Book-style foldable phones are on track to decisively outpace clamshell models in 2026, with Counterpoint Research projecting they will command 65% of foldable shipments. It would mark the first clear breakaway for larger, “book” or “passport”-style designs after years of near parity with flip-style devices. The drivers are stacking up: higher average selling prices, stronger productivity credentials, shifting OEM priorities amid component tightness, and the specter of Apple’s long-rumored entry.

Why Bigger Books Are Winning in the Foldable Market

For many buyers, the book-style pitch is simple: more screen equals more utility. A tablet-like canvas makes split-screen, drag-and-drop, and stylus note-taking feel natural, while leaving ample room for video, gaming, and reading. Larger chassis also let manufacturers pack bigger batteries, improved thermal solutions, and more ambitious camera stacks—features that resonate with power users and professionals.

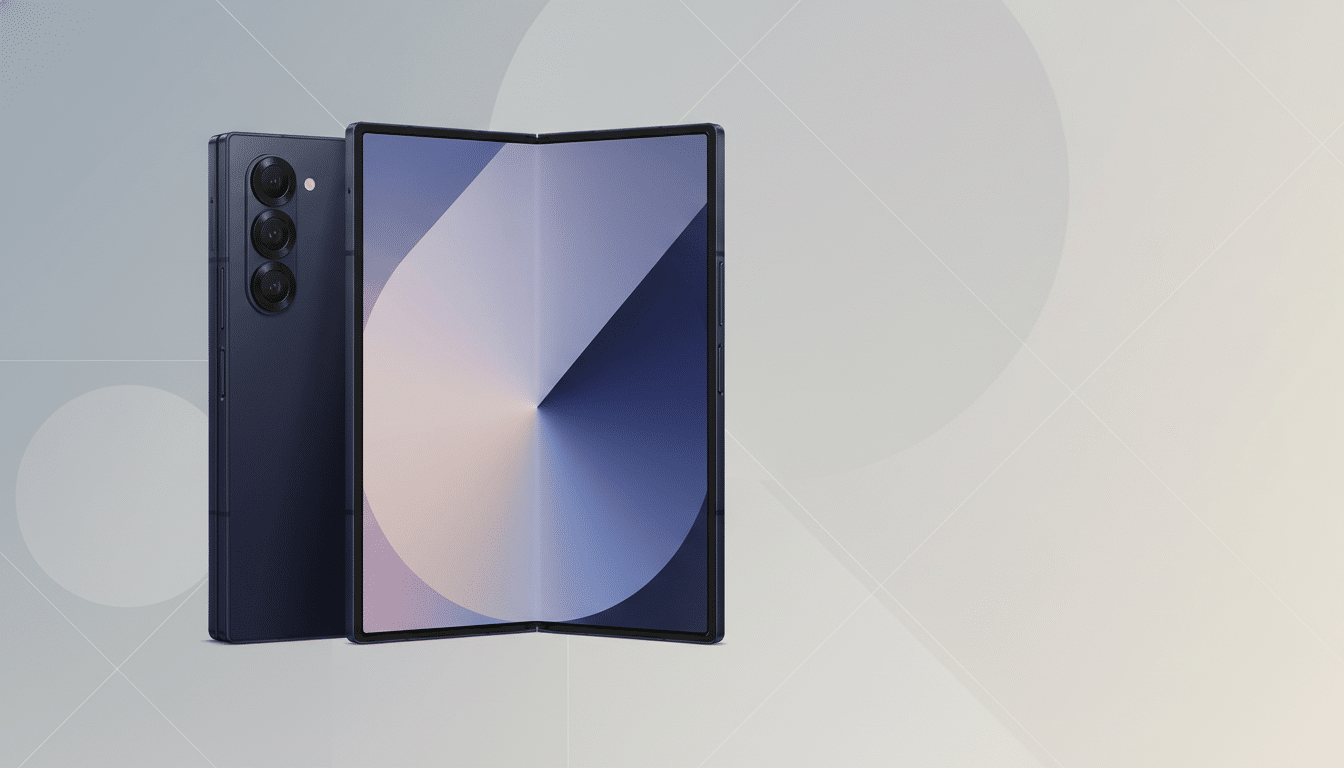

Hardware and software maturity are reinforcing the trend. Multitasking on devices like Samsung’s Galaxy Z Fold series increasingly resembles a compact laptop, and rivals have closed the gap with thinner frames and cleaner hinges. Chinese brands have pushed aggressive thin-and-light book-style designs that soften long-standing concerns around weight and crease visibility, expanding the appeal beyond early adopters.

The Numbers Behind the Shift Toward Book-Style Phones

Counterpoint’s timeline shows how steady momentum turned into a tipping point. Book-style models represented 35% of foldable shipments in 2020, 39% in 2021, and 47% in 2022. After hovering near parity—47% in 2023 and 51% in 2024—the category inched to 52% in 2025. The next step is the decisive one: a projected 65% share in 2026 as buyers and brands consolidate around larger form factors.

Early signals match the forecast. Counterpoint notes Samsung sold more Galaxy Z Fold 7 units than Galaxy Z Flip 7 in the second half of 2025, a reversal of the flip-first dynamic that defined the segment’s early growth. When the market leader’s mix tilts toward book-style, it often previews broader category direction.

Pricing Power and the Memory Squeeze Driving Strategy

Profitability, not just popularity, is shaping OEM roadmaps. Counterpoint highlights tightening memory supply affecting components common in low- and mid-range phones, which is nudging brands to emphasize higher-value devices. In other words, when DRAM and NAND are pricier or scarce, it makes more sense to allocate them to premium models with stronger margins—precisely where book-style foldables live.

That calculus dovetails with customer expectations. Book-style devices often ship with 12–16GB of RAM and 512GB–1TB of storage, specifications that support desktop-like multitasking and large media libraries. Research firms tracking memory pricing, such as TrendForce, have reported sustained pressure on DRAM and NAND costs; premium allocations help OEMs expand ASPs while justifying the bill of materials through features power users can feel.

Competitive Dynamics and the Apple Wildcard

Samsung remains the global foldable volume leader, regaining the top spot after a brief handoff to Huawei previously. The competition is healthy: Huawei, Honor, and others have proven that ultra-thin book designs can be both durable and elegant, with hinge mechanisms now commonly rated for hundreds of thousands of folds and creases less conspicuous than early generations.

Then there’s Apple. Counterpoint’s outlook factors in the possibility of a book-style foldable iPhone, which could accelerate mainstream adoption. Apple has a track record of normalizing new categories once they enter, from wearables to tablets. If that happens, expect display suppliers like Samsung Display and BOE to push flexible OLED capacity and yields higher, further lowering the barrier for book-style devices to dominate.

What to Watch Next for Foldables and Market Signals

Three indicators will show whether 65% is conservative or just right: pricing, polish, and promotion.

- Watch if more book-style models dip closer to the flagship sweet spot on price without sacrificing specs.

- Look for continued software refinement—windowing, task continuity, and pen-first apps—that turns big screens into everyday advantages.

- Expect carriers and retailers to lean into trade-in programs that shrink the upfront delta versus flips and slabs.

If those pieces align, the book-style form factor won’t just win the shipment share battle—it will become the default definition of what a premium foldable can be.