And Page is just notching his belt with the first of those checks: Disrupt 2021 Early-Stage Session speaker Lojik Health raised a $300,000 pre-seed led by him earlier this year and has only found success since.

The appeal is clear: Founders building technology know they need institutional capital to get their product out the door.

This dynamic makes maximum sense for anyone looking for an optimistic take on tech today: On one hand, founders have more options than ever when it comes to fundraising; on the other, expect plenty more VCs and rolling funds hoping to bring you in only as far as your seed round before taking your sale price that ultimate case study branding keynote stage seat (cough).

The bummer about changes is how hard they are to track in real time.

Fetch me some tissues; next I want double tears from their fellow traditional venture bucket hat-tippers at Disrupt 2025 so Hudson or Chaddha can tell me again where we’re all going!

One is a pre-seed specialist who lives on conviction before traction; the other operates a multistage franchise with company-building through I.P.O.s and acquisitions. Together, they will break down what it really takes to get a “yes” when there’s little more than a sharp insight and a team ready to scratch and claw.

Why these investors should matter for first checks

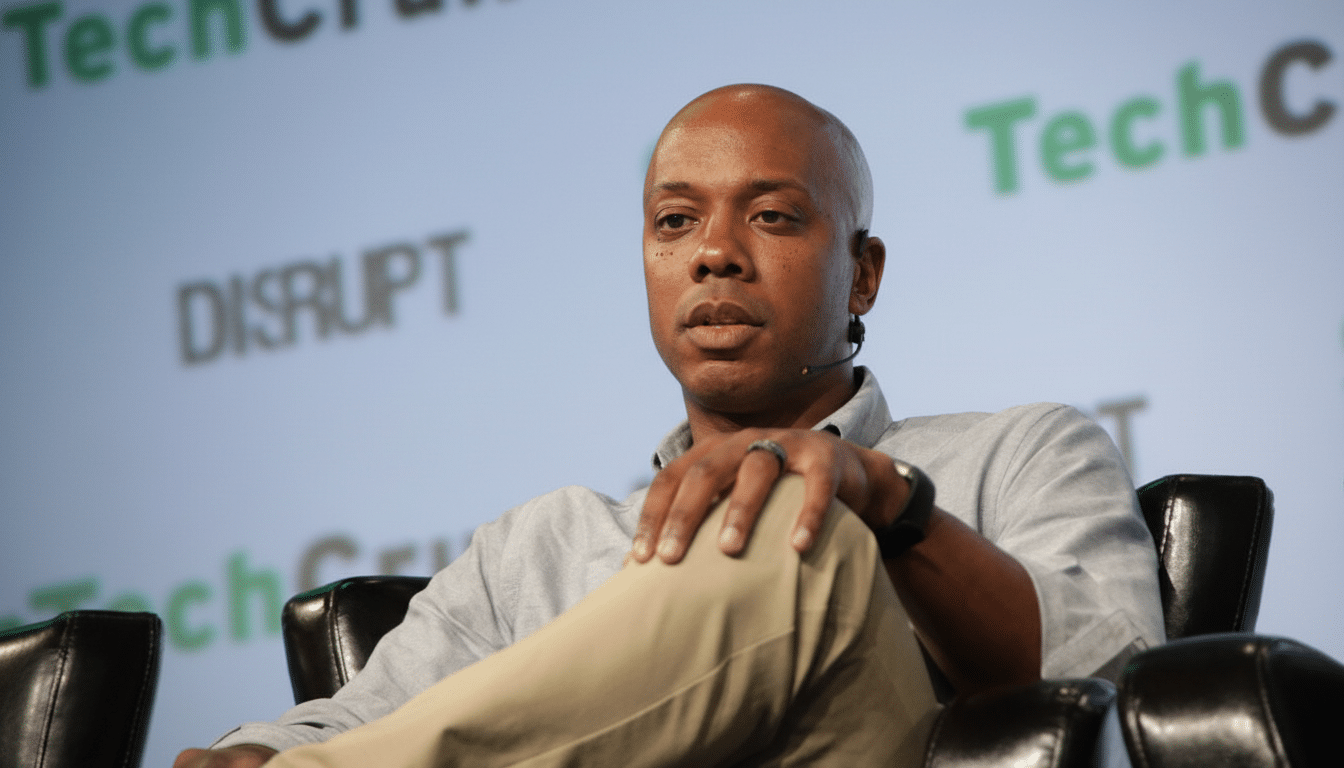

Hudson has structured Precursor to be the earliest of early bets — he backs hundreds of founders way before there are any metrics. He has a penchant for founder-market fit, the rate at which a team learns and evidence of scrappy validation — pilot discussions, early design partners in the pipeline or a sharp articulation of the wedge into an overcrowded market. His portfolio leans toward first-time and underrepresented founders, providing him with a wide sample set of what truly works at zero-to-one.

Chaddha, who is the managing partner at Mayfield and perennial Midas Lister, offers decades of pattern recognition across multiple cycles. He invested in companies like Lyft, Poshmark and HashiCorp — directly translating the vision of founders into sustainable businesses with strong go-to-market motion and defensibility. Mayfield’s model prioritizes hands-on company-building and the firm has invested in hundreds of startups in enterprise software, data infrastructure, cybersecurity and human and planetary health.

What founders encounter on stage during the session

Anticipate a tactical road map on how to go from idea to investable plan. That includes figuring out how to frame a problem so it doesn’t feel as if it’s just something useful, but rather inevitable; how to show velocity without vanity metrics; and how to convert customer discovery into concrete 12–18-month milestones. The duo is ready to unpack the qualitative that investors report using when products are at their most nascent: credibility with the user, rate of iteration around the team, quality of references and clarity of the initial GTM wedge.

They’ll also explore the “trust gap” every founder has pre-traction. Hudson often seeks fast feedback loops and an ability to reframe based on objections; Chaddha is more likely to question whether you have long-term moats — say, data network effects, distribution advantages or a technical edge that lasts beyond the next round of funding. Collectively, the advice suggests that it should enable founders to articulate a story that has narrative, product and path to revenue for guidance.

Signals and red flags at pre-seed and seed

Top signals they repeatedly cite are a nontrivial insight based on lived experience; early proof of pull from prospective customers; and a hiring plan that demonstrates discipline on burn. Founders who can speak credibly to a story about build, validate, sell, expand play stand out — despite their lean coded deliverables. Practically speaking, investors don’t just want to see polished looks but comfortable learning, too: customer notes — as in praise and pangs of despair, iteration histories and evidence of focus.

On the downside of the qualitative axis, we see inflated total addressable markets and absence of clear entry points, pilot “interest” not tied to real paid commitments and cap tables that limit hiring in the future or future follow-on rounds. In fast-moving categories like AI, they’ll venture beyond model demos to inquire about proprietary data access, unit economics for inference and how the product avoids becoming a feature inside a larger platform.

The early-stage market context all founders need to understand

New PitchBook-NVCA Venture Monitor data updates us on U.S. seed activity in the first quarter of 2022, where deal counts pulled back from peak 2021 levels and median seed valuations remained fairly minimal, in the low-teens millions. Carta’s private markets reports have also demonstrated a pullback in the private market even before 2023 — tighter round dynamics, including more structured terms at the Series A level, making seed discipline that much more crucial. Yet even with the cooldown, VC dry powder is close to record levels, and specialized funds are still leaning in on pre-seed where pricing is more rational.

The way that dynamic sorts itself out is into a barbell: Capital is plentiful for strong, high-potential narratives — especially in AI infrastructure, security and vertically oriented software — but middling stories have to fight tooth and nail just to get a clean shot at clearing the partner meeting. And for founders, that means honing evidence of founder-market fit and showing how they plan to get to a fundable Series A round, rather than just a deliverable MVP.

Practical tips for turning the odds in your favor

Express learning velocity with receipts: the weekly product notes, customer transcripts and what changed. Ditch TAM slides in favor of a small and winnable wedge. Create clear goals for the next 12 months that are attributable to engineering, revenue or an unlock. Bring a use-of-funds plan that is credible and balances build and GTM. Explain your pricing and how you win the first 10 accounts. And, yes, early cap table cleanliness — future rounds will depend on it.

U.S. pre-seed checks typically fall in the low six figures up to $1.5 million; seed rounds are often bunched at $2–5 million. What successful founders do instead is calibrate asks to the milestones that they can credibly hit with that capital, and then over-communicate progress toward it. The pair’s joint session on the Builders Stage, with any luck, will provide a rare, grounded look at just how to make that first check feel inevitable — long before metrics say it is.