T-Mobile responded to AT&T’s latest attack ad with a new television commercial featuring Billy Bob Thornton, renewing a tense rivalry over network performance claims and advertising rules.

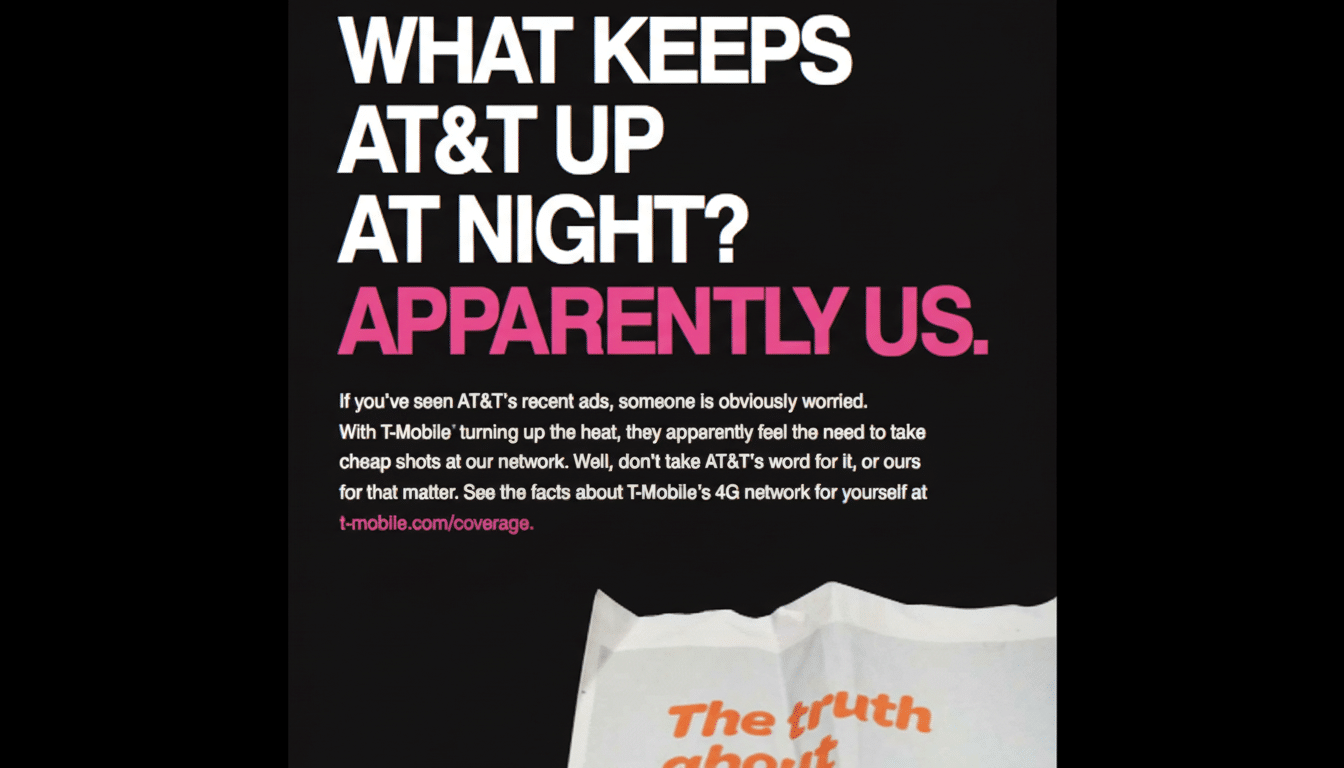

The Un‑Carrier’s new spot takes a comedic approach and squarely rejects the claims from AT&T’s previous ad, suggesting that the carriers’ marketing battle is not yet won.

How the Dispute Started Between AT&T and T-Mobile

The latest flare-up was ignited when AT&T ran an ad featuring the actor Luke Wilson that accused T‑Mobile of “Un‑Truths.” That spot improperly referred to materials produced by BBB National Programs’ National Advertising Division (NAD) instead of using the name of that entity, T‑Mobile alleges. NAD’s standards also warn companies against mischaracterizing or repurposing NAD decisions or press materials for promotion, a principle meant to ensure that competitive claims are made within context rather than through cherry‑picked headlines.

After challenges, the AT&T campaign faced takedown requests based on those NAD standards. AT&T has said it plans to “vigorously” defend its position and take it to court — a signal the dispute might be headed for more than industry self‑regulation in law, where false‑advertising cases often arise under the Lanham Act.

Inside the New T-Mobile Ad Featuring Billy Bob Thornton

In T‑Mobile’s rejoinder, Thornton plays off of an oft‑used cliché about a friend who claims he once gave T‑Mobile a go and “it sucked.” The punchline, of course, is progress — lots and lots of things used to be bad (brick‑sized phones!) before the ad asserts that T‑Mobile’s network now “leads by, like a lot.” The breezy tone echoes that of AT&T’s earlier creative, and the script ends on the note of a winking zinger to its rival’s shot across the bow, driving home T‑Mobile’s long‑running Un‑Carrier personality from upstart challenger to market leader.

Celebrity‑driven advertising is hardly new in wireless, but the symmetry here — Wilson for AT&T, Thornton for T‑Mobile — suggests both brands are competing not just for performance metrics but also who has the right to narrate them.

It is a battle of brands as much as technology.

What Independent Tests Show About 5G Speed and Coverage

Third‑party tests draw a more nuanced image.

Recent findings from Opensignal and Ookla have often placed T‑Mobile first in national median download speeds and 5G availability, which aligns with its early bet on mid‑band spectrum. T‑Mobile also has 5G reaching more than 300 million people, and its faster mid‑band footprint covers almost all of those people.

AT&T, meanwhile, has been steadily building mid‑band 5G with C‑band and 3.45 GHz spectrum and also tends to do well in metrics such as consistency and reliability on RootMetrics tests. The takeaway: When it comes to speed and 5G coverage, T‑Mobile has been leading in recent independent reports; AT&T is competing closely with the Un‑Carrier on QoS indicators, while gaps are closing as deployments mature.

This is precisely why NAD and its appellate body, the National Advertising Review Board, pay attention to how brands condense data. Selective framing — focusing on one measure to the exclusion of others — can make a good victory look like a misleading headline. That tension lies at the core of the current spat.

Why the Messaging War Is Important for U.S. Wireless

U.S. wireless growth has shifted. Postpaid phone adds have softened industry‑wide while prepaid and value segments gain share. Cable‑operated MVNOs such as Xfinity Mobile and Spectrum Mobile are cannibalizing price‑conscious subscriber segments, and fixed wireless home internet from mobile carriers has become a new front in market‑share battles. In this climate, perception — who has the “best” network — can matter as much as raw engineering reality.

Carriers invest billions of dollars annually to shape that impression. When advocacy bleeds into accuracy, regulators and industry watchdogs are there to step in. A ruling or court judgment in favor of one side could resonate through campaigns to come and limit how carriers trumpet test results, population‑coverage gains, or speed claims. It also could be a factor in how aggressively brands push back against their rivals’ adverts, raising the financial stakes for any claim that ends up on air.

What to Watch Next as the Ad and Legal Battles Escalate

If AT&T decides to sue, anticipate a blizzard of filings that parse NAD guidance, research methodologies, and the fine print behind network claims. T‑Mobile, instead, is expected to continue to crank third‑party accolades up while leveraging its mid‑band advantage and celebrity‑driven narrative. There are going to be a lot more ads; the open question is whether some form of adjudication cools things down or emboldens a new round of comparative campaigns.

For consumers, the back‑and‑forth is a reminder to look beyond the punchlines. As with previous leagues, independent test results, local coverage maps, and real‑world experience still matter more than any single spot. This fight isn’t just about pride for the carriers — it’s about locking up the narrative and scoring the next million customers.