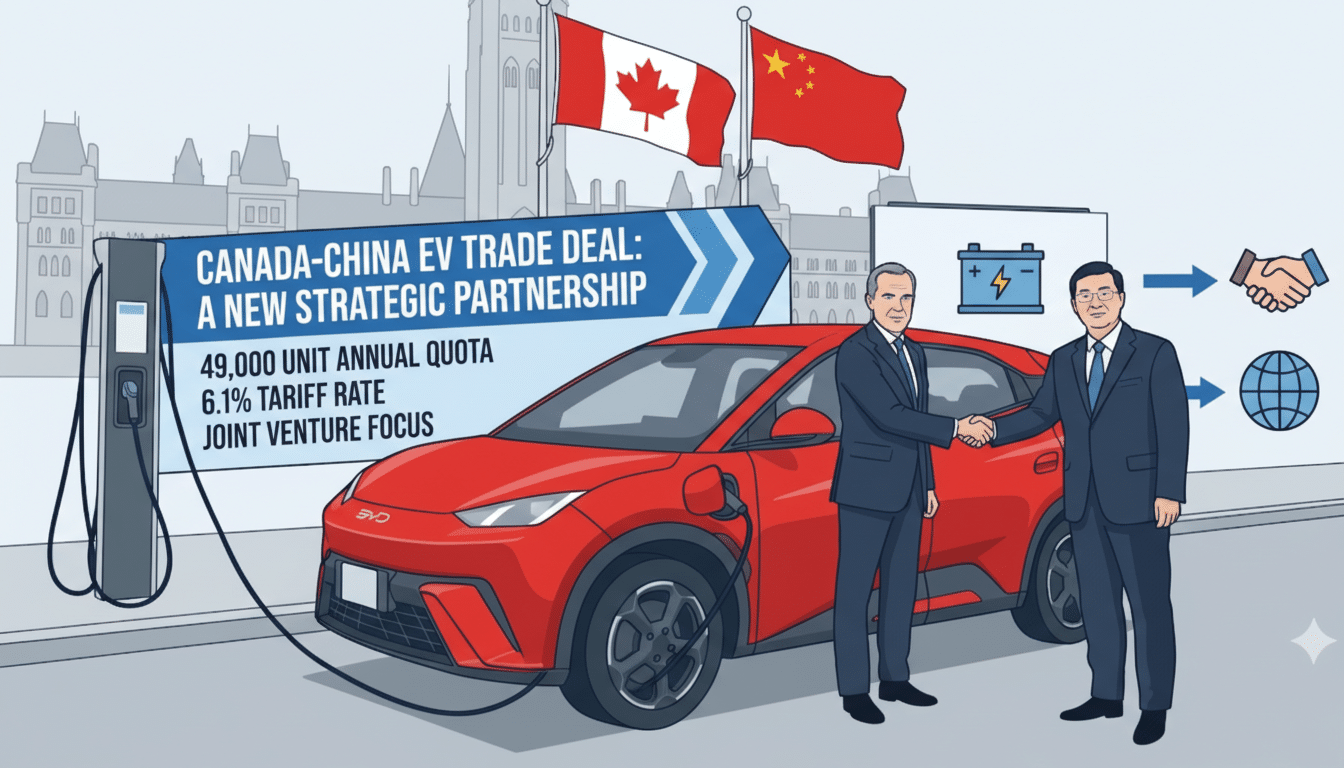

Canada has opened a new North American beachhead for Chinese electric vehicles, cutting its 100% import tax to 6.1% and setting an initial annual cap of 49,000 vehicles that will rise to roughly 70,000 over five years, according to reporting from the Associated Press. The policy shift gives companies like BYD, Geely, and Xiaomi a clearer route into Canada—and puts fresh pressure on the United States, which still maintains steep trade and security barriers.

What Canada Changed in Tariffs and Import Limits

By reverting to its standard 6.1% most-favored-nation rate for passenger cars while capping annual import volumes, Ottawa is trying to split the difference between consumer affordability and industrial policy. The move likely aligns vehicle pricing with Canada’s iZEV program, which offers up to C$5,000 in federal rebates for qualifying models subject to MSRP thresholds. That puts mass-market Chinese EVs within reach of Canadian buyers, especially if provinces layer on additional incentives.

- What Canada Changed in Tariffs and Import Limits

- Why This Policy Shift Matters for the United States

- Pricing Power and Product Depth of Chinese EVs

- Policy and Security Hurdles for the United States Market

- The Evolving North American Chessboard for Chinese EVs

- What to Watch Next After Canada Eases EV Import Tariffs

Just as important, Canada’s safety regulations are closely harmonized with U.S. standards, meaning many models designed for Europe and Mexico can be adapted for Canadian sale without extensive redesign. That streamlines homologation and dealerships, lowering market-entry friction for Chinese brands intent on scaling quickly.

Why This Policy Shift Matters for the United States

Washington still levies a 100% tariff on Chinese-made EVs and has layered on separate national security restrictions for “connected vehicles.” That effectively keeps direct imports off American roads. Crucially, the USMCA’s rules of origin require about 75% regional content for duty-free treatment; a car built in China and shipped via Canada would not qualify and would still face U.S. penalties at the border. In other words, Canada is not a tariff backdoor.

But proximity changes the competitive temperature. If Canadians can buy sub-$30,000 equivalent Chinese EVs with modern software and long-range batteries, U.S. shoppers will take notice. That dynamic has already played out in Europe, where Chinese-brand EVs moved from novelty to meaningful share. S&P Global Mobility and the International Energy Agency have both tracked China’s rapid export ramp, with IEA data showing China became the world’s largest auto exporter by 2023, propelled by EVs.

Brand-building is another spillover. Showcase fleets, service networks, and word of mouth north of the border can seed demand and readiness for a future U.S. launch, whether via local manufacturing, partnerships, or joint ventures that sidestep existing import barriers.

Pricing Power and Product Depth of Chinese EVs

China’s edge is cost and cadence. The IEA has noted that average EV transaction prices in China are roughly half those in the U.S., thanks to vast domestic supply chains, aggressive scale, and tight hardware–software integration. BYD’s lineup spans compact hatchbacks to premium sedans; Geely’s portfolio now includes global-facing architectures; and Xiaomi entered the EV race with software-heavy designs aimed at fast updates and ecosystem lock-in.

That breadth contrasts with the U.S. market’s current tilt toward larger, pricier EVs. While American sticker prices are easing, Kelley Blue Book data through 2024 still put average EV transactions well above those of gasoline cars. If Canadian lots fill with competitive $25,000–$35,000 offerings boasting robust range and five-star safety ratings (as seen in recent Euro NCAP results for several Chinese-made models), the price-value gap will be hard to ignore.

Policy and Security Hurdles for the United States Market

Even as Canada opens the door, the U.S. is reinforcing guardrails. The U.S. Department of Commerce’s Bureau of Industry and Security last year proposed rules to restrict certain connected vehicles and components linked to China or Russia, citing data security and supply chain risks. The Inflation Reduction Act’s “foreign entity of concern” provisions also wall off federal EV tax credits from vehicles with sensitive content or ownership ties.

That has not settled the debate. Industry voices—from dealer groups to legacy automakers—are split on whether to allow Chinese brands to manufacture in North America. Advocates argue local plants would create jobs and drive prices down; critics warn of hollowing out domestic supply chains. The nonprofit Securing America’s Future Energy recently cautioned that inviting Chinese automakers to build in the U.S. could harm the industrial base and national security, urging the White House to maintain a hard line.

The Evolving North American Chessboard for Chinese EVs

Mexico has already become a launchpad for Chinese brands, with strong sales momentum and reports of site scouting for assembly. A Canada–Mexico two-pronged strategy would let companies test product-market fit, localize service, and learn regulatory nuances across two distinct but connected markets.

For the U.S., the near-term response will hinge on three levers: maintaining or modifying tariffs, accelerating domestic EV affordability, and clarifying security rules for software-defined vehicles. If Detroit and its partners can push compelling sub-$35,000 EVs into showrooms at scale, the price narrative shifts. If not, the Canadian experiment could amplify consumer anxiety about paying more for less.

What to Watch Next After Canada Eases EV Import Tariffs

Stay tuned for Canada’s final import-allocation mechanics, model-by-model eligibility under iZEV, and the first Chinese brands to announce retail networks. Watch U.S. regulators for updates to connected-vehicle rules and enforcement around data localization. And track whether Chinese automakers accelerate North American manufacturing plans—especially in Mexico—to navigate tariffs, meet content thresholds, and shorten logistics.

Canada’s tariff cut does not open America’s gates. It does, however, move the front lines of EV competition right up to them.