Teradar has raised $150 million to bring a solid-state terahertz sensor to market that it says can outperform lidar and radar in range, resolution, and all-weather reliability for top advanced driver assistance systems (ADAS) or self-driving cars.

The Boston startup’s device is a terahertz-band offering, which falls between microwaves and infrared and has long been celebrated in academia but seldom productized at automotive scale. Teradar’s simple sell is radar robustness with lidar-like detail, in an affordable, no-moving-parts module designed for mass production.

- What Teradar Built: a modular solid-state terahertz sensor

- Strategic $150M round highlights dual-use ambitions

- Why terahertz sensing may move the needle for ADAS

- Is the price right? Is packaging right for mass adoption?

- Competition and remaining risks for automotive adoption

- The bigger picture if Teradar’s approach gains traction

What Teradar Built: a modular solid-state terahertz sensor

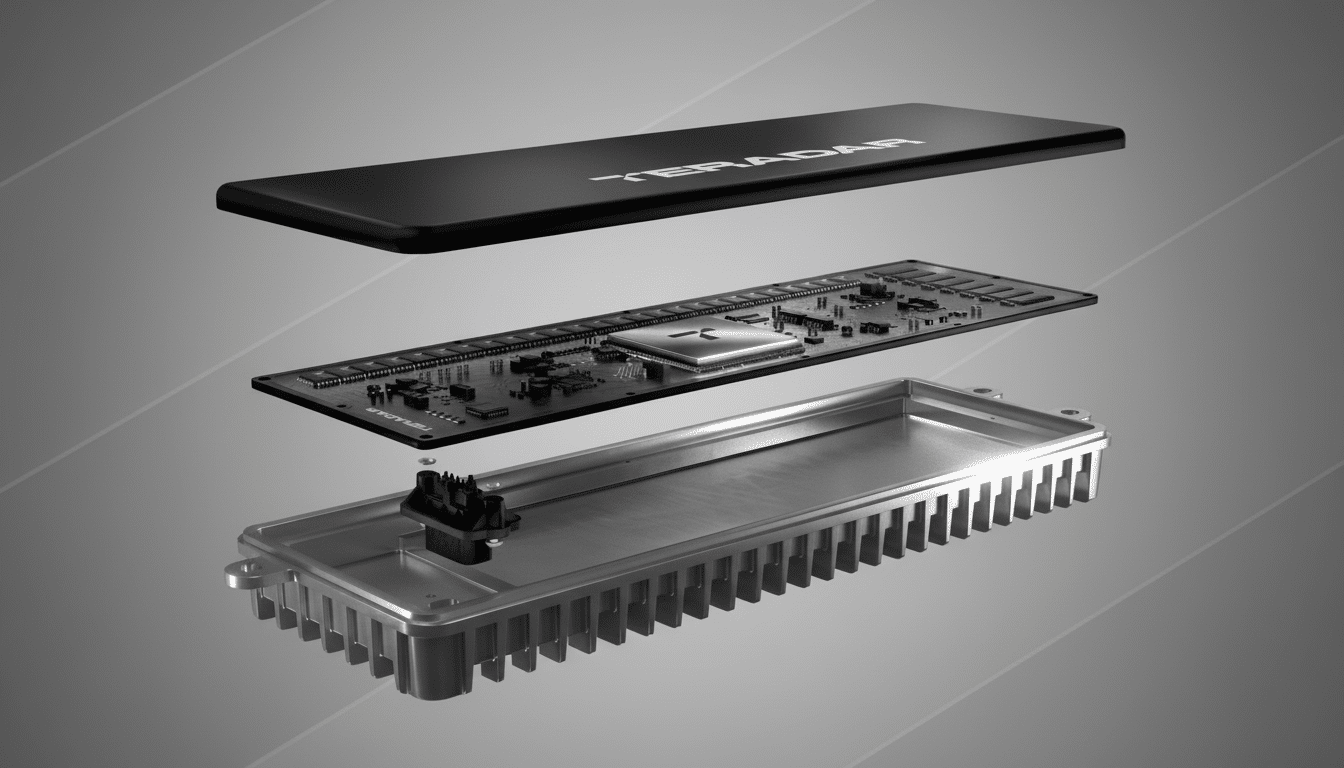

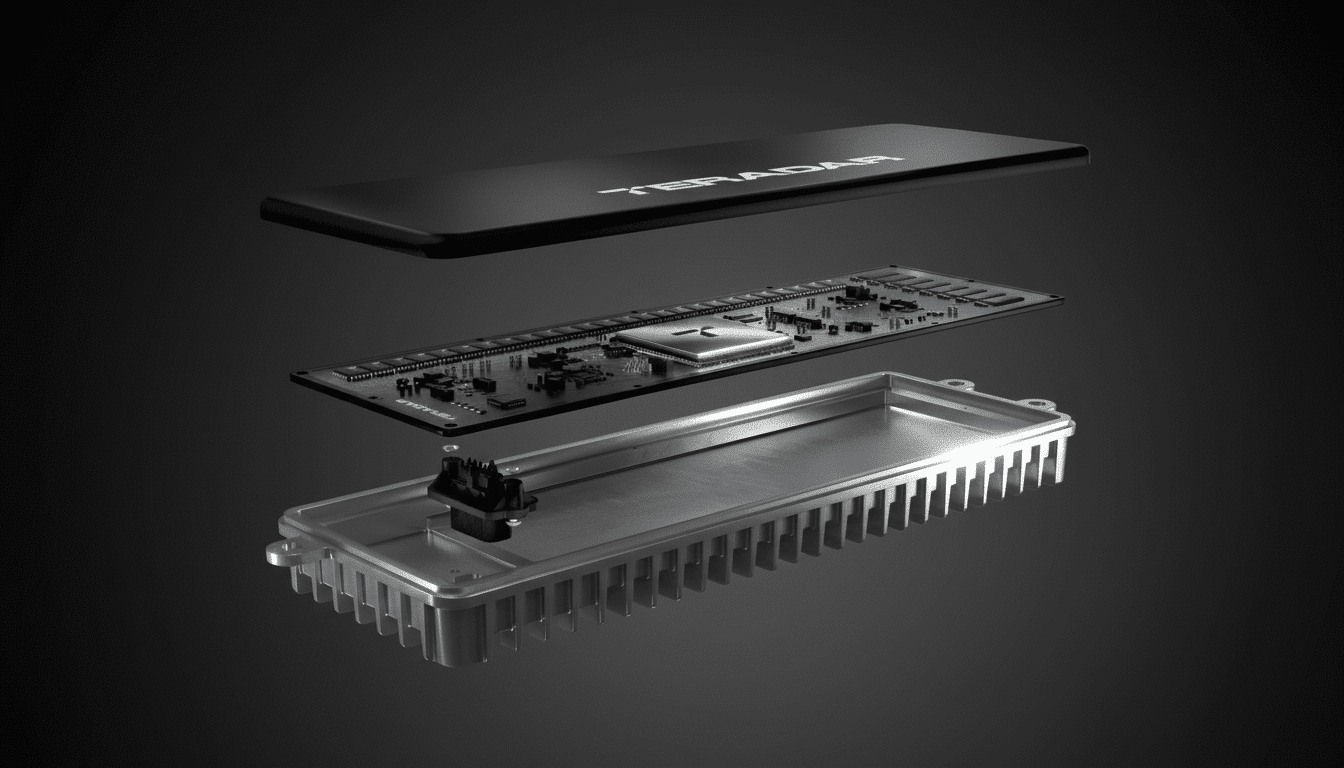

At its heart is a “modular terahertz engine,” a solid-state transceiver array that’s been created to image through rain, fog, and spray while still maintaining high angular resolution. Unlike mechanical-scanning lidar, Teradar’s method is semiconductor beamforming—similar to phased-array radar—eliminating moving optics and increasing durability.

Technically, terahertz has been a tough nut to crack: getting enough on-chip power, reducing atmospheric absorption, and managing noise have given previous efforts difficulty. “Recent progress in silicon germanium and CMOS that you read about in DARPA programs, as well as published results within IEEE, enable compact automotive-grade transmit/receive chains today,” Teradar said. The company says it can select “spectral windows” in the band that minimize water-vapor loss, maintaining range in bad weather.

Strategic $150M round highlights dual-use ambitions

The real “stars” of the Series B are Capricorn Investment Group, one of Lockheed Martin’s venture funds, IBEX Investors (which many will recognize from its former project Canoo), and VXI Capital—a fund led by Angela M. Miele, the former U.S. Army CTO who most recently spent four years as that service’s liaison at the U.S. Defense Innovation Unit (DIU). Beyond capital, the lineup is a signal of dual-use potential and availability and capability of accessing robust testing ecosystems. Teradar also says it is in relations with three Tier 1 suppliers for manufacturing, a critical step to automotive scale-up.

On the customer side, the startup says it’s validating programs with five large automakers from the U.S. and Europe, aiming for a first model-year integration around the end of the decade. Reaching that timeline means design freeze and PPAP readiness well before then, with ISO 26262 functional safety and AEC-Q qualification as table stakes.

Why terahertz sensing may move the needle for ADAS

The Achilles’ heel of many perception stacks is still bad weather. The Federal Highway Administration estimates that about 21 percent of crashes in which a vehicle runs off the road or skids involve weather each year, and fog, heavy rain, and spray form low-contrast scenes that can confuse cameras and weaken lidar returns. Academic work from teams at ETH Zurich and Carnegie Mellon has demonstrated steep performance degradation for optics-first systems during dense fog or in the dark.

Radar weathers the weather, but it usually does poorly when it must classify objects and finely locate them. That gulf has prompted a push toward “4D imaging radar” from some suppliers like Arbe and Continental. Teradar’s gambit is more aggressive still: exploit terahertz wavelengths short enough to offer fine resolution but preserve the penetrating, solid-state advantages that made radar indispensable. If it is as effective as advertised, the sensor may help to limit vehicle edge cases that currently lead to conservative driving and takeovers within automated vehicles.

Is the price right? Is packaging right for mass adoption?

Teradar places its unit in the cost gap between radar and lidar, at a few hundred dollars per sensor. For context, mainstream automotive radar modules end up in the hundreds, and some types of long-range, high-performance, automotive-grade lidars over the last couple of years have been moving from four figures down toward the higher hundreds as suppliers like Luminar and Hesai ramp production. A mid-price point with improved resolution over radar and better weather performance than lidar would be appealing for both L2+ ADAS and more autonomous stacks.

And the “modular engine” bit is important, too. Auto manufacturers, for their part, want a pick-and-choose family (say, short-range for near-field and long-range for highway) of modules that do not require rewriting fusion code. Integrations with Tier 1s will help to fast-track that trajectory, and an alignment of Teradar’s approach with standards work in IEEE 802.15.3d (designed for links between 252–325 GHz) suggests a growing ecosystem around terahertz components is coalescing, faute de mieux.

Competition and remaining risks for automotive adoption

Teradar enters a crowded field. Lidar suppliers are sending out second- and third-gen units with improved weather filtering, imaging radar is closing the resolution gap, and thermal cameras from defense-lineage vendors such as Teledyne FLIR offer strong night and smoke performance. In other words, a lot of OEMs prefer redundancy through sensor fusion—camera + radar + lidar + thermal—so Teradar’s path to “beating” incumbents probably goes through replacing one sensor and supplementing the remaining sensors rather than stripping out the stack.

Technical and regulatory hurdles remain. Terahertz transmission may be sensitive to humidity; achieving IP6K9K ingress protection, automotive thermal cycling, and lifetime drift requirements is not easy. Spectrum management above 100 GHz is not as developed as the radar band of 76–81 GHz and will need to be harmonized with global regulators, and that coexistence will need to be demonstrated. OEMs will want irrefutable proof beyond that—test track data, edge-case replay, fleet miles—before awarding high-volume programs.

The bigger picture if Teradar’s approach gains traction

If Teradar succeeds, the payoff could be outsize: fewer perception failures in inclement weather, greater highway driving automation stability, and potentially lower sensor counts per vehicle. The defense interest in the cap table also suggests applications in low-visibility targeting, perimeter security, and search and rescue—use cases for which terahertz has been talked about for decades but rarely deployed at scale.

For now, the company is focused exclusively on automotive. With new financing, Tier 1s on board, and OEM pilots imminent, the next boxes to tick are obvious:

- Range/resolution in all weather

- Cost down to “a few hundred dollars”

- Failure and abuse testing that is as punishing as automotive validation

Many have pledged next-generation sensors; few have delivered. There it is, now with the runway to try.