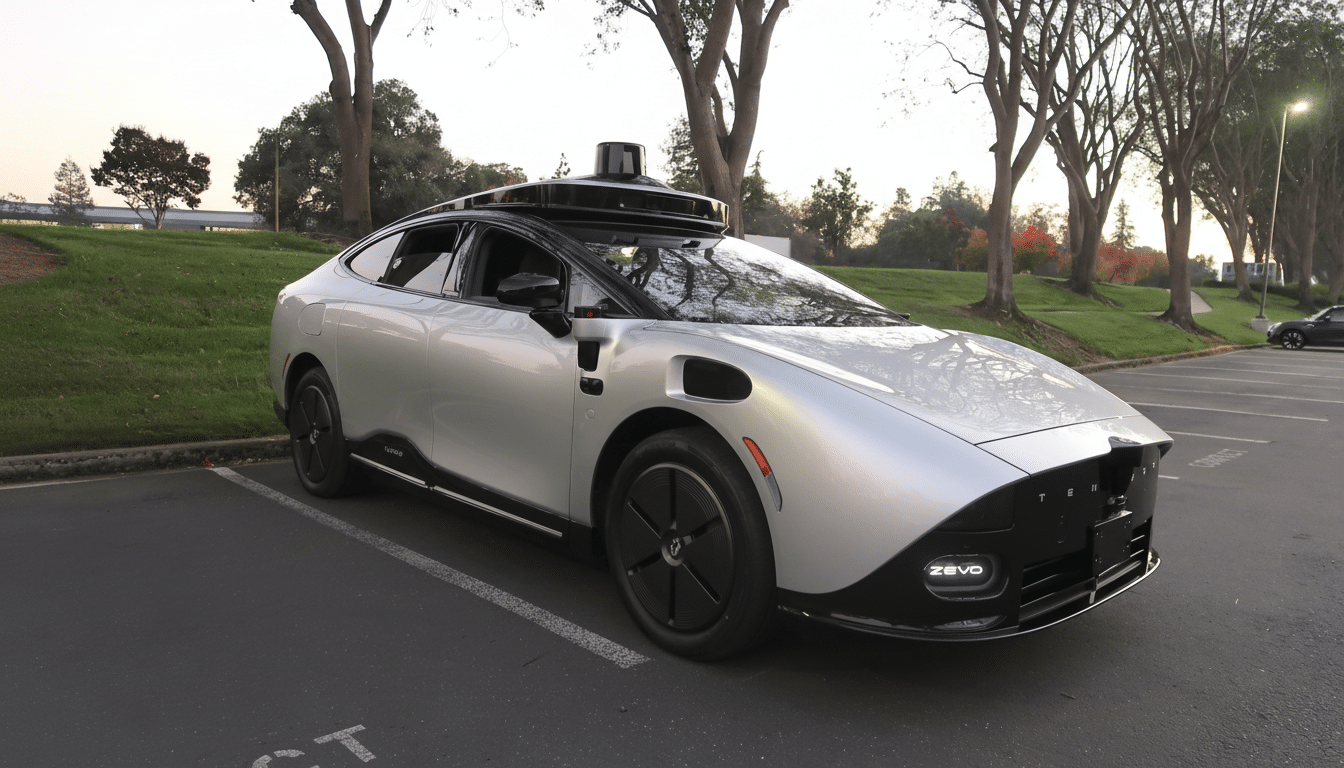

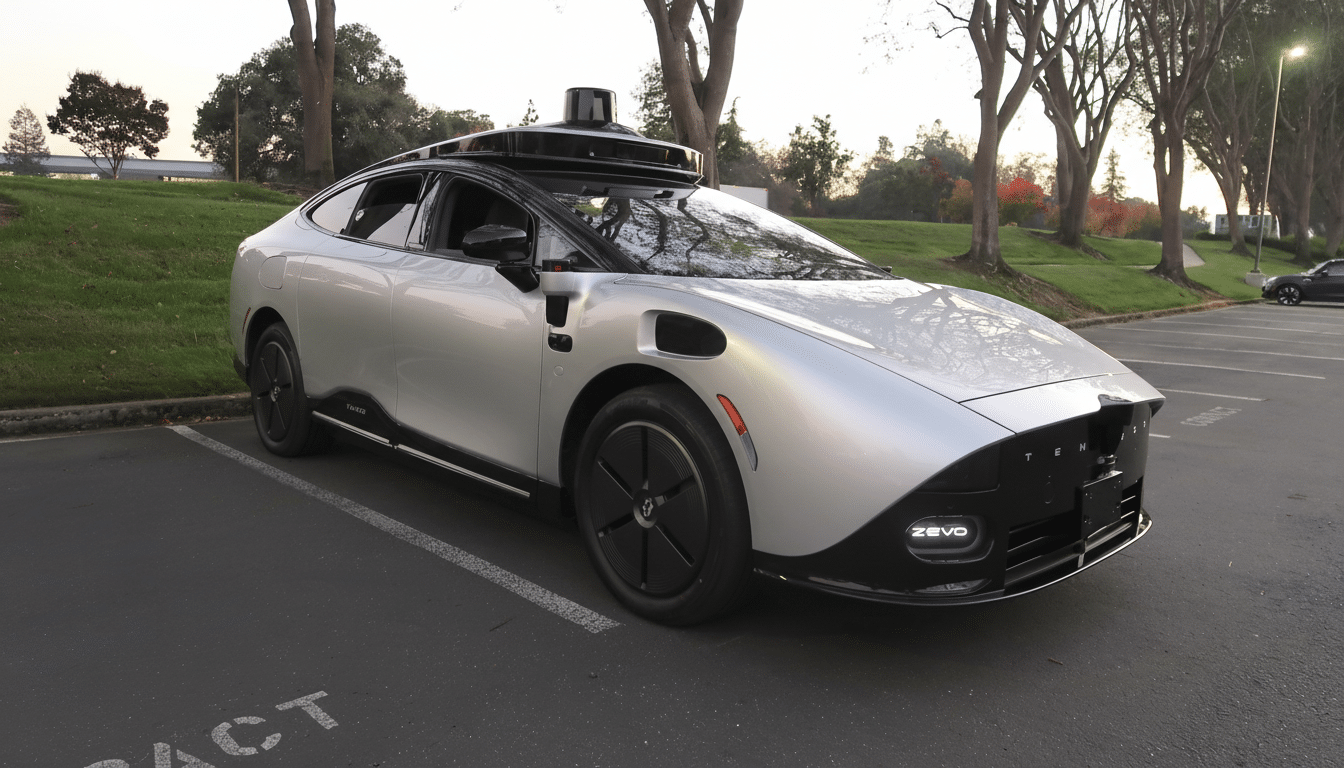

Dallas EV car-share startup Zevo moves to introduce fully driverless vehicles into its fleet, signing a purchase agreement for as many as 100 autonomous cars from new kid on the block Tensor. Assuming the integration clears regulatory and manufacturing hurdles, Zevo members would be able to book self-driving rides from the same app they use to reserve EVs in short order — essentially transforming a car-share network into an autonomous robotaxi service.

Tensor is a newcomer with familiar DNA. The company can trace its origins to AutoX, a Silicon Valley autonomous driving startup that has been operating in China and is offering an audacious plan to sell consumer-grade self-driving cars as early as 2026. Zevo’s bet gives Tensor a way to prove itself while also providing Zevo with a shortcut to autonomy without having to build an in-house AV stack.

Why Zevo Wants Independence in EV Car-Share Operations

Zevo has spent the past year running an EV-only car-share model, and sees autonomy as a way to get more out of cars and introduce new revenue streams. Private automobiles sit dormant much of the day — the International Transport Forum has long pegged the utilization rate at about 5% — and Zevo’s thesis is that offering driverless operation allows cars to “work” when not in use for a ride or while on their way to pick up another person, perhaps taking them offline temporarily for practical tasks such as dry cleaning pickup.

There’s also a software play. Startups such as Tensor tend to provide a more complete level of integration than traditional automakers, offering partners access to vehicle APIs for remote diagnostics, automated charging, fleet orchestration and payments. Zevo has done similar deals in the past, most recently a non-binding order for 1,000 electric vans from Faraday Future this fall — an instance of exchanging supplier maturity for pricing and customization.

Tensor’s Big Promise, and the Even Bigger Hurdles Ahead

Tensor says it is developing a completely autonomous vehicle for the average consumer, not just fleets. That’s an audacious goal in a space where even well-financed players have found it difficult to achieve scale. In addition to safe autonomy, Tensor will be required to demonstrate manufacturing readiness and supply chain depth and conform to automotive-grade safety processes such as ISO 26262 compliance — which take years for the typical company to mature.

Regulatory hurdles are numerous, too. In the United States, state agencies — such as the California Department of Motor Vehicles, which sets testing rules; and the California Public Utilities Commission, which governs commercial robotaxi service — hold that power. At the federal level, NHTSA is responsible for defect investigations and crash reporting involving automated systems. Recent history illustrates the stakes: Cruise’s operations were restricted in California following safety incidents; Argo AI wound down in 2022; and a variety of AV timelines have slipped as companies face complex real-world situations whose challenges are being reconciled with public expectations.

How a Robotaxi-Enabled Car-Share Service Might Work

Zevo’s pitch combines the commonality of car-sharing with the on-demand convenience of ride-hailing. Members would request the car via the app; a car would drive to pick them up, complete their trip and then either return to service or reposition for another rider. Preliminary pilots often operate in geofenced areas with good mapping coverage and connectivity and clearly demarcated pickup zones to minimize curb conflict.

There’ll probably be phased-in safety oversight. A lot of pilots begin with a safety operator and then move to remote assist — humans who instruct them in rare edge cases while not driving the car. Waymo rolling out its paid robotaxi service in parts of Phoenix and the San Francisco Bay Area is helping to set a pattern for autonomous vehicles that can work with ride-hail while focusing on predictable trips and favorable weather windows first.

Zevo will hunt for a low cost per mile economically via high utilization, automated charging, and quiet routing. Insurance and liability structures are still emerging, but big fleet operators are increasingly leaning on granular telematics and event data recorders to manage risk and navigate claims — capabilities that more extensive vehicle software integration could strengthen.

Key Risks and Early Indicators to Watch for Zevo and Tensor

Tensor has yet to manufacture cars at the volumes needed and win the permits required to operate without drivers. Look for third-party safety certifications, a limited pilot rollout in controlled neighborhoods and evidence of supply chain partners that exhibit automotive-grade quality. Any approvals from these regulatory agencies, milestones in reporting to NHTSA or partnerships with insurers would be significant signs of forward progress.

For Zevo, the key questions are uptime, customer satisfaction and unit economics. Statistics like average wait time, completed trips per vehicle per day and cost per mile will offer an unvarnished view of whether robotaxi-enabled car shares can prove competitive with ride-hail services and traditional rentals. If Zevo and Tensor can demonstrate reliable service in a single market, the model could scale up fast — particularly in those Sunbelt cities where AV pilots and EV infrastructure have taken off.

It’s a risk, but one whose timing is entirely intentional. Now that robotaxis are no longer a science project and consumers are more comfortable with on-demand mobility, a hybrid car-share/AV network could serve as the bridge between private ownership and fully autonomous fleets. If Tensor comes through and regulators are helpful, Zevo’s move could be a model for how many local fleets are sequenced in the next wave of urban transportation.