Amazon has agreed to resolve a class-action case over disputed refunds by creating a $309.5 million non‑reversionary common fund for consumers, according to court filings, capping a broader package of monetary and operational remedies linked to its returns process. The company also values more than $363 million in non‑monetary changes designed to prevent similar issues. Amazon denies wrongdoing.

The settlement follows allegations that some shoppers were charged for items despite sending them back, leading to “unjustified monetary losses,” as described in the lawsuit. The agreement acknowledges substantial refunds already in motion: roughly $570 million has been issued and an additional ~$34 million remains to be paid out, per the filings. Reuters first reported details of the deal.

What the settlement covers and who could be eligible

The heart of the agreement is a non‑reversionary fund, which means unclaimed money does not return to Amazon. Instead, it is redistributed to eligible class members or directed to court‑approved purposes. That structure typically results in higher effective recovery for consumers compared with settlements where leftover funds revert to the defendant.

Eligible shoppers are those who returned products but were nevertheless charged, according to the complaint. Exact eligibility windows and documentation requirements will be set by the court and the settlement administrator. The total consumer relief spans three pillars: the new $309.5 million fund; hundreds of millions in refunds already delivered or pending; and extensive policy, technology, and process changes meant to strengthen refund accuracy.

How consumers could receive money from the settlement

Payments in class actions generally depend on how many people file valid claims and the documented value of each claim. In many cases, shoppers receive automatic credits if the retailer can verify eligibility from internal records; others may need to submit a brief claim form. Distribution methods typically include digital payments, paper checks, or Amazon credits, determined by the final approval order.

Consumers should watch for official notices from the settlement administrator and confirm sender details to avoid phishing. A reliable starting point is the orders and returns history in your account: identify transactions where a return was accepted but the charge was never reversed. While the court still has to grant final approval, preparation now can help ensure timely recovery once the fund is distributed.

Operational changes at Amazon to improve refund accuracy

Beyond cash, the settlement assigns more than $363 million in value to non‑monetary relief, signaling significant internal investment. Court documents point to enhancements in return tracking, clearer and more frequent customer notifications, and stronger audit trails between carriers, fulfillment centers, and billing systems. The goal is to minimize gaps between a return being scanned, processed, and refunded.

Marketplace dynamics add complexity: many items are sold by third‑party merchants but fulfilled or refunded through Amazon’s systems. Observers expect tighter alignment between Amazon’s A‑to‑Z Guarantee and seller workflows, with more standardized timelines and triggers for automatic credits when scans confirm a return has entered the network. If executed well, that should reduce edge‑case errors that frustrate high‑volume shoppers.

Why returns are under the microscope across e‑commerce

Returns are a costly pressure point across retail. The National Retail Federation has reported that returns represent a mid‑teens share of annual U.S. retail sales—hundreds of billions of dollars—making accuracy and fraud prevention essential. In e‑commerce, the stakes are higher: any misstep erodes trust in a model where convenience and predictability are the brand promise.

Amazon’s settlement arrives as large platforms face heightened consumer‑protection scrutiny. The company previously agreed to a $2.5 billion settlement with the Federal Trade Commission related to Prime signups and cancellations. While the issues differ, both matters underscore the regulatory focus on how digital systems handle critical moments—enrollment, cancellation, returns, and refunds—at massive scale.

What it means for shoppers and sellers across the platform

For consumers, the headline is straightforward: money is on the table, and the processes that failed some shoppers should improve. Expect clearer timelines, better visibility into return scans, and fewer situations where a refund falls through the cracks. For sellers, more consistent rules and data sharing can cut back‑and‑forth disputes and reduce chargeback risk when returns are validated.

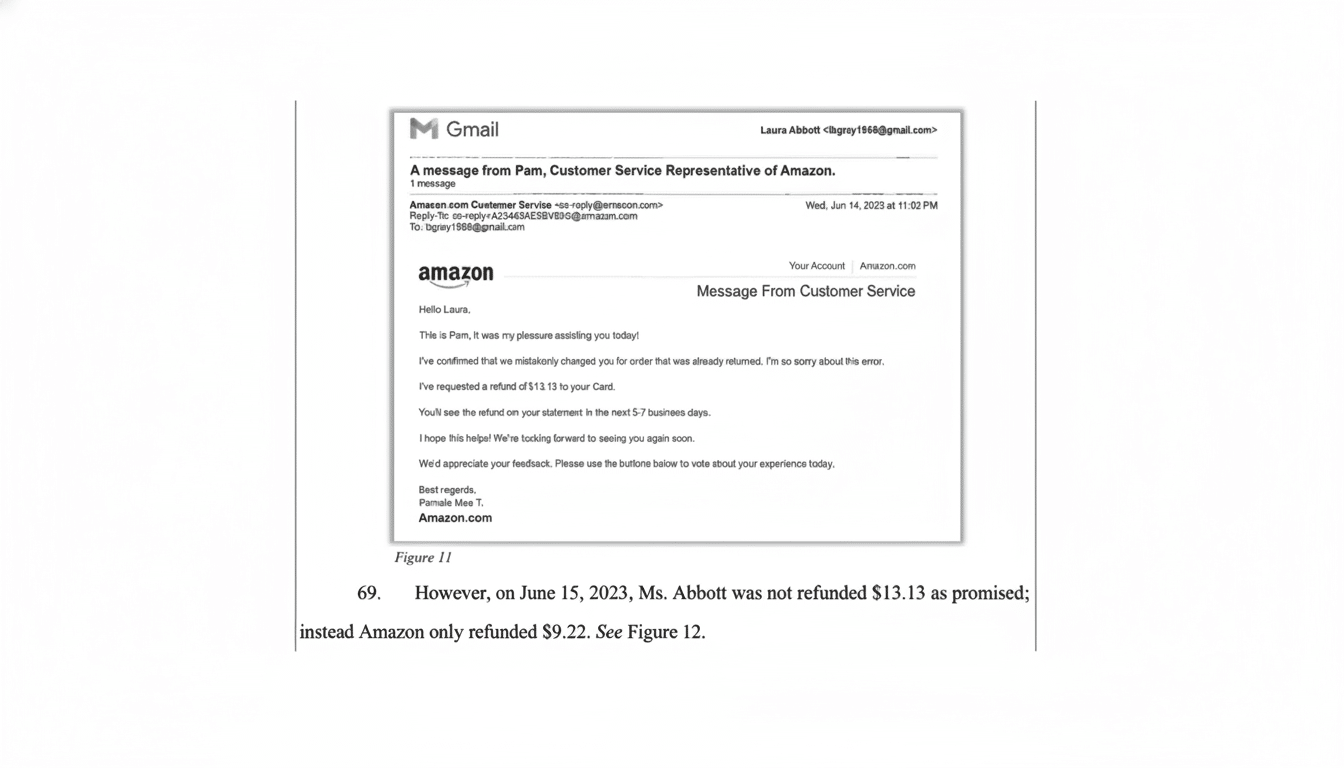

The bigger takeaway is that returns, often treated as an operational afterthought, are now a front‑line consumer‑trust issue. The size of this settlement, coupled with mandated systems improvements, will push not only Amazon but the wider industry toward tighter reconciliation between logistics and billing. If the contemplated changes stick, the most visible outcome could be the simplest: refunds that arrive when customers expect them to—without asking twice.