Elon Musk says Tesla is ending one-time purchases of Full Self-Driving, moving the driver-assistance suite to a subscription-only model. The shift, revealed on X, closes the door on lifetime ownership and underscores Tesla’s push to turn advanced software into recurring revenue.

For prospective buyers, it means a narrowing window to buy FSD outright, while existing owners who already paid for FSD should retain access under Tesla’s current policy. The change also raises fresh questions about resale value, adoption rates, and how Tesla plans to scale supervised autonomy amid intensifying regulatory scrutiny.

- What a subscription-only FSD shift means for drivers

- Why Tesla Is Pivoting To Recurring Revenue

- Safety and regulatory reality check for FSD (Supervised)

- Pricing changes and the consumer math for FSD access

- How it stacks up against rivals in driver-assist tech

- The bottom line for drivers considering FSD today

What a subscription-only FSD shift means for drivers

Historically, Tesla offered FSD as a one-time add-on priced in the thousands of dollars in the U.S., alongside a monthly plan. Subscription-only flips that dynamic: lower upfront cost, but ongoing fees. For many drivers, that will make FSD easier to trial and cancel, but it removes the ability to lock in a permanent license that could enhance a vehicle’s resale value.

Tesla has periodically run limited “FSD transfer” promotions between vehicles, yet purchases have generally been tied to a specific car. A subscription model is simpler to administer across a fleet that frequently changes hands—and it aligns with how other automakers monetize software-defined features.

Why Tesla Is Pivoting To Recurring Revenue

Software subscriptions smooth revenue and make adoption easier to grow over time. Tesla has long deferred a portion of FSD revenue and recognized it as features are delivered, a practice detailed in its shareholder reports. Moving to subscriptions formalizes that approach while potentially boosting take rates by lowering the barrier to entry.

Wall Street has treated Tesla’s autonomy stack as a margin lever. Analysts have argued that high-gross-margin software can offset hardware cyclicality, and that a large installed base can deliver meaningful annual recurring revenue. The subscription-only move is consistent with that thesis.

Safety and regulatory reality check for FSD (Supervised)

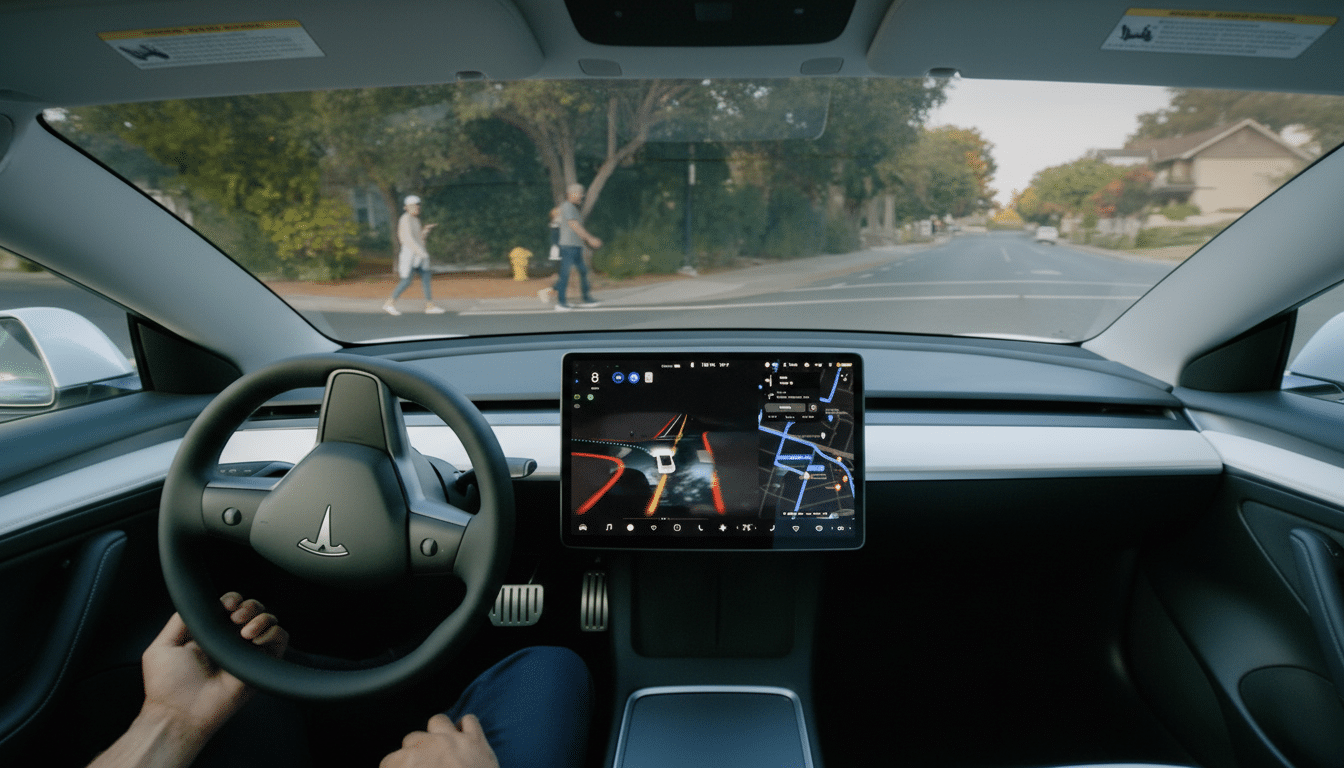

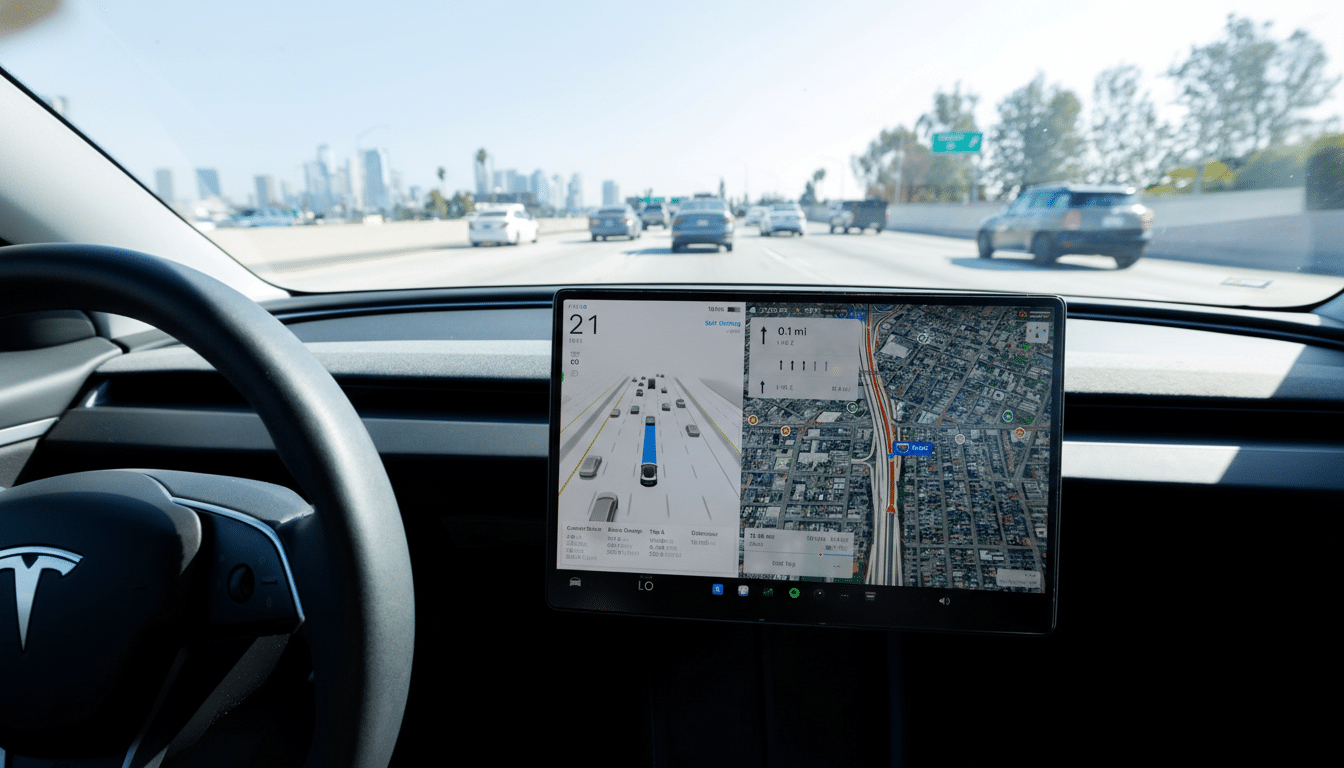

Despite the branding, FSD—now labeled Full Self-Driving (Supervised)—is not autonomous and requires active driver attention. Tesla’s own documentation emphasizes that drivers must keep their hands on the wheel and be ready to take over at any time.

Regulators have kept a close watch. The U.S. National Highway Traffic Safety Administration has conducted multiple probes into Tesla’s driver-assistance systems and oversaw a wide-ranging software recall affecting nearly 2 million vehicles that added additional safeguards. In Europe, type-approval rules and UNECE regulations have limited the rollout of certain features; national authorities such as Germany’s KBA have taken a conservative stance on supervised automation. Tesla has begun controlled testing in parts of Europe, but availability remains uneven by region.

Pricing changes and the consumer math for FSD access

Tesla has frequently adjusted FSD pricing. In recent months, the one-time purchase in the U.S. was listed at a mid-four-figure amount, while monthly subscriptions varied by market and promotions. For many drivers who want FSD only during road trips or specific seasons, a month-to-month plan can be cheaper than a perpetual license.

The trade-off is ownership. A subscription does not transfer additional value to a used buyer the way a paid-up FSD package could. That could narrow price gaps in the used market between vehicles with and without FSD, while shifting more of the decision to the next owner at the time of use.

How it stacks up against rivals in driver-assist tech

Tesla isn’t alone in moving advanced driver assistance behind subscriptions. Ford’s BlueCruise is offered as a paid service after trial periods, General Motors prices Super Cruise access on a subscription basis, and Mercedes-Benz has marketed its Drive Pilot Level 3 system with annual fees in approved jurisdictions. Across the industry, the direction of travel is clear: features are increasingly activated and updated over the air, with billing to match.

The differentiator for Tesla remains scope and frequency of updates. Recent FSD (Supervised) releases have leaned on end-to-end neural networks and large-scale fleet learning, producing noticeable improvements in city driving behavior. Whether a subscription-only approach accelerates uptake—and therefore the data flywheel—will be a key metric to watch.

The bottom line for drivers considering FSD today

If you’ve been considering FSD, the decision is shifting from “buy once” to “pay as you go.” That could be a win for drivers who prefer flexibility, and it may ultimately boost Tesla’s software revenue. But the fundamental caveat remains: FSD is supervised assistance, not autonomy, and its utility depends on where you drive and what local regulators allow.

Musk’s subscription-only pivot is as much about business model as it is about product maturity. The next test will be simple: does easier access translate into wider adoption, safer performance, and a clearer path to the self-driving future Tesla has been promising for years.