Uber is launching a robotaxi service in Dallas, introducing an extremely geofenced program that combines certain ride requests with self-driving vehicles operated by partner Avride. The first service area will cover 9 square miles of Downtown, Uptown, Turtle Creek and Deep Ellum. Initially, a trained driver will be behind the wheel to observe the system, but eventually, after the company hits performance and safety thresholds, drivers won’t be necessary.

How the Dallas robotaxi program works for Uber riders

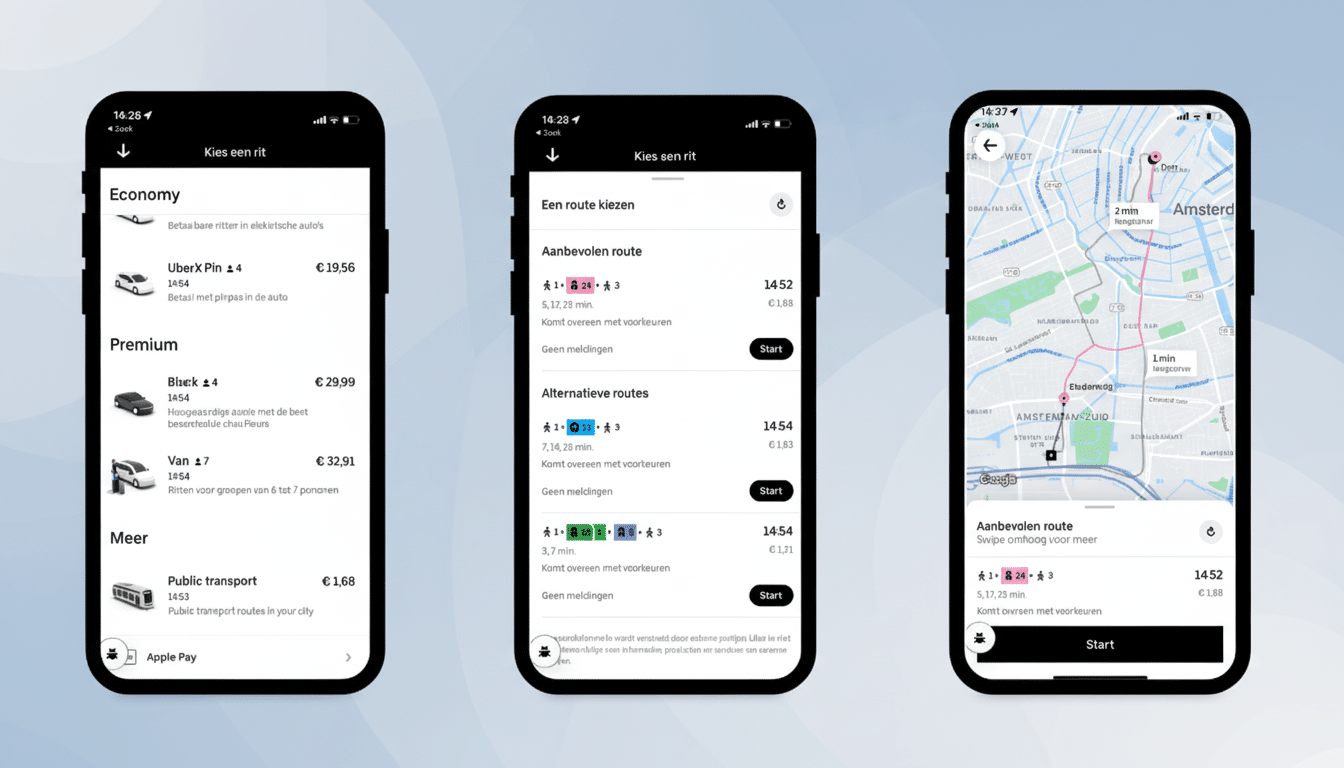

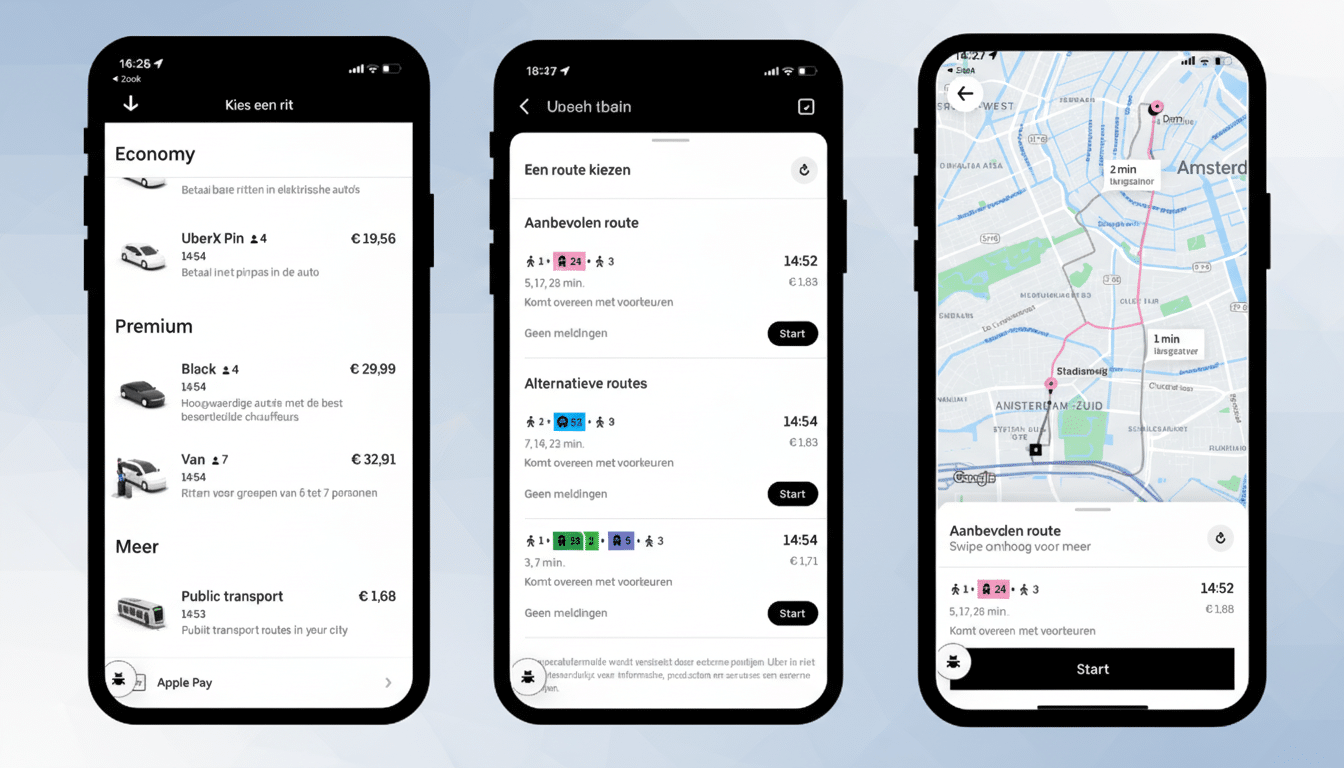

It’s not as if riders will be ordering up an autonomy option. Instead, if they ask for an UberX, Uber Comfort or Uber Comfort Electric ride, under the right conditions and within the operational zone, Avride’s electric robotaxi could be sent. Customers who would prefer a traditional car can switch prior to pickup. Users can also opt in under Ride Preferences in the app’s Settings to increase their chances of getting a robotaxi match.

Uber says Avride’s vehicles are built for full autonomy, but the service in Dallas will still have a safety driver in the car to monitor it and intervene if necessary.

They will operate very conservatively — we are talking precision lane positioning and waiting for gaps at unprotected turns. These are traditionally conservative practices of commercially deployed autonomous systems while they’re still trying to learn a city.

Safety measures and regulatory oversight in Dallas

Texas is one of the states that has among the least restrictive legal environments for automated vehicles. Under state law, the vehicles are allowed to operate on public roads with traffic laws and safety features specific to them — as well as special insurance. Against that background, companies typically phase in service with human supervisors until on-road performance, edge-case handling and remote operations protocols are proven.

Crash reporting for more advanced automation systems is covered by the National Highway Traffic Safety Administration’s Standing General Order, under which companies are required to provide info when there are incidents involving vehicles equipped with automated driving systems. To date, most reported AV accidents are at low speed and involve minimal damage, but regulators continue to examine how vehicles react around vulnerable road users (VRU), emergency situations and intricate construction areas.

Public confidence is still a hill to climb.

Following a number of high-profile accidents in the sector, a survey by the American Automobile Association found 68% of drivers were uncomfortable with fully self-driving vehicles. Uber’s gradual rollout — and clear options to switch to a human-driven ride — is meant to ease riders into the experience, while the company gathers local safety and reliability data.

Why Uber chose Dallas for its robotaxi launch, and why now

Dallas presents a compelling testbed: a dense, urban core peppered with multilane arterials, evolving bike infrastructure and plenty of events that stress-test routing. The area is also a key logistics hub. Autonomous trucking projects already underway by companies like Aurora and Kodiak Robotics are using Texas corridors, developing a wider pool of mapping, simulation and operations expertise to support passenger AV deployments.

Electrification momentum is another draw. Uber has committed to conducting 100 percent of rides in the U.S., Canada and Europe using zero-emission vehicles by 2030, and pairing autonomy with electric could help the company whittle away at both per-mile cost and emissions targets. To riders, the robotaxis appear as part of the same app flow they already know; to drivers, a new supervised phase creates additional roles centered around safety operations and data collection.

Competition and industry context for Uber’s AV rollout

Uber is pivoting from developing its own self-driving stack to a platform strategy that accommodates third-party AV fleets. In Phoenix, riders can already hail driverless cars through the Uber app as part of a partnership with Waymo. Elsewhere, the industry’s learning curve was a steep one: some operators halted their driverless services to focus on how they address safety issues and streamline remote assistance and incident response protocols. The Dallas rollout fits that mold — test the waters, monitor and expand as the data justify.

North Texas isn’t new to autonomy pilots. Arlington has run autonomous shuttles in its Entertainment District, and retailers and logistics companies have piloted ground robots as well as middle-mile automation across the metro area. Uber’s entry brings a high-profile consumer use case that could speed up policy conversations around curb management, designated pickup areas and data-sharing norms.

What comes next for riders using Uber’s Dallas robotaxis

Uber hasn’t provided pricing differences for robotaxi matches, and riders will see upfront fares as normal. The hours of service and timing of expansion are usually tied to performance metrics: the rates at which riders disengage, overall rider satisfaction, number of miles between incidents (the drivers report when they need assistance), how adept the system is at handling complicated events like lane closures or big stadium traffic. Only after meeting those targets will the footprint grow beyond the initial 9 square miles.

For now, the benefit is plain: convenience without a new learning curve. You ask for a ride the way you always have; Uber and Avride work out the autonomy behind the scenes. If the rollout goes smoothly, Dallas may serve as a bellwether for how supervised robotaxis evolve to genuinely driverless service in big, multifaceted urban markets.