A new reader poll shows 31% of respondents pay for Strava’s subscription, a surprisingly high share for a fitness app built on a freemium model. For a platform known equally for training tools and social kudos, the result hints at just how sticky its premium features and community network have become.

What the poll reveals about Strava subscription uptake

Three in ten participants reporting they pay for Strava suggest strong conversion far above what many consumer apps see. Industry analysts regularly peg freemium conversions in the low single digits for mass-market categories, though fitness and productivity often outperform the average. Even allowing for selection bias—enthusiasts are more likely to engage with a poll about a training app—31% stands out.

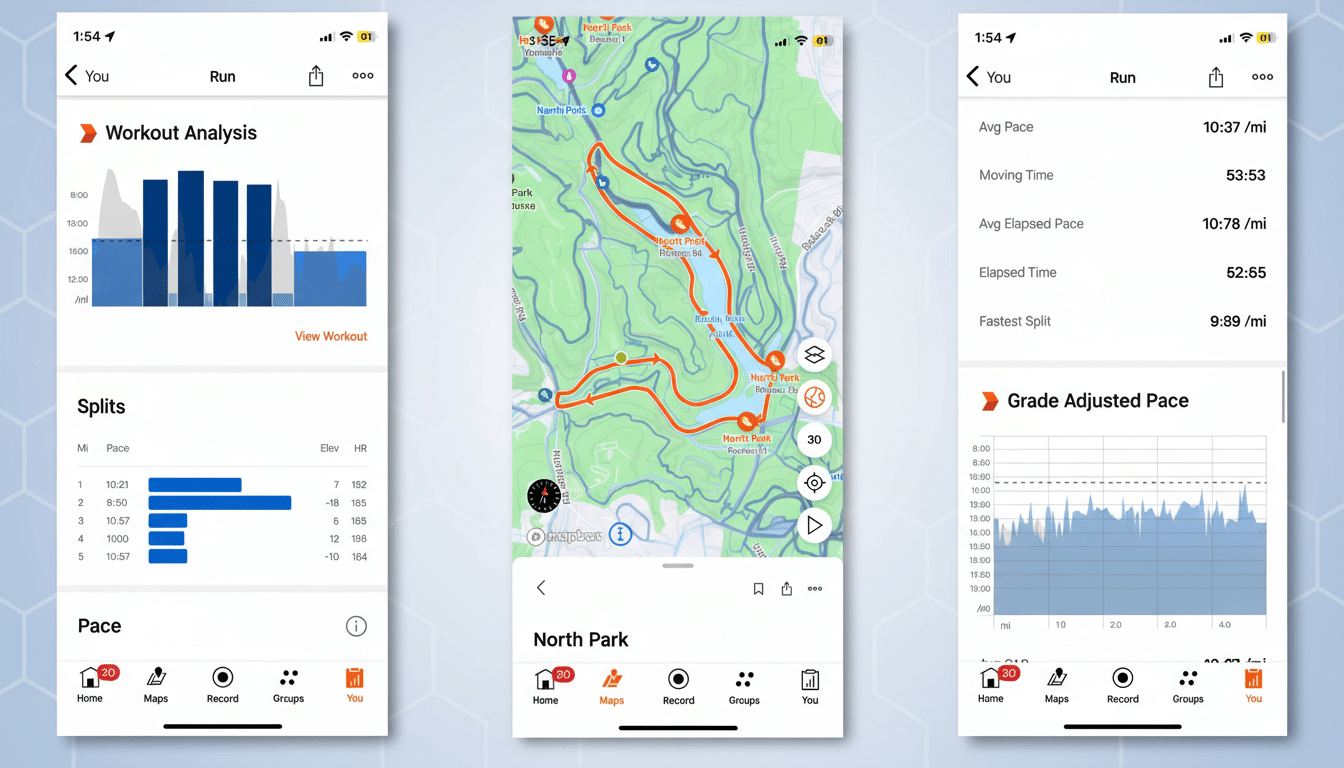

The finding aligns with a clear strategic shift: Strava has leaned hard into a paywall for deeper analytics and more granular data access. While free users can log activities and join the social feed, subscribers unlock advanced training metrics, robust route planning, segment leaderboards, and tools that serious runners and cyclists use to structure workouts and gauge progress.

Why the Strava paywall works for committed athletes

Strava’s power is network effect plus habit. Many athletes train with GPS watches and bike computers that sync seamlessly to the platform, making Strava an automatic hub for all their data. Add in club leaderboards, challenges, and long-term performance tracking, and the switching costs rise quickly.

Price also matters, but perceived value matters more. In the US, the subscription typically runs around $80 per year, with monthly options available and pricing that varies by market. For dedicated athletes, access to historical analytics, goal tracking, and route discovery can feel like a justifiable line item—akin to paying for a race entry, a coaching plan, or a piece of gear that reliably improves training.

Scale helps. The company has publicly said it serves well over 100 million athletes worldwide, making it the default social layer for endurance sports. Ubiquity can convert skeptics: when your entire club lives on one app, the pressure to get full functionality grows.

Where users push back on Strava’s paid features

At the same time, the commentariat around Strava has grown more vocal about friction. Some athletes argue the platform has walled off too much, too quickly—complaining of frequent upsell prompts or the feeling that personal data is increasingly locked behind a pay tier. Others say the social feed has shifted from motivating to performative, turning training into a public scoreboard that heightens anxiety rather than enjoyment.

There’s also substitution at play. Runners and cyclists who already invest in ecosystems like Garmin Connect or Apple Fitness often pair those with specialized tools such as TrainingPeaks, Wahoo’s SYSTM, or Zwift, trimming the need for yet another subscription. For those users, Strava’s free tier—activity logging and basic social features—may feel sufficient.

How Strava’s conversion compares to other consumer apps

Context helps interpret the 31% figure. Company filings from Spotify regularly show its premium share near 39% of monthly active users, an outlier driven by a globally dominant product and a universally understood value prop: ad-free listening and downloads. By contrast, most consumer apps struggle to clear double-digit conversion without a unique hook or mission-critical utility.

Fitness apps that move core features behind a paywall can spark backlash—witness the industry reaction when calorie and macro tracking tools limited staples to subscribers. Yet they also tend to solidify paying bases if the locked features are essential to progress. Strava’s premium metrics, long-term analysis, and segment competition appear to fall into that “essential for enthusiasts” bucket.

What it means for Strava’s business model and athletes

If this poll mirrors broader behavior, Strava’s strategy is working: build indispensable training tools on top of a vibrant community, then monetize the depth. That said, the company risks alienating casual athletes if paywalls feel more like penalties than perks. Clear communication, stable pricing, and thoughtful defaults for privacy and social pressure could help sustain trust.

For users, the calculus is simple: if premium features materially improve your training or safety, the fee is a rational spend. If the app adds stress or duplicates what you already get from your watch ecosystem, free may be enough. A 31% conversion suggests many athletes have already done that math—and for now, Strava is passing the test.