Uber and Lyft are gearing up to test self-driving rides in London, following in the wake of Waymo’s supervised rollout and suggesting that the capital is emerging as a key proving ground for robotaxis. Both will use Baidu’s Apollo Go technology, with drivers at the wheel when needed in the early stages to comply with UK regulations.

How the London Pilots Will Function and Comply With Rules

UK policy currently permits testing of autonomous systems on the road, but only with a capable driver in charge. Public demonstrations of the technology without a driver behind the wheel would be allowed during public trials but only after regulations are opened to that phase, and full commercial services will be available only once provisions in the Automated Vehicles Act have come into force. TfL will manage permits and conditions for working in the capital, under frameworks set out by the Department for Transport and the Centre for Connected and Autonomous Vehicles.

- How the London Pilots Will Function and Comply With Rules

- Why Uber and Lyft Are Moving Now in the London Market

- Baidu’s Position and Global Reach in Robotaxi Services

- What Regulators and Riders Will Watch For

- Competitive Dynamics and Partnerships in London Pilots

- What to Watch Next as London Robotaxi Pilots Advance

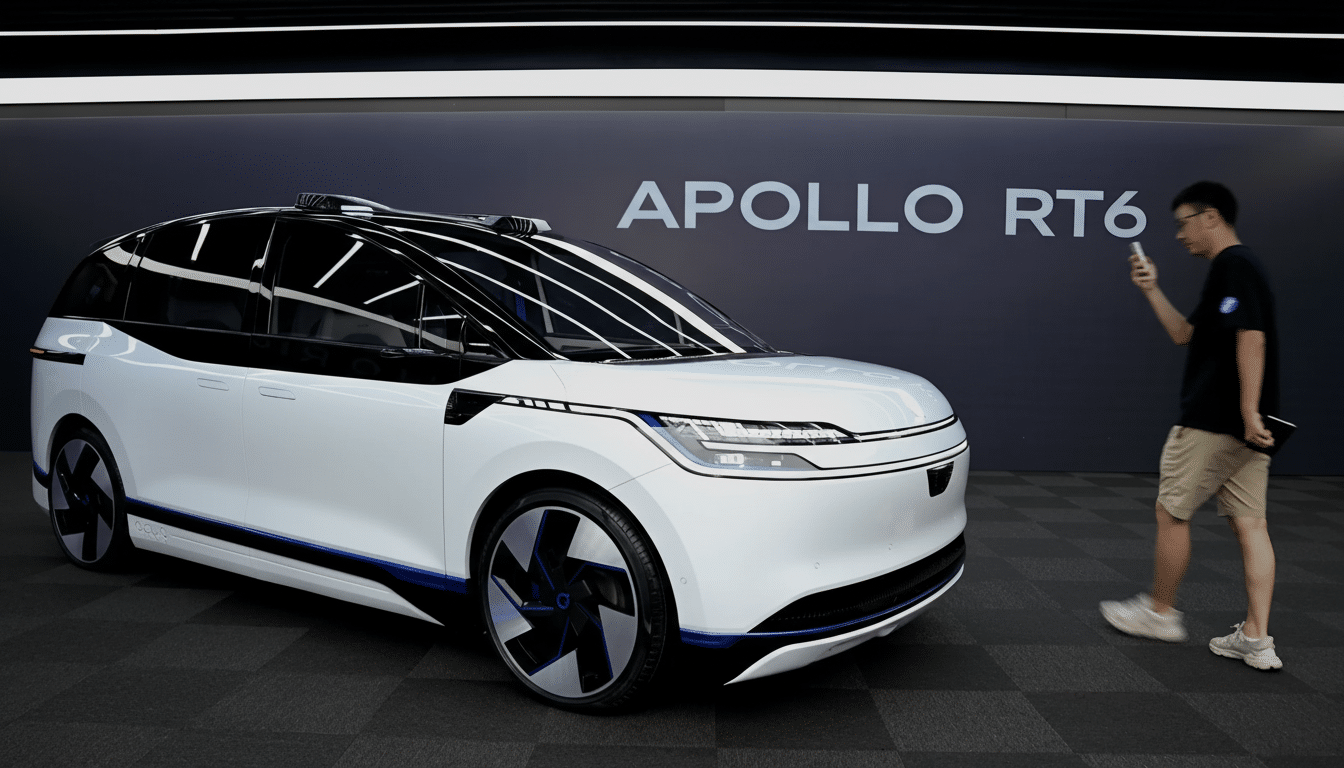

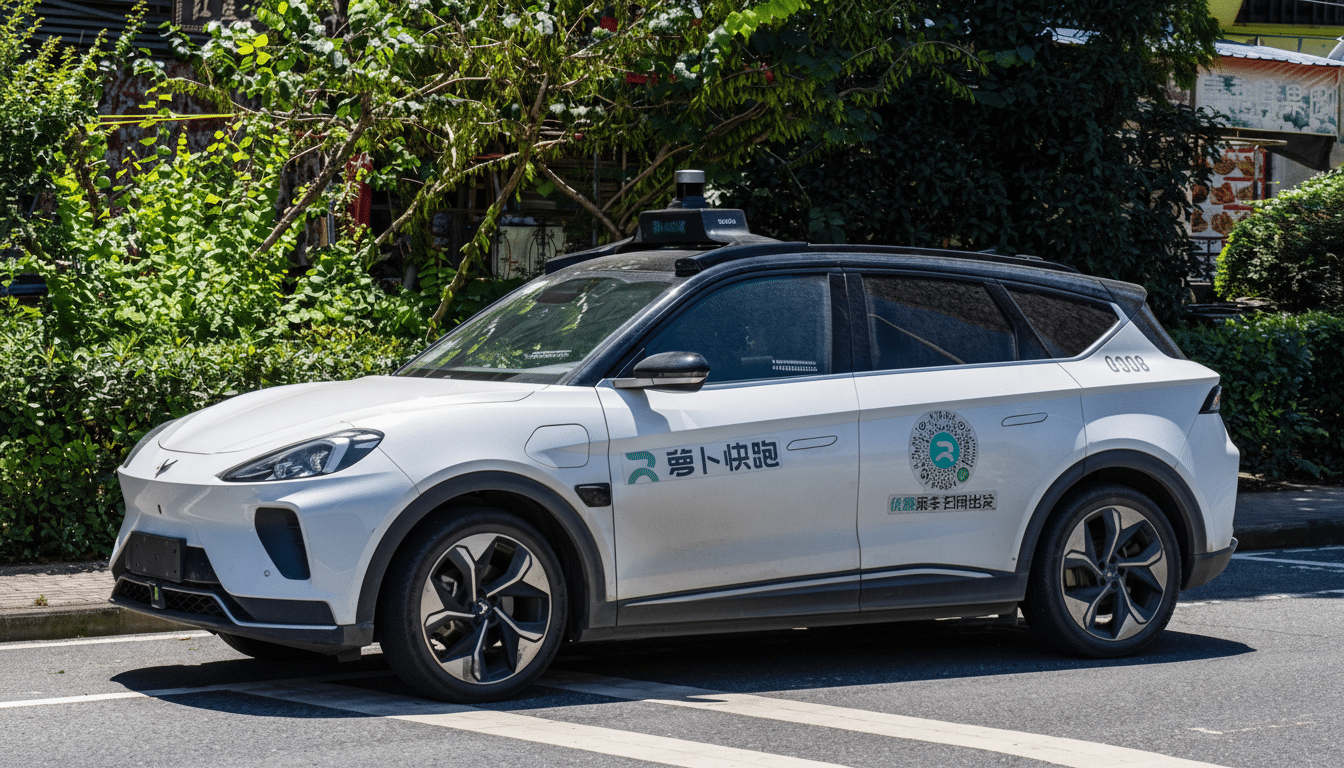

Uber expects to start with Baidu’s Apollo Go vehicles once the first testing window is approved by regulators. Lyft says it will begin as soon as approvals are granted, and it will operate on Baidu’s Apollo Go RT6 platform. Both companies will have to provide detailed safety cases, supply authorities with data about incidents and disengagements in their vehicles, and mark vehicles clearly so other road users know when autonomous systems are engaged.

Why Uber and Lyft Are Moving Now in the London Market

Waymo has already started its supervised runs in London, and its progress around the world is difficult to ignore. The startup is one of the most prominent players in the US when it comes to driverless ride-hailing and says it has recorded hundreds of thousands of rides each week across its service areas, with more scale to come. By starting pilots in London, Uber and Lyft remain part of the conversation as the ride-hailing market changes from a human-only business to one using hybrid fleets that include both human drivers and driverless cars.

London is a harsh but strategically valuable testbed. The dense urban core, complex road network, a kilometres-long bus lane system and a large amount of cycle traffic put perception and planning stacks to the test. It is also a marquee market for ride-hailing — TfL licenses more than 100,000 private hire drivers. Proving safe, trustworthy autonomous driving here can influence public opinion and regulatory philosophy across Europe.

Baidu’s Position and Global Reach in Robotaxi Services

Both are piloting using Baidu’s Apollo Go program. Baidu’s made-for-robotaxi Level 4 vehicle, called the RT6, uses lidar, radar and high-resolution cameras, and redundant computer systems in key elements. The firm has banked more than 17 million rides in 22 cities worldwide, according to company disclosures cited by executives. That experience — and the ability to deploy a common hardware stack — allows Uber and Lyft to run tests on their own without waiting for their own vehicle platforms.

But launching in the UK will also require some adaptations. Vehicles need to comply with local homologation requirements, be fitted for UK roads, and report back to TfL. Operational design domains will be highly geofenced, at least at first — selected boroughs at certain hours in restricted weather conditions — and only expand as performance data justifies broader coverage.

What Regulators and Riders Will Watch For

Safety remains the gating factor. The UK-focused approach highlights the trained safety driver, detailed incident reporting and clear accountability through the ‘Authorised Self-Driving Entity’ designation in the Automated Vehicles Act. Insurers (the ‘first responders to liability’ under the Act’s model) will also have a say in reasonable risk thresholds, data availability and claims management.

Operationally, nothing would throw up unique challenges for autonomy like London: narrow streets in old quarters, pedestrians who step off the footpath at any time on a high street, endless roadworks, and weather for sensors to deal with. Strong remote assist protocols (human overseers giving guidance without actually “driving”) will be key in early deployment, particularly with rare edge cases or complex temporary traffic control.

Competitive Dynamics and Partnerships in London Pilots

Local operations for Waymo are backed by local mobility partners, which include fleet and ops folks like Moove. Uber and Lyft are taking a different approach, tethering their London pilots to Baidu’s stack in another example of the modular partnerships that are increasingly defining the industry: platforms offering demand and routing, autonomy specialists providing driverless capability.

For Uber and Lyft, that upside is two-pronged.

- Autonomy provides a boost to unit economics if the vehicle can see very high utilization with low downtime.

- Autonomy increases network robustness by augmenting human supply at peak times.

The trade-off, though, is that early-stage deployments are expensive and limited; public sentiment can shift rapidly in response to high-profile incidents (as was demonstrated in other cities where robotaxi rollouts slowed following traffic disruptions).

What to Watch Next as London Robotaxi Pilots Advance

Key milestones would be the beginning of supervised testing on public roads, publication of safety performance summaries, and an ongoing transition to driverless public trials when allowed by regulators. Look out for transparency commitments concerning collision and near-miss reporting, more explicit in-ride safety communications, and pricing experiments that frame robotaxis as being on par with regular private hire options.

Lyft’s leadership has said it is working closely with TfL and local communities to responsibly grow the ride-hailing market, just as Uber has stressed its intention to comply with the evolving UK framework. Should the pilots clear safety and reliability hurdles, London could serve as a template for how ride-hail platforms and autonomy providers grow driverless mobility in dense European cities.