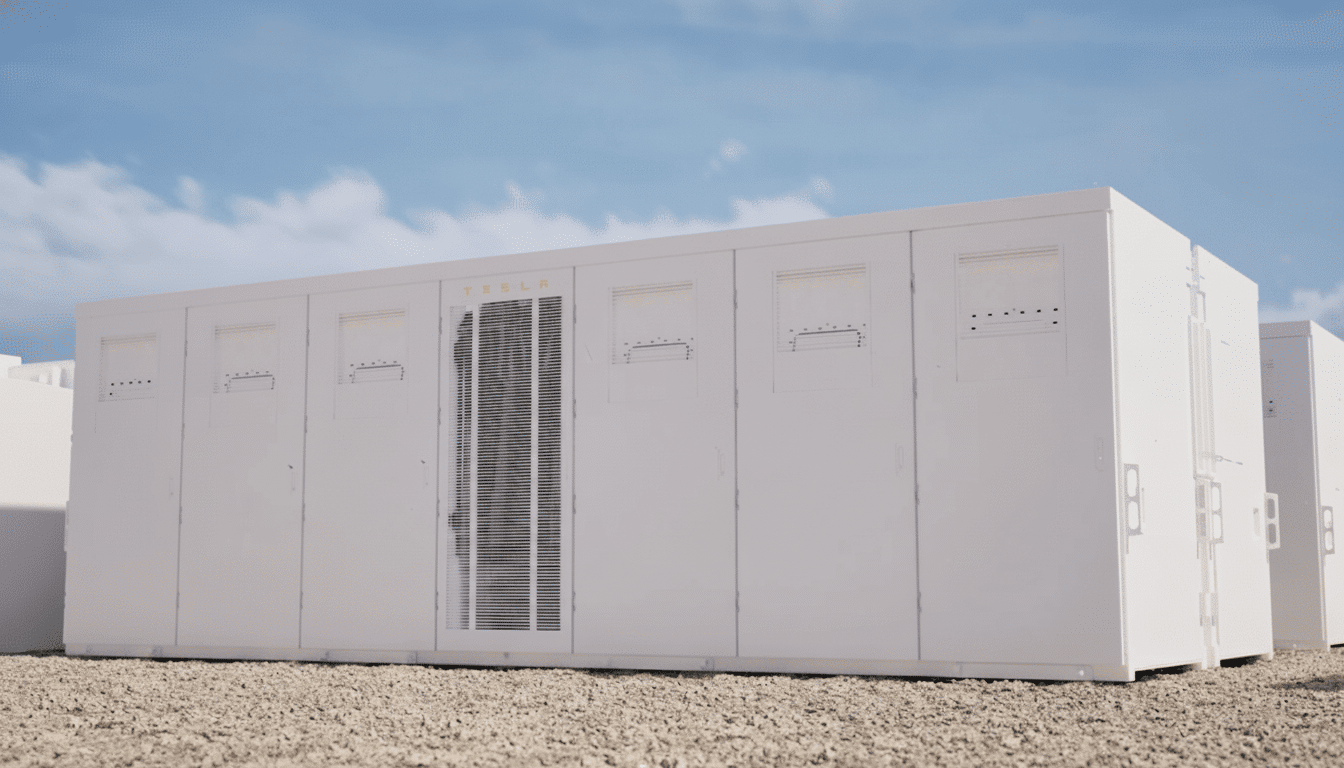

Tesla is introducing a significant redesign of its utility-scale Powerpack energy storage system that just went with its new name: Megapack.Tesla Megapack 3 As we previously reported, Tesla is also introducing a new four-pack design called Megablock as we understand that it is trying to turn things around with its energy storage business after a slow year and now even a slide in the business. Instead, the refresh aims for utilities and data center developers in search of quick, dependable capacity additions — and it’s designed to install and run more efficiently than previous generations.

The company said Megapack 3 offers more energy per unit, longer life, and expanded operating conditions, while Megablock also groups four units into a factory-integrated block to reduce project timelines and site complexity. It’s a pitch directed squarely at grid operators contending with peak demand and AI campuses straining local infrastructure.

What’s new in Mega Pack 3

Megapack 3 holds about a megawatt-hour more than Tesla’s largest previous cabinet, and actually introduces some telling density without the footprint growing to match. The new design revolves around an improved thermal management system to allow operation from –40°F to 140°F – a range that encompasses arctic winters and desert summers, and everything in between.

Recent stationary storage products from Tesla are using lithium-iron phosphate chemistry, which prioritizes cycle life and safety over the absolute energy density. Megapack 3 will have cells come from the U.S., Southeast Asia and China, a diversified supply approach to underpin volume yet also manage trade and logistics risk.

Megablock targets speed-to-power

Megablock prepackages four Megapack 3 units to comprise a 20 MWh building — enough to power around 4,000 homes for four hours, a typical duration for applications such as peak-shaving and solar shifting. The process reduces installation time by 23 percent and construction schedules by up to 40 percent, and takes more of the work into the factory, and less onto crowded, expensive sites, Tesla said.

For utilities, IPPs, and EPCs, less on-site variability translates to reduced contingencies and faster interconnection readiness. Pre-integration also simplifies standardization of fire suppression, monitoring, and compliance testing, which can stall large-scale projects that come with NFPA 855 and UL 9540A territory.

Chasing utility and AI data center demand

Tesla’s timing is no accident. The company has reported two consecutive quarters of storage deployments that were lower even as the overall market grows. In a forecast of the battery energy storage market for 2025, Wood Mackenzie ranked Tesla as the top supplier of systems in 2024, but said its leading market share lead was shrinking as competitors spanning BYD to Sungrow to Fluence were making inroads.

Meanwhile the power demands from hyperscale and AI data centers are exploding. One notable example: xAI, controlled by Tesla’s chief executive, placed 168 Megapacks at a facility in South Memphis as part of a hybrid approach. Developers in core markets such as ERCOT and PJM are increasingly adding batteries to new load in order to minimize negative impacts to the grid and hedge against volatile prices.

The pipeline looks deep. Energy storage comprised hundreds of gigawatts of capacity in U.S. interconnection queues as of last year, Lawrence Berkeley National Laboratory reported last week, and four-hour systems are the dominant configuration. At the same time, BloombergNEF has charted steep drops in lithium-ion pack prices, bringing the economics of projects down with them, while grid services markets have become more settled.

Production size and revenue progression

Both Megapack 3 and Megablock will be produced at Tesla’s new Megafactory outside of Houston, which was designed to have up to 50 GWh of annual capacity. Production is expected to begin in the second half of 2026, so it won’t have material revenue impact immediately. For reference, last quarter Tesla installed 9.6 GWh of stationary storage — which is massive, but not up to the run rate required to max out the new factory.

Grid storage is now subject to cutthroat price competition, pressing margins for even the players at scale. Tesla’s solution is to slide more value up to integration and software—via its Autobidder platform, warranty structure, and full-stack service as differentiated there. U.S. policy may give it a boost as well: projects that satisfy minimum domestic content standards are eligible for enhanced investment tax credits under federal rules, which could favor suppliers with a greater domestic component.

Risks, reliability and what to watch for

Key challenges remain in high ambient performance, accelerated cycling close to nameplate, and system-level safety. A redesigned thermal system and factory-integrated fire mitigation will lower the risk, but buyers will demand third-party certifications, field data that pass UL 9540A test protocols and tough uptime guarantees.

Ultimately, the Megapack 3 wager is about speed and certainty: denser cabinets, standardized blocks, and a high-throughput factory targeting skyrocketing utility and AI data center demand.” If Tesla can meet its production targets and manage its costs, the makeover could halt recent declines and re-establish its lead in a market that’s growing but increasingly cutthroat with each passing quarter.