Tesla is ending the option to buy Full Self-Driving (Supervised) outright and will make the advanced driver-assistance package available only as a monthly subscription. The move resets how the EV maker monetizes its most discussed software, with big implications for adoption, recurring revenue, legal exposure, and competitive positioning.

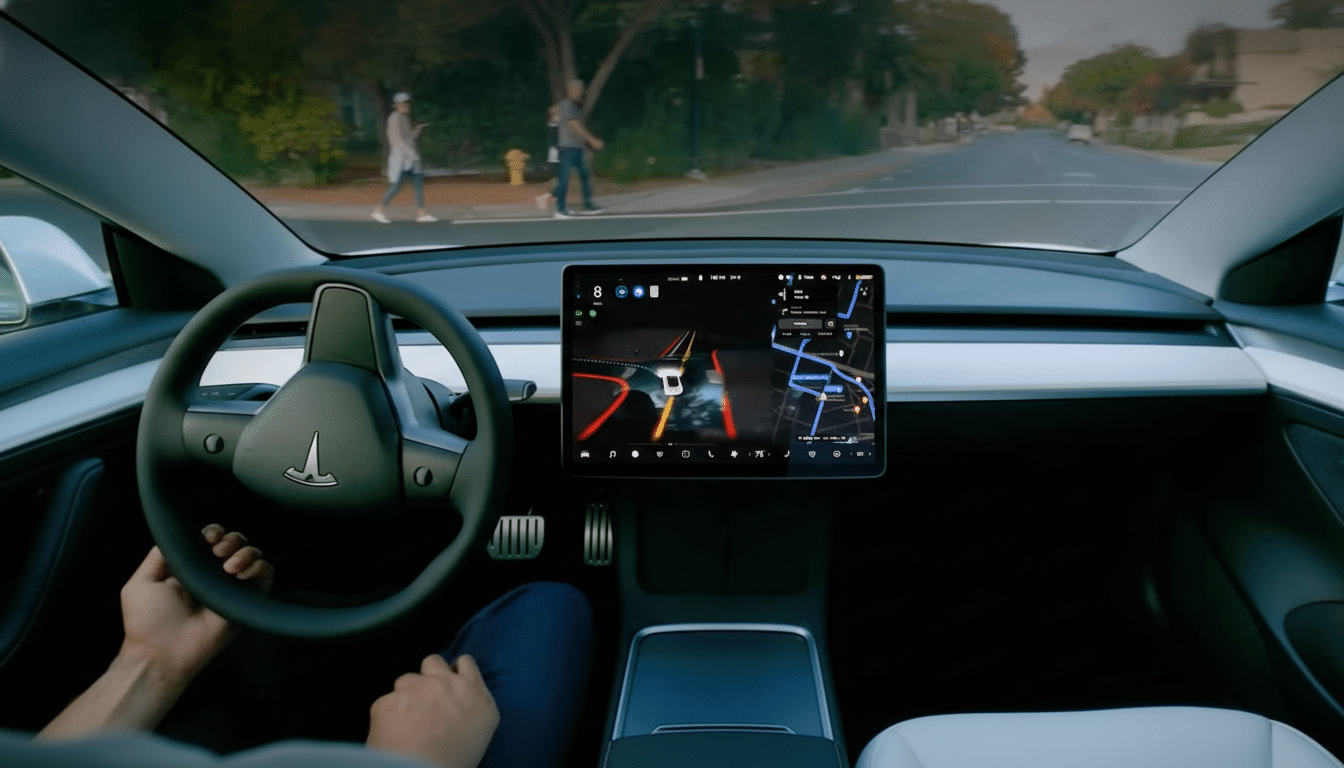

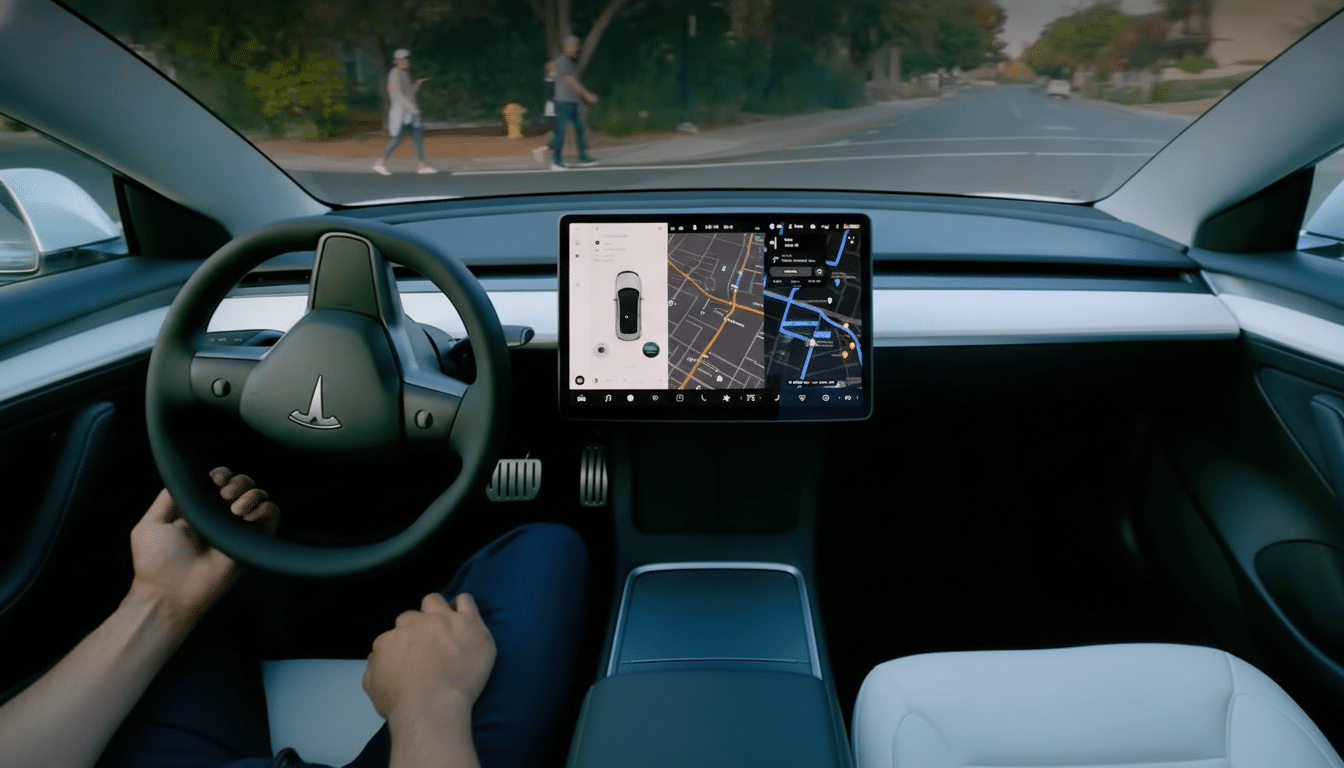

Despite the name, FSD (Supervised) does not turn a Tesla into a fully autonomous vehicle and still requires attentive human oversight. Until now, owners could either pay a large upfront fee or subscribe. The one-time price has fluctuated — peaking in the five figures and more recently landing below that — while subscriptions have been offered at a lower monthly cost that Tesla has adjusted over time.

What Changes for Owners Under Subscription-Only FSD

New customers who want FSD (Supervised) will subscribe rather than buy a perpetual software license. Existing owners who previously purchased the package keep their access. Subscription pricing has most recently been positioned as the value entry point, with Tesla historically experimenting around the $99 per month level.

For drivers weighing costs, a simple break-even illustrates the shift: at $99 per month, it would take roughly 80 months to match an $8,000 upfront outlay. That math favors short-term or occasional use but raises the long-horizon cost for those who planned to keep the feature for many years. It also reduces the chance of FSD materially boosting a car’s resale value, since access is now tied to an account’s active subscription rather than a transferable purchase.

Practically, a subscription model also lets Tesla throttle access by hardware level and region. Owners of vehicles with older computer or sensor suites—often referred to as earlier “Hardware” generations—have faced limitations and upgrade requirements; a subscription approach gives Tesla flexibility to align capabilities with specific configurations.

Why Tesla Wants Subscriptions for FSD (Supervised)

Tesla has signaled that FSD adoption has been lower than hoped. On an investor call, chief financial officer Vaibhav Taneja cited a 12% take rate among owners. Removing the high upfront payment should widen the funnel, lifting the attach rate and smoothing revenue.

Subscriptions produce predictable, compounding cash flows and cleaner revenue recognition compared to large, deferred software sales. They also give Tesla latitude to test pricing, bundle features, or run trials that nudge customers into long-term use. A back-of-the-envelope view shows the potential: 2 million subscribers at $99 a month would equate to roughly $198 million in monthly revenue; 10 million would imply around $990 million per month. Those figures are illustrative, but they show why recurring software income has become a central pillar of automaker strategy.

The shift also aligns with leadership incentives. Company materials describing product milestones for executive compensation include aggressive targets tied to active FSD subscriptions. Building a large, durable subscriber base is the most direct route to those goals.

Legal and Regulatory Backdrop for Tesla FSD Shift

Tesla’s driver-assistance branding and marketing have drawn scrutiny. In a case brought by the California Department of Motor Vehicles, a judge ruled that the company engaged in deceptive marketing around Autopilot and FSD and ordered a temporary license suspension, which was stayed while Tesla was given time to comply by changing product names or fully delivering promised capabilities. The company’s current “Full Self-Driving (Supervised)” label emphasizes human oversight and appears designed to address such concerns.

Shifting to subscriptions may also limit legal exposure from claims tied to perpetual purchases and “future capability” promises. For years, Tesla suggested vehicles had the hardware needed for autonomy and would be upgraded via software; in practice, multiple hardware revisions have been required. A month-to-month arrangement better matches evolving feature sets to what specific vehicles can actually support.

Separately, U.S. safety regulators, including the National Highway Traffic Safety Administration, have scrutinized driver-assistance features and human-factors design. A subscription framework can gate access, roll out updates incrementally, and collect performance data to support compliance and safety improvements.

Competitive Pressure and Tesla’s Market Position Today

Tesla’s software remains among the most capable widely available systems in the U.S., particularly in dense urban settings, but competitors are closing gaps. Ford’s BlueCruise and GM’s Super Cruise and Ultra Cruise offer polished hands-free highway experiences. Rivian has outlined a roadmap for wider geographic coverage and richer features. In China, companies such as XPeng, Li Auto, and Huawei-backed systems aggressively deploy city navigation and valet features, sometimes as standard equipment.

Many rivals already lean on subscriptions or bundled service plans, so Tesla’s move brings it squarely in line with an industry shift toward “software-defined vehicles.” For consumers, that means lower initial costs and the ability to add or drop features at will. For automakers, it means a growing portion of lifetime vehicle revenue will come from code rather than hardware.

What to Watch Next on Pricing, Safety, and Adoption

Key questions now center on pricing, packaging, and safety outcomes. Will Tesla introduce tiered FSD offerings or per-mile plans? How aggressively will it seed free trials to grow the base? What thresholds will regulators apply to naming, driver monitoring, and feature scope under the “Supervised” banner?

The answer to those questions will determine whether the subscription-only pivot fuels a step-change in adoption or simply reshuffles who pays and when. Either way, Tesla just made clear that the future of its most important software will be rented, not bought.