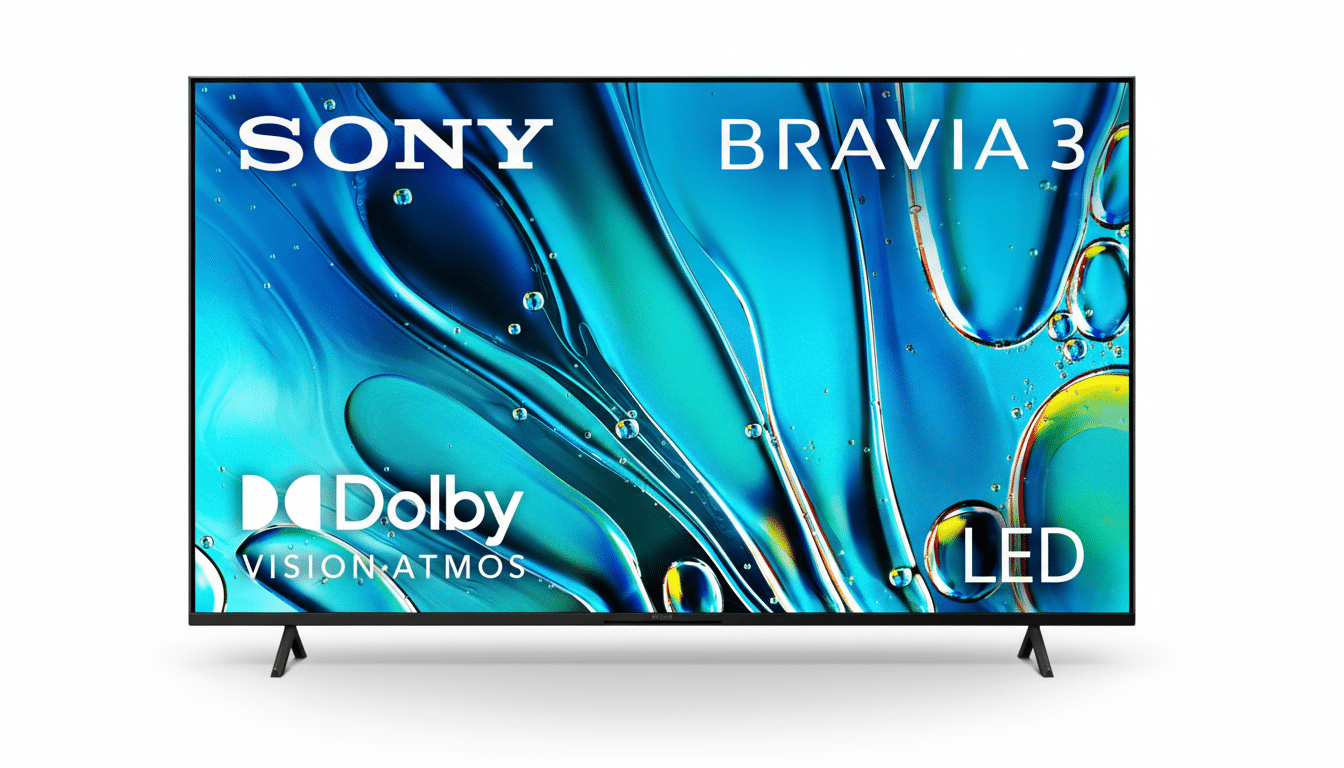

In a move that reshapes the global TV landscape, TCL will assume operational control of Sony’s television and home audio business through a new joint venture, holding a 51% stake while Sony retains 49%. The companies said the Bravia name will stay on the bezel, preserving one of the industry’s most recognizable premium brands even as manufacturing and go-to-market operations shift to TCL.

What the Joint Venture Covers for Sony TVs and Audio

According to the companies’ announcement, the new entity will handle end-to-end design, manufacturing, sales, logistics, and customer service for Sony-branded TVs and home audio worldwide. TCL will manage day-to-day operations, while Sony licenses its trademarks and picture/audio technologies, ensuring that products continue to reflect the Bravia identity and Sony’s signal-processing know-how.

- What the Joint Venture Covers for Sony TVs and Audio

- Why Sony Is Handing Over the Keys to TCL Operations

- What It Means for Bravia Buyers and Sony Loyalists

- Scale Meets Heritage in the Sony–TCL Joint Venture

- Strategic Context and Risks for the Sony–TCL Partnership

- What to Watch Next as the Sony–TCL Venture Launches

Brand continuity is central to the pact: consumers should still see Bravia on premium panels and Sony on soundbars and AV gear. The joint venture’s name has not been disclosed, and the agreement remains subject to customary regulatory approvals before it goes live.

Why Sony Is Handing Over the Keys to TCL Operations

Television has long been a tough business, with heavy capital requirements, volatile panel pricing, and tight margins. Sony has increasingly focused on higher-return intellectual property—film, television, anime, music, and sports rights—while streamlining lower-margin hardware lines. Bloomberg has reported that several Japanese electronics brands, including Toshiba, Hitachi, and Mitsubishi, have already exited or restructured TV operations in the face of fierce Chinese and Korean competition.

The shift aligns with where value accrues today: on the content and services side and in brand-led differentiation at the high end. Sony remains influential in premium categories thanks to its processing, industrial design, and ecosystem features, but scaling global TV manufacturing is increasingly a game of volume, cost discipline, and supply-chain leverage—areas where TCL excels.

What It Means for Bravia Buyers and Sony Loyalists

For consumers, the headline is stability with added scale. The Bravia brand will continue, and Sony’s picture and audio technologies—think cognitive processing, motion handling, and acoustic innovations—are expected to remain core. Google TV integration, calibration features favored by enthusiasts, and Sony Pictures Core access should continue to differentiate top-tier models.

TCL’s manufacturing footprint could bring faster adoption of advanced panels and backlighting, plus more consistent supply. That may translate into more aggressive pricing in mainstream segments and improved availability in emerging markets, while flagship Bravia models aim to preserve the premium experience Sony buyers expect. The venture also covers home audio, suggesting tighter coordination between TVs and soundbars in features such as 3D audio formats and acoustic auto-calibration.

Scale Meets Heritage in the Sony–TCL Joint Venture

TCL brings formidable scale. Omdia’s global TV shipment data has placed TCL among the top two by unit volume in recent years, leveraging its panel affiliate CSOT and extensive assembly operations. Scale matters: it improves bargaining power with panel makers, spreads R&D across more models, and shortens time-to-market for new display tech such as Mini-LED and high-zone local dimming.

Sony contributes brand equity at the premium end and deep expertise in image processing and color accuracy, areas that drive revenue share in high-priced segments. Expect continued reliance on multiple panel suppliers—LG Display for WOLED and Samsung Display for QD-OLED in select models—paired with TCL’s Mini-LED and LCD capabilities to address a full range from entry to flagship.

Strategic Context and Risks for the Sony–TCL Partnership

Consolidation is not new to TVs. Toshiba-branded sets, for example, are produced under Hisense stewardship in many markets, and Sharp has shifted strategies over time with licensing and in-house efforts. The Sony–TCL structure is different—Sony remains a shareholder and technology licensor—which should help preserve product identity while unlocking operational efficiencies.

The risks are familiar: protecting premium positioning while driving cost efficiencies, keeping software experiences consistent across regions, and managing complex component supply across OLED, QD-OLED, and Mini-LED lines. Clear product segmentation and tight quality control will be crucial to ensure Bravia’s image quality and motion fidelity remain intact as volumes grow.

What to Watch Next as the Sony–TCL Venture Launches

The companies say the venture will commence once regulators sign off. Watch for the first Bravia models produced under the new structure, updates to Sony’s picture processor roadmap, and how TCL’s backlight and panel tech appears across Sony’s lineup. Retail execution—channel partnerships, warranty terms, and regional lineups—will be early indicators of how effectively scale and heritage combine.

Sony characterized the move as a way to deliver “even more captivating audio and visual experiences” by pairing its engineering with TCL’s operational excellence. If the partnership hits its mark, shoppers could see broader choice, sharper pricing, and faster diffusion of cutting-edge display tech—all without losing the Bravia identity that has defined Sony TVs for decades.