Waymo’s robotaxi business is hitting the gas pedal. An investor letter from Tiger Global Management, first reported by CNBC, said the Alphabet unit is now providing nearly 450,000 autonomous rides a week across its operating areas. That figure is roughly double the 250,000 weekly rides Waymo reported six months earlier — suggesting a steep rise in usage and demand.

If the pace continues, the new rate would be close to 64,000 rides a day and an annualized run rate of slightly more than 20 million trips. For a commercial robotaxi service, those are scale numbers — an indicator that autonomous ride-hailing is no longer in pilot stage in a few markets. Waymo declined to comment on the investor letter.

- Growth at scale across Waymo’s expanding service areas

- What the investor letter hints about Waymo’s momentum

- Safety and regulation still at the forefront

- Economics of autonomy as utilization and scale improve

- Where the rides are growing across current and new cities

- What to watch next as Waymo scales autonomous rides

Growth at scale across Waymo’s expanding service areas

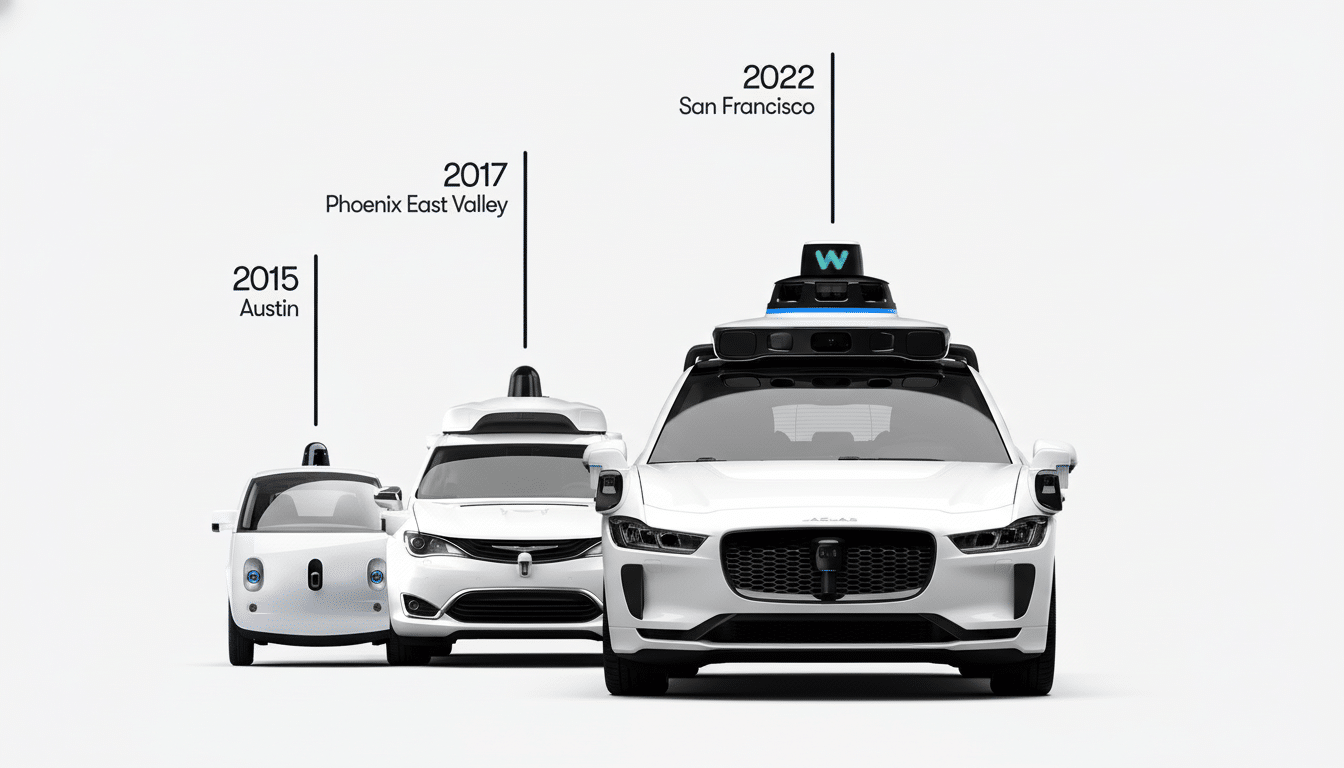

Waymo has long run paid service without a rider in the back seat of the vehicle, known as rider-only service, in the San Francisco Bay Area and Los Angeles, as well as the served regions of Phoenix, Austin, and Atlanta, according to earlier company disclosures. And the tally of the investor letter seems to imply higher vehicle utilization across those metros and more coverage density within existing geofences.

The company has also telegraphed an aggressive expansion plan, listing a dozen more launch cities in its next wave of rollouts, among them Dallas, Denver, Houston, Nashville, and San Diego. The critical test as coverage expands will be whether the quality of service — pickup times, trip reliability, and route availability — can hold up as more neighborhoods and user types are brought online.

What the investor letter hints about Waymo’s momentum

There are a couple of reasons why the reference to Waymo’s ride volume is interesting. For one, it provides rare, tangible performance data for a firm that regularly discloses high-level milestones. Second, it establishes autonomy as a growth category in late-stage venture portfolios next to AI infrastructure and model leaders.

For Alphabet, the momentum strengthens the strategic argument for continued investment: more rides generally lead to better mapping coverage, rarer edge cases, and operational playbooks that unlock new markets. The flywheel effect — the more data that leads to better performance which allows more rides and more data — seems to be spinning faster.

Safety and regulation still at the forefront

Scale isn’t the only thing that should make us feel comfortable about safety. Regulators are still examining automated systems, with the National Highway Traffic Safety Administration conducting ongoing studies of AV performance across the industry. Waymo has shared safety analyses that compare its performance favorably against human drivers operating in like circumstances, but this independent validation on a jurisdiction-by-jurisdiction basis is critical as service areas scale up.

Local approvals also may not be based solely on crash data: first-responder training, reporting of incidents, and fleet behavior in complex urban scenarios also influence public trust. The sector learned painful lessons from headline-grabbing mishaps at other operators, and city officials and state regulators will be closely monitoring Waymo’s ability to scale rides while minimizing incidents.

Economics of autonomy as utilization and scale improve

When weekly rides jump from 250,000 to 450,000 it is equivalent to about 80% growth in utilization — a single-digit percentage of improvement in unit economics would be created as you spread your fixed costs over more revenue miles. Investors will be watching trips per vehicle per day, fleet availability, and maintenance overhead — particularly as Waymo integrates next-gen sensors and compute into its vehicles.

Partnerships also matter. Waymo’s partnerships with ride-hailing companies in specific markets had expanded the number of people coming into the top of its funnel and helped to turn traditional app-based riders into AV users. Look for more distribution deals, airport and event venue integrations, and perhaps even experiments in subscription or commuter-focused pricing as fleets pack in and heat maps get denser.

Where the rides are growing across current and new cities

Phoenix continues to be a poster child for mature AV service, with wide suburban coverage and ever-complicating urban corridors. San Francisco and Los Angeles test the system’s mettle in tightly packed, highly varied traffic that I liken to a labyrinth if not a snake pit, while Austin and Atlanta extend the model to fast-growing metros with different road norms and infrastructure.

Lastly, new city additions like Dallas, Denver, Houston, Nashville, and San Diego bring with them a variety of climate conditions, altitude levels, road layouts, and rider populations. Dependable results across such a range will be a strong indication that Waymo’s software and operations toolkit is not overfit to its original setup — one of the field’s big technical challenges.

What to watch next as Waymo scales autonomous rides

Three indicators will tell us whether this boom has staying power: consistent growth in weekly ride volume, increasing service footprints with level wait times, and open safety reporting keeping regulators and the public on the same page. If Waymo can deliver on those fronts, 450,000 rides a week may only prove to be a waypoint for the company rather than any kind of peak.

As it does, the investor letter gives a rare snapshot: autonomous ride-hailing at meaningful scale, growing fast and getting closer to the daily routine of the average rider.