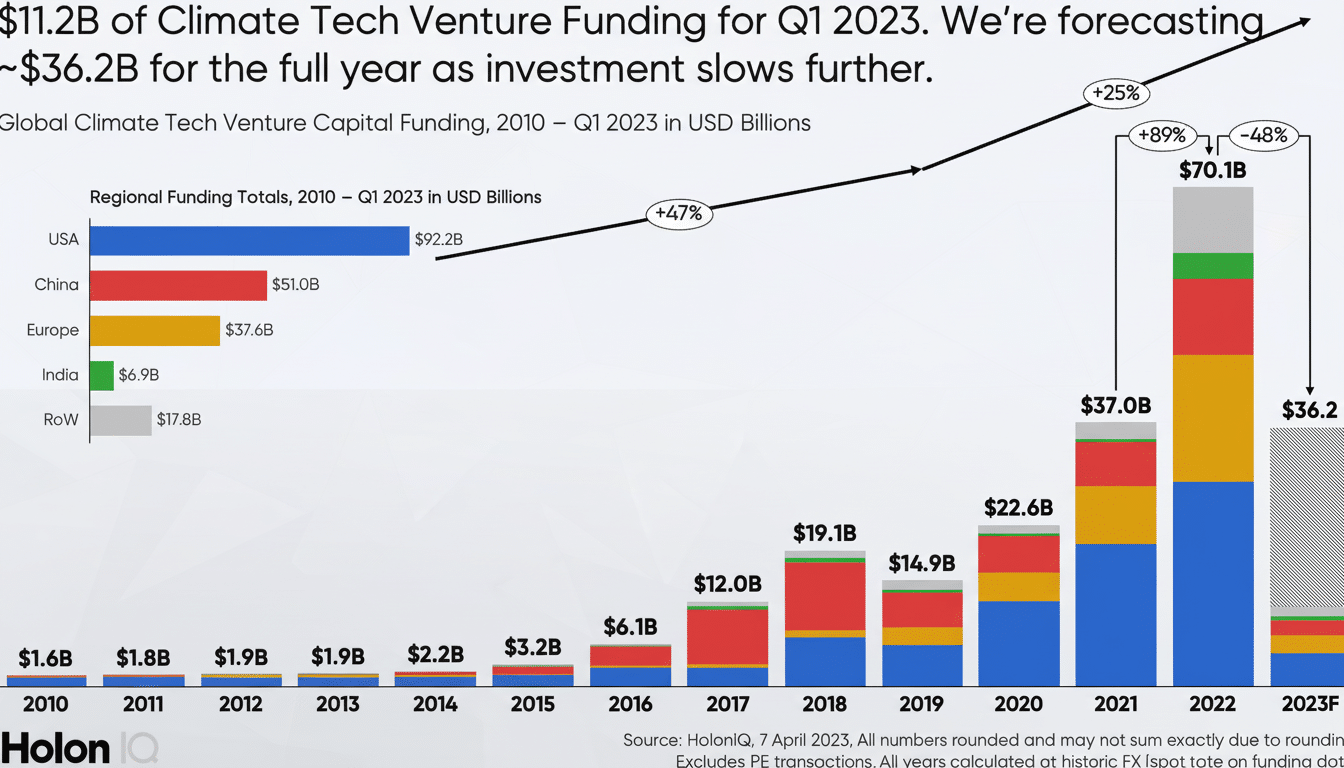

A dozen leading investors believe climate tech will head into 2026 with surprising momentum — even as policy winds change and AI’s power appetite dominates headlines. Their consensus mentality is grudgingly bullish: the capital is in, the cost curves continue to drop, and now the grid has emerged as the primary battleground for value creation. Climate venture activity flat: Climate venture activity stayed roughly even year-over-year, a surprise to some who predicted a downturn. Years of learning-by-doing continue to make wind, solar and batteries the cheapest new power plants in much of the world, CTVC reports.

AI and Power Needs Shift Toward Resilience Strategies

Data centers dominated the energy story in 2025; investors anticipate the narrative will move from raw demand to resilience in 2026. One consistent theme is unweaving from choked grids through on-site generation and storage to shield hyperscalers from interconnection lead times, price spikes and community opposition. Various investors cautioned that an AI build-out bubble could develop, but most said it would not disrupt existing spending on energy and infrastructure.

The nuance matters: some are expecting froth in data center valuations, but none see a bubble in electricity generation. As compute becomes cheaper and is increasingly adopted throughout different industries, the demand for clean, reliable power will continue to grow. Anticipate further bespoke offtake agreements, hard-firming strategies and behind-the-meter solutions that are targeted to 24/7 operation rather than headline megawatt-hours.

Geothermal, Nuclear and Storage Are Leads in the Mix

Investors are betting on a diversified generation stack being formed. Geothermal and fission (yes, nukes) will likely come into favor, with advanced geothermal often held up as already scalable. Fervo Energy, hot off a large raise and a 500 MW Utah project, is often mentioned as an IPO-watch name. “Nuclear everything” is a back-in-vogue mantra, though most warn that grid-scale impact will come in multiple waves as projects wind through licensing, financing and construction.

Meanwhile, solar-plus-storage will keep compounding. Grid-scale batteries experienced record deployments in 2025 and are poised for another leap as chemistries like sodium-ion and zinc bring costs lower. Investors harped on a new discipline in storage-making: prove demand and unit economics before building gigafactories. That, they say, ought to speed adoption without replicating previous overbuilds.

The Grid Is the Bottleneck and the Reward

Today, interconnection queues and permitting backlogs are the growth barrier. Investors are betting on 2026 as the year to reward “grid execution” — software, hardware and supply-chain solutions that enable utilities to interconnect more rapidly, plan smarter, and operate more flexibly. Long-duration storage is graduating from one-off pilots to repeatable deployments, while hybrid strategies mixing grid power, batteries and demand management help data centers hit timelines.

Many also pointed to “bring your own generation” projects and to siting near retired coal or nuclear plants in order to reuse transmission nodes. In the U.S., tens of gigawatts of coal capacity has retired over the last decade, establishing high-capacity interconnection points that can shave years from project schedules. “More on-site baseload procurement and distributed resources are practical solutions to overloaded substations.”

Reindustrialization and Critical Minerals Into Focus

But beyond data centers, investors point to a wider reindustrialization: batteries, power electronics, industrial heat pumps and robotics are drawing supply chains back onshore. Solid-state transformers and factory intelligence software are being seen as the enablers for effective electrification. Recycling of batteries and home processing are strategic priorities for the materials. Copper is still the silent bottleneck for data centers; battery metals like lithium, nickel and cobalt are starting to be recovered from recycling in order to reduce geopolitical risk and compress costs.

Real-world examples are emerging. Second-life and advanced stationary storage scaling companies are lining up commercial production, while recyclers claim the first domestic production of battery-grade materials. Investors anticipate that stationary storage will grow from around tens of gigawatt-hours installed across the world in the early 2020s to hundreds of gigawatts by decade’s end, based on reports from BNEF and the IEA that detail steep cost declines and accelerated deployment.

Scale Will Come if We Can Finance Innovation

The next unlock is also financial and not purely technical. Investors hope there will be more first-of-a-kind risk transfer instruments — performance guarantees, surety for construction, credit insurance and pooled offtake agreements — that will crowd in commercial lenders and private debt. The idea is to reduce the cost of capital and hasten the walk from FOAK to NOAK. Look for de-SPACs and IPOs with real revenue and offtakes like solid-state battery players as well as developers in geothermal and fission.

AI is also quietly encouraging a cost curve improvement across heavy industry. From mine planning and chemical process control to grid optimization and advanced manufacturing, investors are hearing tales of software slashing capex and opex. That countervailing force would mitigate some of the upward pressure on electricity demand caused by AI.

What to Watch in 2026 for Climate Tech Investors

- Prepare for municipalities to extract “community benefits” from hyperscalers — affordability, resilience, local jobs — in return for faster permitting.

- Watch for the first notifications to proceed of off-grid, world-sized data centers, more rationally priced utility-scale storage deployments, or early fusion milestones that aren’t ready for the grid but are still nudging the field forward.

- On the demand side, EV trucking could reach a turning point if new long-haul specs prove to be attractive.

- In robotics, money is moving away from humanoids and toward task-specific machines that do construction, grid build-out, agriculture and waste.

- And now there’s a class of resilience: rolling out wildfire mitigation, burying transmission with robots, and to each household — rooftop solar, batteries, heat pumps and smart controls — as it can add capacity faster than new centralized plants.

And the headline takeaway from this investor dozen: 2026’s spoils will go to companies that move electrons and equipment faster than the market anticipates. Winners will figure out how to deliver firm clean power, tame interconnection and bring financing into line with physics. Everything else is commentary.