Employee unrest is rising inside two of America’s largest wireless companies, as frontline workers at T-Mobile and Verizon demand job security amid changes that they say are pushing retail work, pay structures and customer service to the breaking point. The blowback underscores how rapidly the industry is hurtling toward app-based sales and automation — frequently at the eXpense of store staffing, commissions and morale.

Verizon notified employees that it would cut 13,000 employees in a major restructuring, and T-Mobile is moving more plan sign-ups and device fulfillment into its T-Life app and other digital channels. On X and Reddit, posts from current and former employees detail a decline in culture, reduced hours and the feeling that stores are being gutted as transactions move online.

Why Employees Are Pushing Back Against New Retail Changes

The reductions at Verizon are an effort to simplify the company’s operations and lower costs, according to messaging reviewed by employees. But for in-store reps and call-center agents, the immediate picture is one of thinner staffing and higher sales pressure. Workers say they are apprehensive of a cycle in which fewer employees will be tasked with more sales — and who often have little, if any, control over inventory, what the promotions will look like or whether back-end systems run by computers, not people, can honor a deal.

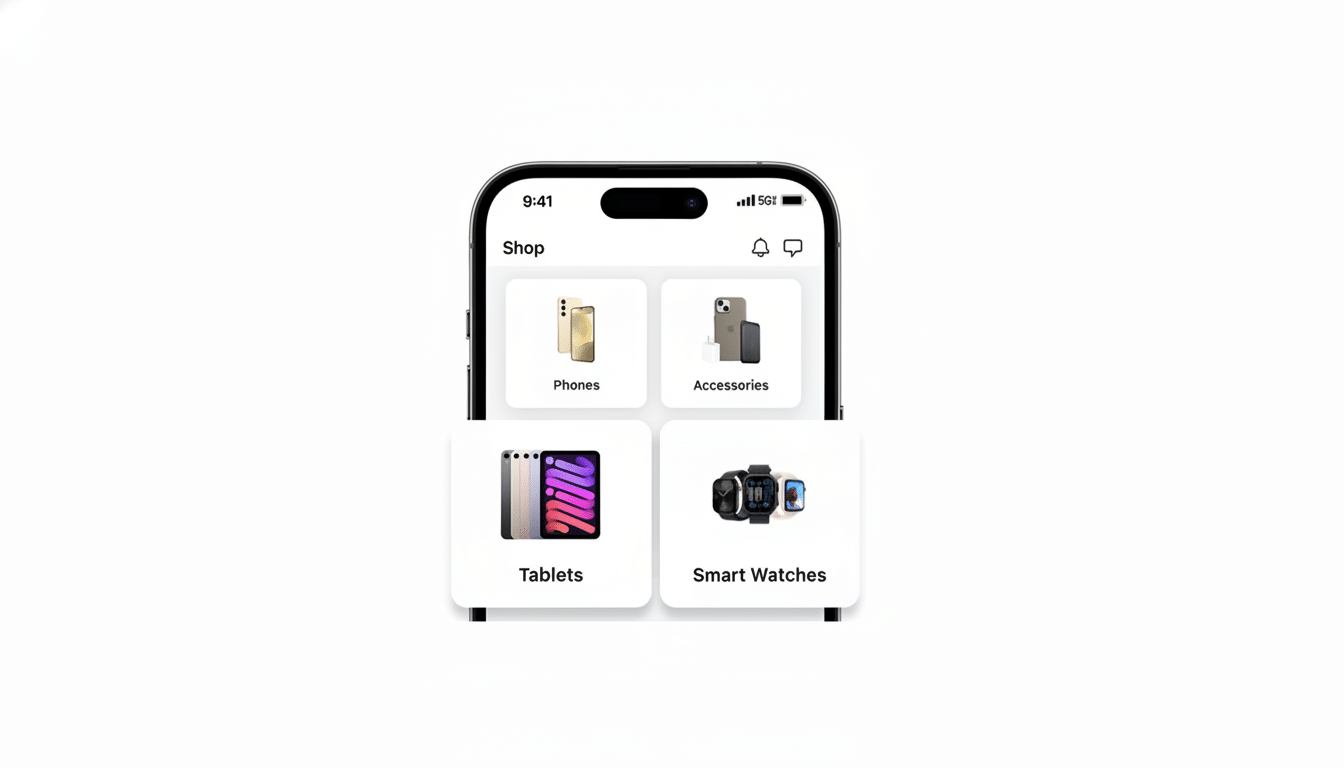

At T-Mobile, workers cite another form of agony: fast-tracking key transactions through the T-Life app. Reps say they’re being directed to route activations, upgrades and add-ons through self-service flows that minimize face-to-face transactions and, significantly, commissionable moments. Some employees say they’re punished if they don’t push transactions to the app, which has raised questions about take-home pay and the retail role’s long-term viability.

On Social Media, A Flashpoint For Organizing

Social feeds are now a pressure valve. On Reddit, posts urge group activity — coordinated sick days, interest in unionization. A few Verizon employees have raised Black Friday as a figurative deadline, though others point out that holiday shopping in the wireless industry stretches over the course of weeks, taking some pressure off from any one-day action.

The organizing talk is not happening in isolation. The Communications Workers of America, a union representing some of the telecom workforce, has cataloged mounting concerns over staffing and sales goals throughout the industry. Whether that coalesces into formal drives at scale remains to be seen, particularly with low national union density — around 10 percent of workers, according to the Bureau of Labor Statistics — but in making those statements, Amazon illustrates a shift from private griping to public mobilization.

Customer Service Risks And The Retail Fallout

Employees caution that the reduced staffing has some stores turning into “ghost stores” with long lines and lingering complex issues. That perception is consistent with broader consumer sentiment. Recent research from the American Customer Satisfaction Index and J.D. Power has identified uneven customer care experiences in U.S. wireless, including longer wait times and more friction around billing or plan changes.

Carriers say digital-first workflows can accelerate routine transactions. But the same agility that can reinforce trust also sometimes undermines it when a customer’s predicament doesn’t align with a script — trade-in mismatches, porting failures or financing hiccups that demand human discretion. Employees say the more the model relies on apps and bots, the harder it is for customers to locate a human authorized to fix outliers.

What The Carriers Say, And The Business Math

Executives at the big wireless carriers have stressed that modernization, digital convenience and cost discipline are competitive imperatives. The math is clear: customer acquisition costs a lot, promotional support for devices is high and investments in the network don’t stop. Taking transactions online, streamlining support and eliminating overlapping positions can bolster margins and keep investors happy — particularly during lulls in subscriber growth.

But there are trade-offs. But sales quotas that focus on short-term conversions can encourage shady add-ons and eat away at loyalty. Commission redesigns that prioritize app flows may dampen earnings for high-performing reps. And if retail footprints decline too rapidly, carriers risk forfeiting the consultative face-to-face moments at retail that assist families in negotiating plan complexity, insurance options and device financing in a way that leaves them free of unexpected surprises.

What To Watch Next As Verizon Restructures And T-Mobile Shifts

Key things to watch for are the speed with which Verizon pushes forward its restructuring, policy changes related to T-Mobile’s adoption of T-Life and any mounting formal organizing activity. Monitor churn trends and customer-satisfaction surveys; the cost savings from automation could disappear if service starts to suffer with higher defections and complaints.

“The writing on the wall is, more automation, more app-based flows, less traditional reps. The gamble is whether carriers can reform incentives and staffing models in ways that still accommodate the human problem-solving customers want — and make it possible for workers to earn a living wage. For now, T-Mobile and Verizon are dealing with a workforce that isn’t quietly submitting to change but is rather raising its voice to have a say in how it comes.”