SpaceX’s satellite unit has submitted applications with the FCC and to the International Telecommunication Union for trademark use of both Starlink Mobile and Powered by Starlink, in what would be a bold play for SpaceX after years of talking down speculation that Elon Musk’s space company might become directly involved in providing cellular service. The applications, first spotted by PCMag, involve cellular communications services and the relay of video and data to phones and smart devices — language that seems very much like the bones of a mobile network operator play.

What the Starlink trademark filing suggests for mobile

The Starlink Mobile trademark is linked to wideband communications, such as cellular personal communication services and the delivery of content to mobile handsets. A partner mark, Powered by Starlink, hints at co-branded service models — imagine carriers and OEMs packaging Starlink’s satellite backhaul or direct-to-cell coverage as a feature à la existing partnerships with KDDI in Japan and Rogers up north.

This extends steady telecom momentum: Starlink’s direct-to-cell alliance with T-Mobile in the U.S., growing trials of satellite messaging, and the purchase of terrestrial spectrum assets from EchoStar’s Boost Mobile parent. Each step alone may be incremental. What they tell together reads like a prospectus for a mobile offering that combines terrestrial and non-terrestrial networks.

A playbook taking shape for Starlink’s mobile ambitions

A near-term path is simple: start up an MVNO that uses a partner carrier’s ground network for everyday, everywhere else coverage, while satellites fill in the gaps and emergencies.

The Powered by Starlink branding would allow global operators to bolt satellite augmentation onto their networks without building their own constellations, with the bonus that Starlink would build brand equity with consumers before moving into deeper ventures.

Further out, Starlink’s second-generation satellites and larger phased-array antennas are planned to serve direct-to-cell links via existing licensed spectrum on 3GPP Release 17 NTN. The Federal Communications Commission’s Supplemental Coverage from Space framework provides a regulatory path for these hybrid services, allowing operators to lease terrestrial spectrum to satellite companies covering areas where towers miss the mark.

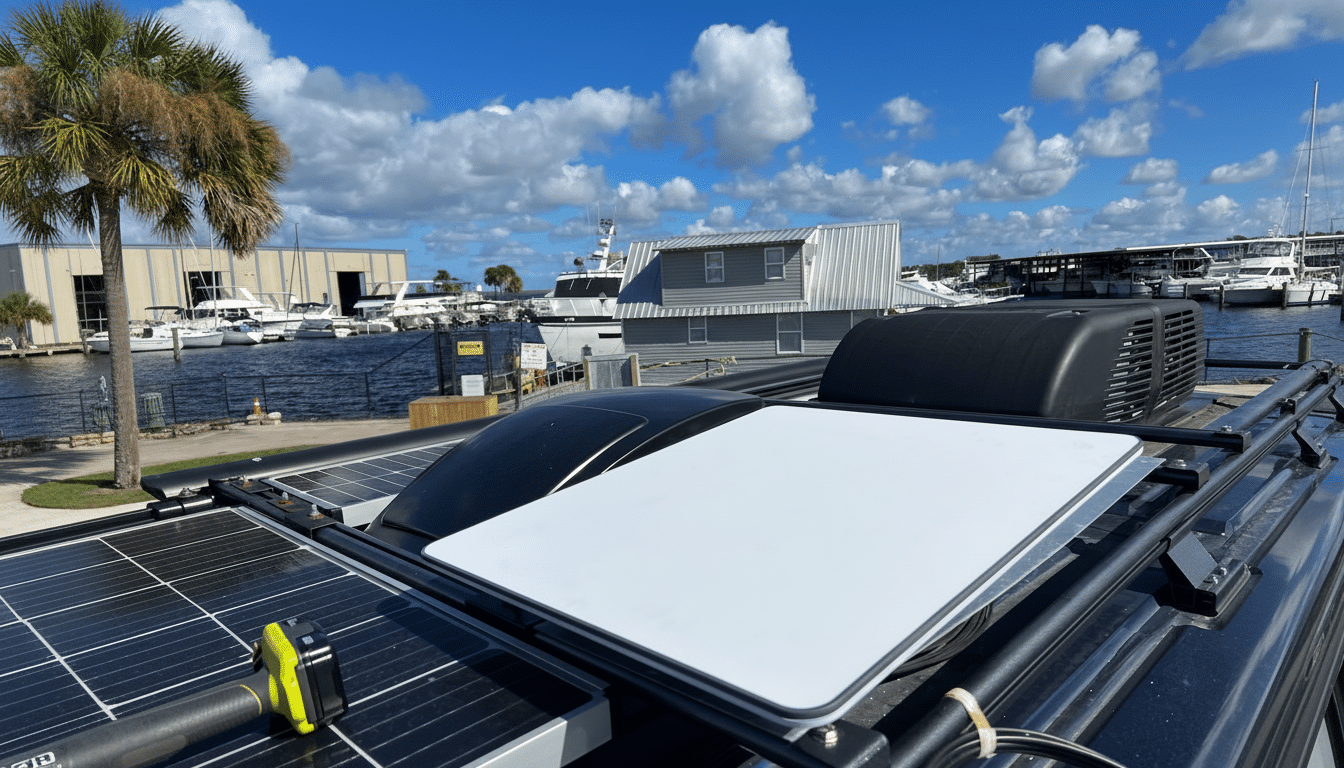

Starlink already has the distribution muscle: millions of internet customers, a retail presence through its hardware, and enterprise accounts in aviation, maritime, and energy. It would be a natural extension to convert a slice of that base into mobile lines — first as add-ons, and later, full primary service — if device economics and compatibility align.

Key hurdles and realistic timelines for Starlink mobile

Developing a brand into an unboxing video star in the mobile phone market is another thing. Technically, support for NTNs continues its way through next-gen chipsets and phones; standards-compliant satellite messaging and IoT additions have started on modern modems, but everywhere broadband delivered to handsets over satellites is predicated on tight power budgets, new scheduling, coordination in spectrum. That’s without roaming, E911, lawful intercept, and the billing stack stepping into the chat.

Regulatory approval differs by country and band. In the U.S., the FCC’s new regulation offers a framework to follow, but it will need to be pursued through an independent process with national regulators in other markets and with incumbent holders of spectrum. Starlink’s recent purchase of terrestrial spectrum does not hurt, but it will not obviate the requirement for MVNO agreements and cross-border harmonization.

Competitive pressure rises as rivals test direct-to-cell

Starlink is not the only one trying to phone up to space. AST SpaceMobile has proved the concept of mobile broadband, and it is doing direct-to-device trials with AT&T and Vodafone. Lynk Global provides satellite SMS coverage for carriers in certain areas. Apple’s Emergency SOS via satellite, powered by Globalstar, has also trained consumers to expect forms of off-grid connectivity. The competitive bar is shifting from emergency communication to coverage and data that’s everyday.

Starlink has two advantages: scale and cadence. The company has thousands of satellites operating in low Earth orbit, it refreshes hardware often and the firm’s launch pipeline is robust. SpaceX has also reported millions of Starlink subscribers around the world, representing a rare combination of infrastructure and customers waiting to sign up. If any player can weave satellite coverage into a mainstream mobile product, this is the one to keep an eye on.

What to watch next as Starlink moves toward mobile

Things to watch include:

- More MVNO-like plan announcements under a Starlink banner

- Broader carrier partnerships for Powered by Starlink

- Wider device compatibility on standard NTN capabilities

A staged approach — satellite messaging and basic connectivity first, voice and higher-rate data to follow — would mirror the strategy other upstarts have taken with direct-to-cell.

Please note that a filing like the one below does not ensure an imminent release, but a filing serves as a sign of intent. But with regulatory tailwinds, maturing standards, and Starlink’s existing carrier deals, the descent from satellite add-on to actual mobile service looks less like a speculative leap of faith and more like a matter of time. It’s all up to pace, pricing, and how soon the phones in people’s pockets are willing to call space home.