Base Power has raised $1 billion to push forward a sweeping buildout of residential battery systems designed to turn neighborhoods into a flexible power plant that can both keep the lights on and balance the grid. The Austin company says the new production will support a rapid era of expansion outside Texas — in other words, out of state — thanks to a round of financing led by Addition with participation from CapitalG, Elad Gil, Lightspeed, Ribbit, Thrive Capital and Valor Equity Partners. The New York Times says the pre-money valuation for the round is $3 billion.

The company’s pitch is simple: make big batteries accessible to the average home, and then operate them as a virtual power plant when the grid needs support. In under two years, Base Power says it has built one of the largest battery storage footprints in Texas and sold more than 100 megawatt-hours’ worth of home storage to date in the state.

- Why This Funding Round Matters for Grid Reliability and Costs

- Why Texas Is the Launchpad for Base Power’s Expansion

- What Base Power Offers to Homeowners Through Leasing

- How Virtual Power Plant Economics Make the Model Work

- Manufacturing Plans and U.S. Supply Chain Considerations

- Competitive Landscape and Key Risks Facing Base Power

- What to Watch Next as Base Power Scales Beyond Texas

Why This Funding Round Matters for Grid Reliability and Costs

Grid planners have one whopper of a peak problem. The spikes last for only a few dozen hours per year, and they force utilities to buy expensive standby generation. Batteries can flatten those peaks in minutes, reducing reliance on gas peakers and hushing up price volatility. Wood Mackenzie analysts have recorded skyrocketing storage additions in Texas and nationwide, as batteries take on a growing share of vital “fast frequency” and reserve services. By pooling thousands of homes together, Base Power is essentially creating a distributed power plant that can mobilize fast and expand with consumer demand.

Why Texas Is the Launchpad for Base Power’s Expansion

There are few better laboratories for this model than Texas. Its deregulated retail market means it is easy for households to change electricity providers, and the state’s grid operator, ERCOT, pays handsomely for this fast-response capacity when supply gets tight. That pairing enables Base Power to reduce the upfront cost for homeowners while allowing them to monetize batteries as a grid asset. During weather extremes and periods of tight supply, distributed storage can respond nearly instantaneously — the precise kind of flexibility for which ERCOT’s market incentives are supposed to compensate.

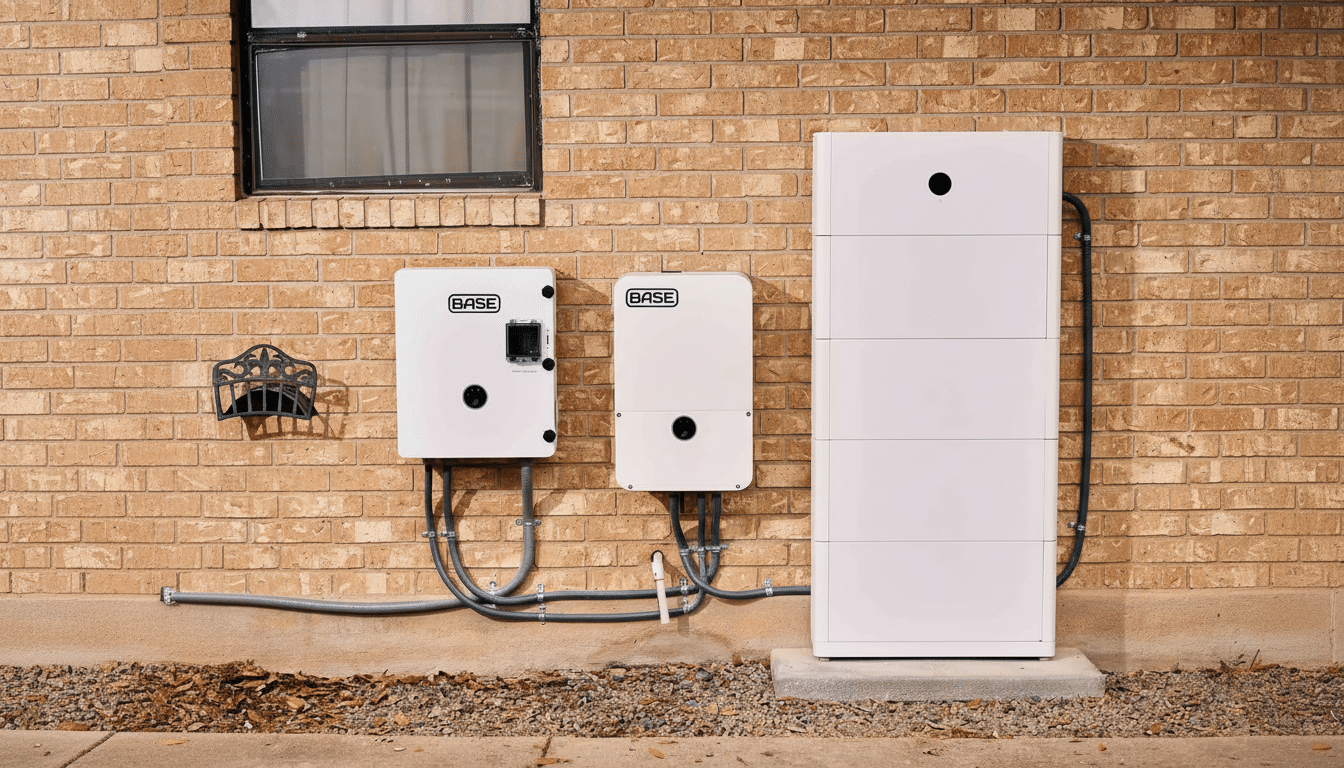

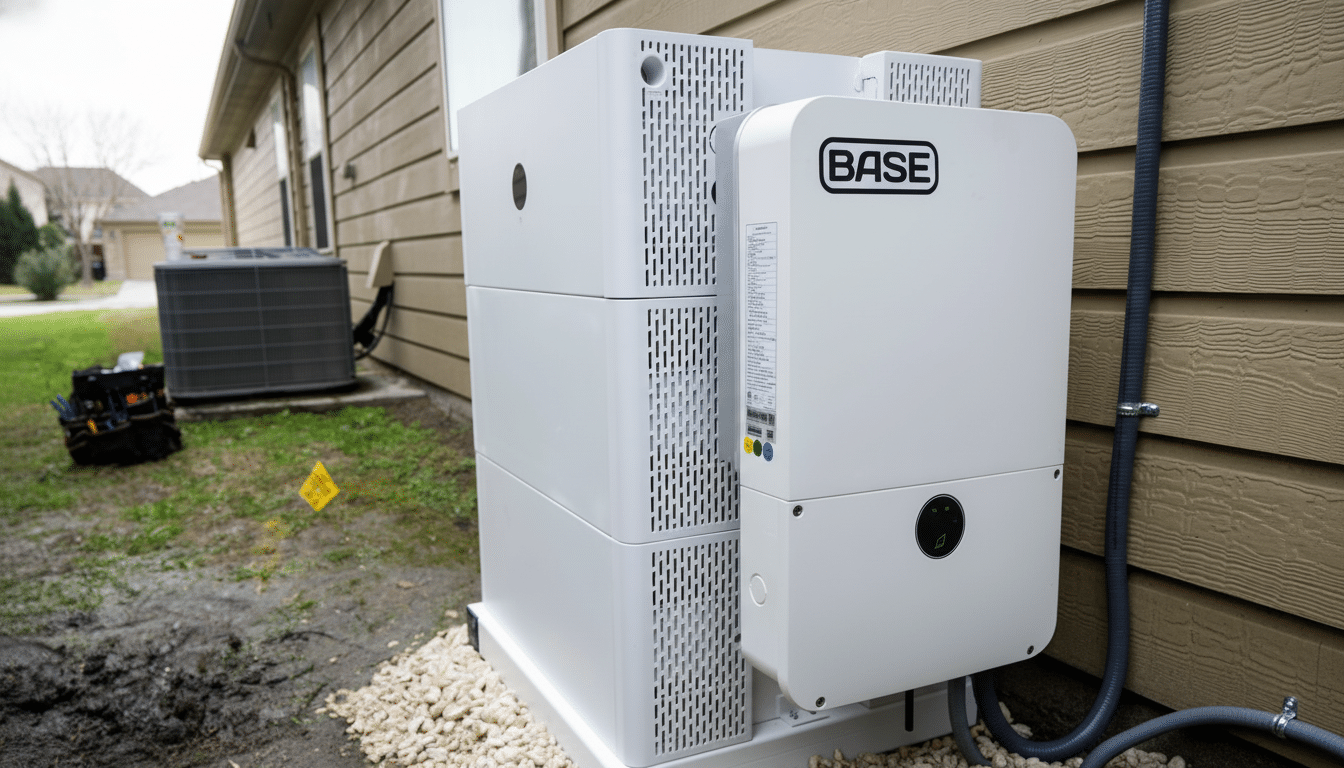

What Base Power Offers to Homeowners Through Leasing

Base Power leases 25 kilowatt-hour and 50 kilowatt-hour systems, with consumers paying $695 to $995 upfront for system installation plus a monthly fee of either $19 or $29. In exchange, households pledge to purchase electricity from Base Power for three years at a rate of 8.5 cents per kilowatt-hour, plus the regular cost of delivering the power. The company claims its 25 kWh unit provides approximately double the storage of one Tesla Powerwall and backup power for up to 48 hours, based on usage.

The economics aim to knock down a stubborn obstacle: sticker shock. According to various studies (including National Renewable Energy Laboratory and Lawrence Berkeley National Laboratory analyses), the average installed cost for a home battery system can reach five figures, even at the smaller end of the size range. Because Base Power owns and pools the assets, it can take federal incentives for standalone storage under the Investment Tax Credit — and flow part of that value directly to customers as reduced upfront pricing.

How Virtual Power Plant Economics Make the Model Work

(Image: AAP) The company makes money from retail power sales and wholesale market services, dispatching customer batteries as a single fleet when households do not need backup energy. Importantly, customers give Base Power access to their systems for grid firming but retain a reserve for outages. The U.S. Department of Energy has emphasized that virtual power plants have the potential to provide tens of gigawatts of flexible capacity this decade, and Texas is showing today how distributed assets can significantly mitigate peak demand and enhance reliability.

If Base Power can maintain high uptime and dispatch intelligently during charging cycles (charging when prices are cheap, discharging when they’re scarce), it can stack revenues from ancillary services or energy arbitrage. It is that margin that allows for the low upfront price and oversized battery capacity relative to typical residential products.

Manufacturing Plans and U.S. Supply Chain Considerations

In addition to making its fleet larger, Base Power is intending to construct a second battery factory in the United States next to its first plant outside Austin. Domestic manufacturing will help offset logistics risks, speed installation and even allow systems to qualify for more incentives connected to U.S.-made components. The company will also encounter a competitive, global market for lithium iron phosphate cells and safety certifications like UL 9540 and UL 9540A, which are increasingly required by local jurisdictions and insurers.

Competitive Landscape and Key Risks Facing Base Power

The home storage race is home to deep-pocketed players, including Tesla Energy, Sunrun, Enphase and Generac. The distinction of Base Power comes from bigger-capacity systems, a no-frills lease, and deeper participation in wholesale markets. The stakes are not insubstantial: Wholesale earnings can be fickle, the regulatory landscape changes, and real-world performance needs to stand up in heat waves and storms — not to mention extended power outages. California utilities have said virtual power plants helped them during tight system conditions but that scaling to millions of homes requires strong customer protections, sturdy software and clear service assurances.

What to Watch Next as Base Power Scales Beyond Texas

All eyes are on execution now. Key milestones will be how swiftly Base Power can convert capital into installed megawatt-hours in the home market of Texas, and expand through deployments with utilities or industrial companies in new geographies; and whether its manufacturing strategy delivers a reliable, cost-effective supply. If the model holds up at a national level, home batteries could go from off-the-shelf forms of resilience to standard grid infrastructure — partly paid for by the very peaks they modulate.