Uber Eats is tapping Starship Technologies’ six-wheeled sidewalk robots to handle food deliveries in the UK. The company began piloting its bots on the streets of London earlier this year; now it plans to open up the delivery service to merchants in two UK cities initially, Leeds and Sheffield, starting with select merchants on December 10th.

The partners say the rollout will expand beyond that initial wave, with Uber planning to bring it to other European markets starting in 2026 and a number of U.S. cities beginning in 2027 if performance targets are met.

- How the robot deliveries work across Leeds and Sheffield

- Why this timing makes sense for Uber’s UK robot rollout

- Local impact in Leeds and Sheffield as deliveries begin

- Safety and accessibility considerations for sidewalk robots

- A broader autonomy strategy behind Uber’s delivery plans

- What to watch next as the UK robot delivery pilot expands

The tie-up adds another thread to Uber’s strategy for autonomous delivery, which already extends from small sidewalk bots on up to larger on-road pilots. Starship, meanwhile, deploys what is among the most mature fleets in the category, with more than 3,000 robots working at over 270 sites worldwide and regular delivery times of less than 30 minutes within a two-mile radius.

How the robot deliveries work across Leeds and Sheffield

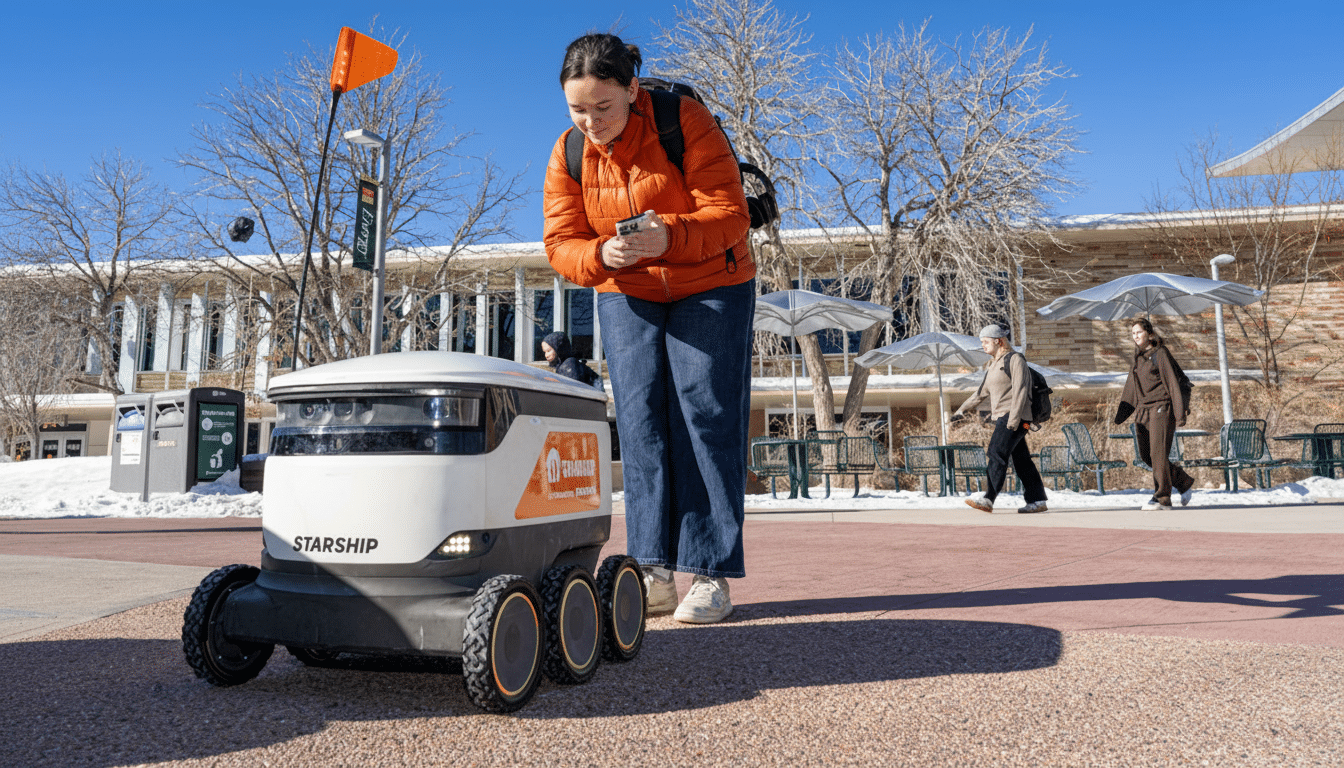

When the conditions are right — for example, short distances, suitable sidewalks and participating merchants — orders placed in the Uber Eats app will be directed to a nearby Starship robot.

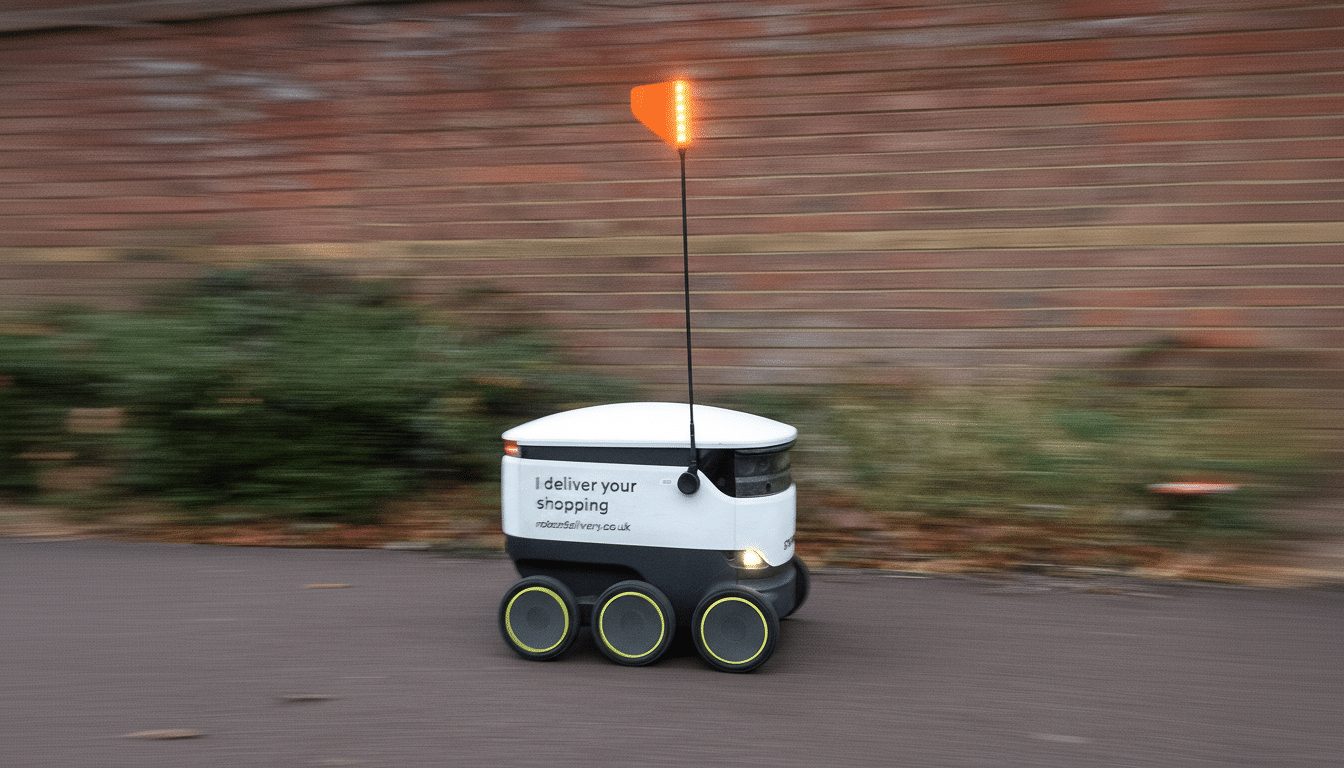

The battery-electric robots move at a walking pace, rely on a mixture of cameras, sensors and machine learning to find their way around, and are monitored from afar by operators who can help with tricky crossings.

Customers can follow the robot’s progress on a live map and unlock the insulated lid with an app or a secure code upon arrival. Their small size makes them less likely to add curbside clutter, and the bots are programmed to stop and yield for people, dogs, buggies and wheelchairs. The sealed cargo bay, Starship says, keeps food at temperature and prevents it being affected by the elements.

Why this timing makes sense for Uber’s UK robot rollout

Automation is creeping into the “last mile” for an obvious reason: It is the costliest leg of the fulfillment process. Many industry analyses from the likes of McKinsey and Capgemini routinely put last-mile logistics at around 50% of total shipping costs, a burden that crimps margins in on-demand food. Robots can subtract costs from short trips, iron out spikes in the rush hour and boost delivery capacity without deepening gridlock.

The UK also provides fertile ground for pavement trials. Starship has already demonstrated demand in British towns like Milton Keynes and Northampton, where its robots are a familiar sight and work with grocers like The Co-operative Group. That playbook has developed guidelines for routing, geofencing and customer support that Uber can now call upon as it introduces restaurant deliveries at urban scale.

Local impact in Leeds and Sheffield as deliveries begin

Leeds and Sheffield are a good combo: dense neighborhoods, university populations, active high streets with short-trip demand.

For councils which prioritise air quality and safer streets, the robots’ small footprint and electric drivetrains provide a low-emission substitute for short car runs or mopeds when it comes to local orders.

The success of the pilot will depend on route density and reliability. High merchant clustering helps keep trips within that ~two-mile sweet spot, and clear pavement rules and well-marked crossings minimize operator interventions. If Uber can demonstrate strong completion rates and satisfied customers without surprise delivery fees, adoption could grow swiftly from those core areas toward the fringes.

Safety and accessibility considerations for sidewalk robots

Sidewalk autonomy still draws scrutiny. Recent legislation in the UK concerns on-road self-driving, however micromobility and sidewalk systems have been addressed through local permissions and trials. Groups including the Royal National Institute of Blind People have urged careful deployment to ensure people with sight loss and others with barriers in communal areas are not harmed.

Here’s how it usually runs: Starship travels at conservative speeds, sounding out loud signals, emitting noticeable lighting and receiving remote encouragement, with data sharing to councils so that geofencing can be adjusted. Leeds and Sheffield should be tailor-designed to local needs around pavement width, busy footfall areas and school routes, with a process of escalation for incidents.

A broader autonomy strategy behind Uber’s delivery plans

For Uber, the Starship acquisition fits around its US efforts with Serve Robotics and newer trials with Avride to show a portfolio approach: match delivery form factor to trip type. They are also well suited to short and predictable journeys on good-quality pavements, which plays to the advantage of sidewalk robots; longer hauls or more complex traffic may yet require couriers or some other autonomous mode.

Competition is changing, too. Food delivery rivals in the UK have tried similar pilots over the years and larger retailers have trialled orders being dropped off by robots to some postcodes. That means the differentiators as technology scales further will be network density, unit economics, and how seamlessly autonomy melds with merchant operations and customer experience.

What to watch next as the UK robot delivery pilot expands

Key signals to watch in the coming months:

- Completion rates of deliveries on mixed-weather days

- Average time per drop

- Share of orders served by robots as opposed to couriers

- Any tweaks this winter to delivery fees

- Council feedback and accessibility checks

- Whether merchant participation goes beyond early adopters

If Uber and Starship can show that robots make human sense, are safe and economically viable at the neighborhood scale, Leeds and Sheffield could be a template for a UK-wide expansion — leading into Europe from 2026, with a US push in 2027.