Verizon is turning back on certain loyalty discounts for wireless customers with a “Please keep your business” message that bridges the gap between what’s remained unsaid and events that have already appeared in some customers’ automatic bill credits. The offers are account-specific, but many users say they’re being offered $10 to $20 off per line per month for as long as a year. Some others report receiving a blanket 15% reduction of the price of each individual line.

What Verizon Is Offering to Eligible Wireless Customers

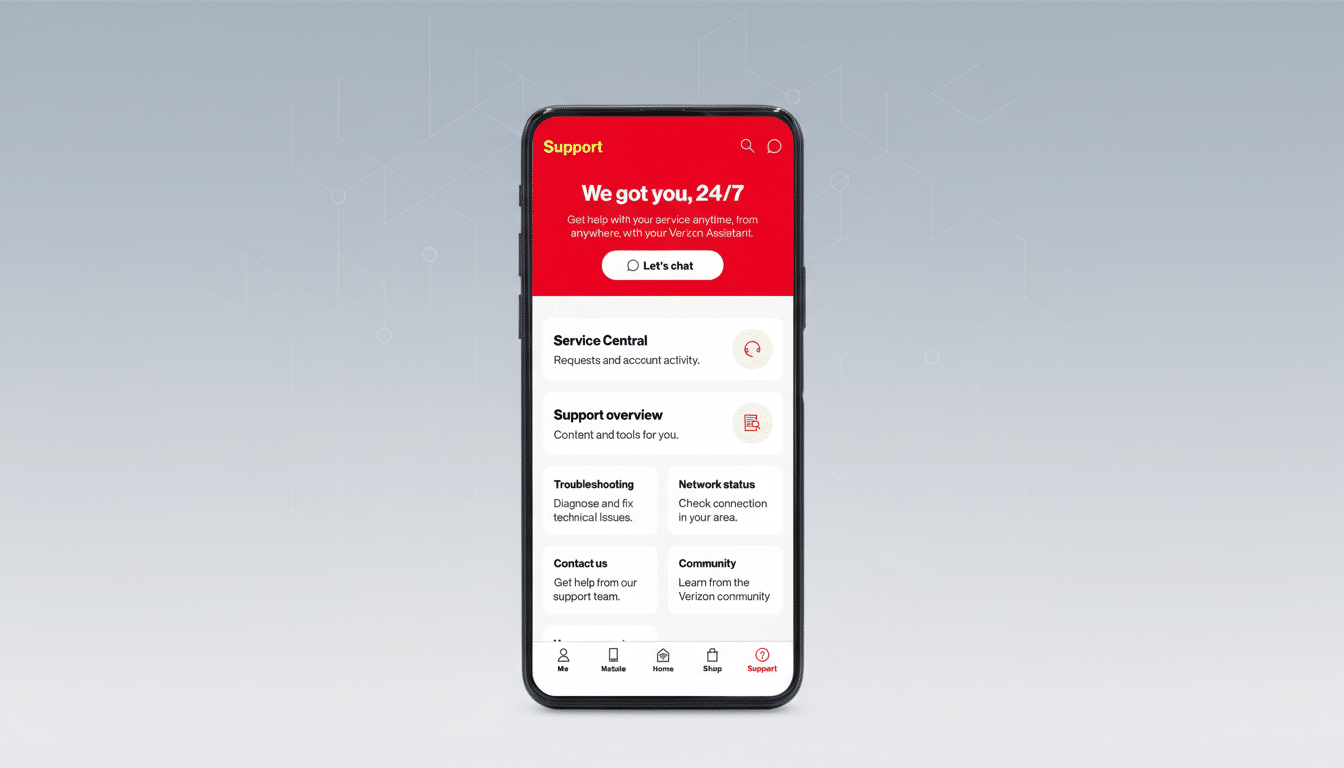

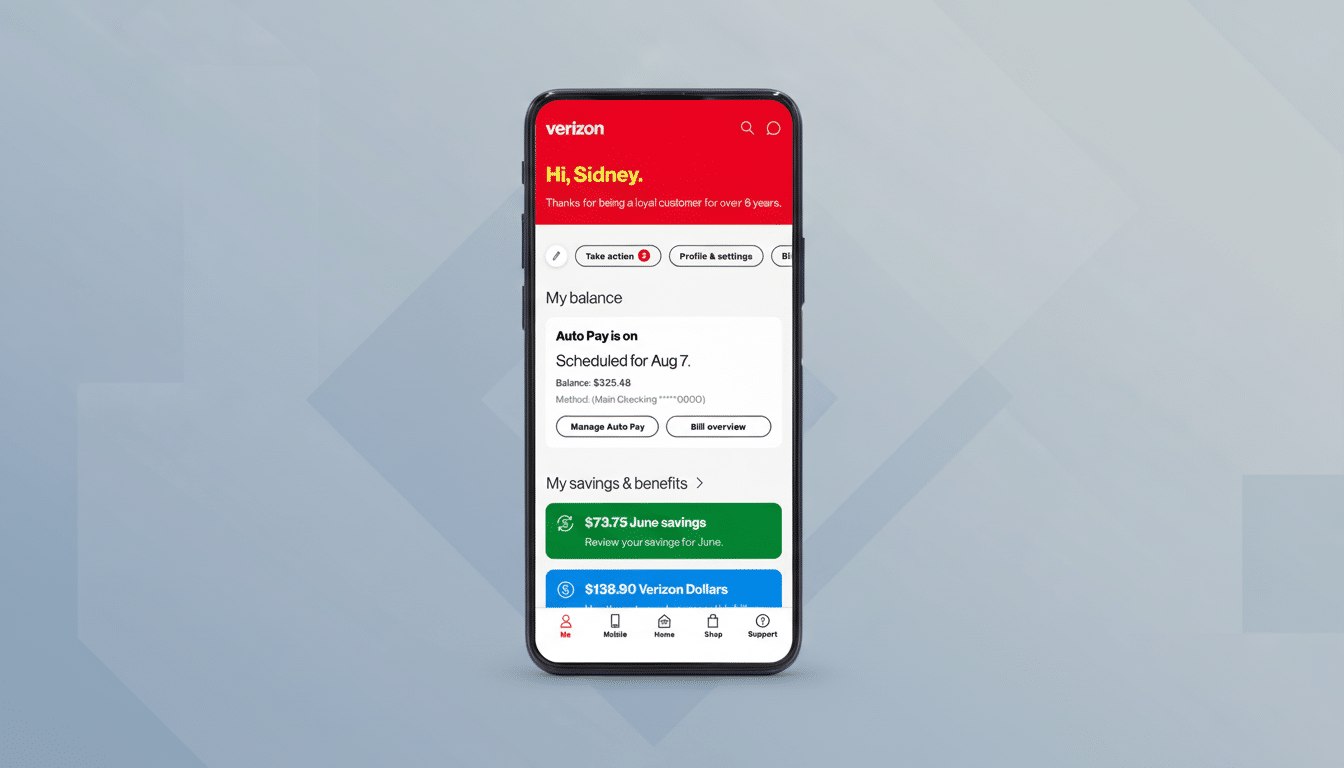

Customer posts in carrier forums and on Reddit say they’re receiving targeted discounts that show up in an account dashboard or the My Verizon app. The credits are not uniform — one household might get $20 off one line but only $10 off another, and others would be in line for a percentage cut when the number of lines is taken into account. Duration is typically 12 months but specifics may vary from one user and plan to the next.

These are not traditional promo codes or public offers. Instead, they are retention offers that are triggered at the line level and often layered on top of any existing plan pricing. Some subscribers say they received a discount without any action on their part; others report the offer came shortly after they took steps to change carriers, such as requesting a port-out PIN.

Why Verizon Is Doing This and What It Means for Churn

Verizon has seen increased churn in recent quarters as aggressive promotions from AT&T and T-Mobile have reset consumer perceptions about value. The carrier also angered sections of its base by getting rid of legacy perks, hiking some fees and adding caveats to prior loyalty credits. During its most recent earnings call, company executives themselves admitted that relying too much on price increases can speed up disconnects and is not a long-term growth engine.

Targeted bill credits are a familiar pressure valve. They also serve to bolster near-term retention without forcing a repricing of the portfolio in its entirety, and allow Verizon to target relief where models flag accounts as being at greatest risk. Analysts at both MoffettNathanson and New Street Research have for some time said that U.S. carriers use save offers to control churn, particularly when switcher incentives are ramping across the industry.

How the discounts appear on accounts and why they vary

Discounts appear to be triggered based on user accounts in a few ways:

- Automatically after prior credits expire

- When contacting customer support

- After making port-out PIN requests

Not all are treated the same way. Whether a save offer is triggered, and how sweet it is, can depend on tenure, plan type, device financing and payment history.

The variance helps account for why one family gets $20 off three lines and another $10 off four. In other cases, the company is specifically targeting only one line on a multi-line account — which is probably a risk score carded back to that segment. The upshot is a patchwork of incentives aimed at ensuring the most “at-risk” lines don’t leave without setting up across-the-board pricing.

What customers should watch before accepting any discount

If something new arises, read the fine print.

- Many time-limited offers expire after a year.

- Some depend on staying on a particular plan or keeping autopay and paperless billing enabled.

- Make sure accepting a credit doesn’t change your plan or remove existing perks.

It’s worth contrasting these loyalty credits with the carrier-switcher offers that rivals are offering today. AT&T and T-Mobile still hawk big trade-in credits and bill credits for movers with the potential to offset device costs, but new financing agreements and multi-year commitments may be necessary. Even a targeted Verizon discount can be easier — and no less valuable — if you’re otherwise happy with coverage and plan features.

The bigger picture for Verizon’s retention strategy now

The return of loyalty discounts suggests a tactical move back toward customer retention, rather than ARPU growth for its own sake. It also illustrates Verizon reacting to more than a year of consumer pushback against changes in price and perks. That these targeted credits will make much of a dent in churn is going to depend on how broadly they are rolled out, as well as whether clearer value propositions come packed with plan bundles.

For now, the message is simple: if you are a Verizon customer, watch your account.

There could be an unexpected credit waiting for you already — part of a larger push by the carrier to stop existing customers from heading toward a competitor.