Some of the most powerful figures in global technology dined with President Trump at a state banquet here, an emblem of how artificial intelligence, computing power and digital infrastructure now sit at the heart of the transatlantic agenda.

Who was in the room — and why it matters

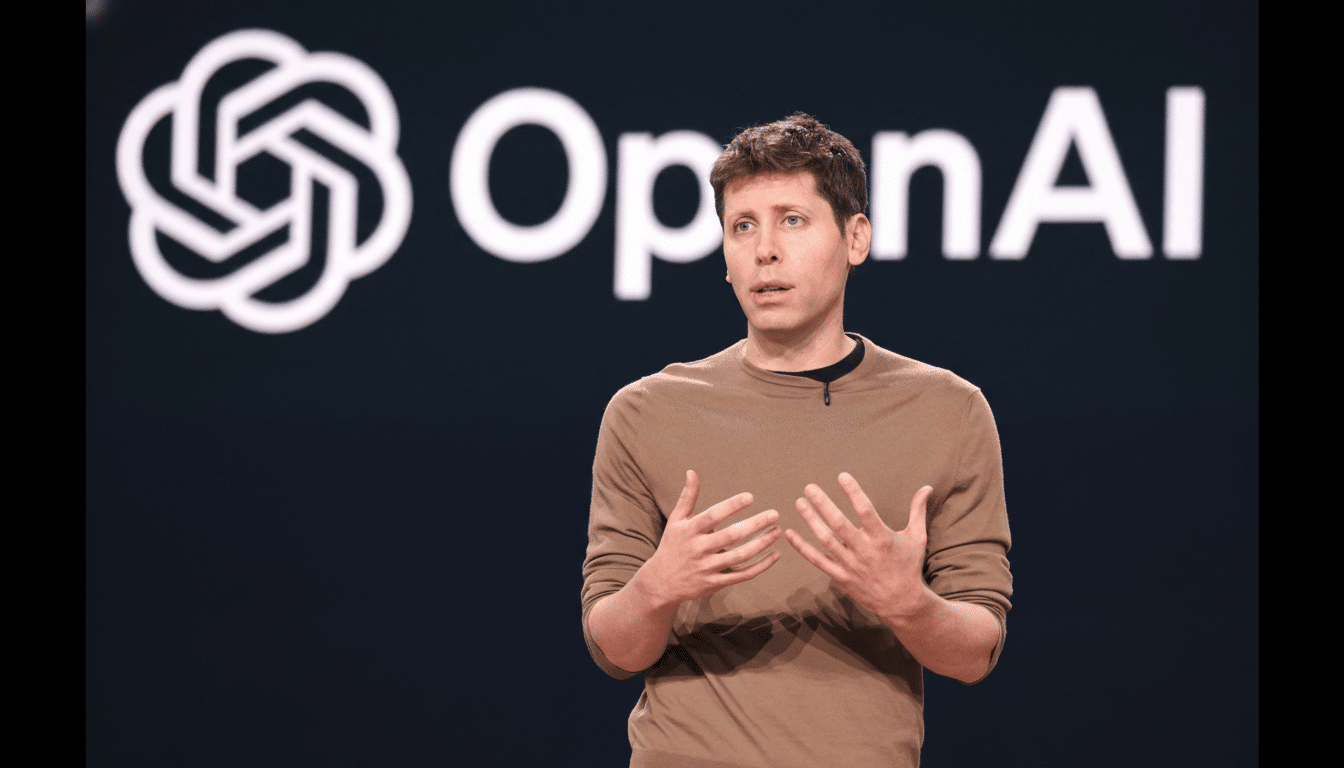

Apple’s Tim Cook, OpenAI’s Sam Altman (pictured at top), NVIDIA’s Jensen Huang, Microsoft’s Satya Nadella, Salesforce’s Marc Benioff, Alphabet and Google president Ruth Porat, investor–policymaker David Sacks — all were headliners, as reported by the New York Times. The guest list was filled with leaders steering AI chips, cloud platforms and enterprise software — the plumbing of today’s digital economy.

Who was in the mix — and who… did not. High-profile Hollywood talent was conspicuously absent — though Amazon’s Bezos is becoming a familiar face with his ownership of The Washington Post and his place in the news for ulterior reasons. In their places were executives whose investments and roadmaps demarcate where the next wave of AI capacity, data centers and advanced manufacturing will touch down. The administration has separately wooed Silicon Valley heavyweights in meetings, conveying a calculated, long-term courtship of Big Tech as partners to compete alongside the nation.

A deal for compute, energy, and technical staffing

In addition to the pageantry, Washington and London announced the Tech Prosperity Deal — a framework designed to expedite collaboration on AI, nuclear and quantum technologies. Government communications highlighted collaborative work on safety testing, research access, and resilient supply chains that echoes UK AI Safety Institute and US NIST-led initiatives for assessing frontier models.

The inclusion of nuclear is a pragmatic consideration: modern AI operates on enormous amounts of electricity and cooling. More often now, policy makers are tying long-term compute planning to a provision of reliable, low-carbon power — which can come from advanced nuclear reactors and expanded grids. For quantum, both are placing their bets on nearer-term applications in materials, cybersecurity and optimization to dovetail with AI and spur industrial productivity.

Pledge of £31bn for UK artificial intelligence infrastructure

American tech companies pledged a total of £31 billion, at least $42 billion, in investment to bolster A.I. infrastructure in the UK. Google, Microsoft, NVIDIA and OpenAI all announced plans for building or expanding data centers, while equivalent news from CoreWeave and Salesforce amounted to multiple billions in investment in compute power and cloud capacity.

The message is clear: scale the high-density sites, land advanced GPUs and pop up regional hubs dispersing away from London to help overcome power and land limitations. CBRE and Uptime Institute analysts have clocked a rapid acceleration of European data center absorption, with the UK counted among the most active nations. These deployments are expected to drive secondary effects — from specialized construction and power contracting, to new AI engineering jobs — as companies localize workloads to help meet data residency, latency and cost targets.

For the UK, these commitments help to lock in its status as a global AI testbed matching government-backed compute clusters and expanding national model evaluation capabilities. The UK provides US companies with a regulatory environment they already know, access to research universities and closeness to European customers without the full burden of bloc-wide rules.

Reading the policy subtext behind the guest list

The guest list also telegraphed a policy conversation that extends past photo ops. The administration has doubled down on its tech posture — sparring with Apple over supply chains, naming a point person for A.I. and digital assets, and announcing instructions on automation that labor groups dubbed “anti‑work.” It has also pushed for reviews of diversity, equity and inclusion programs, which are often linked to federal funding but have become a flashpoint for large employers seeking to comply in multiple jurisdictions.

Industry leaders, on the other hand, are eager for clarity on export controls for advanced chips, data transfer and privacy regimes, competition policy around AI platforms and public procurement of AI tools. The UK’s competition authority has already indicated it will be examining AI tie‑ups and cloud dynamics with a beady eye, while US regulators weigh concentration risks in compute and model access. The executives at the banquet work at the bullseye of those debates.

What it means for AI markets and governance

Goldman Sachs and other research houses on Wall Street have estimated that spending from around the world to build AI infrastructure could reach hundreds of billions of dollars in the coming years, with data centers, chips and power contracts leading the charge. That scale demands private balance sheets and, yes, policy stability — predictable permitting, energy planning, cross‑border standards.

Burying the AI stack at the centre of a menu suggested its pragmatic alignment: US and UK want to speed up deployment, while maintaining an advantage in safety testing and frontier research. If the Tech Prosperity Deal results in smoother sign-off for new capacity and common benchmarks for evaluations, it could accelerate time to market for AI services across health, finance and government, where pilots increasingly depend on provisioned compute and explicit guardrails.

Given that perspective, the optics were substance: a head table filled with the people writing the checks and building the machines. For investors and partners, the message was equally clear — the transatlantic corridor is open for AI business, with political capital now clearly aligned behind it.