Tesla’s driverless ride-hailing program in Austin has logged five additional crashes in the latest federal filings, bringing the total to 14 since launch. The new reports, submitted to the National Highway Traffic Safety Administration (NHTSA) and summarized by Electrek, largely involve low-speed contacts and property damage. No injuries were reported in the latest cases, though one earlier incident in the database was reclassified as involving a minor injury requiring hospitalization, according to the outlet.

What the New Federal Crash Reports Show in Austin

The five newly disclosed incidents span a range of scenarios familiar to autonomous-vehicle testers. One Tesla robotaxi hit a fixed object at about 17 mph. Another bumped a heavy truck at roughly 4 mph. Two separate backing maneuvers resulted in contact with stationary objects, including a pole or tree at around 1–2 mph. In a fifth case, the Tesla was reportedly stationary when it was struck by a bus. Collectively, these read like the kinds of “fender-bender” interactions that plague dense, stop-and-go environments where perception, prediction, and control stack precision is relentlessly tested.

Tesla told regulators the episodes produced property damage but no injuries among the newly added crashes. That said, database updates matter: Electrek notes an earlier entry was later upgraded from property damage only to a minor injury with hospitalization, underscoring how safety records can evolve as claims and medical reports are finalized.

Crash Rate and Benchmarking Against Human Drivers

Electrek’s analysis, drawing on Tesla’s reported mileage, puts the Austin robotaxi program at roughly 14 crashes over about 800,000 miles—an average of one crash every 57,000 miles. By comparison, Tesla has previously cited an average American driver experiencing a minor crash roughly every 229,000 miles. On that basis, the robotaxi crash frequency comes out about four times worse than the human benchmark.

These comparisons, while directionally useful, deserve caveats. “Minor crash” definitions differ, police-reporting thresholds vary by jurisdiction, and autonomous services often operate in challenging urban cores that can inflate exposure to low-speed contacts. Still, transparent, apples-to-apples metrics—such as injury-causing crash rates per million miles and standardized severity scales—are critical if the public is to judge whether autonomous fleets are trending safer than human drivers.

Safety Drivers and Austin Operations Timeline and Context

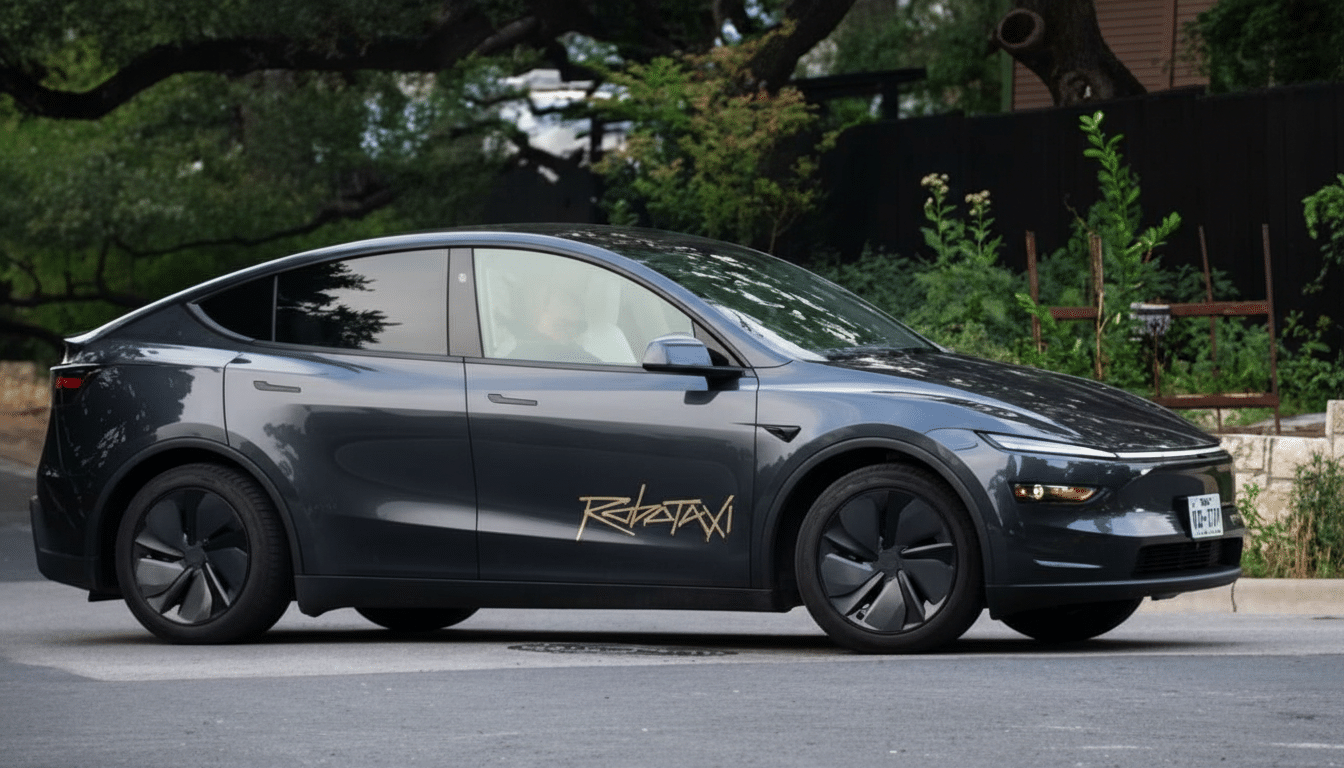

Tesla runs the Austin pilot with modified Model Y vehicles. The service began with human safety drivers supervising from the front seat, then transitioned to select rides without a safety driver, per public statements by CEO Elon Musk. According to Electrek, the latest cluster of crash filings predates that shift. The sequencing matters because regulators and city partners often tailor oversight—geofences, permitted speeds, operating hours—based on whether a fleet is supervised or fully driverless.

The incident mix also hints at where improvements are needed. Low-speed contacts during reversing and interactions with large vehicles (like trucks and buses) are classic edge cases for perception and path planning. Expect software releases to target tighter obstacle detection at bumper range, more conservative backing protocols, and refined yield/creep behaviors around oversized vehicles and bus stops.

Rivals and Growing Regulatory Pressure on Autonomy

Tesla isn’t alone in navigating a rocky path to autonomy. Waymo has faced scrutiny after a driverless vehicle struck a child in Santa Monica; NHTSA is reviewing that incident, and there have been separate reports of Waymo cars failing to appropriately stop for school buses in multiple cities. Waymo maintains its driverless system outperforms human drivers in avoiding injury-causing crashes, pointing to internal safety analyses.

Meanwhile, Cruise’s San Francisco operations were sharply curtailed after a high-profile pedestrian-dragging incident led to license suspensions and executive departures. The lesson for all autonomous operators is straightforward: regulators will move decisively when safety or transparency is questioned. Austin’s program will be judged against that backdrop.

What to Watch Next in Austin as Tesla Scales Robotaxis

Three signals will reveal whether Tesla can bend the curve: clearer, independently verifiable safety metrics (with consistent definitions of “minor” vs. injury crashes), faster software iteration that measurably reduces low-speed contact rates, and deeper coordination with local agencies on routing, bus interactions, school zones, and event traffic. Publishing near-miss and disengagement context—not just crash counts—would also help establish whether risk is being driven down over time.

For now, the data paints a mixed picture: a relatively small fleet accumulating real-world miles but experiencing more frequent contact events than the average human driver benchmark. Whether those numbers improve—and how openly the company documents progress—will determine public trust as robotaxis scale beyond pilot status in Austin.