Aurora says its driverless semitrucks can now haul freight nonstop across a 1,000-mile lane between Fort Worth and Phoenix in roughly 15 hours—faster and farther than a human driver can legally manage. The milestone turns a core promise of autonomous trucking into practical advantage: higher speed and longer reach without mandated rest breaks.

How Driverless Operation Cuts Transit Time on 1,000 Miles

The U.S. Federal Motor Carrier Safety Administration limits human drivers to 11 hours of driving before a 10-hour off-duty period, plus a 30-minute break after eight hours of driving and a 14-hour on-duty window. Those rules, designed for safety, stretch a 1,000-mile trip well beyond a single-duty cycle. By contrast, Aurora’s vehicles don’t face fatigue constraints, enabling near-continuous operation that compresses door-to-door times.

On this long-haul corridor, Aurora estimates it can nearly halve transit time compared with traditional operations—an efficiency pitch that has attracted shippers and carriers prioritizing speed-sensitive freight. Early adopters include Uber Freight, Werner, FedEx, Schneider, and Hirschbach, which are using Aurora’s lanes to tighten delivery windows and reduce dwell.

Routes and Rollout Across Key Sun Belt Freight Corridors

Aurora’s network now spans key Sun Belt freight corridors, including Dallas–Houston, Fort Worth–El Paso, El Paso–Phoenix, Fort Worth–Phoenix, and Laredo–Dallas. The company plans to broaden coverage across Texas, New Mexico, Arizona, and into additional southern states as it adds trucks and software capabilities for varied terrain and weather.

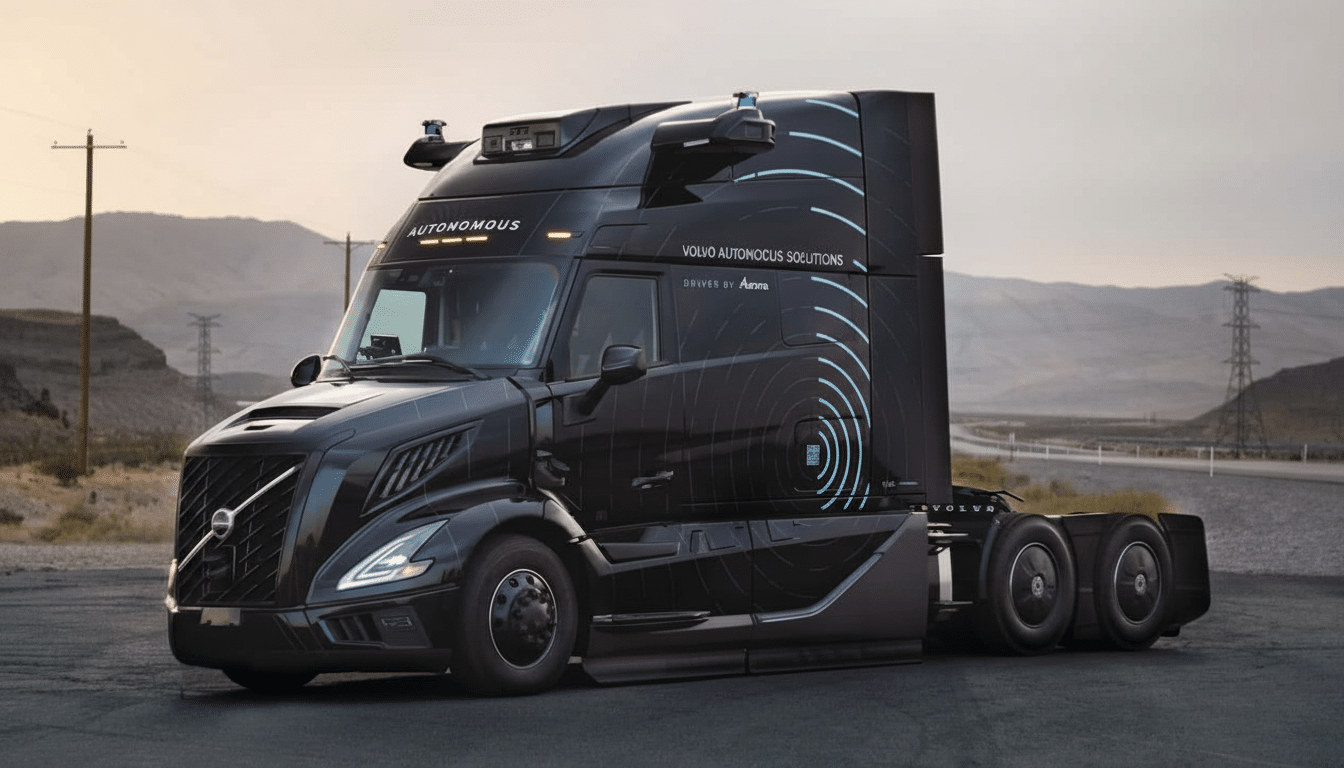

Today’s operations mix fully driverless runs with select routes that still carry a human observer, a requirement tied to certain manufacturer agreements. Aurora says its next wave will feature International LT trucks running without an onboard human, while Paccar-based vehicles will continue with observers until manufacturer sign-off.

Performance Metrics and Operating Economics for Aurora

The company reports 250,000 driverless miles to date with no at-fault incidents, and a fleet of 30 trucks, 10 of which are operating driverlessly. Management expects to scale beyond 200 trucks as new hardware and software roll out, including a second-generation sensor suite aimed at reducing cost per mile and improving reliability in heat, dust, crosswinds, and nighttime conditions common in the Southwest.

Revenue has begun to reflect this shift from R&D to operations. According to filings with the U.S. Securities and Exchange Commission, Aurora posted $1 million in the most recent fourth quarter and $3 million for the year, with $4 million in adjusted revenue when early pilot income is included. Losses remain substantial—net loss reached $816 million, up 9%—as the company invests in scaling routes, equipment, and support.

For shippers, the calculus is asset utilization. A truck that can legally run nearly around the clock yields more revenue miles per day, fewer overnight handoffs, and tighter schedules from border or port gateways to inland hubs. The 1,000-mile lane effectively turns what was a two-shift journey into a same-day or overnight linehaul, potentially trimming inventory buffers and expediting high-value loads.

Safety, Compliance, and Oversight for Nonstop Driverless Trucks

Driverless trucks are not bound by human Hours-of-Service limits, but they operate under a patchwork of state rules and federal oversight from agencies such as FMCSA and the National Highway Traffic Safety Administration. Aurora emphasizes a layered safety case that includes redundant perception, long-range lidar and radar, continuous remote monitoring, and conservative fallback behaviors for debris, sudden lane closures, or erratic motorists.

The move to nonstop service amplifies operational demands: predictive maintenance to avoid roadside failures, rigorous weather forecasting, and robust yard operations for rapid trailer swaps. Meeting those benchmarks consistently will be as critical to customer confidence as headline speed gains.

Industry Context and What to Watch as Autonomous Freight Scales

Autonomous freight has multiple contenders—Kodiak Robotics, Torc Robotics, and others are validating long-haul lanes and transfer hub models—yet Aurora’s 1,000-mile nonstop run establishes a new bar for end-to-end speed on a major corridor. The American Trucking Associations has reported a long-term driver shortfall exceeding 60,000 positions in recent years; sustained autonomous capacity on high-volume lanes could ease pinch points without displacing local and regional roles that still require human touch.

Key proof points now are density and uptime: more nodes across the Sun Belt, consistent 15-hour performance on thousand-mile routes, and a reliable flow of trailers that keep trucks turning. If Aurora maintains a clean safety record while scaling to hundreds of vehicles and broader geography, faster-than-human delivery will start to look less like a demo and more like the new baseline for long-haul logistics.