Tesla has quietly removed Basic Autopilot from new vehicles in the US, ending a long-standing bundle that paired adaptive cruise with lane-centering. The shift pushes buyers who want Autosteer into the company’s paid Full Self-Driving subscription, reshaping both the feature set and the cost calculus for Model 3 and Model Y shoppers.

What Changed and Why It Matters for US Buyers

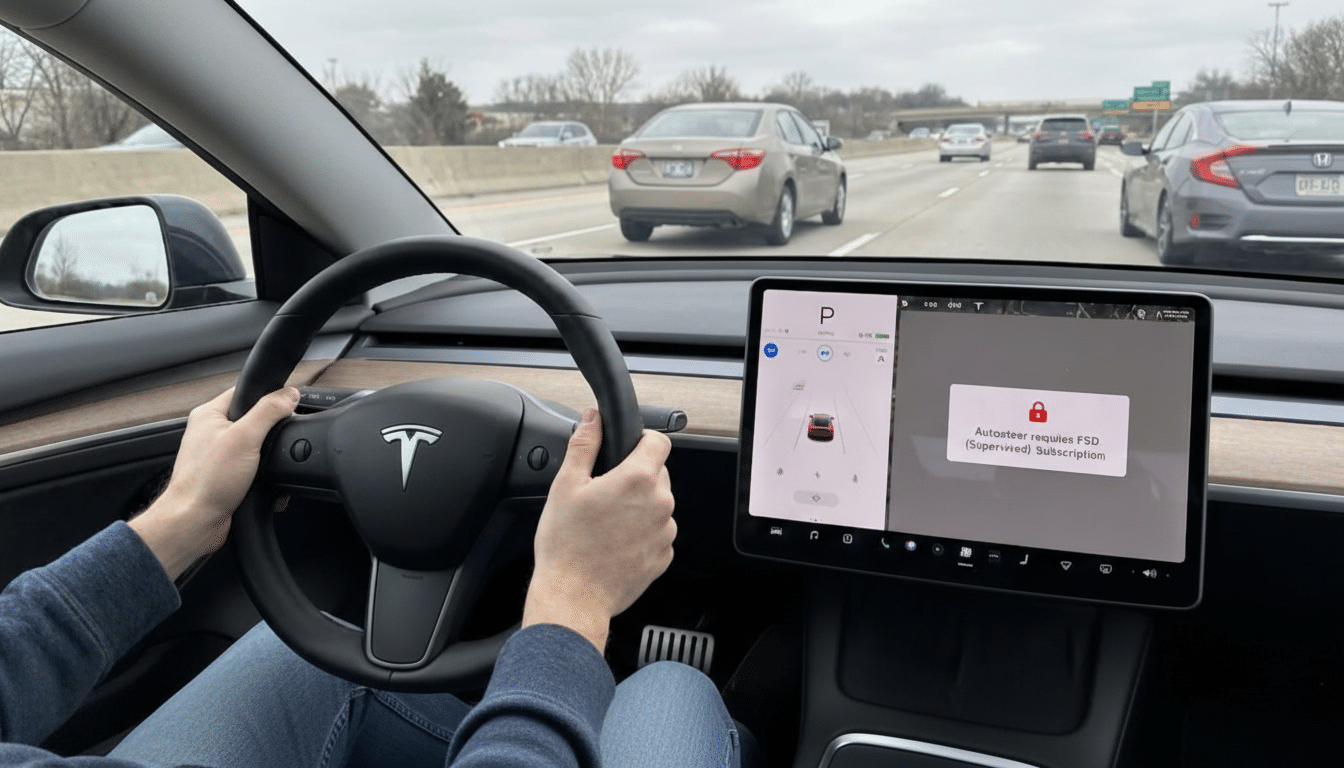

Historically, Basic Autopilot included Traffic-Aware Cruise Control and Autosteer, letting the car maintain distance and stay centered in its lane on highways with driver supervision. New US-bound Teslas now include only Traffic-Aware Cruise Control, with lane-centering tucked behind the Full Self-Driving paywall. In practical terms, the single-stalk, one-tap highway assist many drivers relied on is no longer standard.

- What Changed and Why It Matters for US Buyers

- Pricing and Packaging Changes for Tesla Driver Aids

- A Push Toward Subscription Revenue for Tesla Vehicles

- Safety and Regulatory Backdrop for Driver Assistance

- How Tesla Now Compares with Mainstream Driver Assists

- International Differences Persist Across Available Features

- What Buyers Should Consider Now Before Purchasing

Outside the US, Tesla still markets Enhanced Autopilot in some regions, offering features like Navigate on Autopilot, lane changes, and Smart Summon, underscoring how regional regulations and product strategies continue to diverge.

Pricing and Packaging Changes for Tesla Driver Aids

The US configurator now presents one primary option: Full Self-Driving for a monthly fee, with a one-time purchase still listed but slated to be discontinued. Buyers of Model S, Model X, and the high-performance Cybertruck variant currently receive Full Self-Driving included, but mainstream models do not. Tesla’s site no longer references “Autopilot” language on build pages, a notable departure from years of branding consistency.

The change effectively turns Autosteer into a subscription feature. That makes financial sense for Tesla—software carries rich margins and predictable revenue—but it raises the bar for shoppers who simply want reliable lane-centering without the broader Full Self-Driving suite.

A Push Toward Subscription Revenue for Tesla Vehicles

Tesla has long telegraphed an ambition to monetize software at scale, frequently highlighting the lifetime value of its fleet in shareholder communications. Moving a once-standard assist into a paid tier aligns with that playbook and could lift average revenue per vehicle, particularly as hardware costs tighten margins.

The move also tests consumer tolerance for software gating in cars. Automakers across the industry have tried similar strategies—from hands-free driving subscriptions to feature unlocks—and faced mixed reactions. Tesla’s brand strength and over-the-air update cadence give it an edge, but lane-centering is increasingly viewed by buyers as a baseline driver aid, not a luxury add-on.

Safety and Regulatory Backdrop for Driver Assistance

Autosteer’s repositioning comes amid ongoing scrutiny of driver assistance systems. The National Highway Traffic Safety Administration has investigated misuse and driver engagement with advanced features, leading to software changes across roughly 2 million Tesla vehicles to strengthen driver monitoring. Safety groups like IIHS and Euro NCAP continue to stress that these systems assist, not replace, attentive driving.

Importantly, Full Self-Driving in the US remains a supervised driver-assistance suite. Despite rapid progress and wider rollout, it is not autonomous and requires a fully attentive driver, a point regulators and safety researchers repeatedly emphasize.

How Tesla Now Compares with Mainstream Driver Assists

Competitors increasingly include lane-centering or lane-following on entry models through suites like Toyota Safety Sense, Honda Sensing, and Hyundai SmartSense. While execution varies, the perception that mainstream brands bundle lane-keeping as standard will sharpen price-feature comparisons against Tesla’s new approach.

Tesla still leads on integrated hardware, frequent over-the-air updates, and a unified software stack that can improve capabilities over time. But asking buyers to subscribe for lane-centering places the company at odds with a market trend making core assists more accessible out of the box.

International Differences Persist Across Available Features

In Europe, where many Full Self-Driving capabilities remain restricted, buyers still receive Basic Autopilot and can opt for Enhanced Autopilot at a lower price point than Full Self-Driving. That regional split highlights how policy and homologation shape product packaging just as much as technology readiness.

What Buyers Should Consider Now Before Purchasing

For US shoppers eyeing a Model 3 or Model Y, the default is now adaptive cruise without lane-centering. If Autosteer is essential, the monthly Full Self-Driving plan offers flexibility to pay only during long trips or specific seasons, though Tesla has signaled prices may rise as capabilities expand. Prospective owners should test-drive with and without the paid suite to assess real-world value and comfort with supervision requirements.

The bottom line: Tesla is betting that software-driven revenue—and its pace of feature development—will outweigh backlash over removing a widely used assist from the standard kit. Whether that wager pays off will depend on how many customers decide lane-centering is worth a recurring fee.