Waymo is gearing up for its most aggressive robotaxi rollout yet after securing a $16 billion financing round that pegs the Alphabet unit’s valuation at roughly $126 billion. The company says the fresh capital will underwrite expansion to more than 20 additional cities, with plans that notably include international launches in London and Tokyo.

A War Chest To Accelerate Commercial Scale

The round, led by Dragoneer Investment Group, DST Global, and Sequoia Capital, drew participation from a deep bench of growth investors including Andreessen Horowitz, Mubadala Capital, Bessemer Venture Partners, Silver Lake, Tiger Global, and T. Rowe Price. For a technology that has often struggled to move beyond pilots, the signal is clear: investors are betting Waymo can convert years of R&D into a large-scale, revenue-generating service.

Waymo says the funds will be directed toward fleet growth, mapping and simulation, city onboarding, and operations. Expect heavier spending on compute for perception and planning at the edge, plus data infrastructure to support safety case validation—areas that have become core differentiators for autonomous platforms.

New Markets on Deck as Waymo Targets 20+ Cities

Beyond its existing service areas, the company is targeting more than 20 additional cities. London and Tokyo stand out not just for their density but for their evolving policy frameworks. The United Kingdom’s Automated Vehicles Act established a pathway for supervised commercial deployments, while Japan has been permitting Level 4 operations in designated zones under revisions to the Road Traffic Act. Those shifts create a runway for Waymo’s Driver to operate under defined, safety-led conditions.

Closer to home, Waymo recently added service in Miami and extended San Francisco coverage to San Francisco International Airport, reinforcing a hub-to-city model that is attractive to early riders. Expect expansion to follow corridors where rider demand, local partnerships, and regulatory readiness overlap—think airport connectors, nightlife districts, and business centers where consistent utilization can be demonstrated quickly.

Competitive Pressures And The Robotaxi Race

The timing reflects hotter competitive dynamics in autonomy. Tesla has intensified its robotaxi push and has publicly dismissed Waymo’s prospects, while other players have retrenched after high-profile incidents and regulatory scrutiny. Waymo, by contrast, has leaned on an incremental rollout strategy that emphasizes safety cases and multi-city learnings rather than blitz-scaling everywhere at once.

Industry-watchers note that multi-market operations are increasingly decisive. Each city adds edge cases: unique lane markings, different pedestrian behaviors, varied weather and lighting, even local norms around speed compliance. Expanding to 20+ new locales should broaden Waymo’s dataset and help the Driver generalize, a virtuous cycle that can shorten time-to-reliability in future cities.

Safety And Regulation Remain The Gatekeepers

Waymo’s playbook relies on a documented safety case, extensive simulation, and staged rollouts before opening fully rider-only service. The company has published methodologies outlining how it verifies and validates behaviors, and it regularly engages with regulators such as the National Highway Traffic Safety Administration in the U.S. and transport authorities in prospective markets. California DMV reports and independent academic studies have increasingly focused on disengagement quality and collision typologies, not just miles, a lens that favors mature operators with strong incident response and transparency.

Internationally, deployment will hinge on data-sharing agreements, cybersecurity standards, and insurance frameworks. London’s emphasis on safety assurance and remote monitoring, and Tokyo’s defined operating domains for Level 4 services, align with Waymo’s operational style—but each city will require bespoke integration with local infrastructure and emergency services.

Where the Money Goes in Waymo’s $16 Billion Push

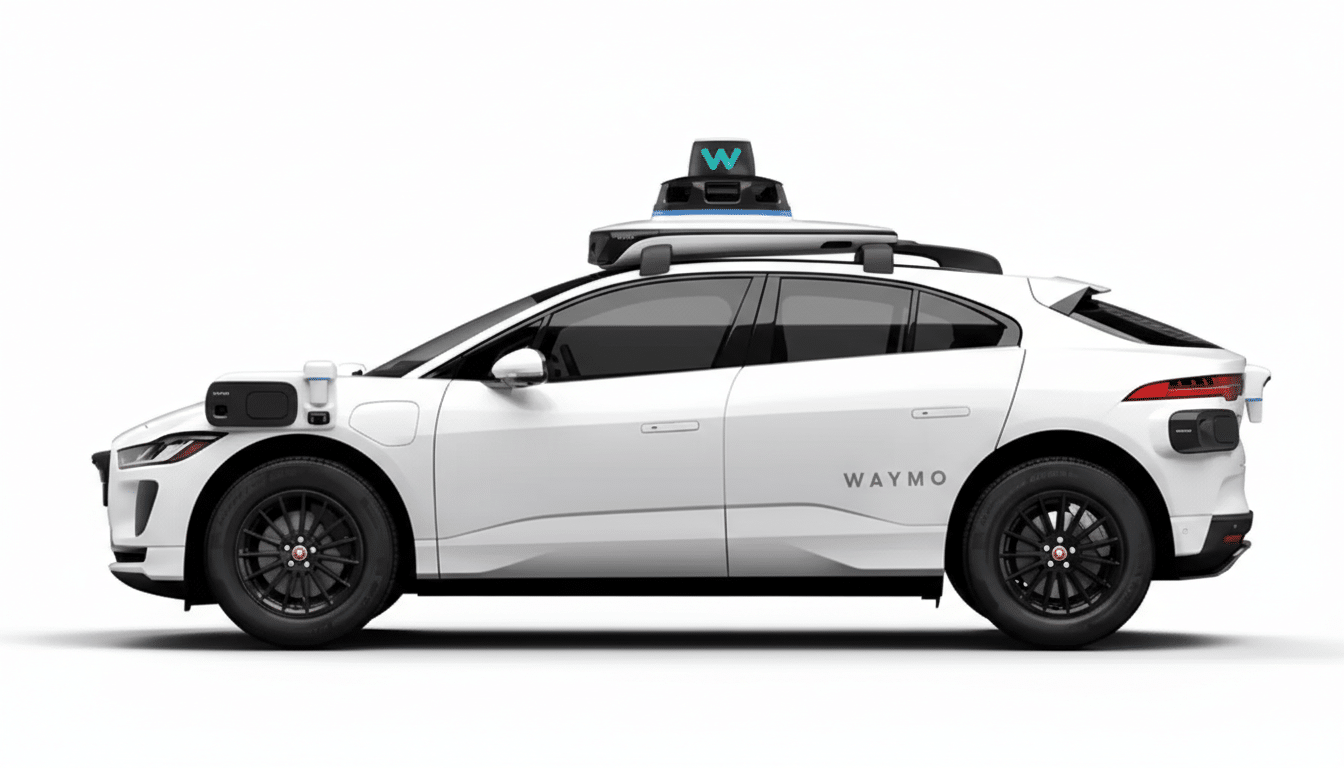

Scaling autonomy is capital intensive beyond the vehicles themselves. High-definition mapping, continuous perception model updates, hardware redundancy, and 24/7 fleet operations all drive cost. Waymo is expected to add vehicles, expand its maintenance depots and charging capacity, and deepen integrations with ride-hailing partners to boost utilization. The company has also invested in purpose-built robotaxi designs to improve ingress, egress, and durability for high-duty cycles.

Critically, the funding should shorten the cycle from pilot to paid service. With millions of rider-only miles already logged across Phoenix, San Francisco, Los Angeles, and now Miami, Waymo has the operational baseline to defend premium service levels and negotiate favorable city access terms. More cities mean more proof points—and more leverage in discussions with policymakers and insurers.

The Bottom Line on Waymo’s Global Expansion Plans

This is a pivotal bet that the economics of robotaxis improve with scale and geographic diversity. A $16 billion infusion gives Waymo the runway to prove it, city by city, while sharpening the competitive contrast in a market where trust and repeatability matter more than hype. If London and Tokyo come online as planned—and if the company sustains strong safety performance—the expansion could mark the moment autonomous ride-hailing moves from showcase to staple.