The hype cycle would have you believe that Google’s Pixel and Samsung’s Galaxy phones slug it out on an even playing field. The sales charts say otherwise. Samsung still ranks as the leading global shipper of smartphones — often hundreds of millions a quarter — but industry analysts, including IDC and Counterpoint Research, are now tracking how it manages competition from the likes of Apple and Huawei. Meanwhile, Pixel remains a niche line — US sell-through is in the “hundreds of thousands” per quarter with little visibility elsewhere. The gap is not merely large; it’s structural — and here are five reasons why it won’t be closing.

Samsung’s Spread is Across All Bands of Price

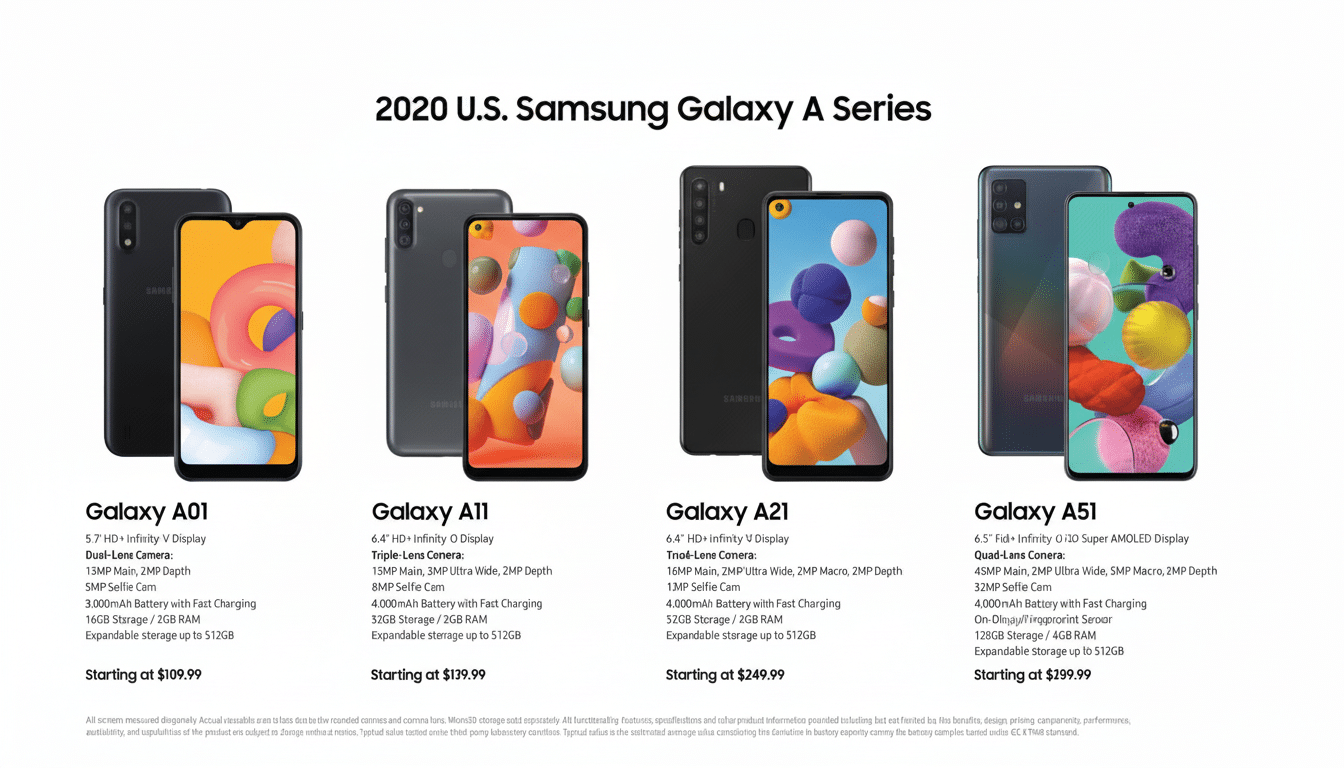

Pixel is deliberately lean: one flagship family and the A-series that crafts its own niche in midrange prices. That approach keeps the brand focused, but it hands the mass market to its competitors. Samsung sells a sprawling family of Galaxy devices, from super-premium flagships to phones that cost less than $200, and it often tweaks models for particular carriers and countries.

Volume is at low and mid tiers. Galaxy A-series phones often surface in Counterpoint’s US market share tracker as best sellers, though we see them do even better in price-sensitive markets like Latin America, Southeast Asia and parts of Africa. And until there are real budget Pixels, Google just cannot reach the huge sources of demand that make companies win in terms of units.

Scale And Vertical Integration Tilt The Cost Curve

It usually requires a price war to outsell a giant. That is hard when the giant benefits from even larger economies of scale. Samsung’s far-flung technology empire — which includes displays, memory and storage as well as camera sensors and even its own foundry for chips — enables it to pinch costs tucked deep within the business, lock down supply and respond quickly when component prices swing up or down. It also translates to more leverage when negotiating everything from logistics to marketing support with partners.

By contrast, Google builds Pixels out of a mosaic of suppliers and contract manufacturers. Even its custom silicon Tensor has had previous generations built by Samsung’s foundry, and top-tier OLED panels are often either from Samsung or BOE. The problem is that when your competitor manufactures much of its most important parts and has a shipping volume many times larger than yours, then your bill of materials cost as well as per-unit overhead are hard to beat — severely limiting room for undercutting on price without eroding margins.

Distribution And Carrier Muscle Win The Shelf

Access is destiny in smartphones. But Samsung’s ties to carriers and retailers cover almost every major market, as well as many developing ones, formed from decades of dominance in the consumer electronics sphere. Carrier channels still make up a significant portion of smartphone sales in the US and other mature markets, as rebates, trade-ins and in-store promotions influence purchase decisions at the point of sale.

Pixel’s footprint is much smaller — it’s being sold in an official capacity in just a few dozen countries — and carrier support can be spottier. It’s a big deal because placement, in-store demo units and sales rep familiarity are every bit as much the currency of activation. It’s not just the fact of being listed online, it’s end caps and bundle deals and financing options — and the promotional engine Samsung funds at truly massive scale.

Brand Trust And After‑Sales Networks Take Years

Samsung’s brand equity for hardware is the result of its relentless spending and execution. Samsung’s annual marketing outlays are in the billions, according to company filings and industry estimates, which support broad awareness from premium flagships to entry models. That visibility is bolstered by large servicing networks, the availability of spare parts and third-party accessories — the type of practical reassurances that persuade aspirational mainstream buyers to stick with what they know.

Google’s consumer image is still software-first: Search, Maps, Gmail and now AI. Pixel has garnered a lot of love among enthusiasts for clean Android builds as well as smart features like Call Screen and photo tools, but the brand is still relatively young or difficult to track down in many parts of the world. Trust that endures, especially beyond early adopters, however, is the product of time and distribution and ongoing after-sales support at a level Google hasn’t come close to matching.

Google’s Aim Isn’t Crown Leadership in Units

There’s also intent. Google’s hardware chiefs have suggested, in interviews with Bloomberg and others, that Pixel is more of a strategic lever to showcase Android and Google AI than an all-out quest for unit supremacy. The most straightforward growth lever for Google is not to convert Samsung users, but rather win over iPhone owners through a combination of easy onboarding, long OS support windows and tight services integration.

Viewed that way, Pixel works as a halo: It pushes Android more quickly into the future, affects partner roadmaps and courts switchers without needing to finance a dozen low-margin models. That approach can increase Android’s ecosystem share and user engagement even if Samsung maintains the volume crown.

Combine them — portfolio breadth, scale economics, distribution power, brand gravity and divergent priorities — and the answer is simple. Pixel can expand, thrill the die-hards and define the direction of software. But outpacing the Galaxy isn’t the game Google is playing, nor a race it’s positioned to win.