Waymo has secured a $16 billion funding round to accelerate the global rollout of its driverless ride-hailing service, with plans to enter more than a dozen new cities and begin international operations in markets including London and Tokyo. The raise values the Alphabet-owned autonomous vehicle company at $126 billion and underscores investor conviction that robotaxi services are moving from pilot projects into scaled transportation networks.

Mega Round Led by Top Growth Investors and Funds

Dragoneer Investment Group, DST Global, and Sequoia Capital led the round, alongside major commitments from Andreessen Horowitz and Mubadala Capital. Other participants include Bessemer Venture Partners, Silver Lake, Tiger Global, and T. Rowe Price, with strategic backing from CapitalG, GV, and Alphabet, which remains the majority owner. The breadth of institutions—blending growth equity, crossover funds, and sovereign capital—signals a belief that autonomy is approaching durable unit economics, not just technical milestones.

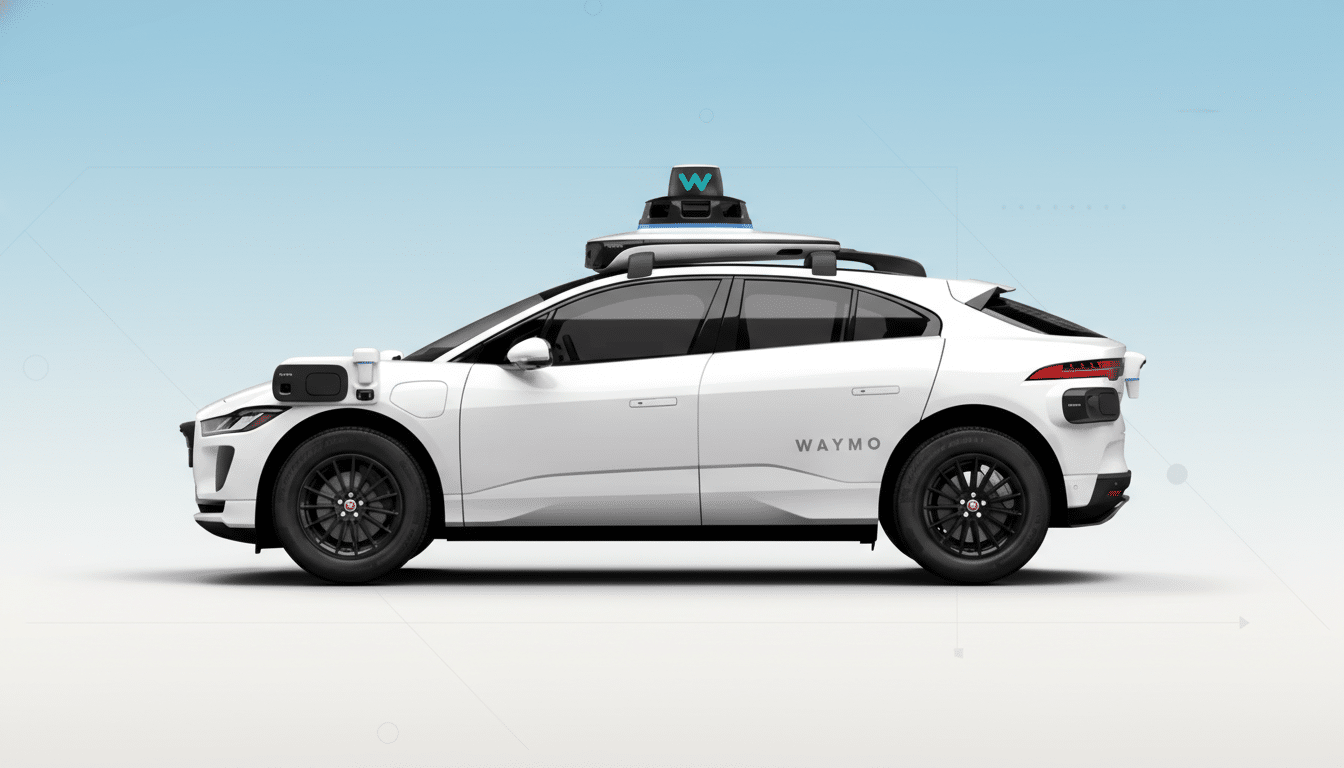

Waymo says the capital will fund vehicle procurement and operations, high-performance compute for model training, mapping and simulation at city scale, and safety assurance required for new jurisdictions. With AV deployments still capital-intensive, this is one of the largest single injections into the sector, positioning Waymo to outspend rivals on both scale and reliability.

Expansion Targets London and Tokyo for Launch

International service means adapting the Waymo Driver to left-hand traffic, local signage, and distinct road norms. London presents dense urban complexity, bus lanes, roundabouts, and strict pick-up rules enforced by Transport for London. Tokyo adds nuanced pedestrian behavior, narrow streets, and station-centric traffic patterns overseen by Japan’s Ministry of Land, Infrastructure, Transport and Tourism. Successfully navigating these environments would demonstrate software generalization well beyond U.S. grids.

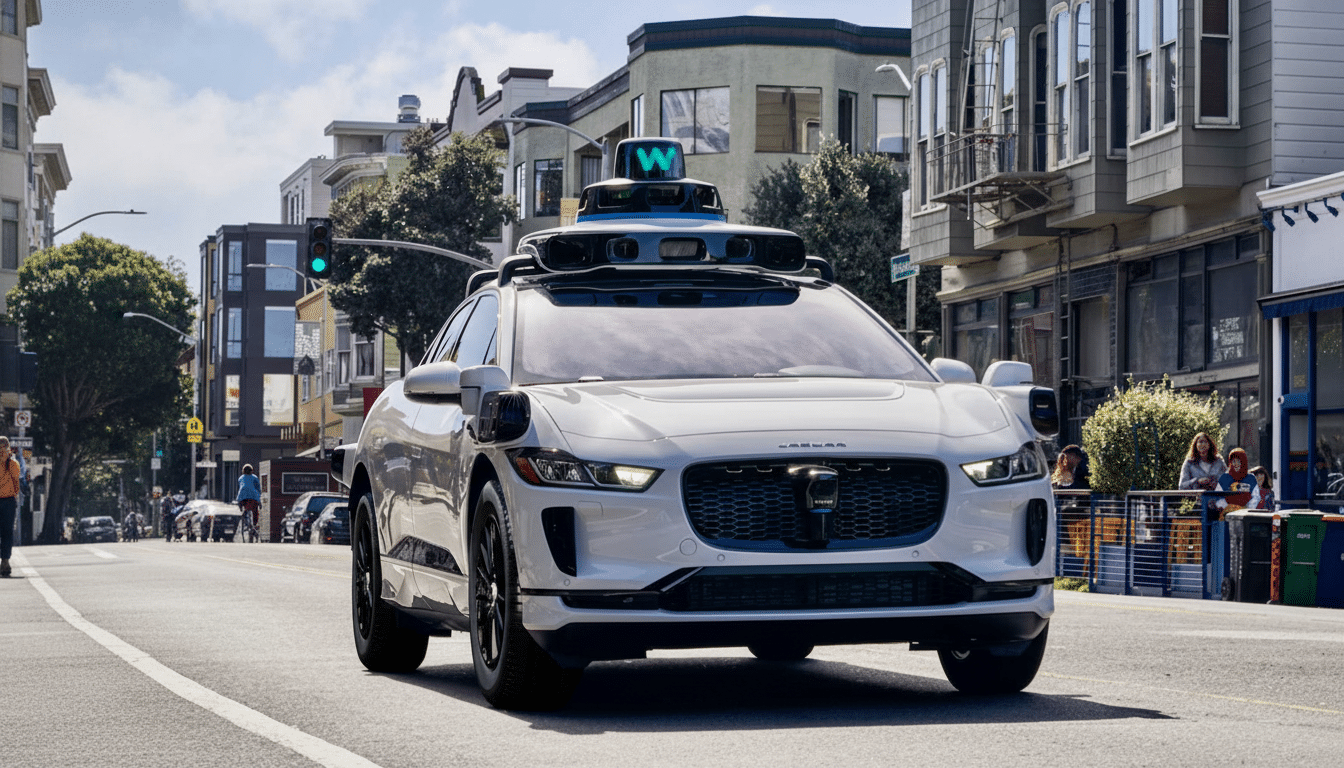

Domestically, Waymo has extended service from its early Phoenix operations to major U.S. metros. The company began charging fares in California after securing approvals from the California Public Utilities Commission, expanded coverage across the Bay Area and Silicon Valley, and launched service in Los Angeles. It added Austin and Atlanta through a ride-hailing partnership and connected to San Francisco International Airport—key steps toward serving end-to-end trips rather than confined zones.

Scale is starting to show in the numbers: Waymo reports roughly 400,000 rides per week across six large U.S. markets. In the past year it delivered about 15 million rides, pushing lifetime trips past 20 million. The company says it is laying groundwork for operations in more than 20 additional cities, with London and Tokyo among the first international entries.

Tipping Point for Robotaxi Economics and Margins

Robotaxi cost curves hinge on vehicle utilization, remote support ratios, battery and sensor lifecycles, and insurance. Waymo’s push into airports and crosstown corridors matters because higher average trip lengths and consistent demand improve utilization, diluting fixed costs such as mapping and fleet base operations. As autonomy stacks mature, operators target lower remote-assistance intervention rates—critical for moving toward positive margins per mile.

Investors in this round have deep experience underwriting transitions from negative-unit-economics platforms to profitable networks. Their bet is that dense fleets will unlock flywheels: more rides yield more edge-case data, improving models, which supports broader geographies and lower prices. If those loops compound, robotaxi fares could converge with or undercut human-driven ride-hailing in the busiest corridors.

Safety And Oversight Under The Microscope

Rapid expansion has brought heightened scrutiny. The National Highway Traffic Safety Administration’s Office of Defects Investigation has opened probes into Waymo vehicles’ behavior around school buses, and the National Transportation Safety Board is reviewing related events. In a recent incident near a school, a Waymo vehicle struck a child at low speed, causing minor injuries, according to authorities. Such cases will shape public confidence and regulatory guardrails as the company scales.

Waymo points to its safety case methodology, multi-sensor redundancy, and simulation-driven validation. But international deployments will require demonstrating compliance with regional frameworks and addressing local concerns—from emergency vehicle interactions in London to school-zone protocols in Japan. Independent oversight from regulators and adherence to standards such as UL 4600 and functional safety practices remain central to sustained approvals.

What It Means for the Autonomous Vehicle Landscape

The raise widens Waymo’s lead at a time when other autonomous contenders are regrouping. Some U.S. rivals have faced operational pauses and regulatory pushback, while international players like Baidu’s Apollo Go continue to expand geofenced robotaxi services in Chinese cities. Amazon-backed Zoox and others are progressing in constrained pilots. With fresh capital and a maturing platform, Waymo is positioned to set the reference playbook for scaling from city pilots to multi-country fleets.

The next proving ground is execution: entering complex foreign markets, maintaining safety performance as miles climb, and driving costs down through utilization and automation. If Waymo meets those marks, its $16 billion bet could accelerate the shift from experimental autonomy to a mainstream urban mobility utility.