Standard Nuclear has secured $140 million in fresh funding, a sizable bet on the nuclear fuel supply chain as demand surges from data centers and utilities hunting for firm, carbon-free power. The Series A, led by Decisive Point with participation from Andreessen Horowitz, Chevron Technology Ventures, Crucible Capital, Fundomo, StepStone Group, Washington Harbour Partners, Welara, and XTX Ventures, positions the company as a pivotal “picks-and-shovels” provider in the emerging small modular reactor market.

The raise underscores a shift in investor attention from reactor designers to critical suppliers. Industry deal trackers tallied roughly $1.1 billion flowing into nuclear startups by the end of last year, largely focused on reactors; now the money is following the bottlenecks—fuel, materials, and manufacturing.

Why the Nuclear Fuel Play Matters for SMRs

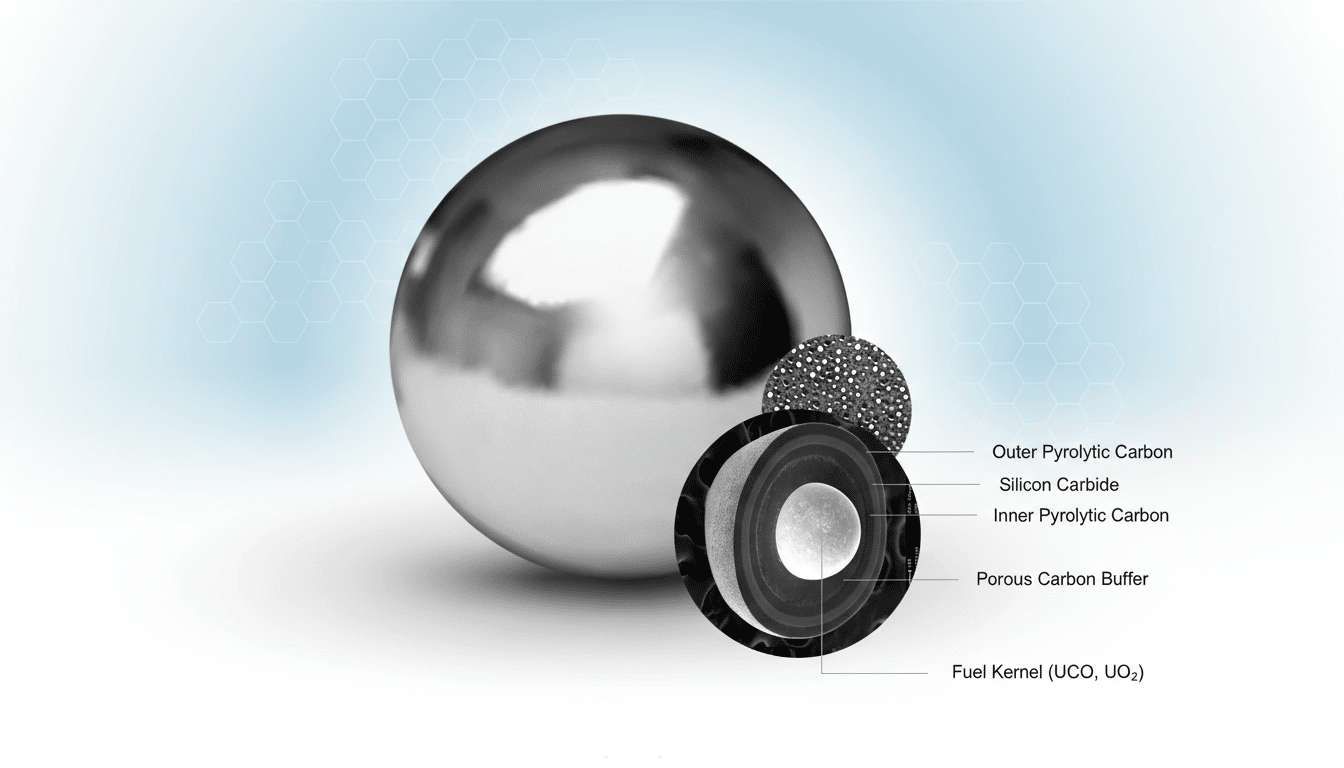

Standard Nuclear specializes in TRISO fuel, a pebble-like material made from poppy-seed-sized uranium kernels encapsulated in layers of ceramic and carbon. This structure allows the fuel to retain fission products and perform at high temperatures, which is why many advanced reactor developers—especially high-temperature gas reactors and microreactors—have gravitated toward it.

TRISO typically uses high-assay low-enriched uranium (HALEU), enriched to as much as 19.75% U-235. The U.S. Department of Energy has repeatedly flagged HALEU availability as a critical constraint for advanced reactors. Standard Nuclear’s focus on manufacturability—particle uniformity, coating quality, and throughput—targets the practical hurdle: producing consistent, licensed fuel at industrial scale rather than lab scale.

The Deal and the Backstory Behind Standard Nuclear’s Round

The new financing comes on the heels of an earlier $42 million round and builds on assets acquired out of Ultra Safe Nuclear Corporation’s bankruptcy. Decisive Point’s founder, Thomas Hendrix, purchased USNC’s fuel-related assets for $28 million, giving Standard Nuclear a head start with existing designs, equipment, and know-how that can shave years off commercialization timelines.

The company says it has secured roughly $100 million in non-binding orders targeted for 2027 delivery. Early customers include Radiant Energy—another Decisive Point portfolio company developing a microreactor—and Nano Nuclear Energy, which acquired USNC’s reactor assets. The preorders are an encouraging demand signal, though conversion will hinge on customers hitting their own licensing and deployment milestones.

AI and the New Power Crunch Reshaping Electricity Demand

The broader backdrop is a power-hungry data economy. The International Energy Agency estimates global data centers could consume 620–1,050 terawatt-hours by the middle of the decade, up sharply from recent years, with AI training and inference intensifying load. Grid operators in the U.S. and Europe report accelerating interconnection requests for large campuses, while the North American Electric Reliability Corporation has warned that peak demand growth is returning after a long lull.

Against that demand, nuclear offers round-the-clock output with minimal land use and no direct emissions. That’s why utilities, cloud providers, and industrials are revisiting fission alongside efficiency, storage, and renewables. If even a fraction of planned microreactors and SMRs materialize, fuel makers like Standard Nuclear will be among the first supply chain links strained by scale.

Licensing Reality And Supply Chain Risks

Fuel qualification is a heavy lift. While TRISO’s safety attributes are well-studied—backed by DOE’s multi-year Advanced Gas Reactor irradiation and post-irradiation examination campaigns at Idaho National Laboratory—regulatory approval still requires meticulous data submission and manufacturing reproducibility. The U.S. Nuclear Regulatory Commission has signaled openness to advanced fuels, but process rigor remains high for good reason.

Then there’s HALEU. Domestic supply is nascent, with early production demonstrated by Centrus Energy and additional capacity envisioned under DOE’s HALEU Availability Program. Scaling to tens of metric tons per year—the level many analysts say is needed for a first wave of advanced reactors—will require multi-year investments in enrichment and deconversion, plus long-term purchase agreements that de-risk those plants.

Competitive Field Takes Shape in Advanced Nuclear Fuel

Standard Nuclear is not alone. BWX Technologies has produced TRISO fuel for government programs, and X-energy has developed TRISO for its Xe-100 reactor. That competition validates the market but also raises the bar on cost, consistency, and delivery schedules. As in other energy technologies, bankability will hinge on repeatable production and third-party qualification rather than prototypes.

The sector has also learned hard lessons: ambitious reactor timelines and cost curves have slipped before. The cancellation of a landmark SMR project and inflation in component costs emphasize how easily deployment can drift. If reactor programs run late, fuel suppliers risk standing factories without near-term offtake—precisely the mismatch that sank earlier ventures.

What to Watch Next as Advanced Reactors Seek Fuel

With $140 million in hand, Standard Nuclear’s near-term milestones are clear: lock HALEU supply, commission high-yield TRISO production lines, complete qualification steps with regulators, and convert early commitments into binding contracts. Expect partnerships with utilities and industrial heat users seeking dependable delivery schedules, and look for independent verification from national labs to bolster lender confidence.

If the coming buildout of advanced reactors arrives on anything like current projections, fuel will be a chokepoint—and a lucrative one. Standard Nuclear’s raise is a bid to own that chokepoint, turning a once-niche fuel into a scalable product just as nuclear enters a modern build cycle pushed by AI, electrification, and the grid’s need for clean, firm power.