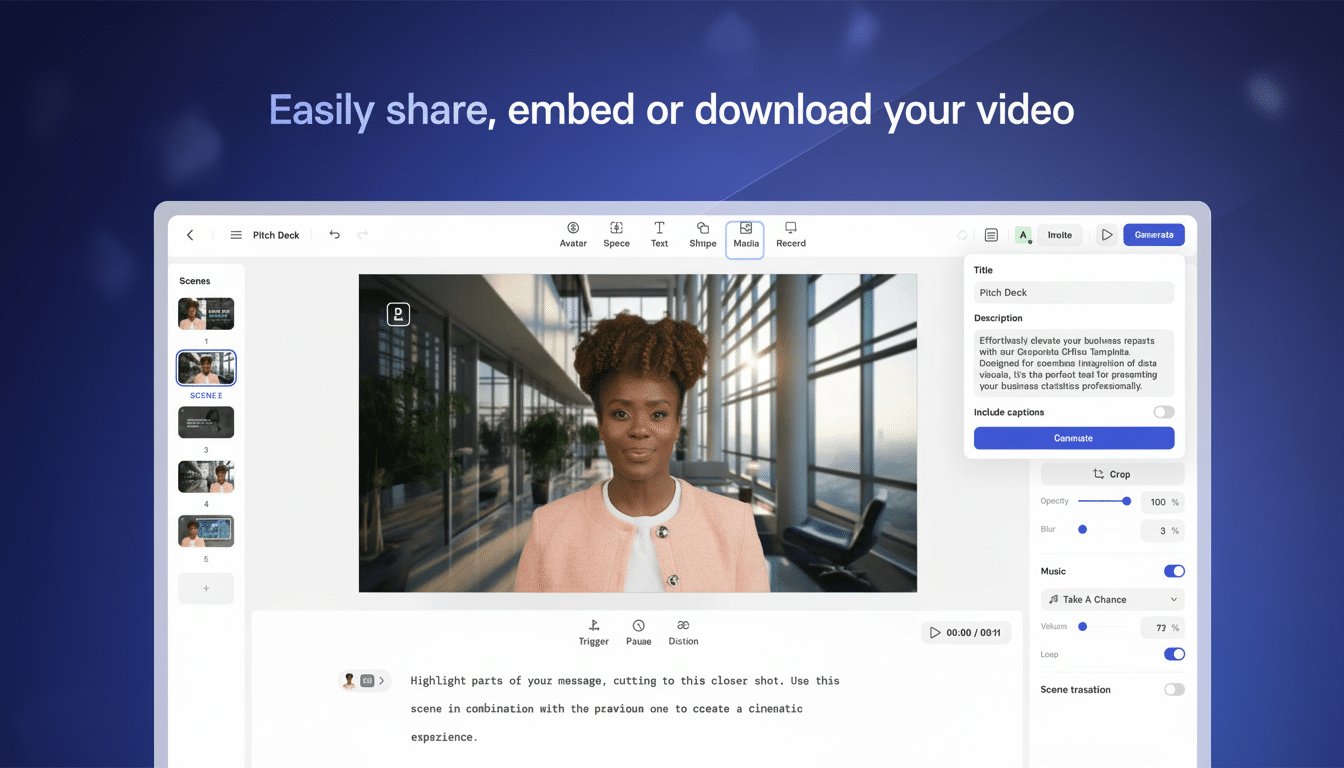

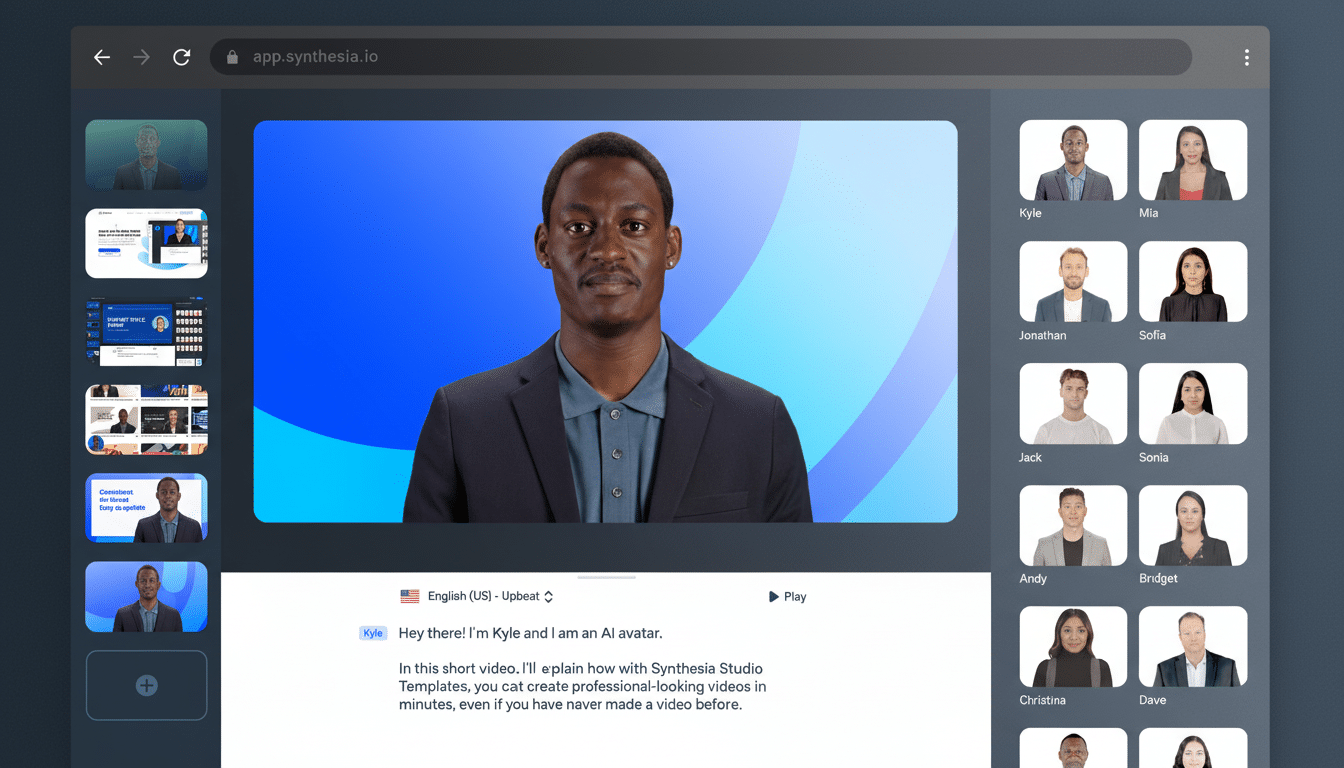

The race to dominate the AI application layer is far from decided, with momentum gathering on both sides of the Atlantic. Though the U.S. still leads on foundation models, fresh data and deal flow are sending a message to venture capitalists that the next killer apps will originate between Shenzhen and Senegal — and from Medellin to Gdansk. Petah has spent six years in startup-coworking-acceleration-business-coliving spaces, with roles at Habita Co (as an investor), 500 Startups (EIR), Mind the Bridge (head of global startup business development), MAKERS Boot Camp Japan, Carlos Slim’s BACKED Fund, greenfieldlabs.com, mit.edu, Only.me, and regalateca.com. Accel’s 2025 Globalscape report also highlights that the application layer is still wide open, and companies like Lovable in software creation and Synthesia in enterprise video are showing how fast AI-native products can scale.

Why The App Layer Reigns Supreme In The Next AI Era

Models are the engines, but applications transform raw capability into business results. The winning apps coordinate multiple models and wrap them in workflow, solve high-friction problems — code generation, sales outreach, research, customer service, creative production — while managing latency, cost, and reliability. Importantly, they control the user’s experience, the context of the data, and how it is distributed — that’s where lasting value lies.

That control is what allows app builders to iterate so quickly as the stack beneath them changes. When new small language models or multimodal releases drop, the top teams swap parts, tune prompts and retrieval, and ship user-facing upgrades weekly. The benefit builds as usage data refines product fit and opens up proprietary datasets.

New Growth Economics For AI-Native Software

Accel notes that it has never encountered a group of AI-native apps that have hit $100 million in annual recurring revenue in only a few years; it took decades before. Revenue per employee is hitting new highs as agentic automation squeezes cost to serve and magnifies product velocity. This is no anecdotal blip; this is a measurable change in software economics.

The venture market is responding. Private investment in #AI kept growing strongly through 2023, with more of it going into generative AI–powered products, according to the Stanford AI Index. IDC is forecasting that global AI spending will top $500 billion in 2027, while Gartner predicts that by 2026, more than 80% of organizations will leverage generative AI APIs or use models in production. As the purchase of AI becomes normalized, apps with clear ROI — shorter cycles, fewer tickets, higher win rates — are shifting from pilots to multi-year contracts.

U.S. Is Ahead in Models—Europe Is Catching Up in Apps

The U.S. lead in everything from compute, concentration of talent, and hyperscaler platforms has meant the world’s leading general-purpose models have been created here. But the map is different at the application layer. Accel’s analysis and the Headline AI Europe 100 list also underline a strong bench of European app competitors, from Synthesia to ElevenLabs in creative tools, healthcare application specialists, and industrial-AI leaders.

Partly this is an ecosystem tale. Ten years of SaaS know-how and growth-stage capital in Europe has led to founders who can tune go-to-market alongside model upgrades. Accel highlights the “flywheel” of repeat entrepreneurs and informed investors, which is now increasingly apparent in results rather than promise. In the meantime, U.S. players like Perplexity (which returns to the Escape Room Creation League for its second season along with teammates Typeface and Replit) are peddling new interfaces and agentic experiences, raising the speed and polish bar on what is possible in a competitive escape room.

Moats Move Beyond Models to Product and Data Advantages

Foundations are being commoditized and multi-sourced, and so defensibility for apps comes from product and data. Durable moats: proprietary corpora, user-authored corrections, workflow depth, enterprise integrations, and brand on privacy and security. Lotan Levkowitz of Grove Ventures has made the case that data is currently undervalued by traditional financial metrics; companies that compound proprietary datasets and periodically analyze its usage form flywheels that become hard to copy.

The pricing and unit economics are changing, too. Teams are combining local small models, efficient retrieval, and on-demand calls to larger models in order to strike a quality-versus-cost balance. The result: healthier gross margins, diminishing inference spend per task, and faster payback periods — particularly in vertical apps where accuracy is testable and value is explicit.

Incumbents Add Agents as Expenses Decrease

Nevertheless, incumbent SaaS and cloud vendors won’t be sitting on their hands. Accel’s Public Cloud Index is up 25% year over year, and much of its leadership is shipping agentic capabilities across productivity, CRM, ITSM, and creative suites. Startups in this space have reason to be afraid, but also plenty of opportunity; as Microsoft’s Copilot, Salesforce’s Einstein Copilot, and ServiceNow’s Now Assist demonstrate, bundling and distribution can make things very difficult — while also expanding the market total and normalizing AI spend.

Falling inference costs and new types of accelerators are tailwinds for both camps. As models get more efficient and on-device or edge-based options evolve, app developers get the flexibility to tune their systems for privacy, latency, and cost, while still providing high performance.

What to Watch Next in the Global AI Application Race

Three signals will determine the next phase of the app-layer race.

- The emergence of real autonomous workflows — agents that can plan, act, and verify across systems — will favor teams that have high-quality data and strong feedback loops.

- Vertical depth over breadth will win; winners will demonstrate measurable and adaptable outcomes in at least healthcare, legal, finance, and industrials — not just cool demos.

- Distribution will continue to separate the winners from the pack, whether through bottoms-up PLG approaches, embedded partnerships, or plugging into existing marketplaces.

The scoreboard continues to evolve. Europe has credible AI-native apps, the U.S. is setting pace in platforms and tooling, and enterprises are moving from proof of concept to standardization. But the global war over the AI app layer isn’t done; it’s entering a more competitive, more practical era — one in which products, data, and execution determine winners.