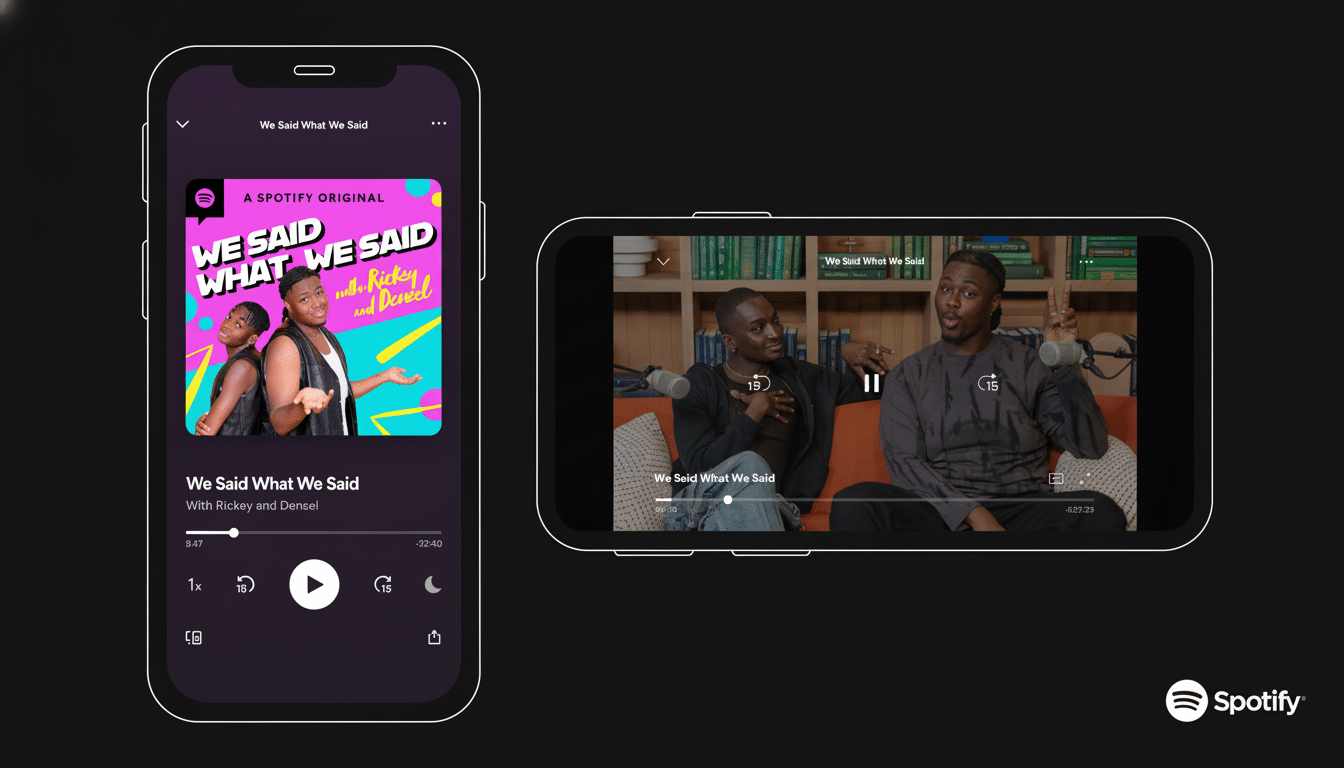

Spotify’s gamble on video is working out. The company says its collection of video podcasts has grown to nearly 500,000 shows, and that more than 390 million users have watched at least one video podcast on the service. That audience number is up 54 percent year over year, a loud signal that video isn’t just some sidecar to Spotify’s podcast strategy — it is quickly becoming a core format.

Video time on Spotify has more than doubled year over year, with video podcasts fueling much of that growth. The numbers reflect a product and distribution playbook that is beginning to click: Make it easy for creators to publish video, give fans interactive tools, and bring shows to where audiences already are.

Why Video Podcasts Are Booming Across Spotify’s Platform

Spotify increased upload access, allowing creators who store their video shows elsewhere to bring them into the app. Toss in comments, Q&As, and polls — features that make passive listening a two-way street — and podcast pages start to look more like communities than static feeds. It’s a combination of utility and social interaction that has driven the recent momentum.

And video is also nice for some formats: interview shows (physical cues matter), comedy or culture shows (visual bits), and sports or news pods that drop in clips and charts. Those types of moments don’t come through quite as well in pure audio. Spotify is betting on that reality, rethinking its app for just as much “lean-in” viewing as it was built for “lean-back” listening.

Industry researchers have been following the trend. That’s also why Edison Research has consistently shown a substantial portion of podcast discovery and consumption now happening on video-leading platforms, particularly among younger listeners — and why Spotify is working to make video native, not an afterthought, in its experience.

Creator Tools and Monetization Drive the Flywheel

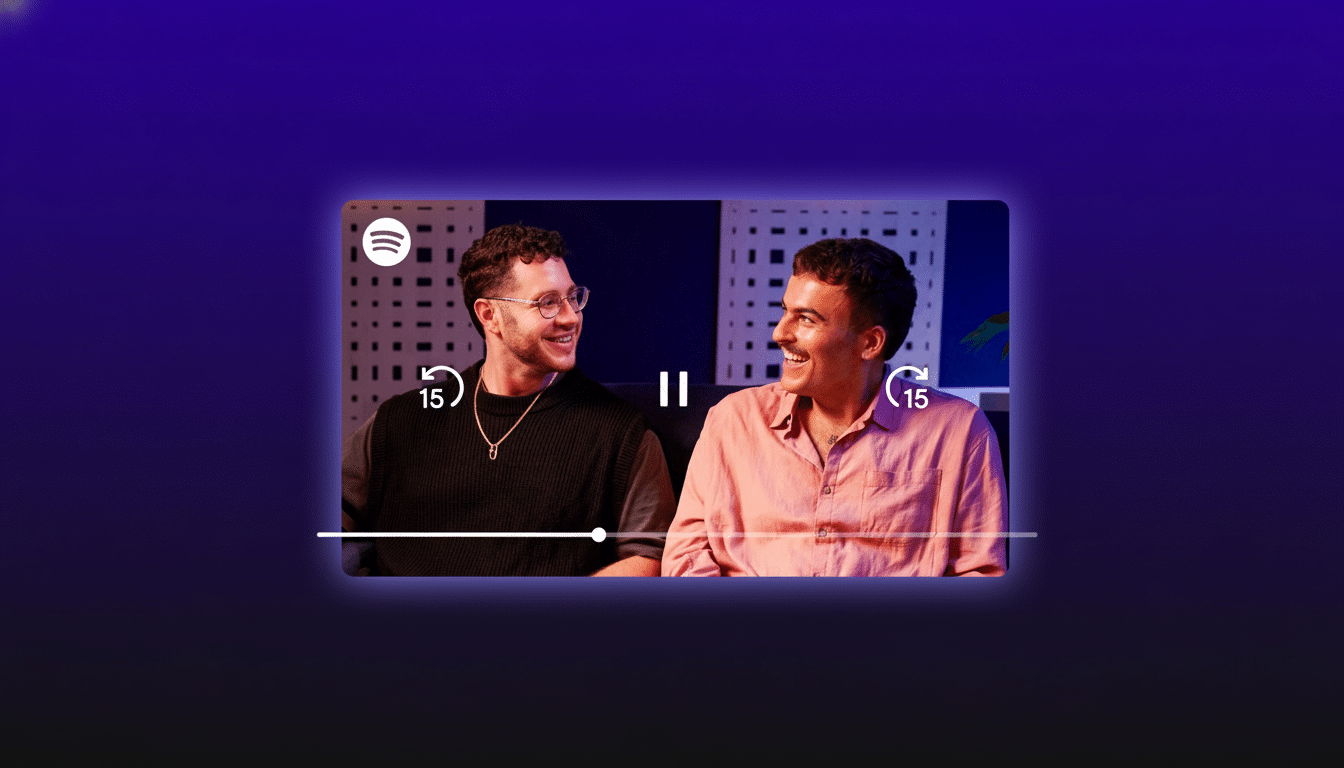

Spotify attributes the growth in video viewing to its Spotify Partner Program, adding that consumption of video podcasts grew more than 80 percent since the program’s launch. The pitch is simple: enhanced monetization, including audience-funded payouts based on engagement from Premium users, and more explicit routes for creators to make money with audio as well as video.

When developers can see real economics, they create more content. It shows in the rapid expansion of the catalog — it roughly doubled after the company introduced non-hosted uploads. It also opens its doors to a spectrum of professional talent that stretches from YouTube-native personas syndicating full episodes to mid-tier podcasters trying on studio-style visuals, live sessions, or chopped highlights.

YouTube and Netflix Are Betting on Distribution

Spotify’s executives describe their approach as “creator-first ubiquity.” In practice, that means looking at Spotify as a sort of central hub and syndicating shows to other giants. And the company says that putting podcasts on YouTube has raised awareness and ultimately led to incremental listening back on Spotify, and it expects the same with its newly announced Netflix partnership to distribute video podcasts to a wider audience beginning in the United States and then elsewhere.

This, too, is a living-room play. Spotify recently updated its Apple TV app, and executives say people’s television screens are becoming a significant new surface for podcast listening. Increases in session time can both increase the value of ad inventory and keep users more engaged.

What Advertisers Need to Know About Spotify Video Podcasts

Spotify has become the latest publisher to offer programmatic audio and video options for podcasts with new buying capabilities that let brands reach consumers via sight-sound-motion experiences as well as through host-read spots.

For video podcasts, this translates to the delivery of both better recall rates and richer context — all while preserving the intimacy that makes podcast ads succeed. The company warns that its ads business is in a state of transition, but it’s gradually clicking the structural pieces into place — scale, video formats, TV distribution, and better measurement.

Scale matters here. Spotify reports 713 million monthly active users and made €4.27 billion in revenue with a net profit of €899 million in its latest quarter. That footprint leaves video podcasts with a powerful top-of-funnel (so to speak), and one that’s difficult for advertisers and creators to ignore.

The takeaway: half a million video podcasts, and hundreds of millions more spectators, is a strategic pivot. It is no longer just a question of whose ears Spotify is up against; it’s also whose eyes. The next step will be turning that attention into lasting monetization, while keeping creators convinced that Spotify is the best home base for their video-first shows.