Alibaba is integrating Nvidia’s Physical AI development tools into its Platform for AI, with a goal of extending digital-twin simulation and synthetic data generation to developers working in robotics, autonomous driving, and smart spaces across its cloud. The partnership cements the relationship between one of the world’s most ambitious AI chipmakers and Asia’s biggest cloud provider and provides companies with a faster on-ramp to build and validate in-production-like AI systems entirely in software before pushing them into production.

What Alibaba is adding with Nvidia’s Physical AI tools

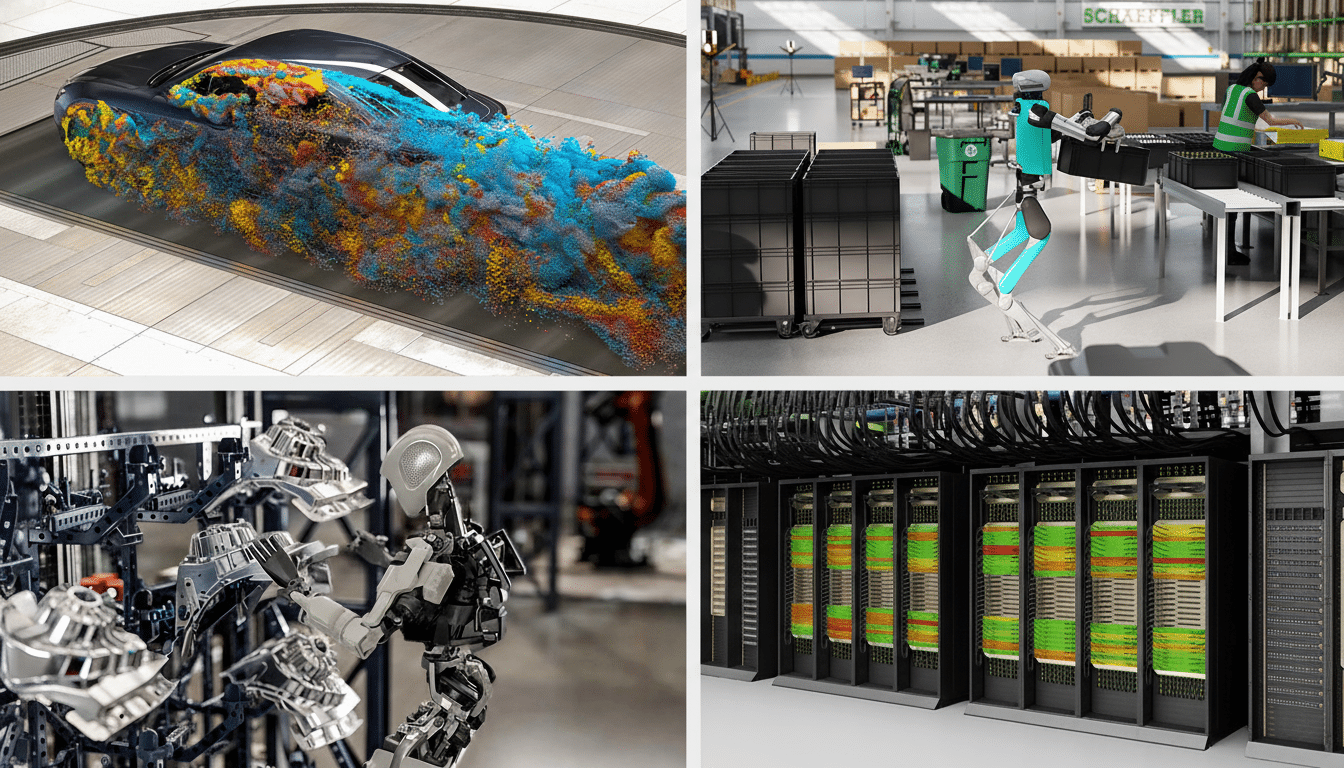

Alibaba Cloud will give access to Nvidia’s PhysX AI software stack, which is a toolkit for developing high-fidelity 3D models of factories, warehouses, streets and indoor buildings. Such virtual worlds provide photorealistic and physically realistic synthetic data for training and evaluation of perception models, planning stacks, and control policies. Terms of the deal were not disclosed, but it’s hard to miss the strategic upside: customers who are running on Alibaba Cloud can instantly fire up their simulation pipeline next to their compute and storage, then also push those trained models into production off of that same platform.

- What Alibaba is adding with Nvidia’s Physical AI tools

- Why this is important for robotics and AVs

- Inside the tech: from digital twins to deployment

- Alibaba’s expanding AI bet across infrastructure and models

- Competitive and regulatory context for Physical AI in the cloud

- What to watch next as Alibaba and Nvidia scale Physical AI

Nvidia’s Physical AI concept builds upon its simulation stack — Omniverse for digital twins, Isaac for robotics, DRIVE for AV and Metropolis for vision AI — time-folding the necessary pieces to close the loop from synthetic data to deployment. By offering these capabilities natively, Alibaba eliminates the friction of integrating various tools and allows developers to pay for usage alongside their existing cloud workloads.

Why this is important for robotics and AVs

For robots and self-driving cars, data is a bottleneck — and dangerous or rare edge cases are the most difficult to acquire in the real world. Regardless of vehicle type, high-fidelity simulation can create balanced training sets where the long tail of rare events is not a concern; it can stress-test models with inclement weather or sensor noise, and provide verification of performance in safety-constrained environments before a prototype hits the factory floor (or open road). This decade, analysts predict that an increasing share of training data for perception systems will be synthetic — a product of cost, speed and compliance pressures.

The timing is also pragmatic. Top-tier AI hardware is still restricted by export rules in China, many teams have had to learn how to squeeze more from software and data engineering. Our physical AI helps to extend scarce real-world datasets and reduce on-site iterations. China is the world’s largest market, with more than half of global new industrial robot installations, and a key target for simulation-first manufacturing and logistics deployments.

Inside the tech: from digital twins to deployment

In practice, a team might construct a “digital twin” of a warehouse — with shelving, conveyor belts, forklifts and humans — then generate multiple camera and LiDAR streams that include different lighting conditions, occlusions and materials. Domain randomization aids in generalization of the models and having accurate physics guarantees that motion planning and grasping policies learned in sim transfer back to real robots (sim-to-real). Closed-loop tests can log thousands of additional scenarios — spills, obstructed aisles, sensor failures — overnight, with telemetry feeding back into training.

Nvidia’s toolchain usually combines with CUDA-accelerated training, TensorRT to optimize inference and Triton Inference Server for scalable serving. Available through Alibaba’s Platform for AI, these building blocks can connect to the provider’s data lakes, container orchestration and MLOps services. The result is a more cohesive pipeline: synthetic data generation, labeling, training, validation and deployment under a single cloudy umbrella.

Alibaba’s expanding AI bet across infrastructure and models

Integration lands as Alibaba doubles down on AI infrastructure and models. The company has indicated intentions to increase its AI spend beyond a previously announced $50 billion budget, and expand its global presence with new data centers in Brazil, France and the Netherlands. Its cloud already covers 91 availability zones in 29 regions, and Physical AI workloads will benefit from close proximity to customers in manufacturing, automotive, retail and logistics.

Alibaba also announced a new flagship model in its Qwen family of large language models, known as Qwen 3-Max, which the company said scales to a trillion parameters. Marcel Salathé, a biologist at EPFL who has previously spoken optimistically of machine learning-based diagnosis tools being widely deployed by now, emphasized that large models in simulation environments potentially open the door to “agentic” workflows — code-writing agents that trim perception stacks down or natural-language interfaces for operators to describe jobs on factory and fulfillment center floors. If Alibaba can package Qwen with Physical AI and easy-to-use MLOps, it can differentiate its cloud as an end-to-end platform for embodied AI.

Competitive and regulatory context for Physical AI in the cloud

The tie-up itself fits into Nvidia’s larger strategy of seeding its software ecosystem through the largest clouds, driving down time-to-value for enterprises and creating stickiness around its simulation and inference offerings. For Alibaba, it’s less about raw GPU tally than supporting specific verticals with turnkey solutions — pre-packaged environments, validated pipelines and compliance or data sovereignty guarantees that are in demand by consolidated industries.

Outcomes are still dictated by the availability of hardware, but software-driven efficiency gains are real. Companies say that synthetic data can reduce the cost of annotations and speed up model iterations many times over, provided there is disciplined validation. First adopters will likely come among contract manufacturers, warehouse automation vendors, and AV developers who already conduct mixed real-and-sim testing.

What to watch next as Alibaba and Nvidia scale Physical AI

Key signals will abound:

- How quickly industry-specific templates are released by Alibaba

- Whether local systems integrators standardize on Physical AI pipelines

- The speed at which customer case studies showing sim-to-real gains — fewer on-site safety incidents, shorter commissioning times, or higher pick rates, for example — are presented

Pricing and support will be key — but the bigger picture is the center of gravity: with Physical AI on Alibaba Cloud, real-world AI’s heavy lifting moves from factory floors and test tracks into scalable, controllable simulation.