Bitcoin slid to roughly $84,000 during a sharp selloff, marking its lowest level of the year and rattling the wider digital asset market. Ether, Dogecoin, and other majors followed lower, with several tokens down as much as 6%. The move is forcing traders to reassess key support zones and the mix of macro and market structure forces driving crypto’s latest downdraft.

Why Bitcoin Is Falling Now Amid Risk-Off Sentiment

This drop did not occur in isolation. Risk assets broadly came under pressure as equities stumbled, led by mega-cap tech. When investors de-risk, crypto often sits near the front of the sell list because it’s more volatile and typically held with leverage. The result is a quicker repricing than in stocks.

Macro sentiment also turned heavier. A firmer U.S. dollar and stickier bond yields, driven by fading hopes for aggressive rate cuts, tend to weigh on Bitcoin. Strategists point to CME FedWatch implied odds shifting toward fewer cuts, tightening financial conditions at the margin. Crypto’s correlation with growth-sensitive indices has climbed in recent months, so a risk-off day in equities can transmit quickly to digital assets.

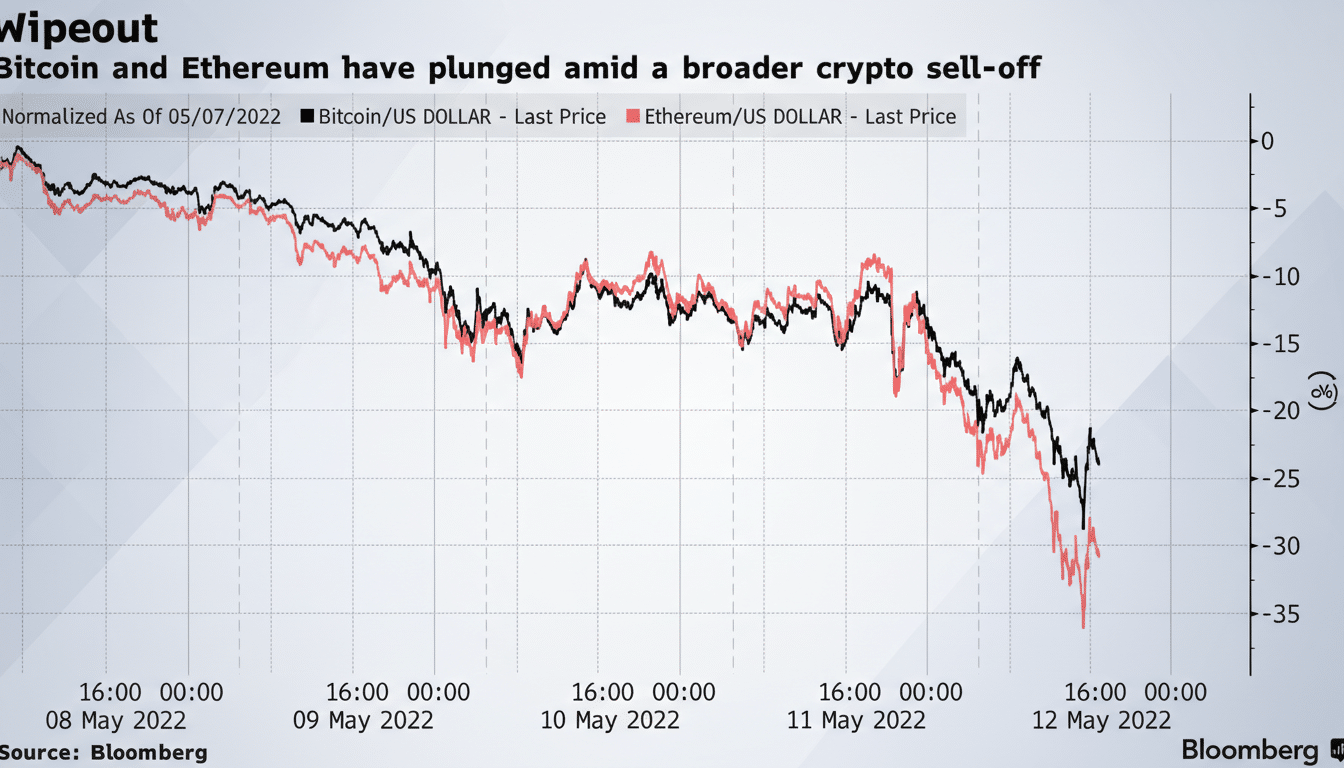

Leverage And Liquidations Magnified The Move

Derivatives amplified the slide. Data tracked by Coinglass showed more than $650 million in crypto positions liquidated during the session, with longs bearing the brunt. When cascading liquidations hit, market depth thins and price impact accelerates—particularly around round-number levels like $85,000 where orders tend to cluster.

Funding rates, which had been elevated during the prior upswing, flipped negative as momentum reversed. Open interest rolled off sharply, a sign that speculative leverage was forced out rather than purely discretionary selling. Options desks noted positioning near key strikes, and dealers potentially turned short gamma around the drop, adding fuel as they hedged dynamically on the way down. Deribit and CME flows underscored the shift from chasing upside to protecting downside.

ETF Flows and On-Chain Signals Add Pressure

The spot Bitcoin ETF bid that supported prices earlier this cycle has looked more selective. CoinShares’ weekly flow reports have shown periods where inflows slow, while legacy products such as GBTC continue to see outflows at times. Even modest net outflows can soften spot demand on choppy days, removing a stabilizing buyer.

On-chain, Glassnode and CryptoQuant have highlighted rising realized profit-taking into strength and increased BTC transfers to exchanges during pullbacks—classic signs of supply meeting a wavering bid. Miner behavior also matters: with margins squeezed when fees dip and hashrate stays high, miners occasionally sell into rallies to manage cash flow, adding incremental supply during fragile tape.

Key Levels and Market Psychology in Focus

The $84,000 area acted as a stress point. Traders are watching whether buyers defend the $80,000 region, which several desks flag as a psychological and technical threshold. A decisive break could open room toward prior consolidation zones, while a swift reclaim of $85,000–$87,000 would suggest the move was a leverage flush rather than a trend change.

Sentiment indicators tilt cautious but not capitulatory. Fear-and-greed gauges have cooled from extreme optimism, and basis on futures compressed without flipping deeply negative. That mix often precedes range trading as markets rebuild liquidity—though a fresh macro catalyst can easily tip the balance.

What to Watch Next for Bitcoin and Crypto Markets

Macro remains the primary driver. Dollar strength, Treasury yield direction, and shifts in policy expectations will steer risk appetite. Big Tech earnings and guidance can ripple into crypto via correlation, while any upside surprise in inflation could keep financial conditions tight.

Inside crypto, monitor spot ETF net flows, stablecoin issuance trends flagged by Coin Metrics, and exchange liquidity. Keep an eye on derivatives: if funding stays negative and open interest rebuilds at lower prices, it can set the stage for volatile squeezes in either direction.

For now, the story is straightforward: a broader risk-off impulse collided with crowded positioning, ETFs provided less cushion, and forced deleveraging did the rest. Whether $80,000 holds will tell investors if this is a garden-variety shakeout—or the start of a deeper reset.