The AI Application Spending Report is the inaugural report on where and how companies are spending money to adopt AI to drive results, based on Mercury’s analysis of bank data for startup customers.

But beyond the headline leaders, the most interesting story lies with the underdogs — lesser-known AI startups that are winning line items despite being fairly unknown because of how they solve gritty, specific problems for teams every day.

- What the spending says about early AI adoption

- The niche advantage driving traction for AI underdogs

- Coding agents shift from hype to utility

- Horizontal AI tools are capturing early enterprise budgets

- Why leaders choose to augment before they replace roles

- What to watch next as underdog AI tools scale up

The report rates the 50 AI-native tools that startups are actually paying for. Yet as OpenAI and Anthropic lead the race, the traction of some smaller names demonstrates what enterprise buyers are looking for today: battle-tested automation, rapid time-to-value, and tools that slide into existing workflows with no total war on change management.

What the spending says about early AI adoption

Horizontal apps are estimated to represent about 60% of spend, while vertical tools account for the remaining 40%. That bifurcation tells us standardization is taking place first in broad-use utilities — language models, search, meeting support — while specialized products carve out high-ROI niches inside functions like support, hiring, and legal ops.

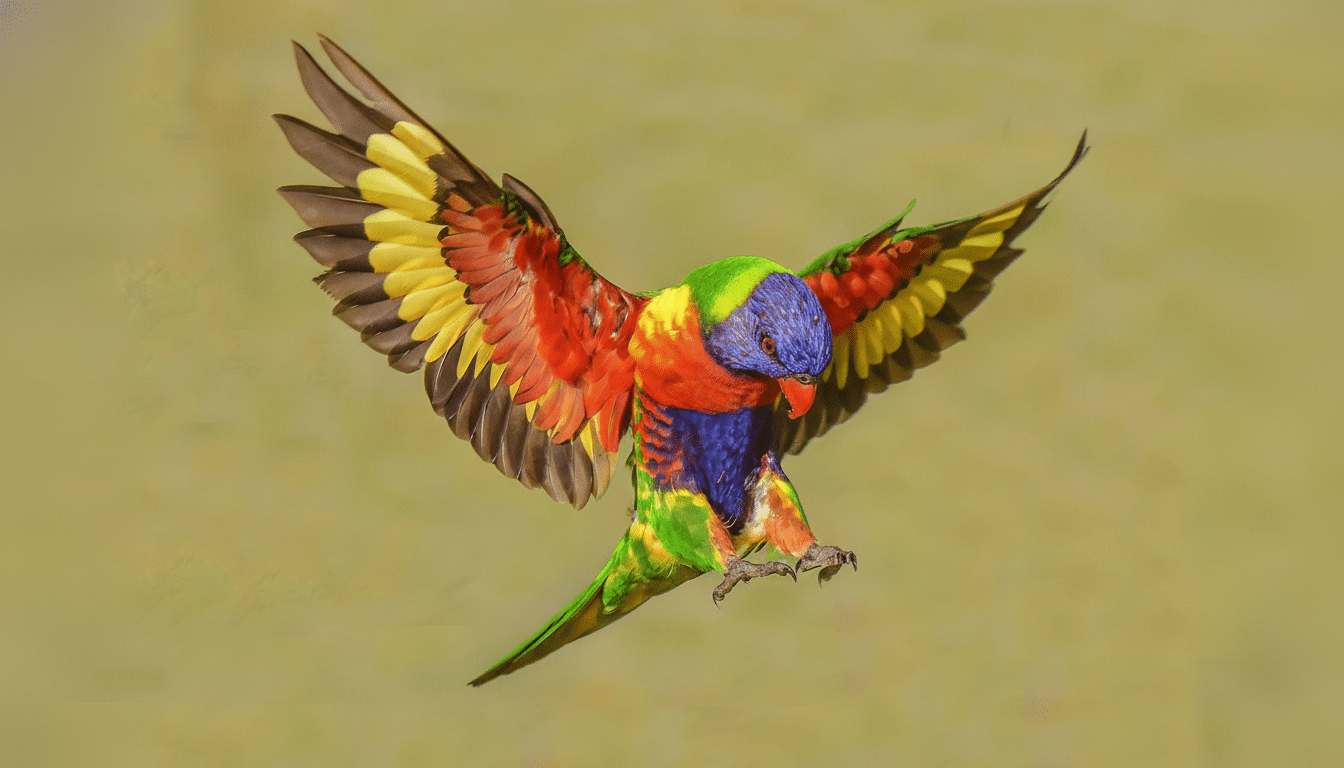

The underdogs on the list highlight that ground truth. Lorikeet (#8), Retell (#16), and Crisp (#46) home in on AI-augmented customer service, where ticket deflection and triage can be priced in minutes saved and CSAT lift. Metaview (#19), which targets recruiting intelligence, and Crosby (#27), which streamlines legal workflows, often are a bottleneck to sales and compliance. Meeting assistants like Fyxer (#7), Cluely (#26), and Happyscribe (#36) represent the straightforward, bankable value of capturing and summarizing conversations across a company.

Since the rankings are from real transaction data rather than surveys, they act like a market seismograph: slight tremors in spend typically come before wide adoption. Those underdogs are early signs of which workflows are ripest for lasting automation.

The niche advantage driving traction for AI underdogs

What makes these less well-known apps take off?

They choose their battles — those they can win. A focused system with out-of-the-box integrations into Zendesk, Salesforce, or an ATS and that automates away repetitive work shows ROI early, minimizes cultural pushback, and enables practitioners to ride the “land-and-expand” curve within teams. Forrester has called this emerging era of AI adoption “frumpy but functional” — a pragmatic shift in which the boring side wins budgets.

The better tools are more like adapters, not replacements: they mold to existing workflows, reveal clear metrics, and demand minimal training. Faced with a cost-per-seat- and security-posture-obsessed buyer, that pragmatism (note: it isn’t sexy) is going to win out over flash every time.

Coding agents shift from hype to utility

Replit clocked in at #3, a sign that “vibe coding” — natural-language coding and agentic dev tools — has git-pushed past its novelty phase into dependable utility. Cursor (#6), Lovable (#18), and Emergent (#48) also featured, reflecting the appetite for tools that enable non-specialists to prototype, and engineers to quickly create boilerplate/scaffolding.

Businesses aren’t buying mere chat UIs; they’re paying for governance, observability, and policy controls so that agents can safely build apps on top of them. Errors of reliability still occur, as in widely advertised data blunders throughout the sector, but spending behavior indicates buyers are ever more willing to believe these platforms can deliver production-quality automation.

Horizontal AI tools are capturing early enterprise budgets

The names with the highest spending are all horizontal — OpenAI, Anthropic, Perplexity (#12), Merlin AI (#30) — signaling a preference for foundational capabilities that can be embedded across departments. Meeting tooling has also become irresistible: it’s immediately usable, cheap and fast to pilot, and doesn’t require a lot of behavioral change, so purchase decisions accelerate.

Indeed, as a recent MIT study found, most AI projects fall short under the burden of top-down orders. The spending model in this chart correlates with a bottom-up truth: when individual teams experiment, demonstrate value, and then grow organically, lightweight, horizontal apps take off.

Why leaders choose to augment before they replace roles

The report’s vertical segment breaks down into tools that augment compared to those that aim to replace humans. Spending today is purely augmentation-biased. Leaders across industries have amplified this stance — big employers, for instance, have been emphasizing upskilling over layoffs — and separate survey work by the CRM platform Creatio found that a majority of executives expect agents to enable existing staff members and even establish new roles.

That stand is both pragmatic and political. Augmentative AI serves multiple duties for risk reduction, maintaining domain knowledge, and ensuring adoption remains a two-way process. Replacement bets can potentially get more expensive over time, but today’s budgets reward the copilots who help teams do more with the tools they already trust.

What to watch next as underdog AI tools scale up

Among the underdogs, two paths are taking shape. Some will extend their niche, adding depth in analytics, compliance, and workflow to emerge as category standards. Others will stretch sideways, transforming a thin edge into a platform complete with agents, integrations, and governance that cater to the wider enterprise stack.

Either way, the message from the spending data is clear: it’s not the loud voices but those with something useful to say who win.

In the A16z Top 50 underdog tier, utility, trustworthiness, and potential for measurable outputs are the real points of differentiation — and they’re quietly beginning to redefine how AI shows up at work.