Criminals are exploiting Amazon’s Shop with Points feature to quietly siphon off credit card rewards, converting miles and points into merchandise without triggering the usual fraud alarms. Victims often don’t notice until their balance suddenly plunges, and because no cash changes hands, the theft can blend into normal account activity.

How the Shop With Points Scam Quietly Drains Rewards

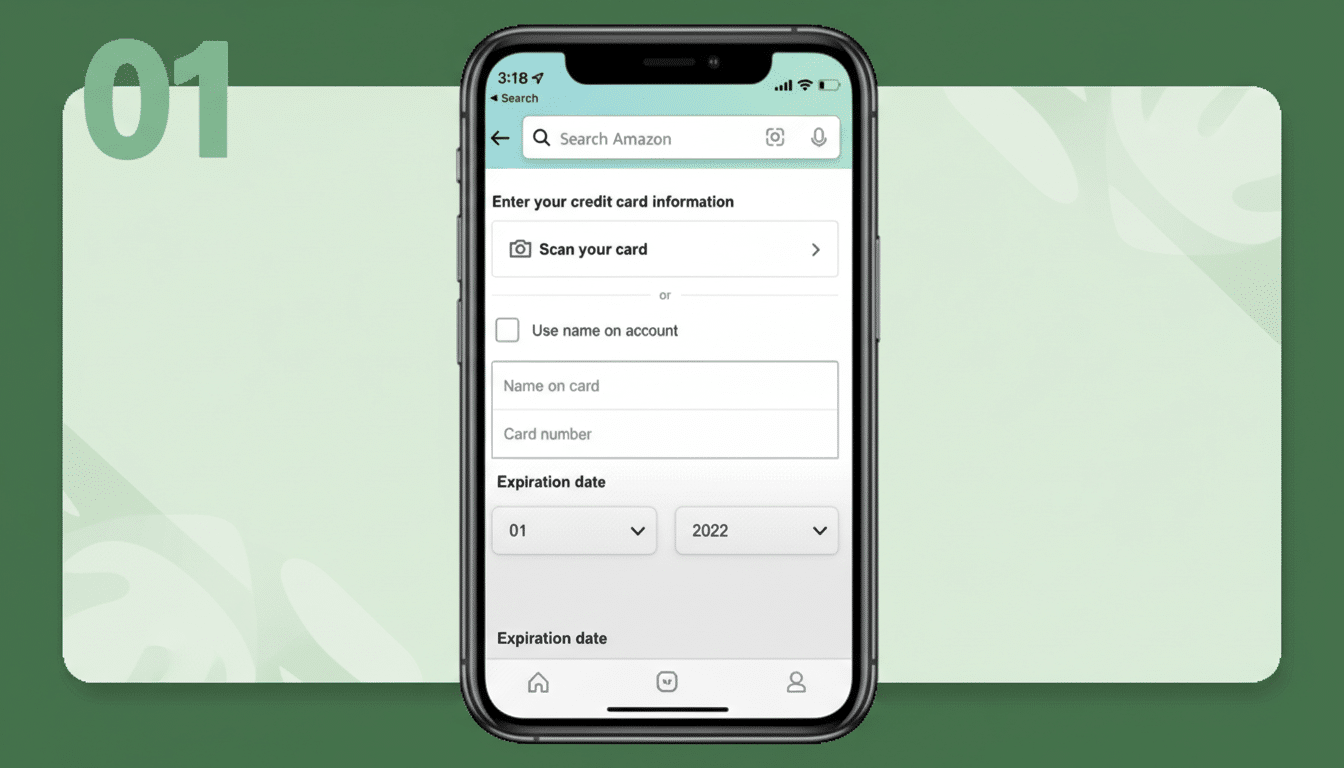

The playbook is straightforward. A fraudster gets your card details—often harvested from a retailer breach or a malware-infected device—and adds that card to their own Amazon account. From there, they activate Shop with Points by linking the card issuer’s rewards program, then spend your points on a series of small, everyday purchases. Those redemptions look like regular checkouts, except the “payment” is your rewards balance.

- How the Shop With Points Scam Quietly Drains Rewards

- Why Shop With Points Fraud Often Evades Detection

- Who Is at Risk From Amazon Shop With Points Fraud

- Real-World Red Flags That Signal Points Theft on Amazon

- What Amazon and Issuing Banks Say About Points Fraud

- Protect Yourself Now With These Steps to Safeguard Points

- If You’re Hit, How to Report and Recover Stolen Rewards

Because this is a rewards redemption rather than a cash charge, issuers’ anti-fraud systems may not flag it. Cardholders typically don’t receive a one-time passcode or enrollment alert when their rewards account is connected to Amazon, and many never see an email when points are used at checkout.

Why Shop With Points Fraud Often Evades Detection

Shop with Points is designed for convenience: once a card is on file, Amazon can check with a bank or rewards partner for available points and apply them at checkout. Amazon says it notifies the rewards partner when a card is enrolled, leaving banks to monitor and decide whether to alert the customer. In practice, some issuers don’t send any message when linking occurs, and their fraud rules are tuned to cash charges, not loyalty currency.

That gap is what thieves exploit. They often redeem in small increments—$10 here, $40 there—to avoid standing out. Cardholders who rarely check their points balance can go weeks before noticing a missing digit. When they do, the transaction history typically shows a string of modest Amazon orders paid partly or entirely with points.

Who Is at Risk From Amazon Shop With Points Fraud

This isn’t isolated to one bank. Shop with Points supports programs from major issuers including Chase Ultimate Rewards, American Express Membership Rewards, Capital One Miles, Citi ThankYou Rewards, and others. Online communities have reported similar incidents across multiple issuers, indicating a systemic blind spot around loyalty redemptions rather than a single compromised platform.

The broader fraud context is sobering. The Federal Trade Commission reported consumers lost more than $10 billion to fraud in 2023, a record high driven by scams that thrive on account access and social engineering. Identity-fraud researchers at firms like Javelin Strategy & Research have repeatedly found account takeover to be a leading driver of losses in digital commerce, and loyalty accounts are increasingly a target because points are liquid and lightly monitored.

Real-World Red Flags That Signal Points Theft on Amazon

Victims often discover the problem by accident—opening a bank app to find a six-figure points balance decimated. Recent cases shared by frequent-flyer enthusiasts and journalists describe dozens of incremental Amazon purchases made over days, sometimes without a single alert from the bank or Amazon. In many instances, issuers restored the stolen points after investigation, but the resolution process took time and required manual dispute filings.

What Amazon and Issuing Banks Say About Points Fraud

Amazon indicates it alerts the rewards partner whenever a customer enrolls a card for Shop with Points, enabling the bank to watch for suspicious activity. The company generally cannot notify the cardholder directly because it may not know who owns the underlying card on an Amazon account. Several banks, including large issuers, say customers are not liable for confirmed unauthorized redemptions and that points will be reinstated. The problem is the lag: absent proactive alerts, the fraud can run until a cardholder spots the loss.

Protect Yourself Now With These Steps to Safeguard Points

- Check your rewards balance weekly in your card issuer’s app and review the “rewards activity” ledger for any Amazon redemptions you don’t recognize. Visibility is the single best defense, because these events often don’t appear in your cash transaction feed.

- Audit your Amazon account. In Payment Options, review Shop with Points and remove any rewards programs you don’t use. Delete stored cards you no longer need. Turn on two-step verification for Amazon and ensure your email account—the key to password resets—also has strong multi-factor authentication.

- Set alerts wherever possible. Some banks offer push notifications for points redemptions or program changes; if yours does, enable them. If not, create custom account alerts for any Amazon charge, even small ones, to surface suspicious activity tied to points spend.

- Harden your card details. Avoid saving cards at retailers by default, use virtual card numbers where your issuer offers them, and rotate cards used for online purchases. A password manager can help you maintain unique, long credentials and reduce phishing risk.

- Track loyalty across programs. Third-party tools from reputable providers can monitor balances and send alerts when points move unexpectedly, giving you a second line of defense beyond your bank app.

If You’re Hit, How to Report and Recover Stolen Rewards

Act fast. Screenshot your rewards activity, contact your issuer to report unauthorized redemptions, and request a new card number. Remove your card from Amazon and disable Shop with Points until the investigation concludes. Most major issuers will restore points after confirming fraud, but early reporting can speed the outcome and limit additional losses.

The takeaway is simple: loyalty currency is real money. Until issuers treat points redemptions with the same rigor as cash transactions—and push proactive alerts by default—cardholders should assume responsibility for monitoring. A quick weekly glance at your points balance could save a costly surprise at checkout.