Verizon is rolling out a budget-friendly Home Internet Lite plan that squarely targets Mint’s upcoming “MINTernet” offering, signaling a fresh round in the fixed wireless access price war. The new Verizon tier starts at $25 per month for existing Verizon voice customers—$5 less than Mint’s $30 plan when prepaid annually—and is designed for light-use households that have struggled with DSL or satellite.

What Verizon Is Offering With Home Internet Lite

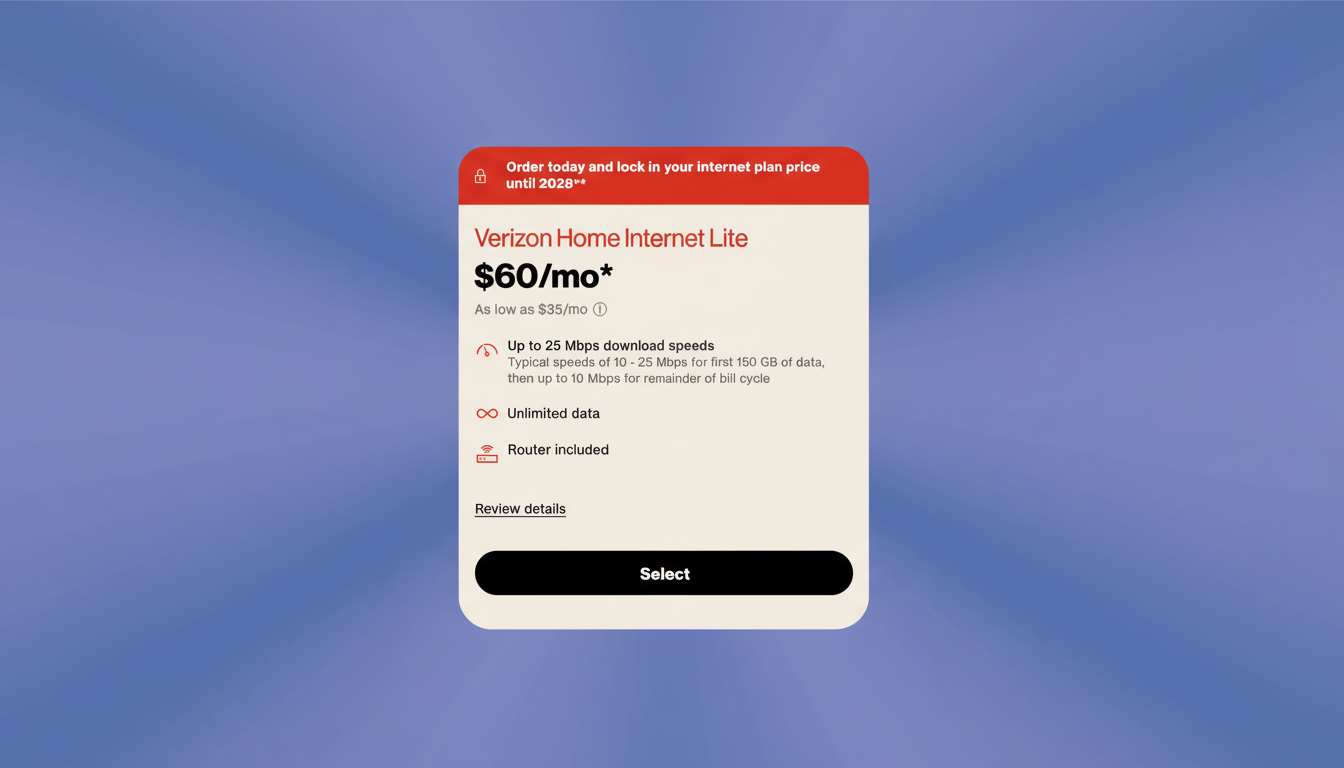

Home Internet Lite caps download speeds at 25Mbps, with Verizon indicating typical performance in the 10–25Mbps range. That ceiling is intentional: the plan is framed for rural and underserved areas where legacy connections have long limited what’s possible online. The $25 rate requires an active Verizon voice line; without it, the plan runs $10 more per month. Unlike Mint’s approach, there’s no need to prepay a full year to unlock the headline price.

- What Verizon Is Offering With Home Internet Lite

- How It Compares To Mint’s Upcoming MINTernet Plan

- What To Expect From Real-World Performance At 25Mbps

- The Fine Print Of Value And Eligibility Requirements

- Why Carriers Are Pushing Fixed Wireless Broadband

- What To Watch Next As These Competing Plans Roll Out

There’s also an upsell path. Verizon’s standard home internet tier costs about $10 more and does not impose the same throttled top speed, which could matter for households with multiple streams, smart-home devices, or larger downloads. The Lite plan, then, is less about raw speed and more about dependability at a predictable, low monthly cost.

How It Compares To Mint’s Upcoming MINTernet Plan

Mint’s MINTernet is slated at $30 per month when paid annually, and the company is pitching it as an unlimited home internet option. Mint operates on T-Mobile’s network, while Verizon is leveraging its own 4G/5G infrastructure for Home Internet Lite. The immediate contrast is pricing mechanics: Verizon undercuts on monthly cost for its existing wireless customers and doesn’t require an annual prepay, while Mint goes for a lower sticker price over a 12-month commitment.

Feature-wise, Verizon’s Lite plan is transparent about a 25Mbps cap. Mint has emphasized affordability and simplicity, but hasn’t framed its offer around a strict speed ceiling in the same way. That makes Verizon’s Lite positioning crystal clear: it’s a value tier for basic connectivity, not a premium performance product.

What To Expect From Real-World Performance At 25Mbps

At 25Mbps, everyday tasks like email, browsing, music streaming, and video calls should be fine, and a single 1080p stream typically fits comfortably. But multiple concurrent HD streams, cloud gaming, or large game updates can quickly saturate that bandwidth. If you’re hoping to run several 4K streams or back up large photo libraries while someone else is on a video call, the cap will feel tight.

The Federal Communications Commission raised its benchmark for “broadband” in 2024 to 100Mbps down and 20Mbps up, underscoring how consumer needs have grown. By that yardstick, Verizon’s Lite tier sits below the modern baseline—but it’s still a meaningful upgrade for households aging out of DSL or trying to escape high-latency satellite plans.

The Fine Print Of Value And Eligibility Requirements

The $25 headline price hinges on already paying Verizon for a voice line. For non-Verizon wireless customers, the plan costs $35, which narrows the discount versus Mint’s $30 prepaid annual rate. Prospective buyers should also consider equipment fees, potential installation requirements, and any network management policies that can affect peak-time performance—common considerations across the fixed wireless category.

If your household’s needs may grow, stepping up to Verizon’s non-capped home internet tier for roughly $10 more could be the smarter long-term move. It’s the classic trade-off: pay less for enough today, or a bit more for headroom tomorrow.

Why Carriers Are Pushing Fixed Wireless Broadband

Fixed wireless access has become the engine of broadband growth in the U.S. Industry trackers such as Leichtman Research Group have reported that FWA accounted for a majority of net broadband subscriber gains in recent periods, as carriers use nationwide 5G coverage to reach homes without running new cables. It’s faster to deploy than fiber and markedly cheaper than building out new wireline networks in sparsely populated areas.

The policy backdrop matters, too. The FCC’s updated broadband benchmark and federal investment through programs overseen by the NTIA aim to close the digital divide, but fiber won’t reach every address soon. That creates space for competitively priced FWA tiers—like Verizon’s Lite and Mint’s MINTernet—to bring adequate, if not elite, service to places that have waited years for better options.

What To Watch Next As These Competing Plans Roll Out

For budget-minded customers with basic needs, Verizon Home Internet Lite is a compelling counter to Mint’s $30 offer, especially if you already have a Verizon voice line and want to avoid annual prepayment. Power users should weigh Verizon’s higher tier or consider whether Mint’s unlimited positioning aligns with their usage patterns.

As both plans roll out, keep an eye on:

- availability maps

- equipment pricing

- trial periods

- any usage management disclosures

In a market where FWA is growing fast and expectations are rising even faster, transparent speed expectations and predictable pricing will be the differentiators that matter.