Venture capitalists have jettisoned a decade of heuristics as AI is remaking what they use to evaluate, fund and scale early-stage companies. Instead of neat growth curves and textbook milestones, investors are focused on data advantage, shipping velocity, and defensibility in a market that is going faster than any prior platform shift.

The New Numbers That Count for AI Startup Investment

Founders pitching AI today do so into an “algorithmic” investment model that is scoring variables different than traditional SaaS.

- The New Numbers That Count for AI Startup Investment

- Why Go-to-Market Execution in AI Is Not Optional

- Why Speed and Shipping Cadence Are a Lasting Moat

- Why Follow-on Funding Milestones Are Getting Tougher

- What VCs Are Looking For in the Room With Founders

- Why This AI Investment Cycle Feels Meaningfully Different

Investors are looking at proprietary data pipelines, the repeatability of model performance and durability of a moat beyond access to frontier APIs. Track records of execution and the depth of a founding team’s research chops have been central inputs, along with customer traction.

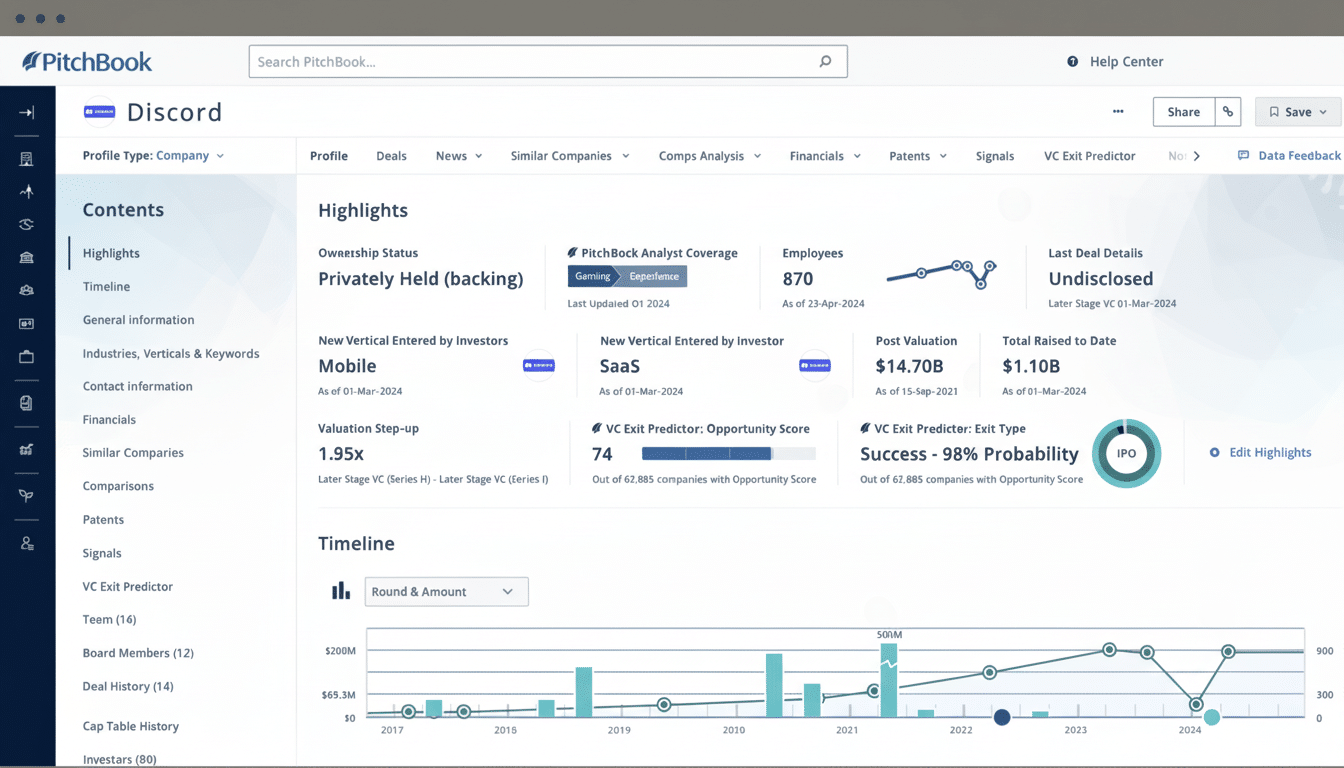

The following signals from experienced investors are evidence that the tide is turning: seed propositions are being graded with Series A scrutiny and Series A rounds increasingly underwritten on leading indicators like user retention by cohort, inference cost curves, and data feedback loop quality. PitchBook has observed that median time from seed to Series A for AI companies compressed, while valuation dispersion expanded — signals of a “barbell” market in which a minority of teams clears a higher bar quickly.

Compute economics are in your face. Investors need evidence that unit economics actually improve as usage scales: tokens per dollar, inference latency at P95, gross margins net of cloud credits. A number of big companies now have their own internal “compute committees” to help portfolio companies acquire GPUs, negotiate discounted cloud contracts and assess build-versus-buy choices around serving and fine-tuning.

Why Go-to-Market Execution in AI Is Not Optional

And a debate is being waged about the primacy of go-to-market over technical differentiation. One faction says breakout results are more likely to come from the best commercial execution, not always the flashiest model. Others say in AI, bad tech is quickly revealed by end users and benchmarks. The new consensus: You must have both — a credible technical depth and a sharp distribution engine that lands usage fast and compounds learning.

Practically, this means investors are looking for love early: design partners that convert to paid usage-based pricing that reflects value and net-revenue retention based off compounding automation rather than discounts. Deals will increasingly include a pipeline audit, teardown of the sales motion, and proof onboarding can achieve first value in minutes versus weeks.

Why Speed and Shipping Cadence Are a Lasting Moat

Shipping cadence has turned into a proxy for founder-market fit. With model capabilities advancing quarter to quarter, investors are rewarding teams that ship production-grade updates quickly and without compromising safety and reliability. Benchmarks, internal evals, and red-team reports are increasingly showing up in data rooms. The template is simple: if incumbents can copy features then the only defense is to out-ship and outlearn.

According to analysts at CB Insights, in many cases rounds featuring generative AI are over-indexed to companies with somewhat-weekly releases as opposed merely to research preprints. Startups that can show a closed loop — usage producing data, data improving models, models unlocking new usage — get premium terms even at roughly the same revenue levels.

Why Follow-on Funding Milestones Are Getting Tougher

Even zero-to-meaningful teams that are sprinting angular to amounts of revenue are finding the next round’s milestone is more. Investors are sorting for revenue quality over raw growth: expansion from production workloads rather than experiments, unit margins resilient without promotional cloud credits and churn held in check as business models mature. Bridge rounds and milestone-driven tranches are also much more prevalent than in the last cycle, pointing to a market that pays for proof rather than promise.

Corporate investors are also remaking the cap table. According to CB Insights, strategics are involved in 30% of AI financings today and can offer distribution and data access but also cross-engagement risk. The job of diligence is increasingly to ask how much a start-up depends on a single hyperscaler, lab or social platform for both compute and customers.

What VCs Are Looking For in the Room With Founders

Some patterns are emerging in the partner meetings.

- First, an explicit data strategy: what is proprietary to the company today and in a year, what needs consent or has provenance attached and how it applies privacy.

- Second, believable cost-down trajectories for inference and training, including architecture options and vendor redundancy.

- Third, a definitive application wedge when the model’s strengths manifest in quantifiable business impact — time saved, errors prevented and dollars made.

For regulated markets, customers demand that service providers align with frameworks from NIST and the EU, along with internal governance playbooks. Security audits, model monitoring and incident response plans are now the table stakes for enterprise-facing AI.

Why This AI Investment Cycle Feels Meaningfully Different

Thus, contrary to previous waves of software innovation, the foundational capabilities are owned by a few labs and cloud providers for whom open-source models move so quickly that short-lived edges get eroded. That ambiguity makes this a “funky time” to invest, he said: There are no clear winners, distribution channels are up for grabs and the feedback loop between research and product is tighter than it’s ever been.

The result is a fresh calculus of investment that rewards teams who can construct data moats, sell with precision and ship relentlessly. Old rules — top-lining at all costs, vanity metrics, platform dependency sans leverage — are doffed. Instead, it has been replaced with a more pragmatic emphasis on sustained advantage. That’s the clear message for founders: treat AI as a product and a system we can reverse-engineer, not just like some demo. As VCs, we could pretty much throw the playbook out and start again, because the models, the markets and moats were all changing.