Google is introducing Android’s on-device call verification to the U.S., a system that aims to put an end to phone-based fraud even before it starts — stopping mobile screen-sharing scams in their tracks. Starting partners will be JPMorgan Chase and Cash App, with broader financial coverage expected as the program grows.

Why Google Is Cracking Down on Screen Sharing Scams

Phone cons have become more complicated, with scammers pretending to be bank fraud teams or money app support to get victims to share their screens. Once a caller can see what you’re doing, it becomes much simpler to capture one-time passcodes, observe account information, or coach you into authorizing a transfer. Social engineering on calls is still a top threat; the Federal Trade Commission estimates consumers lost more than $10 billion to fraud in its most recent annual tally, with impostor scams accounting for about $2.7 billion.

Google is coming in at the riskiest moment of these scams: when a victim tries to open a financial app while a caller on the line can see everything happening on the screen and steal their data. By pushing against that flow, the feature subverts the urgency and authority that scammers prey on.

How the In-Call Protection Works for Phone Calls

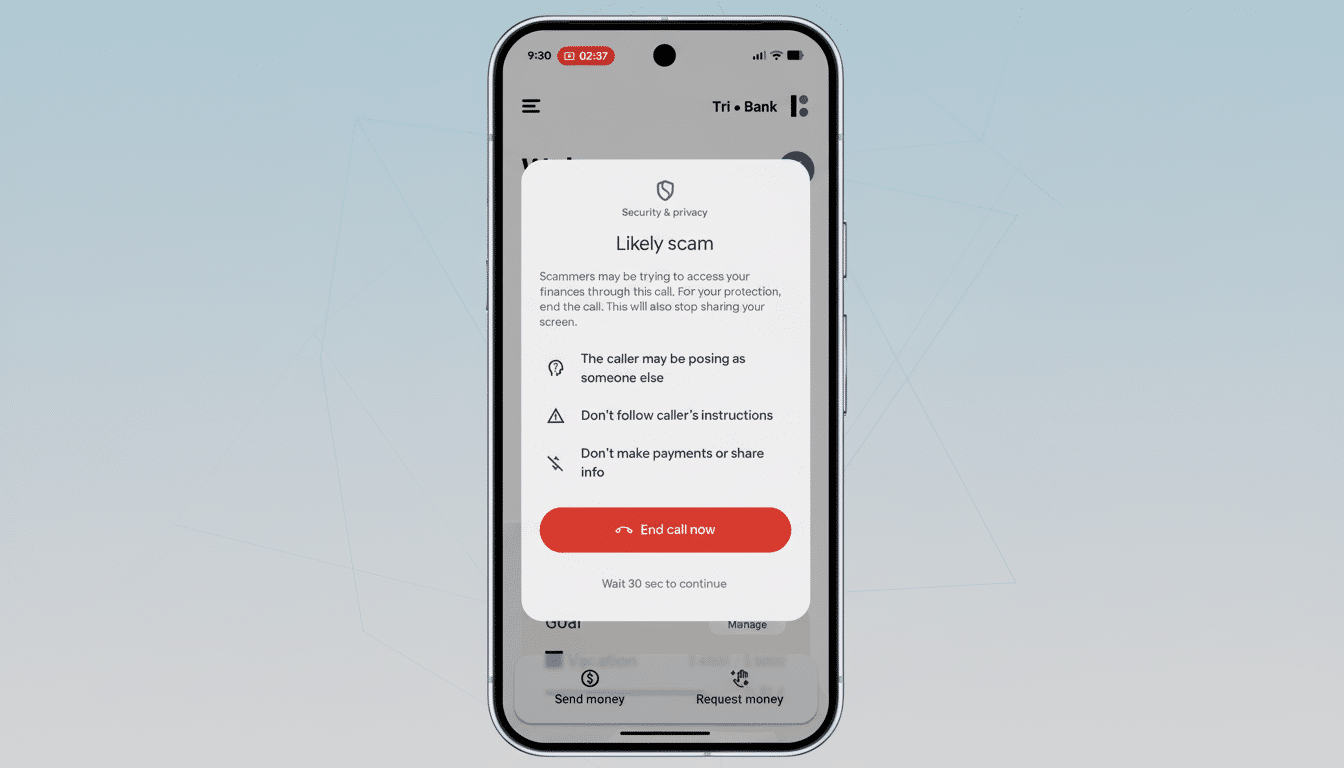

If an Android user is screen-sharing in a call with a number not in their contacts, and they attempt to open a supported banking or payment app, the system issues them a warning in the foreground of the screen and prevents the app from being opened. “By sharing your screen with an unknown, incoming caller you might open yourself up to a risk where sensitive information could be exposed,” the alert reads, and it advises that you terminate the share or hang up before clicking through.

The intent is by design: A short, high-friction pause can often shock users out of a nudge-driven choice. This form of disruption, Google explains, breaks the psychological script that scammers have come to rely on (getting in and out quickly, enforcing authority and time pressure) without preventing legitimate use.

At launch in the U.S., JPMorgan Chase and Cash App are available to use with Google Pay, with more supported banks and financial services promised by Google soon.

The feature is available for Android phones running Android 11 and above.

Early Results From the United Kingdom Pilot Program

Google tested the feature in the UK, where it says the tool has already helped thousands of people cut off suspicious calls and evade financial attacks. UK Finance’s most recent fraud report points to the reason: payment fraud losses are consistently in the billions of pounds each year, and authorised push payment scams — especially — remain alarmingly common. In tests, Android’s approach hit the scammer where they’ve mostly been succeeding — when getting you to authorize or set up a money move over the call.

Google has also started offering support outside of the big banks in the UK, adding peer-to-peer payment apps to what it’s covering. That’s a plausible next step for the U.S. rollout, where P2P services are often used as targets for social engineering.

What U.S. Users Should Know About Android Call Protection

The protection comes as a background feature in Android — there’s nothing new to do here aside from being aware that the warning exists if you happen to see it. The alert only pops up if three risk signals intersect:

- You are on a live call.

- The number is not in your contacts.

- You’re screen-sharing while opening a supported financial app.

If any one of those conditions isn’t fulfilled — say you’re speaking to a known contact — the interruption doesn’t take place.

Here’s a common example: A phone caller purporting to be “from your bank’s fraud department” can request that you share your screen so he can verify an executed transaction and tell you to open up your banking app. The moment you make an attempt, Android butts in with a warning and the means to cease sharing or disconnect. That fleeting pause may stop the caller from steering you, leading you into sharing codes or authorizing a transaction.

The Stakes and the Broader Industry Context for Calls

Customers are being told by financial institutions and payment providers not to share screens or give away one-time codes on calls. By baking those warnings into the operating system, the guidance is timely and gets closer to being unmissable while also complementing carrier spam call filtering and products like call screening by catching sophisticated scams that outsmart simple number-based defenses.

For banks and apps, the lure is plain: fewer fraudulent transfers, fewer chargebacks, and more customer trust. For users, the advantage is even more obvious — an extra bit of protection just when pressure is highest. With heavyweights including JPMorgan Chase and Cash App lined up for day one in the U.S., expect it to be widely adopted across the channel.

Bottom line: Android’s in-call scam protection won’t foil every con, but it goes after a high-yield attack vector with a well-timed circuit breaker.

For a threat landscape driven by social engineering, that’s an important step in the right direction.