Telo has raised $20 million in Series A funding, all so it can have the U.S.’s first tiny electric pickup trundling down its streets to bring home the argument that snack-sizing trucks for dense cities is the quickest way to herd folk away from internal combustion.

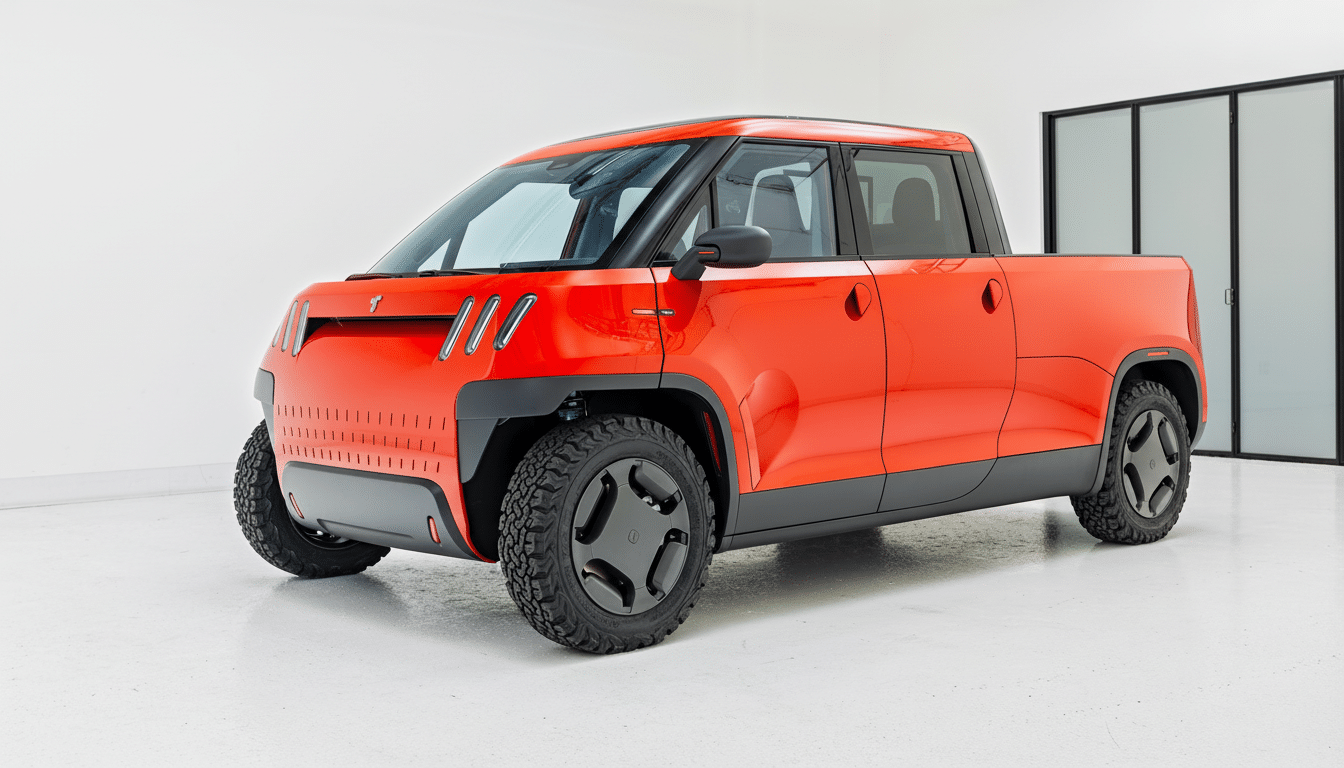

The California startup’s initial model, the MT1, will offer a five-passenger cab and a genuine 5-foot bed in more of a subcompact footprint — capped off by an anticipated 350 miles of range and a starting price around $41,000.

A truck made for urban, not suburban, life

Americans fawn over pickups; urban streets, not so much. Curb space is at a premium, parking is scarce and oversize vehicles complicate everything from delivery drop-offs to emergency response. Telo’s guiding principle is disarmingly straightforward: performance per square foot. For the company, which is compressing the outside while maintaining utility, its goal is to present a revealing truck without the footprint penalties that render traditional pickups awkward in cities.

The MT1 is a five-seater that can carry gear in a bed as long as those found on bigger rivals — an oddball combination larger than the 4.5-foot beds of popular electric and compact trucks, such as the Rivian R1T and the Ford Maverick. Interest in imported Japanese Kei trucks — those micro haulers that have seen new life here in the States for farm and light-duty work — highlights demand for this form factor, but Telo’s take was to wrap modern safety, range and comfort up into that small truck idea.

Who participated in the round and where the money is going

The round is being led by designer Yves Béhar and Tesla co-founder Marc Tarpenning — both of whom are also Telo co-founders; along with the pair, other investors include Salesforce CEO Marc Benioff, who backed Telo as an angel investor in the past, and early-stage backers TO VC, E12 Ventures and Neo.

Unlike the crop of EV startups that attempted to scale to mass volume out of the gate, Telo is taking a targeted path: a roughly 12,000-unit preorder list, plans for building around 5,000 vehicles per year in collaboration with other manufacturers and early emphasis on unit profitability rather than billion-dollar capital outlays.

Proceeds will cover final production-intent development of the MT1, U.S. homologation and remaining crash testing. The company aims to keep its headcount lean — about two dozen employees — and draw on a network of specialist consultants and suppliers. The model is a reflection of how some successful mobility startups have sped up development without incurring hefty fixed costs.

Range, packaging and the safety question

Telo aims to squeeze about 350 miles on a single charge from a 106-kWh battery, an impressive number for something so small. The problem lies in packaging: wedging a big pack into a Mini-like footprint usually means compromises in weight distribution, cooling and crash structure. Telo claims that it’ll put real-world efficiency over eye-watering acceleration, an approach that makes sense in urban driving, where quick 0-60 sprints matter less than practical range between charges.

Short overhangs and very few things poking out of the front raise justifiable concerns about what happens in a crash. Telo recognizes this and is creating the MT1 to meet federal standards under the National Highway Traffic Safety Administration. The Insurance Institute for Highway Safety’s small-overlap test has always been a challenge for vehicles with less crush space, so how Telo manages load paths and energy absorption will be an important proof point once results are public.

Economics and competition in the compact EV truck market

On price, the MT1 slots somewhere above entry-level compact trucks but beneath most premium electric pickups. The calculus for the city operators and small businesses in these trucks will be total cost of ownership. Reviews from the Department of Energy and Consumer Reports have also concluded that EVs tend to be cheaper in fueling and maintenance than similar gas cars. For an urban fleet — think: tradespeople, municipal departments, last-mile couriers — short hops with frequent stops are where electric drivetrains shine.

The approach also stands in contrast to the industry’s fascination with mega-trucks. Some high-profile electric pickups have fought to break through because of challenges with cost, weight and demand. U.S. buyers are tending to bigger vehicles, S&P Global Mobility has observed — but cities are not: the latter is about congestion and curb-management programs — and in some cases, as with low-emission delivery pilots — say “no.” A properly right-sized EV truck could slip swiftly beneath those policy trends.

What to watch before Telo’s first MT1 deliveries begin

Telo’s near-term benchmarks are simple: crash test completion, production tooling commitment with its contract manufacturer and validation of range claims in independent tests.

Supplier nominations for major systems (battery modules, drive units, thermal management) will pull cost structure to the surface and expose just how well-constructed Telo’s bill of materials is against swings in commodity prices.

The company’s urban-first focus is refreshingly disciplined about that. If Telo can convert the average preorder into a financially viable low-volume production run and demonstrate the safety and durability of the MT1, it won’t just add another EV badge to its available features; this might set an example of what work-capable city trucking looks like. For now, the thesis is explicit: make the truck small; make the city large.