Apple and Microsoft have each surged beyond the $4 trillion market capitalization level, not just a symbolic but also a mathematically meaningful point that highlights the way artificial intelligence and cloud computing are profoundly changing investors’ hopes for Big Tech. Apple is only the third company to ever cross the milestone, following Nvidia and Microsoft, and Redmond’s climb back over it underscores how powerful the major players in AI have become.

What Pushed Apple and Microsoft Above $4 Trillion

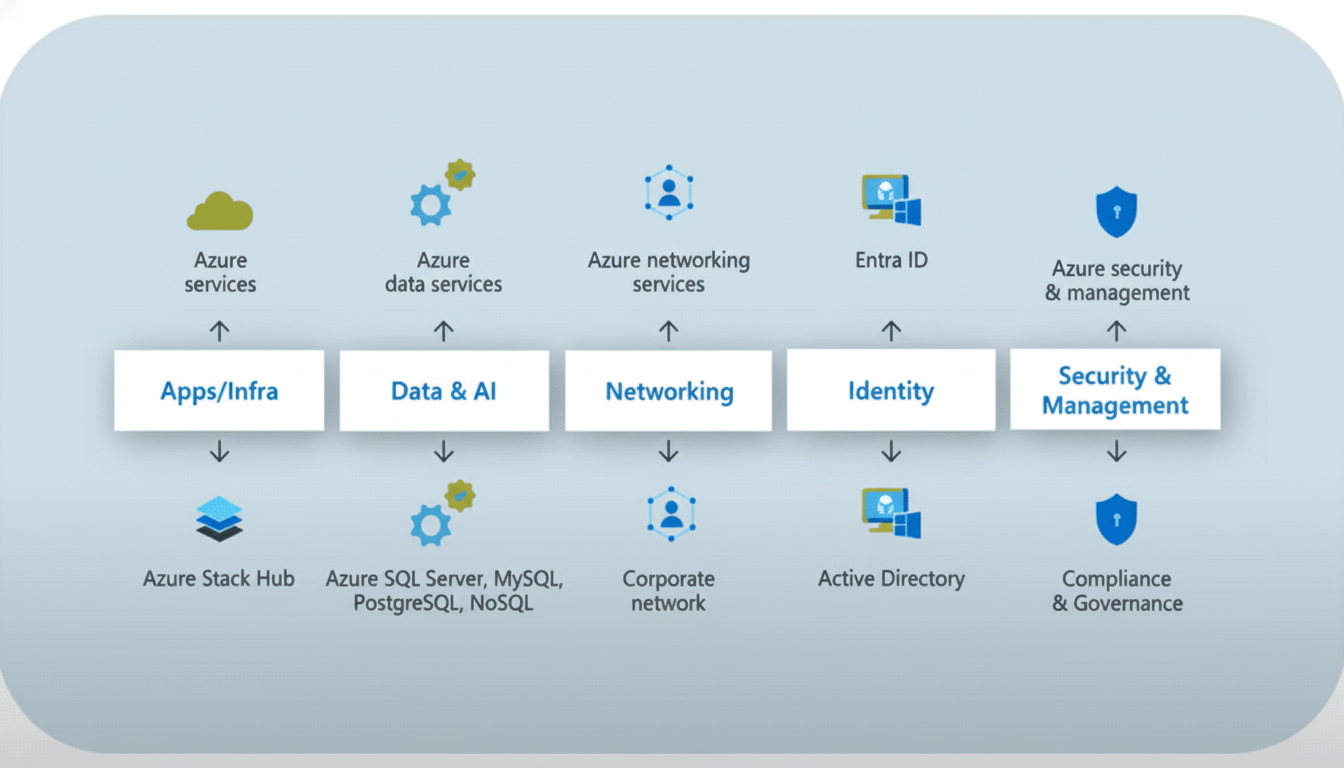

For Microsoft, the motivation is enterprise demand for AI at scale. Azure is also growing as a result of customers training and deploying large language models on Microsoft’s cloud, and broad usage of OpenAI’s models through Azure OpenAI Service. Shares soared on word of a new arrangement with the computing lab OpenAI, and the company said its approximately 27 percent economic interest in the startup has an implied value in the range of $135 billion. Such a stake, along with faster growth in cloud revenue and more options for its artificial intelligence software, has added to optimism about long-term cash generation.

Apple’s rise is rooted in a superior product cycle that exceeds expectations and an engine of services that spits out reliable, high-margin cash flows. The iPhone 17 lineup is ahead of past generations in channel checks from a number of research firms, and Services—including the App Store, subscriptions, advertising and AppleCare—continues to contribute a larger share of total revenue. And the instituting of a buyback and disciplined cost management both lever earnings per share, which offers investors further leverage against the top line. Apple has now gone from $1 trillion to $3 trillion in an incredibly small amount of time and reached $4 trillion on refreshed momentum behind its device upgrades and upcoming on-device AI roadmap.

The AI Flywheel Driving Big Tech Valuations

Nvidia’s previous sprint past $4 trillion helped illustrate the magnitude of demand for AI infrastructure, as luxury apartment complexes’ worth of GPU capacity became a key constraint for many builders. And that dynamic is feeding an increasingly powerful flywheel: hyperscalers invest heavily in data centers; developers build AI services; enterprises consume those tools, while platform owners monetize them through cloud or software subscription use. The AOL of this equation — the one in the middle of that information loop — is Microsoft with Azure, Copilot and its OpenAI connections, while Apple incorporates AI into device-driven experiences and services that can access an unimaginably large installed base.

Investors are eyeing two related trends. First, the capital expenditure on AI infrastructure is at record highs across the industry, as signaled by management commentary and tracked by firms such as Bloomberg and FactSet. Second, it’s also changing the conversation: from use to monetization – how soon will AI features turn into sticky revenue per user and fatter margins? Early signals like productivity suite AI software attach rates and high-end device mix have been supportive.

Market Impact and Concentration Risk for Investors

The dual $4 trillion valuations come with market structure implications. The biggest companies now make up an outsize proportion of major benchmarks, S&P Dow Jones Indices says, increasing their sway over index returns and volatility. Strategists at firms including Goldman Sachs and Bank of America have warned that concentration can be a two-way blade: It lifts passive portfolios when the megacaps are surging — but can also amplify selloffs if sentiment flips or regulation tightens.

Earnings strength has made the weighting justified for now. Microsoft’s Intelligent Cloud is still a profit engine while Apple’s Services margin profile combined with the buyback should continue to support per share metrics. Both firms have fortress balance sheets, enabling investment in AI, supply chain resiliency and shareholder returns.

Alphabet Nears the $4 Trillion Milestone

Alphabet is closing in on that milestone as well, with a market value of about $3.25 trillion when trading started this week. Profitability in the cloud, a recovery in advertising at YouTube and a continued rollout of AI products throughout Search and Workspace have helped close that gap. Should momentum endure, Alphabet could also join Apple and Microsoft in the ultra-rare $4 trillion club, further narrowing leadership down to a small group of AI-heavy platforms.

The larger takeaway is simple: the market is rewarding companies able to transform AI demand into revenue at scale through cloud platforms or closely integrated devices and services. Apple and Microsoft surpassing $4 trillion together is not just a milestone — it’s also a gauge of how much value is becoming concentrated in the digital era of computing.