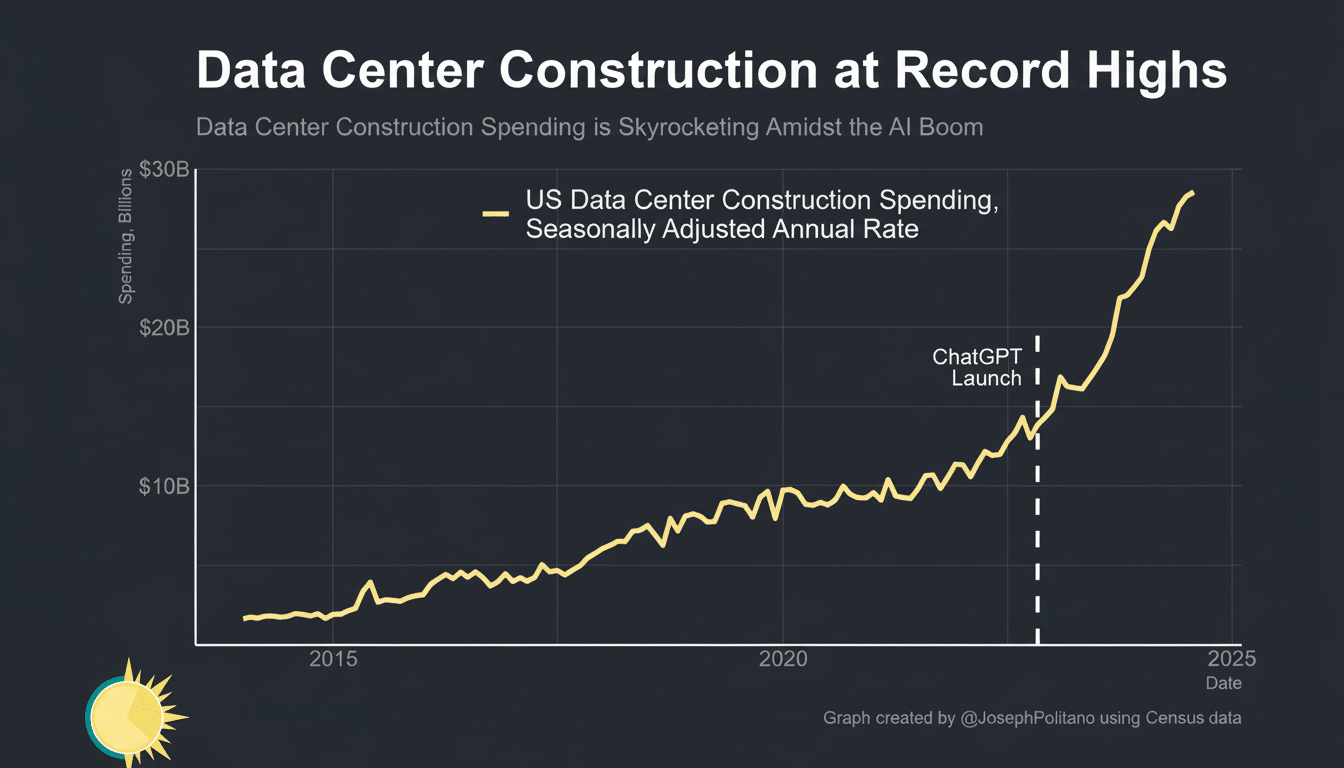

But for now, the backlog is deep and varied. Large cloud users are still pre-leasing capacity and landlords are combining greenfield builds with grid upgrades and on-site generation, which means even more activity for electrical and civil crews. Turner & Townsend and other consultancies have identified data centers as a leading cause of rising costs, a sign that demand is still outstripping supply for both materials and labor.

The net result is abundantly clear: AI is transforming mission-critical building into one of the best-paying gigs in the trades. For employees who are willing to travel, upskill and adjust to the pace of hyperscale builds, the AI boom isn’t an abstraction — it’s a fatter paycheck here and now, a warmer break tent in six months and progress up the ladder at an accelerated pace.