Leaders head into 2026 with a simple mandate: adapt faster than the shocks. Markets are jittery, AI is scaling into every workflow, and digital and physical infrastructure are prime targets. The playbook that worked last decade is now a liability. These ten imperatives separate firms that compound advantage from those that fade by year-end.

Cybersecurity Becomes A Core Enterprise Strategy In 2026

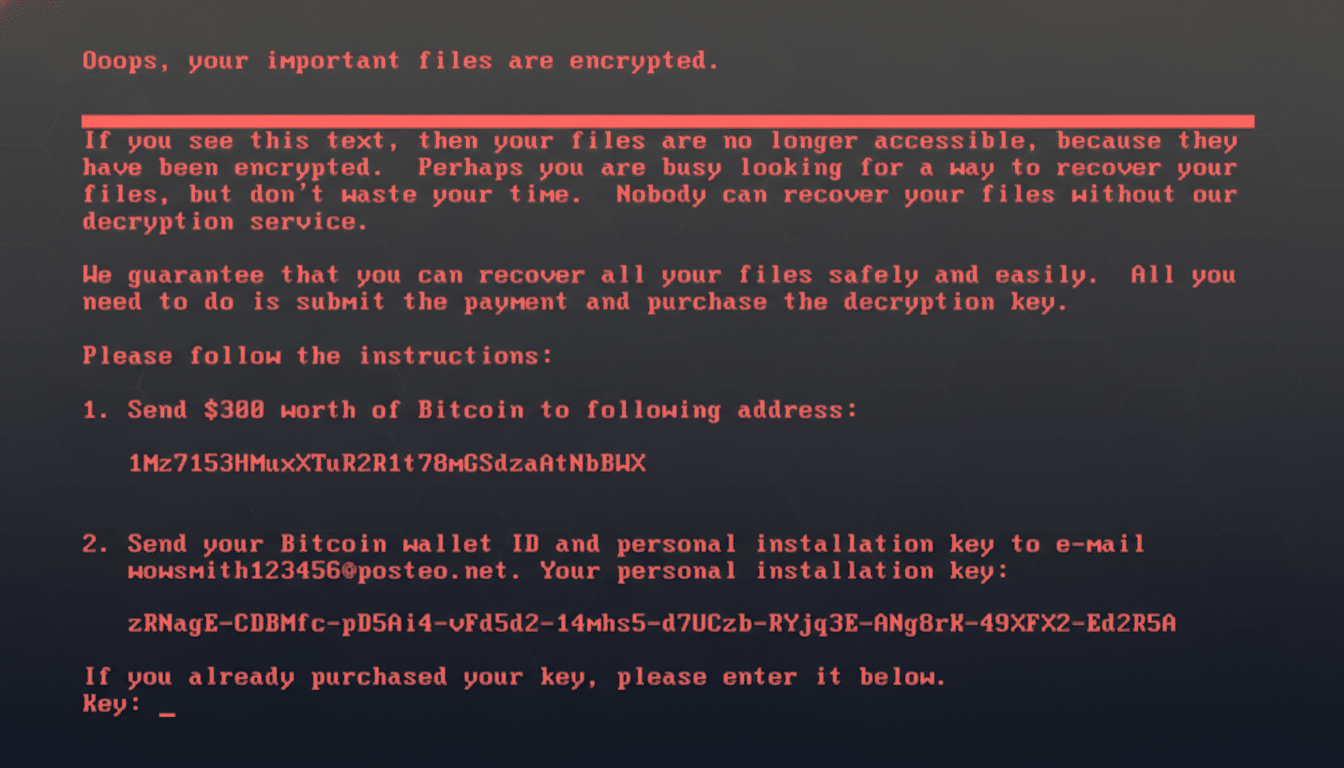

Security can’t sit in the IT silo anymore. IBM’s most recent breach research puts the average incident at just under $5M, and the collateral damage can be existential. Maersk’s NotPetya losses topped hundreds of millions, while Colonial Pipeline showed how digital disruptions trigger real-world scarcity.

- Cybersecurity Becomes A Core Enterprise Strategy In 2026

- Scale AI With Guardrails And ROI Across The Business

- Make Geopolitics A Core C-Suite Discipline For Leaders

- Compete On Data With Privacy By Design Principles

- Design For Reliability Across Cloud And Edge

- Harden Supply Chains And Vendor Concentration

- Build An Adaptive Workforce For The AI-Driven Era

- Decide Faster With Incomplete Information In Volatile Markets

- Make Trust And Safety A Growth Engine For Customers

- Allocate Capital For Productivity And Resilience

Boards should fund zero trust, identity modernization, incident playbooks, and supplier risk scoring as strategic priorities. Run quarterly tabletop exercises tied to financial scenarios and executive decision rights. Treat critical infrastructure dependencies—power, cloud, satellite, and networks—as part of enterprise risk, not background plumbing.

Scale AI With Guardrails And ROI Across The Business

Generative and predictive AI are moving from pilot to P&L. IDC expects enterprise AI spend to surge into the hundreds of billions by mid‑decade, yet many pilots stall without clean data and governance. Anchor programs in use cases with measurable gains: hours saved, revenue lift, or cycle-time reduction.

Adopt the NIST AI Risk Management Framework and prepare for EU AI Act obligations that phase in through 2025–2026. Build model registries, bias testing, red‑team routines, retrieval‑augmented generation for accuracy, and human‑in‑the‑loop checkpoints. Reward teams for shipping safe, useful systems—not just novelty.

Make Geopolitics A Core C-Suite Discipline For Leaders

Technology stacks now have a flag. Export controls, data localization, and supply chain bifurcation are forcing architectural choices between jurisdictions. The World Economic Forum’s risks reports continue to rank geopolitical fragmentation, cyber insecurity, and misinformation among top threats.

Stand up a standing “geo-risk” council spanning strategy, legal, procurement, and security. Run quarterly scenarios on sanctions, cross-border data flows, and semiconductor constraints. Where necessary, design dual operating models—separate clouds, data stores, and vendors—to comply while protecting resilience.

Compete On Data With Privacy By Design Principles

AI is only as good as the data foundation. Leaders are consolidating into productized data platforms with quality SLAs, lineage, and fine‑grained access. First‑party data is the scarce asset as cookies disappear and platforms tighten controls.

Embed privacy‑by‑design and differential access from the start. Consider clean rooms for partner analytics, synthetic data for safe model training, and rigorous de‑identification. Treat data contracts like legal contracts—because regulators increasingly do.

Design For Reliability Across Cloud And Edge

Cloud‑first has matured into right‑workload placement: multi‑cloud for resilience, sovereign cloud where required, and edge for latency and cost control. The Uptime Institute has reported that more than half of outages now cost over $100k, making reliability an earnings issue.

Institutionalize FinOps, SRE practices, and chaos testing. Map single points of failure across DNS, identity, and third‑party APIs. Build graceful degradation paths so customer‑critical functions continue even when providers falter.

Harden Supply Chains And Vendor Concentration

“Just‑in‑time” has given way to “just‑in‑case.” De‑risking means diversified suppliers, nearshoring where economically rational, and contingency inventories for critical components. Deloitte’s recent CxO surveys continue to place supply resilience among top board concerns.

Quantify concentration risk at the tier‑2 and tier‑3 levels, not only tier‑1. Use digital twins to simulate disruptions and recovery time. Bake resilience premiums into pricing and service‑level agreements rather than hoping the market absorbs the shock.

Build An Adaptive Workforce For The AI-Driven Era

The half‑life of skills is shrinking. The World Economic Forum’s Future of Jobs analysis forecast that 44% of worker skills will be disrupted within five years. Winning firms are moving to skills‑based hiring, internal marketplaces for gigs, and AI co‑pilot literacy for all knowledge roles.

Fund learning as an operating expense, not a perk. Tie leadership bonuses to mobility and reskilling metrics. Blend automation with job redesign so AI elevates work rather than merely trimming headcount and institutional knowledge.

Decide Faster With Incomplete Information In Volatile Markets

Legal and risk leaders increasingly acknowledge decisions must land before every variable is known. Convert that reality into process: pre‑authorized decision ranges, cross‑functional “tiger teams,” and a visible metric for time‑to‑decision on strategic bets.

Codify post‑mortems as learning, not blame. In volatile conditions, the slow choice is often the wrong choice. Speed, paired with transparent guardrails, becomes a competitive moat.

Make Trust And Safety A Growth Engine For Customers

Customers buy confidence. The Edelman Trust Barometer has repeatedly shown that trusted companies win preference and pricing power. For AI features, that trust rests on transparency, explainability, and clear recourse when systems err.

Publish model cards, data usage disclosures, and uptime commitments in plain language. Align security, privacy, and safety reviews with product gates. When incidents happen—and they will—over‑communicate and remediate visibly.

Allocate Capital For Productivity And Resilience

With global growth stuck near 3% by IMF estimates and financing costs elevated, capital must chase durable productivity, not fads. Prioritize projects that shrink cycle time, reduce working capital, or harden critical systems.

Track AI and automation returns like any asset: baseline, target, and verified gains in throughput or margin. Keep dry powder for opportunistic M&A, particularly in data, cybersecurity, and automation platforms that deepen moats.

The throughline is coherence. Cyber resilience, AI with guardrails, geopolitical fluency, and human adaptability reinforce one another. Leaders who operationalize these ten imperatives will not only endure 2026’s volatility—they will compound advantage from it.