Constructing or upgrading a PC just became significantly more expensive. Retail RAM kits that rested at historic lows just a little while ago have instead leapt by triple digits, as hyperscale data centers vying to train and serve AI models vacuum up an outsized portion of the world’s memory and storage production.

AI workloads are draining the global memory supply chain

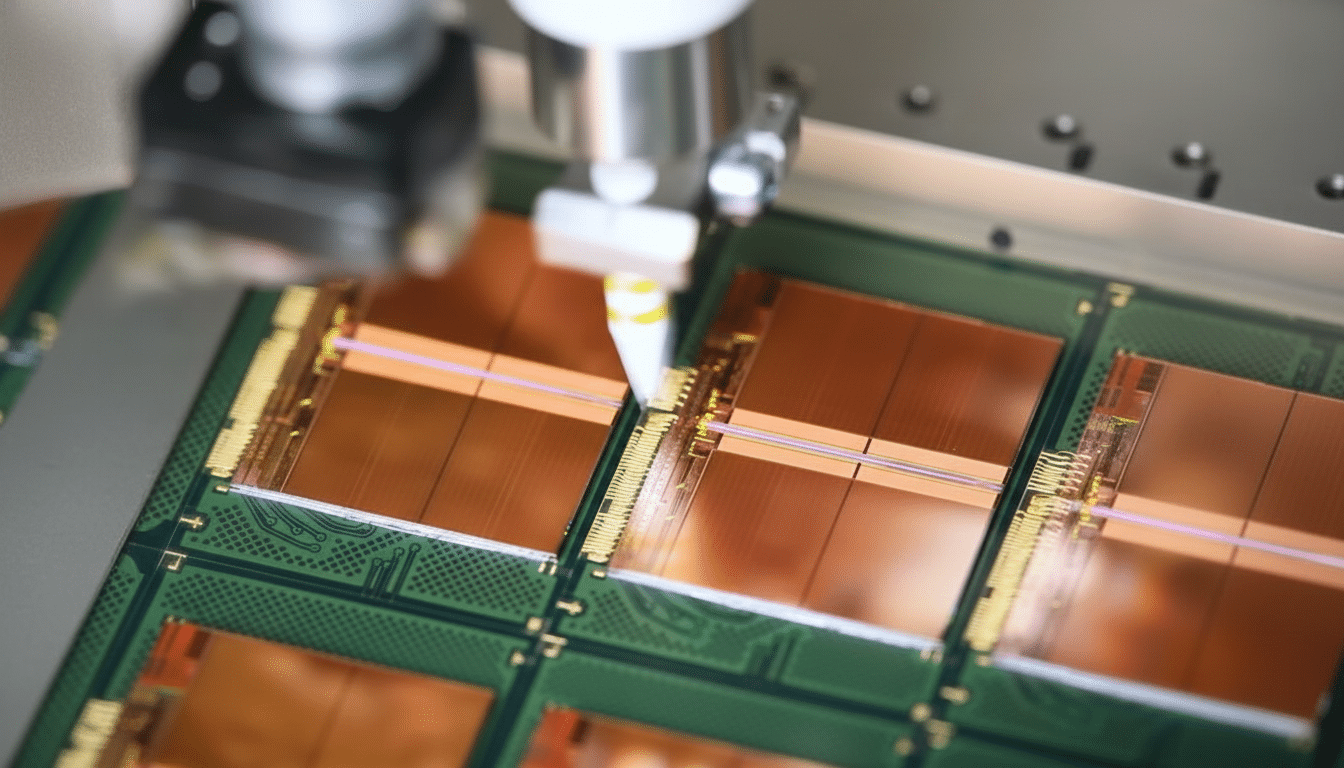

Cloud providers are also tying up long-term deals for server DRAM and high-bandwidth memory, both of which are vital for accelerating AI algorithms. Supplies are being side-tracked to that market at the expense of consumer DDR5, with HBM and server-grade DRAM taking priority, TrendForce and Omdia analysts noted. So when Samsung, SK hynix, and Micron reassign wafer starts and packaging capacity to premium server products, the flipside is fewer bits available for mainstream desktop kits.

The bottleneck isn’t only chipmaking; capacity and yields for HBM advanced packaging remain strained. That spills over to the larger DRAM market as companies refocus their resources where margins are greatest, leaving retail channels scrambling for what remains. Throw in pre-existing, intentional production cuts meant to stabilize prices after a glut, and you have the recipe for a big snapback.

DDR5 leads the spike as consumer kits more than double

Price trackers and channel checks confirm consumer DDR5 is at the center of this upswing. Reporting highlighted by Ars Technica suggests that kits have more than doubled. One example: a 16GB DDR5-6000 kit whose price rose to almost $110 from about $49 — an increase of nearly 125%. One of the most popular 64GB DDR5-6400 kits jumped from around $190 to about $700, an increase of approximately 268 percent, with spikes briefly hitting well above that before cooling off a little.

Why DDR5 specifically? New desktop chip platforms from AMD and Intel have adopted DDR5, attracting new consumer demand at a time when enterprise buyers are already gobbling up server-grade DDR5 at high prices. With supply leaned toward the data center, retail shelves are cleared and bargains disappear.

SSD prices are rising, though increases lag dramatic DRAM

NAND flash prices have also risen following deep output cuts in the previous downcycle. Client SSD contract prices hit all-time highs in 2Q21, with retail tags surging double digits in some regions — TrendForce has reported QoQ gains for the last three quarters. Yet the ascent for SSDs is more gradual than DRAM, in part because NAND expands capacity and migrates nodes faster and also because AI servers value DRAM more highly per system than client-based SSDs.

However, that doesn’t mean storage shoppers are off the hook. Larger-capacity PCIe 4.0 drives that recently dipped to rock-bottom sales prices are slowly rising in price again, and new PCIe 5.0 models are still more expensive due to controller and thermal requirements keeping supply low and prices high.

Why memory prices are so volatile in cyclical markets

Memory is a traditionally cyclical boom–bust market. It takes quarters — sometimes years — to add wafer starts of meaningful capacity or retool for new standards, yet demand can shift in weeks. The pandemic whipsaw demonstrated it: a suddenly occurring PC supercycle, then a crash, then normalization. And manufacturers responded by slashing production drastically to staunch the bleeding — and now this rising AI appetite seems to be running smack into that lean inventory stance.

Contract and spot markets are magnifiers. As pricing on contracts increases, distributors ration their supply and more buyers are forced into the spot market with its wilder price swings. As data centers pay a premium for guaranteed deliveries, retail channels are the release valve — and PC builders feel it first.

What PC buyers can do now as memory and storage costs rise

What you have at your disposal are patience — if you can wait, that is — and waiting is your biggest lever. A number of vendors have indicated that they are scheduling DRAM and package-assembly incremental capacity adds, while industry research institutes predict supply–demand balance will become better after ongoing AI server deployments wane. Historically, memory surges ease as bit output offsets.

If you can’t wait, shop smart. Quality over quantity: in other words, favor capacity over peak frequency; a good 32GB DDR5-5600 or -6000 kit will often provide better real-world gains than more expensive, higher-speed modules. Keep your eye out for system-builder pulls and OEM overstock, which can sell under the price of retail-branded bundles. For storage, aim for proven PCIe 4.0 NVMe drives where price-per-terabyte is cost-effective and avoid bleeding-edge PCIe 5.0 unless you absolutely need the throughput.

Finally, keep an eye on reputable trackers and analyst notes. Early clues on supply shifts can be found in company earnings calls and in forecasts from TrendForce, IDC, and others. Retail RAM prices should ease once server DRAM and HBM tightness calms down, with mid-range kits likely to see relief first. Until then, however, budget builds might have to temper expectations — memory is the new bottleneck and the AI boom gets first dibs on bits.