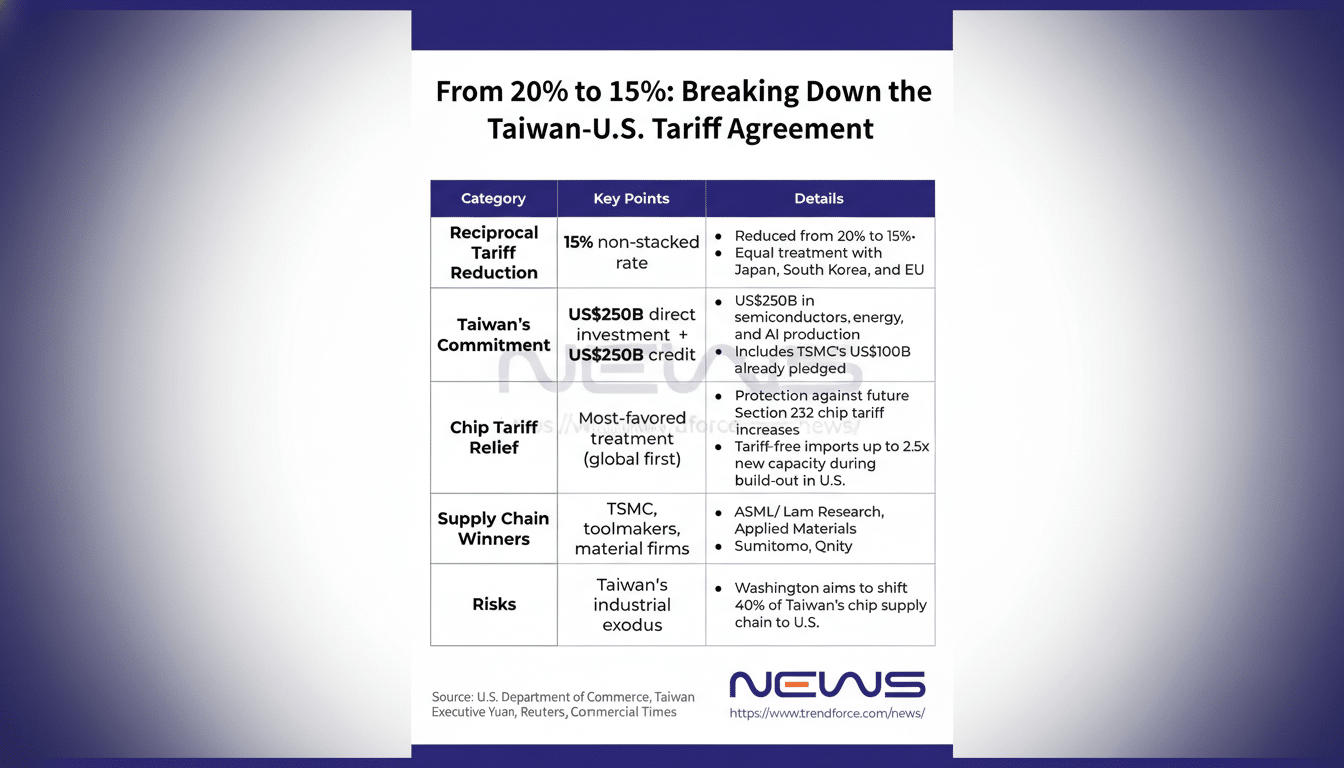

Taiwanese semiconductor and technology firms will channel $250 billion into U.S. chip manufacturing, a sweeping commitment announced by the U.S. Department of Commerce that aims to accelerate America’s onshore capacity across fabrication, advanced packaging, energy, and AI-related production. The plan also includes $250 billion in credit guarantees from Taiwan to backstop additional private investment, signaling an unusually large, government-supported push to rebuild a resilient chip supply chain.

In a reciprocal move, the United States will invest in Taiwan’s semiconductor, defense, AI, telecommunications, and biotech sectors, underscoring a two-way industrial alignment between the world’s most critical chip hub and the world’s largest technology market.

- What the $250B Likely Covers in U.S. Chip Investments

- Why It Matters for U.S. Semiconductor Supply Security

- How This Fits With the CHIPS Act and Existing U.S. Fabs

- How Credit Guarantees Could Change the U.S. Chip Game

- A Two-Way Industrial Compact Between Taiwan and the U.S.

- What to Watch Next as U.S. and Taiwan Deploy Capital

What the $250B Likely Covers in U.S. Chip Investments

Commerce officials described “direct investments” spanning fabs, materials, tools, packaging, and AI production infrastructure. That suggests participation from foundries, equipment makers, and outsourced assembly and test providers, as well as potential build-outs of supplier parks co-located with new and existing U.S. fabs.

Expect capital to flow toward advanced packaging and back-end processes, where U.S. capacity lags. Heterogeneous integration and high-bandwidth memory are now performance bottlenecks for AI systems, and packaging has become as strategic as front-end lithography. SEMI has repeatedly flagged advanced packaging as a critical gap for North American supply security.

The energy component is not incidental. Cutting-edge fabs and AI data centers are power-intensive, and reliability matters as much as cost. Investments in grid upgrades and low-carbon power procurement will likely be bundled into site plans to meet uptime and sustainability targets demanded by leading-edge nodes.

Why It Matters for U.S. Semiconductor Supply Security

Today, the U.S. accounts for roughly 10% of global semiconductor manufacturing, while Taiwan produces well over half of the world’s chips and dominates leading-edge logic. That concentration has long worried policymakers and industry alike, given exposure to geopolitical risk and natural disasters.

The Department of Commerce framed the new commitments as a direct response to those vulnerabilities. The announcement followed a White House proclamation highlighting plans to boost domestic chip production and imposing 25% tariffs on certain advanced AI chips, signaling a broader strategy that leans on both incentives and trade tools.

Industry groups have warned about cost challenges. A joint Semiconductor Industry Association and Boston Consulting Group study found it can cost 30–50% more to run a fab in the U.S. versus Asia. Anchoring large, long-lived capital with allied investment and credit guarantees lowers the cost of capital and helps close that competitiveness gap.

How This Fits With the CHIPS Act and Existing U.S. Fabs

The new Taiwanese capital stacks on top of the CHIPS and Science Act incentives that have already attracted multi-billion-dollar projects from TSMC in Arizona, Intel in Ohio and Arizona, Samsung in Texas, and Micron in New York and Idaho. Commerce has issued major awards to several of these projects, but the ecosystem still needs suppliers for chemicals, wafers, substrates, and packaging to operate at scale.

Consider TSMC’s Arizona complex, which illustrates both the opportunity and the execution risk. Ramping advanced nodes requires specialized talent, sophisticated suppliers, and reliable logistics. Direct investment from Taiwanese partners could accelerate workforce training, bring key vendors stateside, and shorten painfully long supply lines.

If even a fraction of the $250 billion lands in advanced packaging, substrates, and specialty materials, the U.S. could meaningfully upgrade its end-to-end capability—crucial for AI accelerators where memory bandwidth, thermal design, and package yield now determine system performance.

How Credit Guarantees Could Change the U.S. Chip Game

Credit guarantees can be catalytic. By absorbing a portion of downside risk, they unlock bank financing for second- and third-tier suppliers that typically struggle to raise capital for greenfield projects in new geographies. That is especially important for niche toolmakers, substrate producers, and gas and chemical providers that fabs need from day one.

For policymakers, guarantees stretch public dollars further than direct grants while accelerating private deployment. For companies, they cut weighted average cost of capital and justify multi-year commitments tied to long-term purchasing agreements with anchor fabs.

A Two-Way Industrial Compact Between Taiwan and the U.S.

U.S. investment into Taiwan’s defense, AI, telecom, and biotech sectors balances the ledger and signals durable alignment. It also supports the island’s role in cutting-edge manufacturing while opening channels for joint R&D, standards work, and secure supply of specialty components that may never be fully localized in the U.S.

Analysts at the Center for Security and Emerging Technology have long argued that resilient chip supply requires alliances, not autarky. This package reflects that view: duplicating critical capacity where it counts, sharing risk across partners, and knitting together complementary strengths.

What to Watch Next as U.S. and Taiwan Deploy Capital

Key variables remain open, including project timelines, site selections, and how funds are phased. Permitting speed, workforce pipelines, and infrastructure—power, water, and transit—will determine how fast new capacity comes online.

Equally important will be coordination with export controls and tariff policy to ensure predictable market signals. Measurable markers to track: wafers-per-month adds, advanced packaging throughput, supplier co-location, and the share of leading-edge nodes produced on U.S. soil.

The headline number is eye-catching. The enduring impact will depend on execution detail—turning pledged capital into shovels in the ground, resilient ecosystems, and chips that move from pilot lines to high-yield, high-volume production.