Tesla has inquired with San Francisco International, San José Mineta International, and Oakland International about the permits needed to establish ride-hailing services at their facilities, airport representatives and a Politico reported revealed. The outreach comes as Tesla has its own small charter operation here in California, suggesting a push to formalize airport pickups and drop-offs in the Silicon Valley-based company’s backyard.

What Tesla Wants From Airports

Airport officials in San Francisco and Oakland said they have been contacted by Tesla but haven’t met with the company; San José confirmed a new inquiry and no permit application. Airports usually want a commercial ground-transportation permit entailing staging rules, geofenced pickup locations, insurance minimums, driver qualifications and per-ride fees.

Those requirements are nontrivial. Operators make heavy investments to interconnect with the airport system, and control curb congestion, report data, and accept audits. For newcomers, the time it takes to be approved can drag out while staff members examine safety plans, passenger loading procedures and how vehicles will be sent out during peak waves when several flights arrive at once.

The Regulatory Gauntlet in California

Moreover, airport permits aside, Tesla would require the appropriate state authority to operate a real ride-hailing business in California. A CPUC permit is a requirement to provide passenger service for compensation by any app-based ride service, and it falls under the jurisdiction of the California Public Utilities Commission for regulation of Transportation Network Companies. If Tesla is planning on operating commercial rides on its self-driving ride-hailing network, the company will also need separate autonomous testing and deployment permits from the California Department of Motor Vehicles.

Right now, Tesla is working in California under a more limited charter, not a full ride-hail network and not meant to be autonomous. But videos posted by customers show drivers using the company’s Full Self-Driving (Supervised) software to ferry them on rides for pay. FSD (Supervised) is an advanced driver asistance system and cannot be used in commercial service; there are also issues of compliance that regulators are likely to apply very close scrutiny to.

Pressure to regulate Tesla’s autonomy claims has been mounting. The California Department of Motor Vehicles has taken enforcement action over claims of self-driving capabilities, a development that could have an effect on Tesla’s freedoms to market or enlarge automation features. Any kind of airport service in California that leans on driverless tech — even with a human in the seat — will draw interest from CPUC and DMV staffers, who have already put strict reporting and safety guardrails in place for robotaxi operators.

Airports Are Lucrative—and Demanding

Airports are among ride services’ most lucrative markets: demand is predictable, average fares are higher than on urban trips and riders are less price sensitive when they have luggage and are pressed for time. That’s why the curb has long been a battleground — first with taxis and limousines, then with Uber and Lyft, and now, with autonomous fleets competing for premium pickup zones.

The template already exists. Waymo has advanced airport service from pilot stage to product offering, running routes out of the Phoenix Sky Harbor International airport and obtaining permission to serve twice-daily trips to the San José airport after a trial run. Waymo has told Phoenix that the airport is the most frequently requested destination in the area it serves in the city — proof that airport rides can become the cornerstone of a business case for autonomy, and fast.

But airports are also highly regulated. Several of them charge a per-ride fee of several dollars, mandate off-site staging lots to reduce curbside congestion and enforce pickup lanes that are geofenced off to ensure that traffic keeps moving. App-based trips already represent a meaningful share of landside activity and revenue, according to Airports Council International–North America, which makes conveying more data and operational requirements for any new entrant a business-friendly regulation.

Competition and the Robotaxi Question

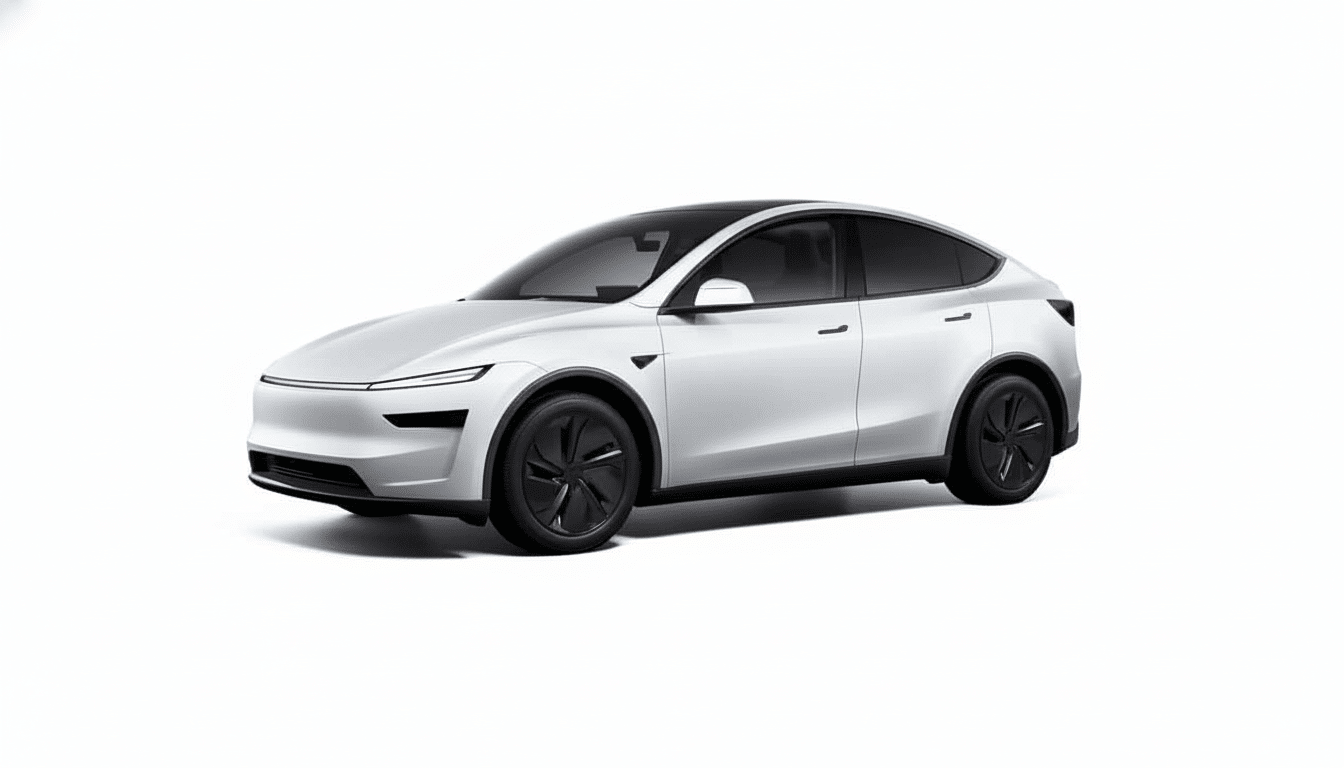

Tesla has been testing a secret robotaxi network in Austin, using small number of vehicles and moving the “safety monitor” position to the driver’s seat. Texas has a less stringent reporting method as opposed to California, so it’s hard to get a feel for how things are truly going besides anecdotal rider videos and posts on social. And scaling that model into California’s regulatory environment — and into airport locations — would be a substantially higher bar.

The strategic fork seems clear: Either start running human-driven Teslas to the airport under the close watch of drivers there with “driver assistance,” or make a direct jump to much more automated rides that set off DMV deployment supervision. The first track could speed up approvals; the second could bring in differentiation but adds far more regulatory risk and operational burden.

What to Watch Next

Key signals will be if Tesla puts in formal applications at SFO, SJC and OAK; if it asks for a CPUC TNC (a la Uber/Lyft) permit that’s beyond charter authority; and how explicitly its plans reference FSD (Supervised) during paid rides. Airport agreements typically involve detailed operations manual, so any filings could indicate whether Tesla plans centralized dispatch, designated staging areas and geofencing pickups as other providers do.

If the approvals land, the first several months will be a shakedown cruise: on-time arrivals versus curb capacity, rider wait times during peak banked flights, and how well the software behaves amid weaving buses, tugs and pedestrians. Because with tens of millions of passengers running through Bay Area airports each year, and a high EV adoption base, the market is a natural one for a well-run electric ride service—provided Tesla can clear the wings of some regulatory turbulence.