Walmart chief executive Doug McMillon thinks artificial intelligence will touch every job in the world’s largest private employer, not just those that involve coding. Addressing a gathering in Bentonville, Ark., he cast the shift as broad but manageable, and called on companies to combine adopting new tools with skilling up so workers aren’t left behind.

For a company that has more than two million workers, this is not a thought experiment. It is a blueprint for how AI could rewrite frontline retail work, supply chain operations and corporate functions in almost lockstep.

AI Moves Beyond Engineering Into Frontline Work

Most of the public discussion has focused on software developers and office workers, for whom coding copilots and content generators are already transforming daily routines. But the technology’s effects are wider and more granular than any one occupation.

McKinsey research estimates that generative AI has the potential to automate work equivalent to 60% to 70% of current employees’ time across existing jobs, with substantial exposure among service and sales role occupants identified by the Organisation for Economic Co-operation and Development (OECD). OpenAI researchers have also shown that frontier models achieve expert human-level performance on a range of economically valuable tasks, not just programming.

What It Means for Walmart Operations Inside

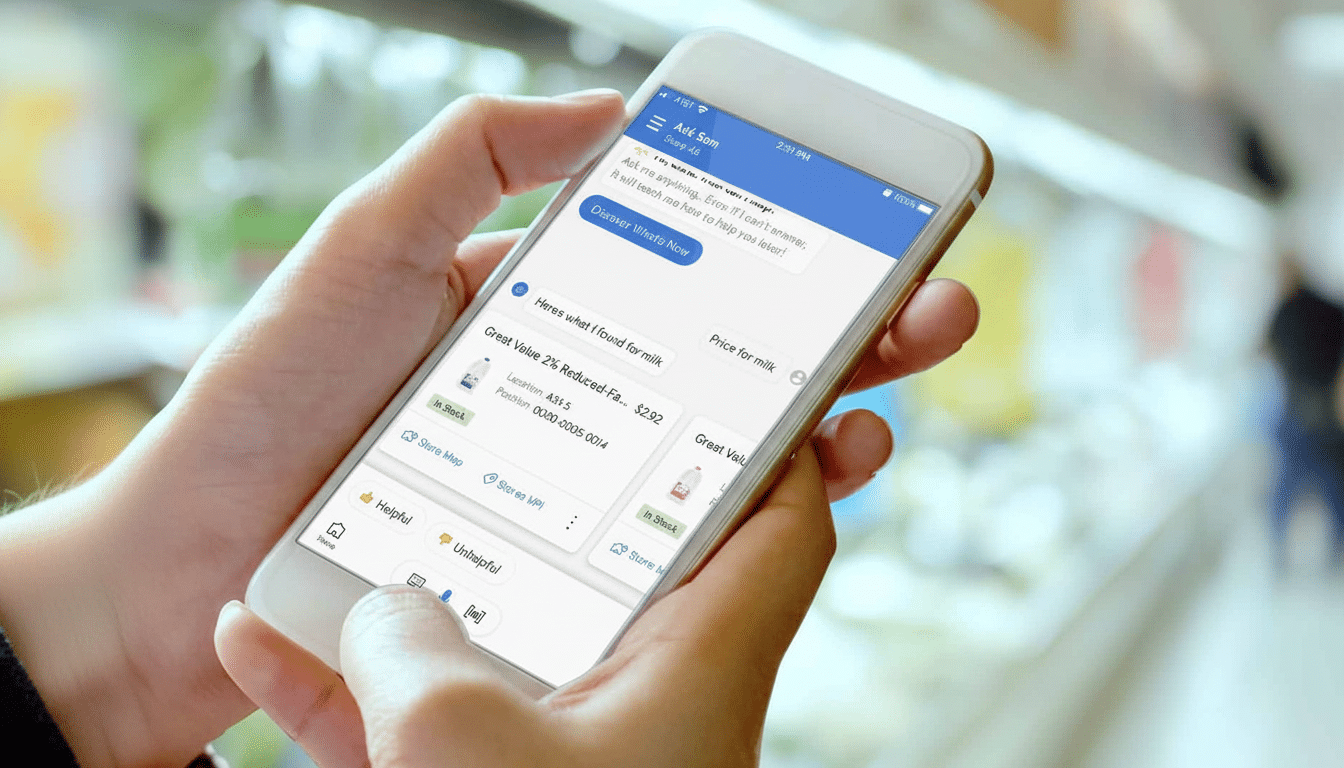

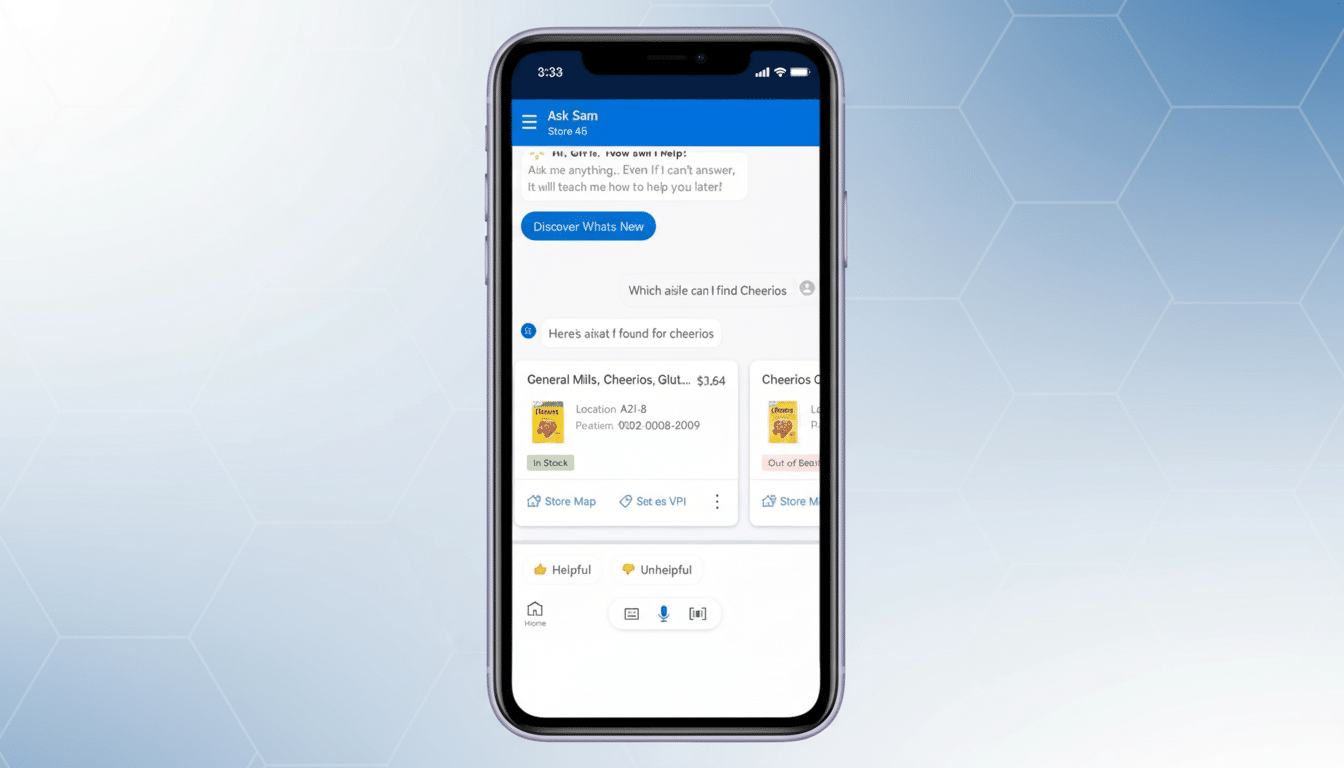

In the store, AI can offer inventory scans that are faster, helping associates more accurately place items and predict out-of-stocks with advanced forecasting capabilities. Walmart has already used tools like Ask Sam, a voice assistant for associates, and unveiled language generation AI features to enhance search and shopping assistance for customers.

In the back end, the company has invested in high-automation distribution centers with systems from Symbotic to speed case handling and reduce monotony. Scheduling, pricing and demand planning are rich with opportunity for such optimization through large-scale models trained on years of sales, weather and local event data — places where an incremental increase in accuracy is an instant cocktail of saving time in real time.

AI writing and analysis tools (Walmart has tested generative assistants for internal knowledge work) can expedite standard tasks for corporate employees, freeing them up to negotiate with vendors, strategize merchandise or comply.

Upskilling Becomes a Business Necessity for Workers

McMillon’s focus is not replacement but reinvention. That would mean investment in training, so entry-level jobs morph rather than disappear. Walmart’s Live Better U program, which covers 100% of tuition and books for degrees and certifications in fields such as data analytics, supply chain and cybersecurity among others, is set to add AI literacy to existing pathways.

It’s the same direction in the policy environment. The National Institute of Standards and Technology issued its AI Risk Management Framework to provide principles for the responsible deployment of AI, and the Department of Labor shared principles for worker-centered AI. For employers, the message is simple: use but document training and track impacts on job quality.

The Productivity Math and the Impact on Job Quality

The largest productivity gains may be realized among newer or lower-skilled workers once AI tools are integrated into workflows, evidence suggests. A well-publicized MIT and Stanford study uncovered a 14% lift in customer support productivity when agents employed generative AI, the least experienced seeing the biggest gains. In retail, analogous copilots might drive faster service desk resolutions, better recommendations of products and more-accurate returns processing.

The catch is transition management. Several million jobs involve cashier and stocker roles; as computer vision is rolled out, along with smart carts, some of those tasks may change. Employers who redeploy workers to higher-value tasks — personal shopping, omnichannel fulfillment, in-aisle expertise — have a chance at capturing productivity and holding headcount. There they will be told if training throughput, redeployment rates and wage progression are working.

Rivals Are Moving Too in the Race to Adopt AI

Walmart is not alone. Amazon has built AI into forecasting, robotics and checkout experiments with its CEO Andy Jassy saying that means fewer people would do some tasks but open new roles. Target has made its own investments in supply chain analytics and demand prediction, and Kroger has teamed up on data-driven fulfillment and dynamic pricing. Competition will force the adoption of AI to be a race, not an option.

For Walmart, scale is not just an advantage; it’s also a responsibility. The company is now training at a scale of mass reach and testing across thousands of locations, but quirkily it also establishes a new kind of precedent for where and how frontline AI transformation props up the broader economy.

What to Watch Next as Retail AI Scales Nationwide

Look for more associate-facing copilots, increased automation in distribution centers and AI-enhanced customer experiences in search, replenishment or checkout.

- Associate-facing copilots to support store and service tasks

- Greater automation in distribution and fulfillment centers

- AI-enhanced experiences in search, replenishment and checkout

Look for specific reporting on training hours per associate, internal mobility into tech-enabled roles, and safety metrics as robots and humans work in closer quarters.

- Training hours per associate and AI literacy progress

- Internal mobility into tech-enabled and higher-value roles

- Safety metrics as robots and humans collaborate more closely

McMillon’s case is ultimately a pragmatic one: AI will transform almost every job, so the winning move will be to transform those jobs on purpose — training people, redesigning workflows and measuring outcomes — rather than simply letting that disruption happen to them. When it comes to retail, that difference could be the distinction between a productivity boom and a churn crisis.