Antares secured fresh financing for its cutting-edge R1 microreactor — a compact nuclear system the startup maintains can provide trusted power on land, at sea, and in space. The $71 million equity contribution and a $25 million debt financing, with money going into two small projects that spent much of the past year asking industry engineers what kind of machine they ought to build, is also unusual — it’s typically rare for startups to get this kind of support; and we haven’t yet seen its like in first-of-a-kind tech investing since the economic crisis anyway.

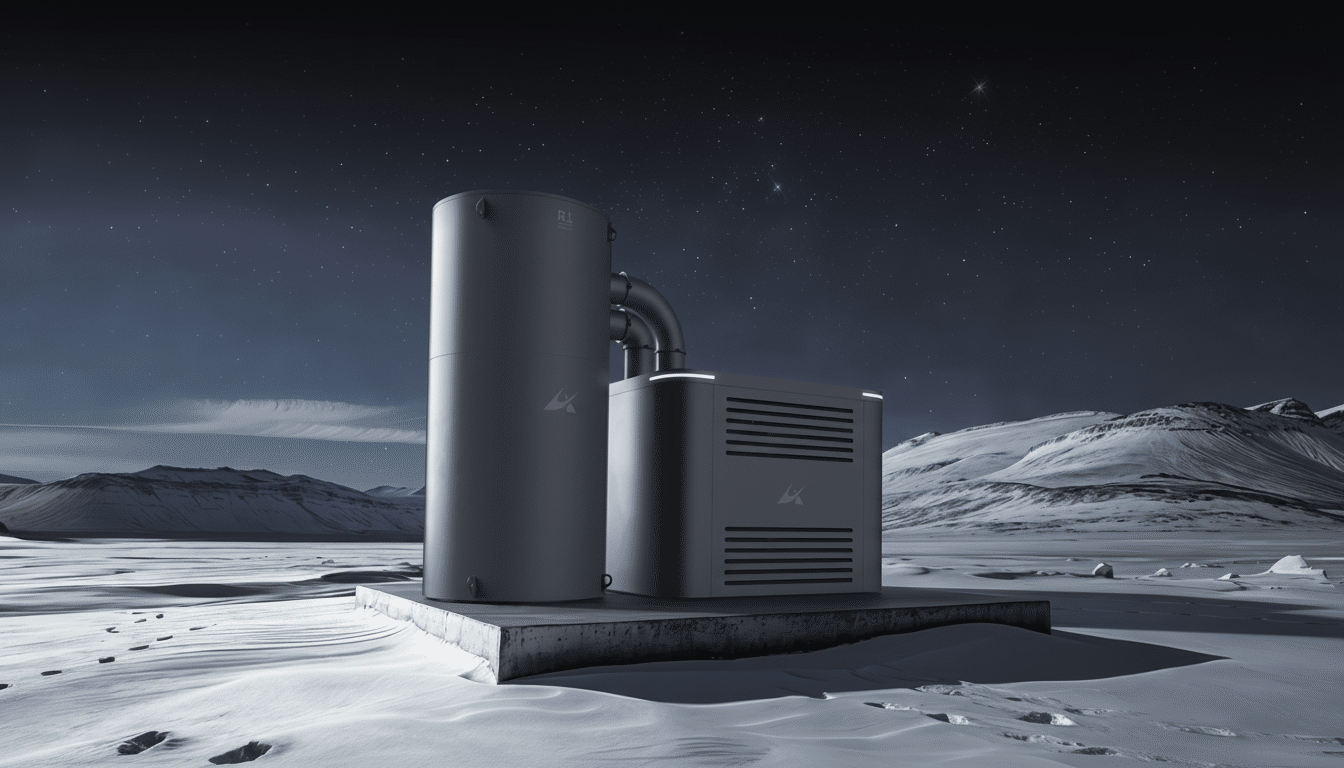

The R1 is planned to produce between 100 kilowatts and 1 megawatt of electricity using TRISO fuel — tiny uranium kernels coated with several layers of ceramics and carbon, and arranged in graphite. The company is aiming first for commercial and defense customers, though the latter will have to come from overseas due to U.S. regulatory restrictions. It’s also laying the groundwork for a maritime propulsion system and off-world power generation systems in which diesel logistics and solar intermittency are constant challenges.

Why microreactors are drawing interest across sectors

From power plants to remote factories, demand for electricity is surging in places where there is limited access to reliable grid power and compact electrical grids. Data centers already use an estimated 1–2% of global electricity, according to the International Energy Agency, and new AI and cloud loads are prompting operators to look for firm (i.e., on-site) generation. Defense planners confront the same pressures at remote bases and in contested theaters, where fuel convoys are expensive to operate and dangerous to run.

Interest is also reviving in nuclear power at sea as the shipping industry looks for ways to decarbonize deeply. Maritime transportation accounts for about 3% of worldwide CO2 emissions, and classification societies like the American Bureau of Shipping have provided guidance to nuclear-powered vessels. In space, NASA and the Department of Energy have been pursuing fission surface power research for lunar and planetary missions, highlighting the desirability of compact reactors in regions where sunlight is scarce and batteries are not practical at scale.

Inside the R1 design and safety approach with TRISO fuel

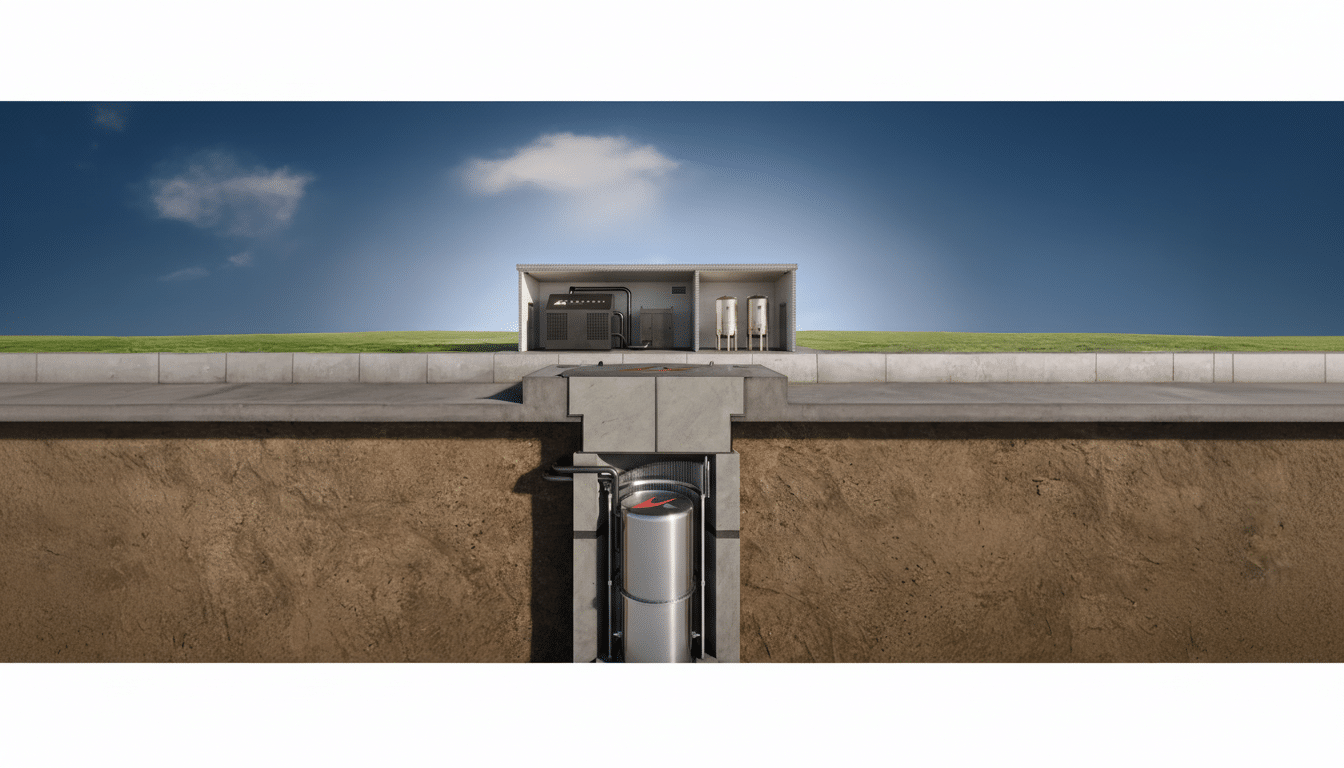

Antares needs to be able to demonstrate that TRISO fuel is safe. The ceramic coatings of each fuel particle serve as miniature containment, which is intended to retain fission products at high temperatures. With the graphite matrix that moderates neutrons and acts as a heat sink, this design enables inherent safety devices, which are easier to operate and maintain compared to conventional large reactors.

According to Antares, the R1 will be portable and quick to deploy, covering a spectrum of use scenarios from microgrids and industrial facilities to seagoing vessels and space habitats off-world. The company’s largest technical bet could be fuel logistics, as most advanced reactors require HALEU (high-assay low-enriched uranium). However, the U.S. Department of Energy has initiated a HALEU availability program, and Centrus Energy started U.S. HALEU production here. TRISO-X, backed by X-energy, is also developing facilities for TRISO fuel fabrication.

Deal terms and a crowded field for advanced microreactors

The combination of equity and debt indicates that Antares is prepping for hardware milestones, for which purchase orders, long-lead items, and site work necessitate flexible financing. The group of investors is comprised of sector specialists and generalists that have turned to increasingly overlapping climate and defense dual-use themes in the microreactor market.

Competition is intensifying. Recently, X-energy announced a $700 million Series D to continue developing its TRISO-fueled designs. TerraPower received a $650 million round that also included strategic support from technology players focused on electrifying AI-scale computing. Aalo Atomics raised $100 million to show a microreactor powering a data center, while Deep Fission hit the public markets through a $30 million reverse merger. On the utility side of things, Constellation Energy was able to win a $1 billion loan from the Department of Energy to restart a reactor at Three Mile Island, underscoring how nuclear has broader momentum.

Regulatory outlook and expanding use cases for microreactors

Antares was chosen by the Department of Energy for its advanced reactor pilot program, which intends to shepherd a number of concepts to operation on an unusually aggressive schedule as far as the sector is concerned. The NRC is also developing non-light-water and microreactor licensing frameworks, such as the one proposed in a Part 53 rulemaking, alongside existing pathways.

Defense is probably the first line of demarcation. Project Pele showed the Pentagon that mobile microreactors can navigate design and safety testing at an accelerated pace, and it developed a playbook for their deployment to forward bases. It will take coordination with the classification societies and flag states to deploy them at sea, and for space fission systems, rigorous launch safety and planetary protection reviews from DOE and NASA.

What to watch next as Antares moves toward deployment

Important goals for Antares are obtaining fuel, a first demonstration site under the watchful eye of DOE, and early customer commitments in data centers, defense, or maritime pilot projects.

Outsourcing for pressure vessels, graphite components, and fuel compacts will define the credibility of the schedule as the company transitions from prototyping to repeatable production.

If Antares can test its range of performance claims — from 100 kW remote microgrids to 1 MW maritime and lunar applications — while securing HALEU supply and licensing approvals, the R1 might prove a versatile workhorse in hard-to-electrify niches. Today’s announced money buys runway; the future will tell us if microreactors can move from promise to power in places that desperately need it.