Rumors of a SpaceX-branded smartphone flare up every few months, but the odds of a near-term launch look slim. Building a phone is hard, sustaining one is harder, and the satellite advantage that might differentiate a SpaceX handset is already leaking into mainstream devices and carrier roadmaps. If you’re waiting to swap your iPhone or Galaxy for a SpaceX phone, don’t hold your breath.

Making a Competitive Smartphone Is Brutally Hard

Smartphones aren’t rockets, but the failure rate for newcomers is just as unforgiving. Beyond industrial design, a vendor must secure component supply at scale, pass global certifications (FCC, PTCRB, CE), earn carrier approval, localize radios for dozens of bands, and maintain updates for years. Counterpoint Research has pegged the bill of materials for a modern flagship in the $400–$500 range, before marketing, warranties, and retail margins even enter the picture.

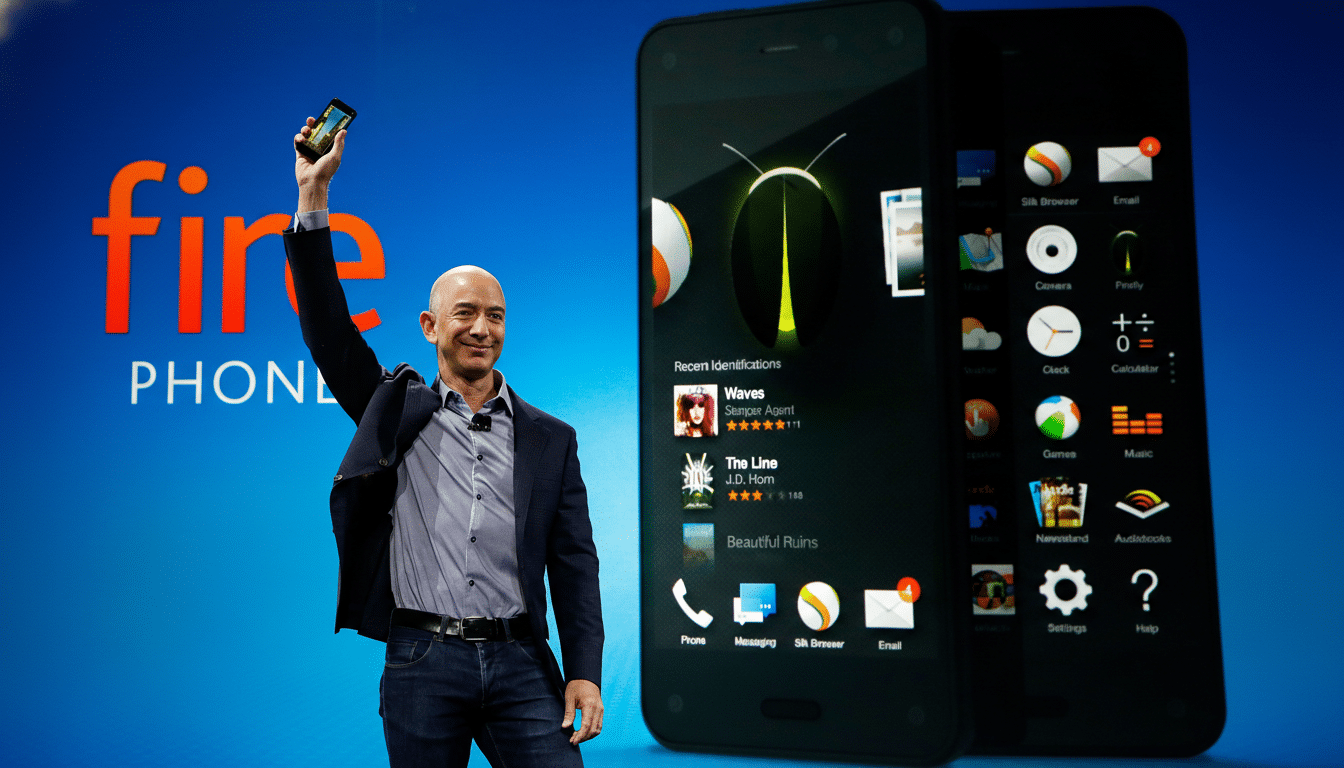

Plenty of deep-pocketed entrants have tried and stumbled. Amazon took a $170 million write-down on the Fire Phone. Essential shuttered after one device. RED abandoned its Hydrogen One. Even brands with hardware pedigrees find the market unforgiving once carriers and consumers reject the first iteration.

SpaceX can outsource much of the handset work, but that creates another problem: if your “phone” is effectively a rebadged Android slab with custom software and a satellite checkbox, it’s instantly compared against the best from Apple, Samsung, and Google. That’s a ruthless league to join without a knockout feature.

Ecosystem Gravity Makes Switching Phones Hard

The consumer switching cost is enormous. IDC and Counterpoint consistently show a global market dominated by a handful of vendors, with Apple and Samsung trading the top two spots and everyone else fighting over the rest. People don’t just buy a phone; they buy an ecosystem of services, accessories, chats, photos, wearables, and backups.

Apple now delivers years of OS updates and services like iMessage, iCloud, and Emergency SOS via satellite. Samsung and Google promise extended Android support, deep integration with watches, earbuds, and smart home gear, and camera pipelines honed by billions of photos. To pry users loose, a SpaceX phone must be more than a satellite novelty. It needs a credible camera system, long-term updates, carrier-grade reliability, and a reason to abandon entrenched habits and group chats.

The Satellite Edge Is Already Crowded With Rivals

Satellite connectivity is moving mainstream without a single vendor owning the experience. Apple’s Emergency SOS via satellite has been live since iPhone 14. On Android, 3GPP Release 17 brought standardized Non-Terrestrial Networks support, and Google has previewed native satellite messaging in Android with Garmin’s emergency response platform as a conduit for some regions.

The market is also diverse on the network side. SpaceX’s Starlink Direct to Cell has a public partnership with T-Mobile for text messaging and limited data in dead zones, and early test messages have been demonstrated. But rivals are not standing still: AST SpaceMobile has completed direct-to-cellular voice and data calls over standard phones with carrier partners like AT&T, and Lynk Global has live commercial texting in multiple countries with regional operators.

The upshot is simple: satellite messaging is arriving on mainstream phones through carriers and standards. You won’t need a SpaceX-branded handset to text from a trailhead or send coordinates from a dead zone.

Partnership Risks May Outweigh Rewards for SpaceX

SpaceX’s strongest play is wholesaling Starlink connectivity to carriers, not competing with them. If SpaceX prioritizes its own hardware, partners could balk at perceived conflicts over spectrum time, capacity, or feature priority. A misstep here risks alienating the very companies needed to scale direct-to-cell services nationwide.

Carriers are pragmatic. If they sense preferential treatment for a SpaceX phone, they have alternatives in AST SpaceMobile, Lynk Global, or hybrid approaches that combine terrestrial coverage with satellite fallback. Preserving neutral, network-first relationships is more valuable to Starlink’s long-term business than chasing single-digit smartphone share.

Software Ambitions Alone Won’t Be Enough to Win

Could a SpaceX phone lean on xAI’s Grok to stand out? Perhaps—but AI assistants are already proliferating across platforms. Apple is rolling out new models for on-device tasks, Google has integrated Gemini across Android and Workspace, and Qualcomm and MediaTek are pushing NPUs that run multimodal models locally. The differentiator won’t be “we have AI,” it will be depth of integration, privacy guarantees, and day-to-day utility. That is a software and services marathon, not a sprint.

What Would Truly Change the SpaceX Phone Story

A SpaceX phone could make sense if it delivered a true field communicator—seamless terrestrial-to-satellite handover, days-long battery life, a rugged yet pocketable design, transparent pricing that bundles satellite messaging and basic data, and a multi-year update guarantee. Pair that with ironclad assurances to carriers that Starlink remains network-neutral and wholesale-first, and the proposition gets more interesting.

Until then, the most likely path is Starlink powering services on phones you already own. That’s good news for coverage in rural America and on the water, and far less risky than building another doomed “hero phone.” Enjoy the hype cycle if you must—but don’t expect to preorder a SpaceX handset anytime soon.